Vanguard Natural Resources LLC

Latest Vanguard Natural Resources LLC News and Updates

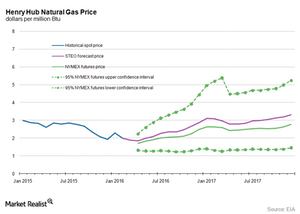

What’s the Long-Term US Natural Gas Price Forecast?

In its March Short-Term Energy Outlook report, the EIA forecast that the US natural gas supply-demand balance could average around 2.9 Bcf per day in 2016.

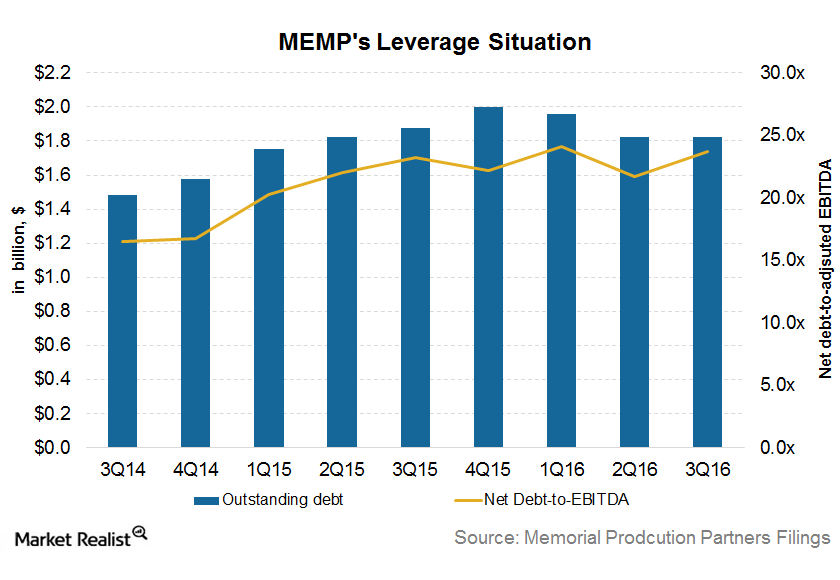

What Led to Memorial Production Partners’ Bankruptcy?

MEMP’s earnings improved in the recent quarter, but prior shortfalls were high and couldn’t be covered without a restructuring under Chapter 11 bankruptcy.

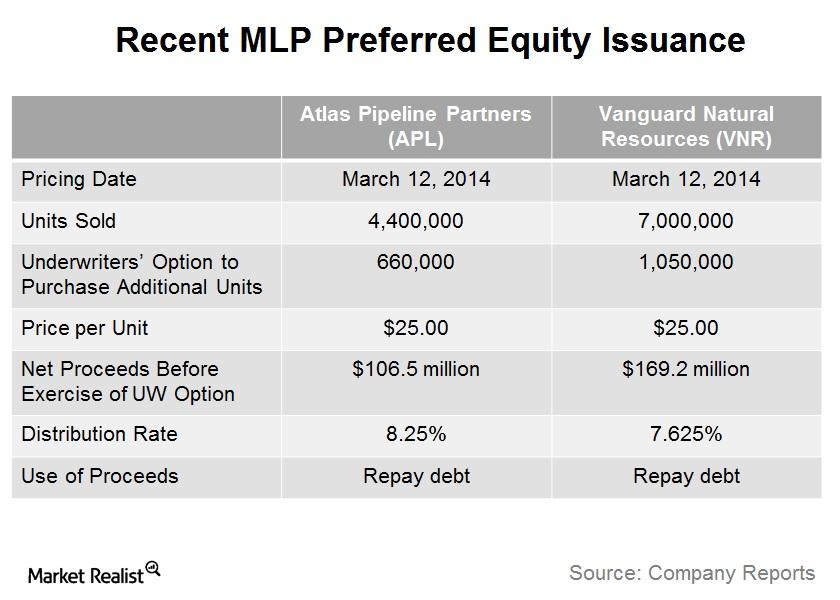

Is preferred equity a trend for master limited partnerships?

Recently, two master limited partnerships issued preferred equity, which is a relatively rare avenue of financing for MLPs.

