Costco’s Industry Positioning: A Porter’s 5 Force Analysis

Costco’s suppliers include companies like PepsiCo (PEP), Procter & Gamble (PG), and the Kraft Heinz Company (KHC). No single supplier accounts for over 5% of revenue.

Nov. 20 2020, Updated 12:24 p.m. ET

Costco Wholesale

Costco Wholesale (COST) is the largest warehouse club operator in the US. In 2015, the company was ranked as the 18th largest firm in the Fortune 500. With a market cap of $66 billion[1. As on January 15, 2016], Costco clocked sales of $116.2 billion in fiscal 2015, which ended August 30, 2015.

The National Retail Federation (or NRF) ranks Costco as the second-largest retailer in the world. Costco has grown the fastest among the top ten firms between 2009 and 2014. The top ten firms on the NRF’s list include several of Costco’s competitors:

Costco’s origins and history

Based in Seattle, Washington, Costco presently operates nearly 700 warehouses in the US and abroad. Costco began its operations in 1983. The company opened its first warehouse under the Costco banner in Seattle the same year. It became the first company to hit the $3 billion sales mark in under six years.

In 1993, the company merged with the Price Company, one of the earliest retailers to operate the warehouse retail model, forming PriceCostco. In 1997, the company spun off most of its non-warehouse assets to a separate entity, Price Enterprises. In 1999, following the company’s reincorporation to Washington, the company changed its name to Costco Wholesale.

Record fiscal 2015 results

In fiscal 2015, which ended August 30, 2015, Costco posted record results. Sales grew 3.2% to $116.2 billion while the company’s net income rose 15.5% to $2.4 billion. Member loyalty was also at all-time highs.

In this series, we’ll provide an overview of the company’s business model and operations, and discuss its financial and stock market performance, valuations, and outlook.

ETF exposure

Costco is a component of the S&P 500 Index and makes up ~0.4% of the holdings in the SPDR S&P 500 ETF (SPY) and ~3.9% in the Consumer Staples Select Sector SPDR Fund (XLP).

Costco’s dividend policies

Costco Wholesale (COST) has generated sufficient cash from operations, allowing the company to steadily raise annual dividends several years in a row. The company first paid a dividend in 2004 at $0.40 per share. In fiscal 2015, the company paid $1.51 per share as its annual dividend. Costco’s annual dividend per share (or DPS) has increased at a compounded annual growth rate (or CAGR) of 14.4% between fiscal 2010 and 2015. Its current DPS is $0.40 per quarter or $1.60 per year.

Dividend yields

Costco’s forward dividend yield over the next four quarters is 1.1%, which is much lower than most rivals. Dividend aristocrats Walmart (WMT) and Target (TGT) are providing dividend yields of 3.3% and 3.2%, respectively. Supermarket chains Kroger (KR) and Whole Foods Market (WFM) are yielding 1.2% and 1.9%, respectively[1. As on January 15, 2016].

Special dividends

However, Costco has also paid special dividends to shareholders from time to time, which increases the stock‘s attractiveness somewhat in terms of yield. Including the special dividend, the stock yielded about 4.5% last year and 5.4% in fiscal 2013.

Costco paid out an additional $7 per share in fiscal 2013 as a special dividend, setting the company back ~$3 billion. Last fiscal year, the retailer paid out $5 per share, or about $2.2 billion in total, as a special dividend. The company issued senior notes in both these years, although its cash balances were more than sufficient to finance the special payments. The company’s recourse to debt markets was primarily to take advantage of low prevailing interest rates.

Investor upside

Costco’s cash balance at the end of fiscal 1Q16 was $6.3 billion while total debt was $6.2 billion. The company’s high cash balance, negative net debt, strong operating cash flows, and healthy coverage ratios could mean that the company may continue the trend of special dividends from time to time in the future.

Low volatility

Costco makes up ~1% of the portfolio holdings in the PowerShares S&P 500 Low Volatility Portfolio (SPLV). SPLV seeks to replicate the investment performance (before fees and expenses) with the price and yield of the S&P 500 Low Volatility Index. The Index comprises of 100 stocks from the S&P 500 Index that exhibit the least volatility in the last 12 months. SPLV invests at least 90% of its holdings in the stocks comprising the underlying Index. 24.8% of SPLV’s holdings are invested in the consumer staples and discretionary sectors.

