US Crude Oil Prices Could Pressure Natural Gas Futures

Baker Hughes is scheduled to release its US crude oil and natural gas rig count report on November 11, 2017.

Nov. 20 2020, Updated 10:59 a.m. ET

US natural gas rig count

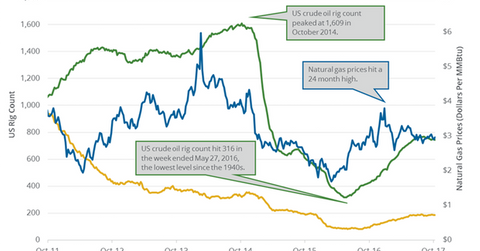

Baker Hughes is scheduled to release its US crude oil and natural gas rig count report on November 11, 2017. In last week’s report, it estimated that rigs fell by three to 169 on October 27–November 3, 2017. The rigs are at the lowest level since April 21, 2017. The rigs have fallen 1.7% week-over-week and 12% since July 28, 2017. The rigs have slowed due to lower oil (UCO) (SCO) and gas (UGAZ) (DGAZ) prices in the past few months.

Volatility in oil (DBO) and gas (BOIL) (GASL) prices impacts energy producers’ (XOP) (RYE) earnings like Rowan Companies (RDC), Atwood Oceanics (ATW), Halliburton (HAL), WPX Energy (WPX), and Rice Energy (RICE).

Monthly drilling productivity report

The EIA (U.S. Energy Information Administration) will release its monthly “Drilling Productivity Report” on November 13, 2017. In its previous report, the EIA reported that US natural gas production would rise in the important shale regions by 827 Mcf (million cubic feet) per day to 60,937 Mcf per day in November 2017—compared to October 2017.

Impact

US gas rigs are near a seven-month low. It indicates that natural gas rigs could fall more. However, US crude oil prices have risen more than 30% since the low in June 2017. They’re near a 30-month high. Natural gas is usually a byproduct of crude oil. Higher crude oil prices could drive US crude oil and gas rigs. The rise in natural gas rigs could drive US natural gas supplies and weigh on natural gas prices.