Encana Corporation

Latest Encana Corporation News and Updates

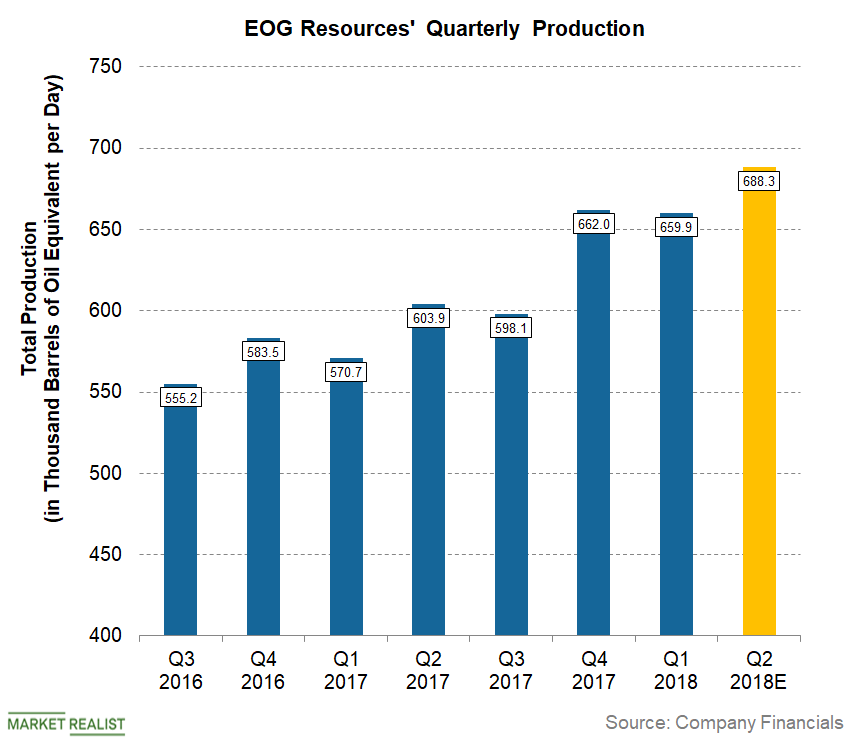

Understanding EOG Resources’ Q2 2018 Production Guidance

For the second quarter, EOG Resources expects total production in the range of 670.3–706.2 Mboepd (thousand barrels of oil equivalent per day).

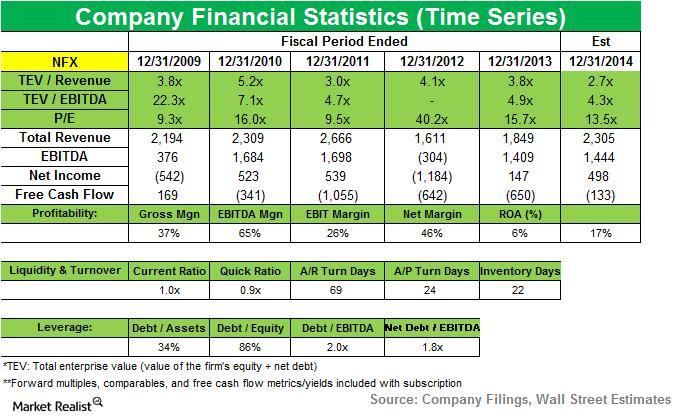

Balyasny exits position in Newfield Exploration Co.

BAM exited its position in Newfield Exploration Co. in 3Q14. It accounted for 1.31% of BAM’s second quarter portfolio. NFX is an energy company.Energy & Utilities Must-know: An overview of Athlon Energy

Athlon is an independent oil and gas exploration and production company. Its activities include the acquisition, exploration, and development of oil and liquids-heavy gas resources in the Permian Basin.