Costco has above-average growth rates in revenue and earnings per share

Costco Wholesale (COST) is the largest warehouse club (XRT) operator in the US. The company has consistently been able to grow its top and bottom lines at rates much higher than the industry average over the past several years. Costco’s global sales have grown at a compounded annual growth rate (or CAGR) of 8.3% over the last five years versus 1.9% for the overall industry.

Costco’s US sales have grown at a CAGR of 7.2% over the period. Considering Costco’s size and nationwide presence, that’s pretty phenomenal in a mature industry with several established players. The fast-growing players in the segment like Amazon (AMZN), Kroger (KR), Publix Supermarkets (PUSH), and Whole Foods Market (WFM) have grown sales at CAGRs of 29.4%, 7.2%, 4.7%, and 11.3%, respectively, over their last five fiscal years.

Earnings per share upside

Costco’s earnings have also grown faster than revenue on a compounded basis over the past five years. Its EBITDA (or earnings before interest, taxes, depreciation, and amortization) has grown at a CAGR of 10.5% while adjusted EPS (or earnings per share) have grown at a CAGR of 12.3%. That’s partly due to the improvement in Costco’s margins as discussed in part 14.

Share repurchases

Earnings per share (or EPS) upside for Costco has also been provided in part by the company’s share repurchase program that has reduced the number of outstanding shares for the retailer. Repurchased shares are retired. At the end of fiscal 1Q16, Costco had 441.4 million shares outstanding[1. Diluted weighted average number of shares].

Costco purchased 2.9 million shares in fiscal 2014 and 3.5 million shares in fiscal 2015 for an average cost of $114.45 and $142.87, respectively. Share buybacks have been accretive. The company’s stock was trading at $150.39 on January 15, 2015.

Currently, the company has $3.6 billion worth of share repurchase authorization remaining of the $4 billion authorization approved by its board of directors in April 2015. The program is valid for five years.

Analyzing Costco’s stock price valuations and their drivers

Costco Wholesale (COST) appears to be the priciest stock among the competitor group considered. The company’s forward price-to-earnings (or PE) ratio is 26.6x compared to 15.3x for the S&P 500 Index and 17.3x for the S&P 500 Food & Staples Retail Index. The company is also valued higher in terms of other valuation measures such as price-to-book value and enterprise value to EBITDA.

However, Costco’s forward price-to-sales ratio is in line with the S&P 500 Food & Staples Retail Index (FXD) (RTH), and it’s lower than several competitors including Dollar Tree (DLTR), Dollar General (DG), Target (TGT), and Whole Foods Market (WFM).

Organic growth rates

The company’s stock price and valuation have risen the most over the past year in comparison to the majority of its peers. Costco also had one of the fastest and most consistent organic growth rates among peers. While companies like Kroger (KR) have raised their top line significantly, the increase has been a result of both organic and inorganic initiatives.

In contrast, Costco’s expansion has proceeded at a measured pace. The company still hasn’t opened a brick-and-mortar warehouse in China. According to Richard Galanti, CFO and executive vice president of Costco, “At some point, we’ll probably open a couple of units. But we haven’t pulled that trigger yet to actually go forth. I would say it’s probable in the next five years, but we got a lot going on. And for 20 years, we’ve never been terribly concerned about we got to get there now.”

Considering Target’s withdrawal from Canada, and the issues faced by other mass merchandisers like Carrefour (CRRFY), Walmart (WMT), and Tesco (TSCDY) in protecting market share in China, the caution may be merited.

Margin expansion

Costco has also been more successful in its overseas forays than its peers have. Currency issues notwithstanding, Costco’s overseas operations have performed relatively better, as discussed in parts six and 11 of this series. Most importantly, low-cost operator Costco has been able to improve margins both in the US and abroad, which has provided upside to its stock price and valuations.

