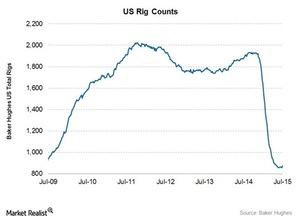

Biggest US Rig Count Rise in a Year: What Does It Change?

Despite recent rises, at 876, the US rig count is still at its lowest level since January 2003. In September 2014, the average rig count came close to the record, reaching 1,931.

July 28 2015, Published 2:46 p.m. ET

Total US rig count

According to oilfield service company Baker Hughes (BHI), there were 876 active oil and gas rigs in the United States in the week ended July 24, 2015. This is 19 more rigs than in the previous week, which ended July 17. This is the third weekly rise in the US rig count in the past four weeks. This also marks the biggest increase in the number of active rigs since August 2014. Until the week ended June 19, the US rig count had fallen consecutively for 28 weeks.

With last week’s rise, the four-week average change in the US rig count increased to four. In comparison, the four-week average change was zero for the week ended July 17. Four-week averages offer a smoother view of this trend, which is otherwise quite volatile on a weekly basis.

Rig counts in perspective

The US rig count experienced an uptrend throughout most of 2014. However, that trend reversed with 28 consecutive weeks of falling rig counts until the week ended June 19. Despite recent rises, the US rig count is still at its lowest level since January 2003.

June’s average rig count of 861 represents a fall of 28 from the 889 active rigs in May. In comparison, May’s rig count fell by 87 from April. So the monthly rate of rig count decreases has also been falling.

The overall US rig count hit 2,031 in September 2008—the highest it had been since July 1987, according to Baker Hughes. In September 2014, the average rig count came close to that record. It reached 1,931. Since then, ~55% of the rigs have been idled.

Impact on energy companies

Energy companies including Encana (ECA), Linn Energy (LINE), SM Energy (SM), Carrizo Oil & Gas (CRZO), and Newfield Exploration (NFX) have upstream operations. A rising rig count typically indicates increased exploration and development activities among these upstream companies. This could lead to greater energy production.

Upstream MLPs such as Memorial Production Partners (MEMP), Legacy Reserves (LGCY), Eagle Rock Energy Partners (EROC), Atlas Resource Partners (ARP), and Vanguard Natural Resources (VNR) could also benefit from increased drilling.

However, higher production could push energy prices lower, which could eventually force rig counts back down. We’ll study this relationship in more detail later in this series.

SM Energy accounts for 1.4% of the SPDR S&P Oil & Gas Exploration & Production ETF (XOP). Carrizo Oil & Gas accounts for 0.13% of the iShares U.S. Energy ETF (IYE).