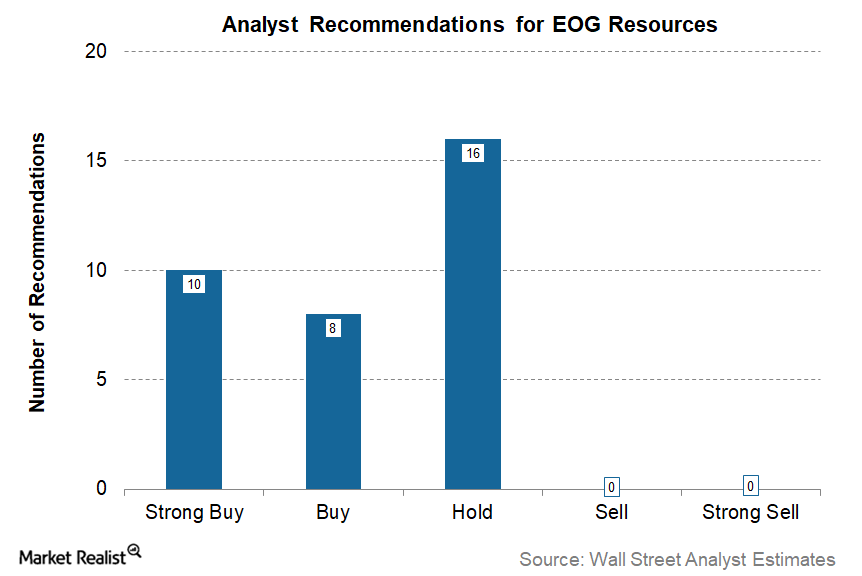

EOG Resources: Post-Earnings Wall Street Ratings

As of March 1, 2018, a total of 34 analysts have made recommendations on EOG Resources (EOG) stock, according to Reuters.

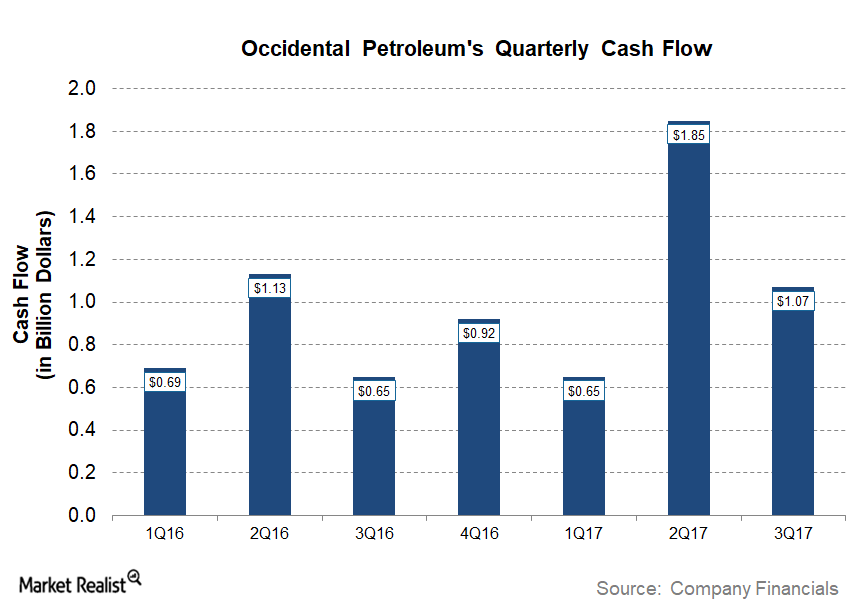

Did Occidental Petroleum Generate Positive Free Cash Flow in 3Q17?

On a year-over-year basis, OXY’s 3Q17 operating cash flow was ~65% higher than the ~$650 million it generated in 3Q16.

