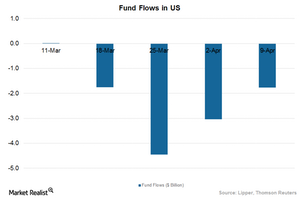

US Equities: 4th Consecutive Week of Outflow

US equities were impacted by weak jobs data and slower construction and manufacturing activity. But the energy sector attracted investors.

Nov. 20 2020, Updated 2:18 p.m. ET

US fund flows

US equities (SPY) witnessed net outflows for the fourth straight week. US equity flows were impacted by weak jobs data and slower construction and manufacturing activity. Other major markets including the European Union (EFA) and emerging markets (EMA) saw net inflows in equities.

Mutual fund offerings include active fund management. This is preferred by investors looking for expert money managers to generate higher returns than the indices. Higher fund flows will benefit T. Rowe Price (TROW), Franklin Resources (BEN), Vanguard, Fidelity, and American Funds.

More than half of all mutual funds are in US equities—~$17 trillion out of more than $30 trillion in mutual funds invested around the globe.

Energy sector attracts investment

The ETF market has grown many times over in the span of just a decade to more than $3 trillion. US Equities have more than 65% of that total allocation.

In early April, the SPDR S&P 500 ETF Trust (SPY) saw the highest outflow of $4.5 billion, followed by the iShares U.S. Real Estate ETF (IYR), the Shwab US Dividend Equity ETF (SCHD), and the Health Care Select Sector SPDR Fund (XLV).

The ETFs that attracted investment in early April include the iShares Russell 2000 ETF (IWM), the Energy Select Sector SPDR Fund (XLE), and the SPDR S&P Oil & Gas Exploration & Production ETF (XOP).

The energy sector appealed to investors on account of discounted valuations stemming from lower oil prices. A recovery in oil prices should continue to benefit providers offering products related to the energy sector. Asset managers including BlackRock (BLK), State Street (STT), and Vanguard are the major players in these ETFs.