Fiscal 1Q16 results analysis

Costco’s stock price touched several all-time highs over the past year. The last record high of $168.87 came about on December 8, 2015. That’s the day before the company announced results for fiscal 1Q16, which ended November 22. The company’s share price had risen by 4.6% in December in the run-up to the results release.

However, Costco’s 1Q16 earnings missed consensus Wall Street analyst estimates for both adjusted earnings per share (or EPS) and revenue. As a result, the stock price plunged 5.4% after the release. This was the first earnings miss for Costco since fiscal 3Q14. In contrast, Walmart (WMT) came in ahead of Wall Street estimates in its last reported quarter although EPS was down year-over-year. Target’s (TGT) earnings were in line with analyst estimates.

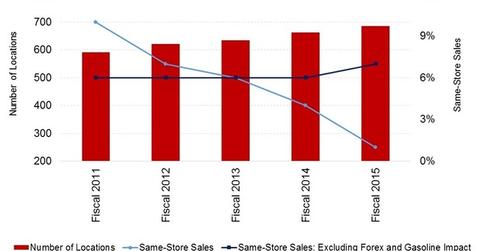

Same-store sales

Costco’s comparable warehouse sales (XRT) (RTH) came in at -1% with US, Canadian, and Other International comps coming in at 2%, -9%, and -5%, respectively. The comps numbers, which appear highly disappointing, were severely affected by energy price deflation and the appreciation of the US dollar versus overseas currencies, particularly the Canadian dollar, the Japanese yen, and the Korean won.

However, excluding the gasoline and forex impact, global same-store sales rose by 6%. US, Canadian, and Other International comps rose by 6%, 9% ,and 7%, respectively.

Costco’s fiscal 1Q16 earnings analysis

Costco’s adjusted EPS came in at $1.09 in 1Q16 versus the consensus market estimate of $1.17. EPS fell 2.7% year-over-year (or YoY). The company[1. Based on comments by Richard Galanti, EVP and CFO of Costco] cited adverse foreign exchange movements, which reduced earnings by $42 million, or $0.10 per share. Other factors affecting earnings included:

- higher expenditure on stock compensation expense, which reduced EPS by $0.05

- higher expenditure on IT modernization, which reduced EPS by $0.03

- non-recurring legal charges incurred in 1Q, which reduced EPS by $0.04

- $0.03 per share non-recurring benefit from a legal settlement received in 1Q15, which benefited last year’s comparison versus that of the current year

- transition impact to the new co-branded credit card, which reduced EPS by $0.02

In the next article, we’ll discuss Costco’s outlook.

Fiscal 2016 outlook

Costco Wholesale (COST) doesn’t provide guidance numbers for earnings and revenue unlike its peers Walmart (WMT) and Target (TGT). Based on consensus Wall Street analyst estimates, the company is expected to clock revenue of $122.1 billion in fiscal 2016, ending August 31, 2016. That’s a growth rate of 5.1% year-over-year. Adjusted earnings per share (or EPS) is expected to come in at $5.51, implying a growth rate of 5.1% over fiscal 2015.

Costco’s outlook and earnings drivers

Growth in earnings and sales is likely to be primarily driven by new warehouse openings. Costco plans to open 32 this fiscal year including 22 in the US. US store (XLP) (SPY) openings may result in sales cannibalization, resulting in slower comparable warehouse sales growth going forward. However, the investments in new warehouses may be necessary given the high geographic concentration and the high growth in same-store sales that the company has already experienced over the past several quarters. Costco plans to spend $2.8 billion to $3.0 billion on capex this year, and about $2.5 billion to $3.0 billion through fiscal 2020.

The negative impact of forex movements and gasoline price deflation, which severely affected fiscal 2015 and 1Q16 results, will likely affect Costco’s financials in the current year as well. On the other hand, these factors may be somewhat mitigated by same-store sales growth, both at home and abroad. Lower gasoline prices will likely provide upside to consumer spending, particularly in the US, where employment generation has been robust.

Profitability upside

Costco’s future margins are likely to benefit from its international expansion plans. As detailed in part 11, Canada and other overseas countries have historically been more profitable for the company. Plus, labor costs also tend to be relatively lower in some countries compared to the US.