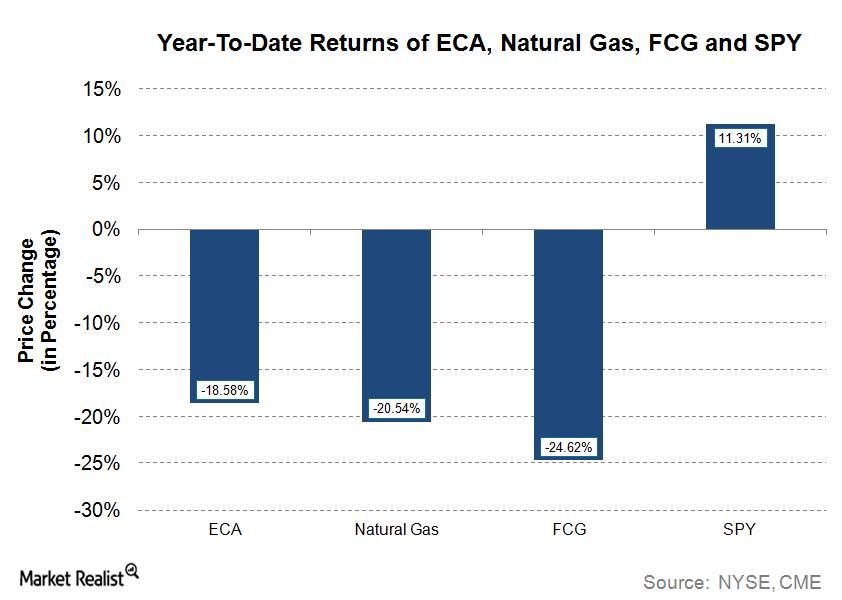

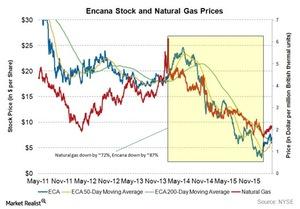

How Encana Stock Has Performed This Year

Year-to-date, Encana’s (ECA) stock has fallen ~19% to $9.53. The stock is trading below its 50-week and 200-week moving averages.

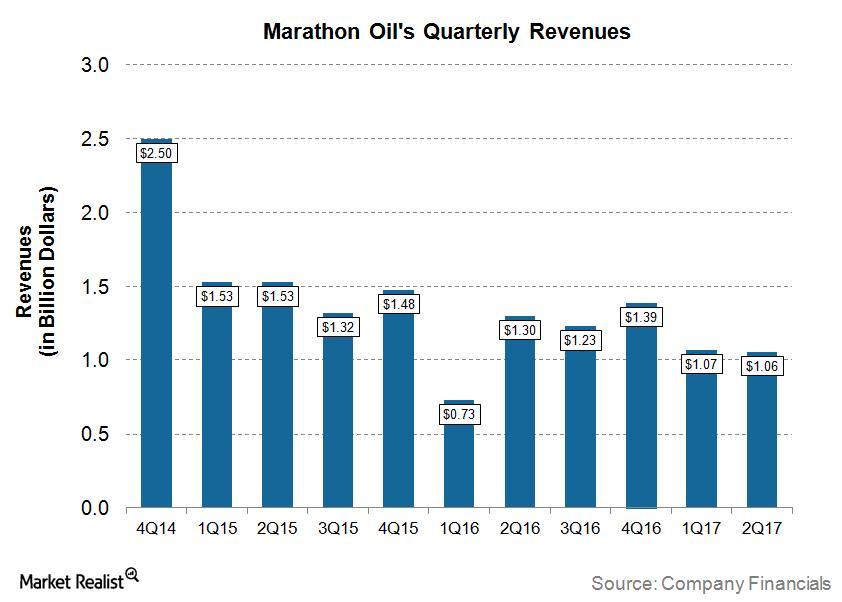

Analyzing Marathon Oil’s 2Q17 Revenues

For 2Q17, Marathon Oil (MRO) reported revenues of ~$1.06 billion, which was higher than Wall Street analysts’ consensus for revenues of ~$1.02 billion.

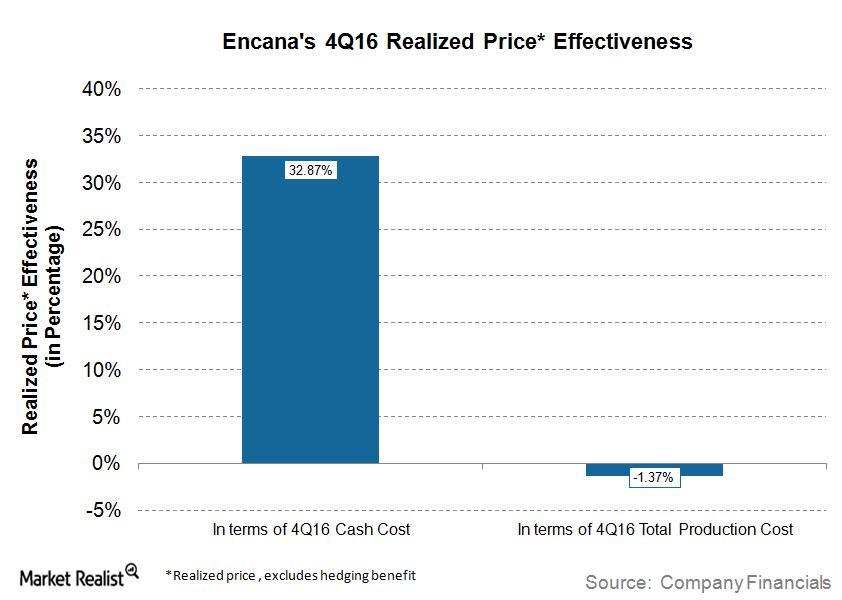

Analyzing Encana’s Realized Price Effectiveness

Encana’s (ECA) production cash cost has increased on a year-over-year basis. For 4Q16, Encana’s production cash cost was $17.92 per boe, higher than $17.74 per boe in 4Q15.