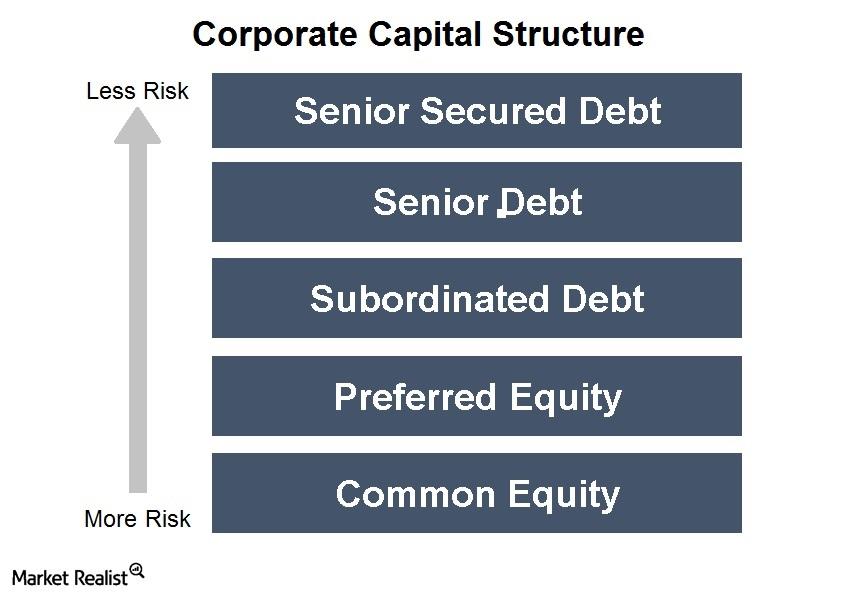

A guide to preferred equity and 2 MLPs that recently issued it

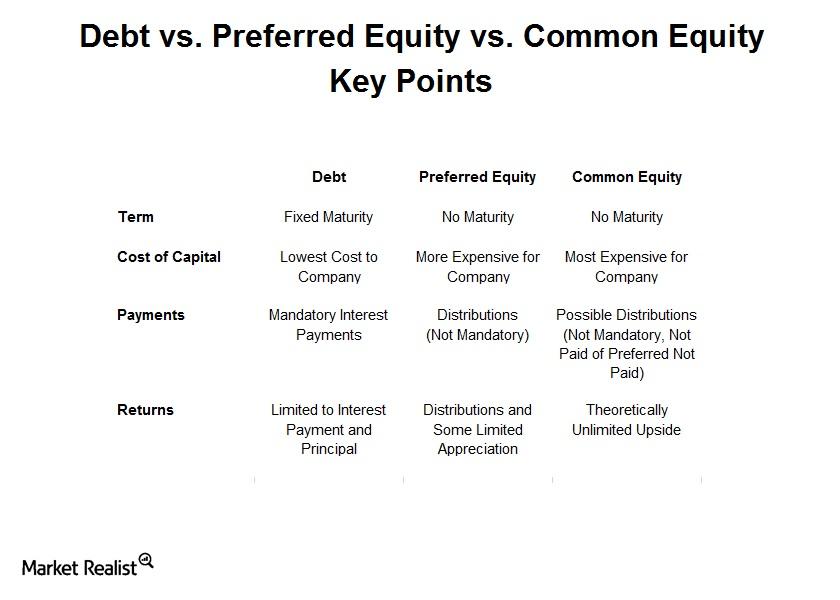

Preferred equity (also called “preferred stock”) is a class of security that has features of both common equity and debt. Preferred equity acts like stock.

Why some companies may “prefer” to issue preferred equity

Companies may prefer to raise money through preferred equity for a few reasons. One possible benefit to issuing preferred equity is to reach a new pocket of investors

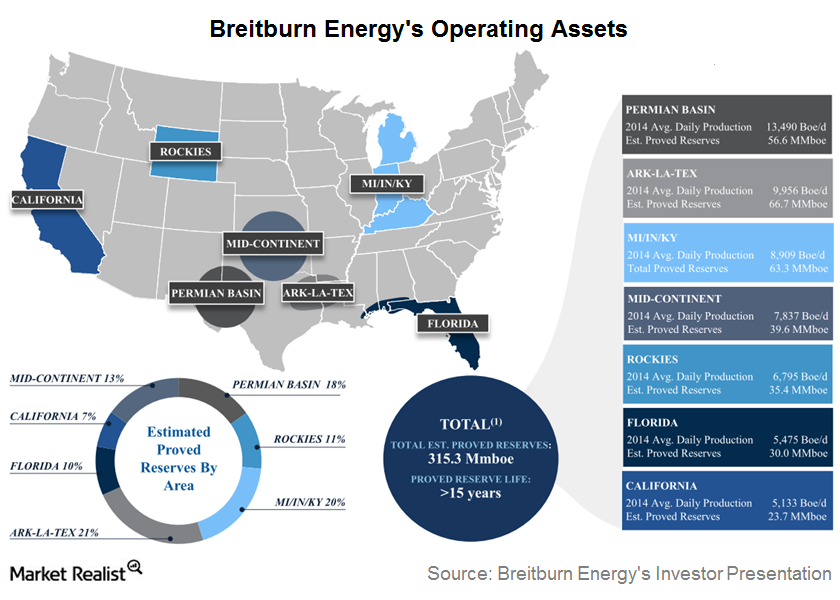

An Overview of Breitburn Energy

Breitburn Energy completed a few acquisitions in late 2014 to boost its total production. In November 2014, the partnership completed its merger with QR Energy.