Will API Inventory Report Limit Upside for Crude Oil Prices?

November WTI (West Texas Intermediate) crude oil futures contracts rose 0.32% to $50.97 per barrel in electronic trade at 5:10 AM EST on October 12, 2016.

Nov. 20 2020, Updated 3:09 p.m. ET

Crude oil prices

November WTI (West Texas Intermediate) crude oil futures contracts rose 0.32% to $50.97 per barrel in electronic trade at 5:10 AM EST on October 12, 2016. For more on crude oil prices, read part one of this series.

API crude oil inventories

On October 12, 2016, the API (American Petroleum Institute) will release its weekly crude oil (USO) (UWTI) (RYE) inventory report.

Market surveys estimate that US crude oil inventories could have risen by 286,000 barrels between September 30 and October 7, 2016. An increase in crude oil inventories could limit the upside for US crude oil prices.

Lower crude oil prices have a negative impact on oil and gas producers’ earnings such as Synergy Resources (SYRG), Comstock Resources (CRK), and Sanchez Energy (SN). On October 4, 2016, the API reported that US crude oil inventories fell by 7,600,000 barrels between September 23 and September 30, 2016.

EIA’s crude oil inventories

The API report will be followed by the EIA’s (U.S. Energy Information Administration) weekly crude oil inventory report for the week ending October 7 on October 13, 2016, at 10:30 AM EST.

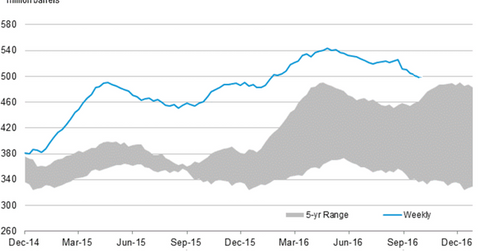

For the week ending September 30, 2016, the EIA reported that US crude oil inventories fell three MMbbls (million barrels) to 499.7 MMbbls from September 23 to September 30, 2016. For a regional breakdown of crude oil inventories, read US Crude Oil Inventories Are Down 26 Million Barrels in 5 Weeks.

Impact of US crude oil inventories

US crude oil inventories hit an all-time high of 543.6 MMbbls in the week ending April 29, 2016. Nationwide crude oil inventories fell 8% from all-time highs. The decrease in inventories could support crude oil prices. High crude oil prices could have a positive impact on the earnings of oil and gas producers like Comstock Resources (CRK) and Sanchez Energy (SN).

The roller coaster ride in oil prices also impacts ETFs and ETNs such as the ProShares Ultra Bloomberg Crude Oil ETF (UCO), the Energy Select Sector SPDR (XLE), the ProShares Ultra Oil & Gas (DIG), the ProShares UltraShort Bloomberg Crude Oil ETF (SCO), the iShares U.S. Energy ETF (IYE), and the United States Brent Oil ETF (BNO).

In the next part of this series, we’ll look at the IEA’s monthly Oil Market Report.