Costco’s profitability is also likely to get a bump from the increasing penetration of its private-label brand, Kirkland Signature, and focus on organics. These factors should also prove accretive to margins going forward.

The weaknesses inherent in Costco’s operating model

Costco Wholesale (COST) is highly concentrated in terms of geography. The US (IVV) and Canada account for 87.5% of its sales and 85% of its operating profit. Even within the US, Costco derives a disproportionate amount of revenue from California, about 31% of total US sales in fiscal 2015. California is also home to some of the company’s highest grossing warehouses. Thus, the performance of California’s economy is critical to Costco’s sales.

Foreign exchange movements

Costco is also vulnerable to adverse forex movements of the US dollar versus foreign currencies, particularly the Canadian dollar. Canada accounted for ~14.9% of Costco’s sales and 21.3% of its operating income in fiscal 2015. The appreciation of the US dollar versus the Canadian dollar negatively impacted sales by ~$2 billion. The global impact of adverse forex movements was $0.28 per diluted share in fiscal 2015. This factor is likely to pose greater risks as the company opens more warehouses abroad. Competitors like Target (TGT), Kroger (KR), and Dollar General (DG) have no overseas stores.

Membership base

Costco’s demographic base is tilted towards the older segment of the population. As its customer base ages and trends towards retirement, these customers’ spending will likely trend lower. Costco is trying to overcome this by appealing to a younger segment of the population, as we discussed in the last article. However, according to Richard Galanti, CFO of Costco, “the average age of a Costco member has come down. I think a few years ago, we were about four years older than the average in the US, now we’re a little under two years older. About a third of our new signups in recent months have been millennials.”

Possible threats: Competition

Costco operates in a highly competitive industry. While its no-frills model has proven hugely successful in the past, competition is on the rise, both from online retailers like Amazon (AMZN), as well as from other supermarket chains and discount operators.

Competition from discount supermarket chains Aldi and Lidl in the US market may also prove a threat to Costco’s operating model. These operators have well-established private-label brands, and could pose further competitive threats to the success of Kirkland Signature, Costco’s own private-label brand.

E. Coli outbreak

In November 2015, an E. Coli outbreak was linked to chicken salad sold at Costco’s warehouses. According to the Center for Disease Control, the company “voluntarily removed” chicken salad from all its US warehouses. While this is a one-off incident, it may have the impact of slowing store traffic, at least in the near term. Health and safety concerns are a paramount risk for Costco as well as its competitors.

To learn more about Costco’s competitor Walmart (WMT), please read the takeaways from its annual investor day in our series A Walmart Investor Update: 3-Year Earnings and Growth Outlook.

Costco’s strengths

Costco Wholesale (COST) employs a dominant no-frills and relatively recession-resistant retail (XRT) model. The company believes in competitive pricing, even if its margins have to take a hit in the short term. This is one of the company’s major strengths. Even during the Great Recession of 2008-09, its same-store sales (excluding fuel) were positive.

Costco’s consistent increase in same-store sales is one of its major strengths. Its value-for-money philosophy has helped the retailer attract and retain a loyal customer base. Renewal rates are rising, both in the US and abroad.

Consistent financial results

Costco’s management has also exhibited good cost control. Profitability margins haven’t varied much in the last ten years. In fact, they’ve risen slightly, owing to the company’s strategic expansion and cost control initiatives. Consistency in financial results is reflected in the company’s cumulative performance, which has surpassed the performance of its peer group in the five years through August 30, 2015. The peer group comprises Walmart (WMT), Target (TGT), The Home Depot (HD), Lowe’s (LOW), Amazon (AMZN), Best Buy (BBY), Kroger (KR), and Staples (SPLS).

Store expansion

Costco has looked at measured expansion in the US and abroad. Its store footprint as yet is considerably smaller than Walmart’s and Target’s, as well as several other competitors. As such, Costco has a sizable opportunity in transitioning from primarily a North America-based retailer to a truly global name.