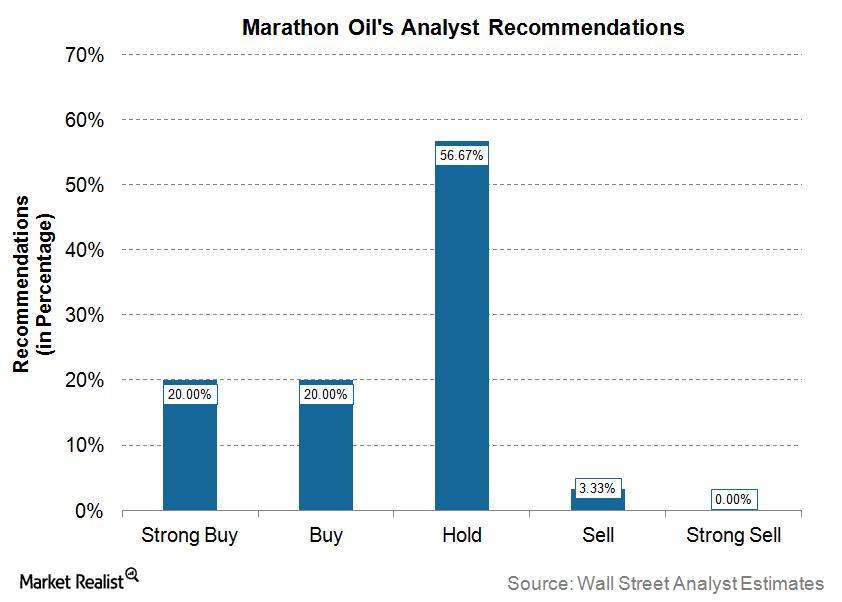

What Are Analysts Saying about Marathon Oil?

Recommendations Currently, 30 analysts cover Marathon Oil (MRO). They’ve given six “strong buy,” six “buy,” 17 “hold,” and one “sell” recommendation on the stock. There were no “strong sell” recommendations. Target price Analysts’ median target price for MRO is $20, which is ~25% higher than the closing price of $16.05 on February 9, 2017. The mean […]

Encana: The Effect of Declining Natural Gas Prices

In this series, we’ll take a look at the effect of declining natural gas prices on Encana. We’ll also cover its May 17 Presentation for Investors on its Montney Resource Play.

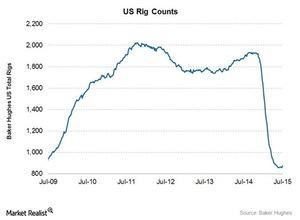

Biggest US Rig Count Rise in a Year: What Does It Change?

Despite recent rises, at 876, the US rig count is still at its lowest level since January 2003. In September 2014, the average rig count came close to the record, reaching 1,931.

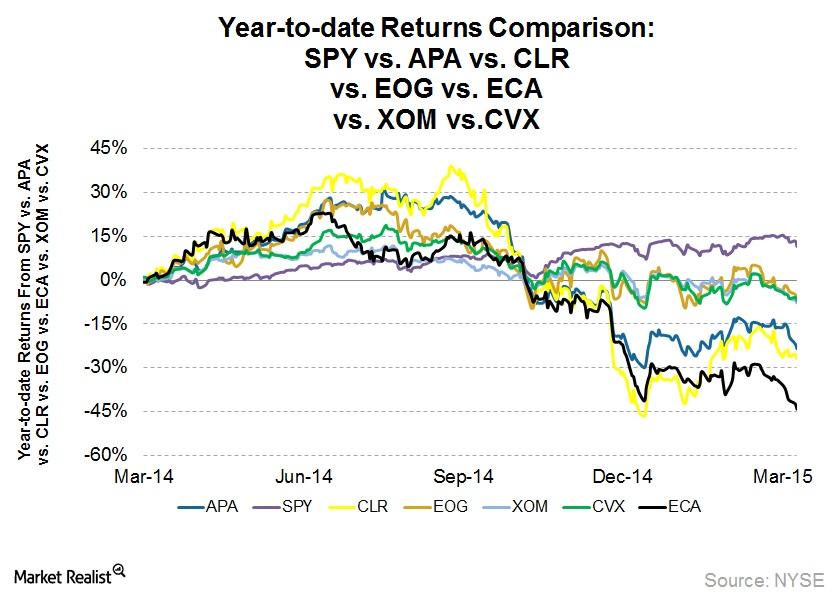

Falling oil prices affect energy upstream and integrated companies

Falling oil prices have started to affect energy upstream companies’ revenues. These companies have resorted to cutting costs and focusing on cash flow.

