Will Natural Gas Prices Hit New Lows?

Cold winter weather could drive natural gas prices higher. But on the other hand, record natural gas stocks will push natural gas prices lower.

Oct. 23 2015, Published 11:08 a.m. ET

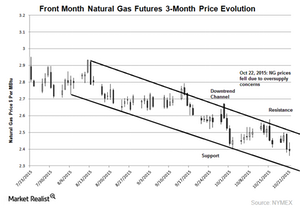

Trading channel

Natural gas futures contracts for November delivery have been trading within a downward trending range since August 2015. Prices fell for the second consecutive day and are trading close to the key support of $2.30 per MMBtu (British thermal units in millions). The long-term oversupply concerns are driving natural gas prices.

Key pivots

Cold winter weather could drive natural gas prices higher. The next resistance for natural gas prices is at $3 per MMBtu. Prices hit this mark in April 2015. On the other hand, record natural gas stocks will push natural gas prices lower. The nearest support for natural gas prices is seen at $2.30 per MMBtu. Prices tested this level in June 2012.

Goldman Sachs (GS) estimates that gas prices could average around $2.70 per MMBtu in 4Q15. The EIA (U.S. Energy Information Administration) forecasts that natural gas prices could average around $2.81 per MMBtu in 2015 and $3.11 per MMBtu in 2016. The natural gas price chart suggests that natural gas prices could oscillate between $2.30 and $2.80 per MMBtu in the short term.

The long-term lower natural gas prices impact US natural gas producers such as Ultra Petroleum (UPL), Gulfport Energy (GPOR), Cimarex Energy (XEC), EXCO Resources (XCO), and Comstock Resources (CRK). These companies account for 5.4% of the SPDR S&P Oil & Gas Exploration & Production ETF (XOP). These companies’ natural gas output mixes are more than 49% of their total production.

The roller coaster ride of oil and gas prices impacts ETFs such as the Velocity Shares 3x Inverse Natural Gas ETN (DGAZ) and the iShares US Oil Equipment & Services ETF (IEZ).