Millennials

Attracting and retaining millennial customers is both a challenge and an opportunity for Costco and other wholesale clubs in North America. Part of the challenge stems from the fact that millennials tend to prefer urban living, whereas Costco’s warehouses, out of economic necessity, tend to be located in more suburban locations. According to Richard Galanti, CFO of Costco, about one-third of new membership signups in recent months have been millennials.

Organics and fresh food

Adding to its fresh and organic produce will be a key attractor for millennials. Plus, organics also represents a sizable opportunity for Costco, both for the top and bottom lines. Also, Costco’s e-commerce channel growth should also boost sales both from millennials as well as other demographic groups.

Scale rules

Warehouse clubs in the US are dominated by three major chains:

Sales growth

The first two firms are more dominant players. Walmart’s Sam’s Club clocked sales of ~$58 billion in fiscal 2015, which ended on January 31, 2015. Costco’s US sales came in at $84.4 billion in fiscal 2015, ending August 30, 2015.

BJ’s Wholesale Club is privately held, having been purchased by Beacon Holding, an affiliate of private equity firm Leonard Green & Partners, in 2011. The National Retail Federation estimates BJ’s sales in the region of $12 billion last fiscal year.

Locations and growth

With 487 warehouses in the US at the end of fiscal 1Q16, Costco is the largest membership warehouse club in terms of sales. Sam’s Club had 652 locations at the end of fiscal 3Q16. BJ’s Wholesale Club is a considerably smaller player with an estimated 210+ outlets, but operating only in 15 US states.

Costco has also been growing the fastest. Its top line in the US has grown at a compounded annual growth rate (or CAGR) of 7.2% over the past five years, nearly twice that of Sam’s Club at ~4%, and over twice that of BJ’s 3.3% CAGR.

Economies of scale are critical to ensuring profit maximization since margins are razor thin and competition is high from other mass merchandisers like Target (TGT), hypermarket chains, and discount retailers. The next article discusses other forces shaping the industry.

Costco, Walmart, and Target together constitute 3.6% of the portfolio holdings in the SPDR S&P Retail ETF (XRT). XRT provides exposure to 101 retail sector stocks. The three companies are also S&P 500 Index components. They’re part of the iShares Core S&P 500 ETF (IVV), making up 1.2% of the ETF’s portfolio.

Porter’s five forces: Industry rivalry and threat of substitutes

Warehouse clubs offer products like groceries, health and wellness products, apparel, electronics, and hardlines. Some outlets also include gasoline stations. Due to the vast array of largely undifferentiated products, they are consequently subject to competition from several general and specialty retailers including supermarkets, home improvement retailers, and department stores.

Costco (COST) cited Walmart (WMT), Target (TGT), and Amazon (AMZN) as some of its most significant competition in the general merchandise category. Big box retailers like Home Depot (HD), Lowe’s (LOW), Best Buy (BBY), as well as food and drug retailers like Walgreens Boots Alliance (WBA) and CVS Health (CVS) also present competition in select categories.

Costco, Walgreens Boots Alliance (WBA), and Amazon together constitute ~8.7% of the holdings in the PowerShares QQQ Trust, Series 1 (QQQ).

Supplier forces

Costco’s suppliers include companies like PepsiCo (PEP), Procter & Gamble (PG), and the Kraft Heinz Company (KHC). No single supplier accounts for over 5% of revenue. Besides, being one of the largest retailers in the world, Costco’s bargaining position is relatively strong with its suppliers.

Customer choices

On the flip side, Costco is also subject to cutthroat competition from other warehouse clubs, supermarkets, supercenters, department stores, discount stores, other specialty retailers, and even neighborhood bodegas. Due to the large space requirement and lean margins model, the company’s presence in urban areas is limited, which leaves a gap in fulfilling consumer requirements in cities. Besides, millennials have typically been averse to shopping at warehouse clubs, although both Costco and Walmart are looking to address this issue and spur membership rates among this demographic.

Barriers to entry

It’s easy to start a competing business, though much harder to do it on the scale employed by Costco due to capital and other logistical requirements. A new competitor would also find it much harder to have the same recognition for consistency in pricing and products that Costco has, as the company has been around for decades. It would also require scale in order to pose a significant threat to Costco.