Why Oil Is More Vital than Natural Gas to Natural-Gas-Weighted Stocks

Natural gas supplies depend on US crude oil prices. In fact, the energy sector as a whole can follow trends set by crude oil.

Nov. 20 2020, Updated 2:07 p.m. ET

Natural-gas-weighted stocks

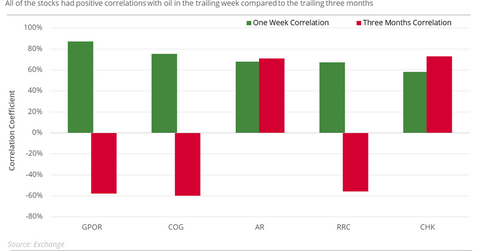

The natural gas-weighted stocks that could rise with oil prices after the inventory report on January 18, 2018, based on the past four trading sessions’ correlations with oil prices are:

These natural-gas-weighted stocks are from the SPDR S&P Oil & Gas Exploration & Production ETF (XOP) with at least a 60% production mix in natural gas.

The natural-gas-weighted stocks that had the least correlation with oil (USO) (USL) prices in the past four trading sessions are:

Oil’s impact

Natural gas supplies depend on US crude oil prices. In fact, the energy sector as a whole can follow trends set by crude oil. So, most of these natural-gas-weighted stocks showed a higher correlation with oil prices compared to natural gas in the past four trading sessions.