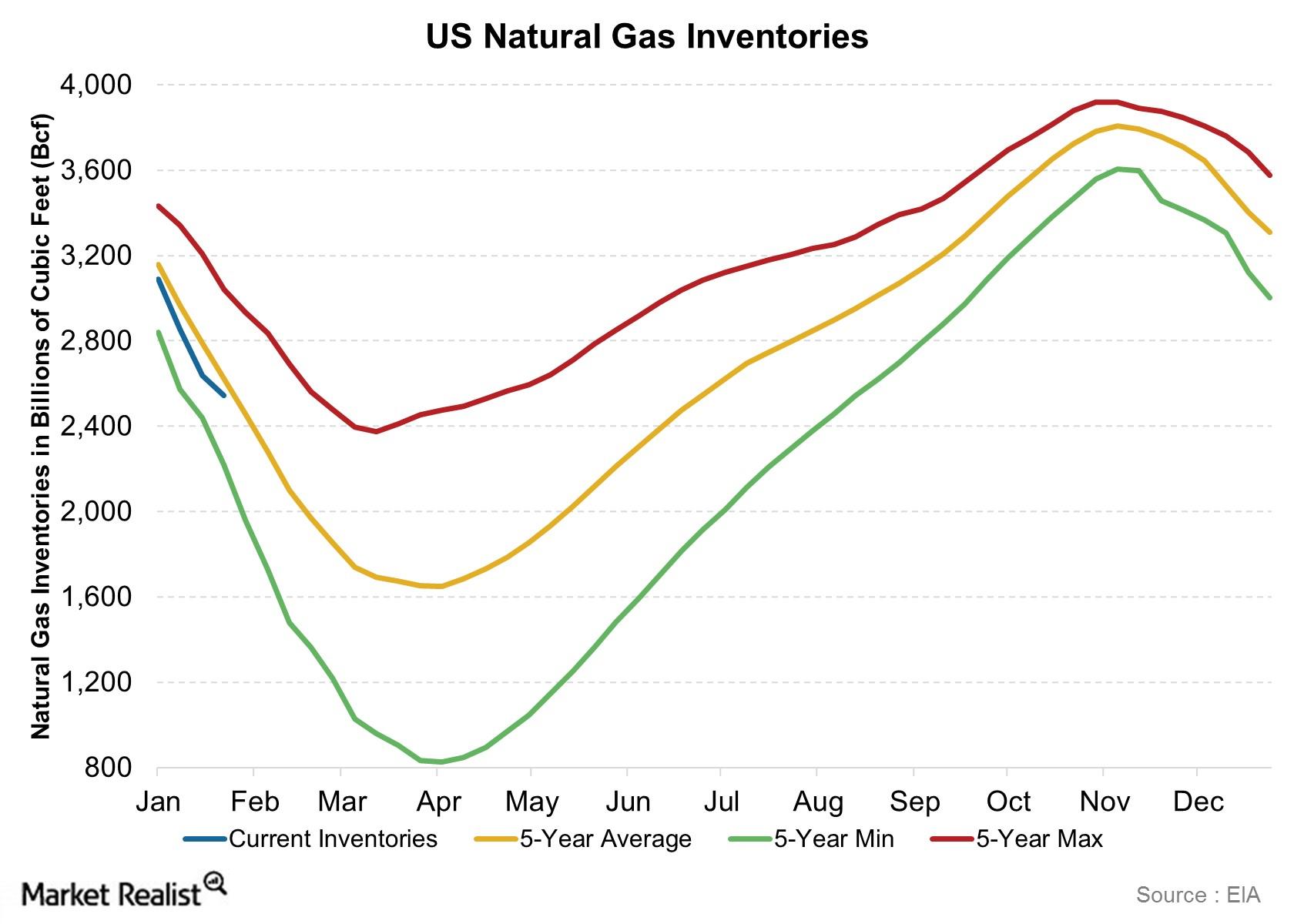

The EIA natural gas inventory report: Why should I care?

Natural gas inventory levels have a direct bearing on natural gas prices, which in turn affect the profitability of natural gas producers.