Atwood Oceanics Inc

Latest Atwood Oceanics Inc News and Updates

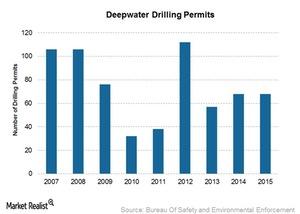

The 2010 Gulf Oil Spill Tragedy and Its Aftermath across the Industry

The marine oil spill in April 2010 was the worst environmental disaster in US history, causing millions of barrels of oil gushed into the Gulf.

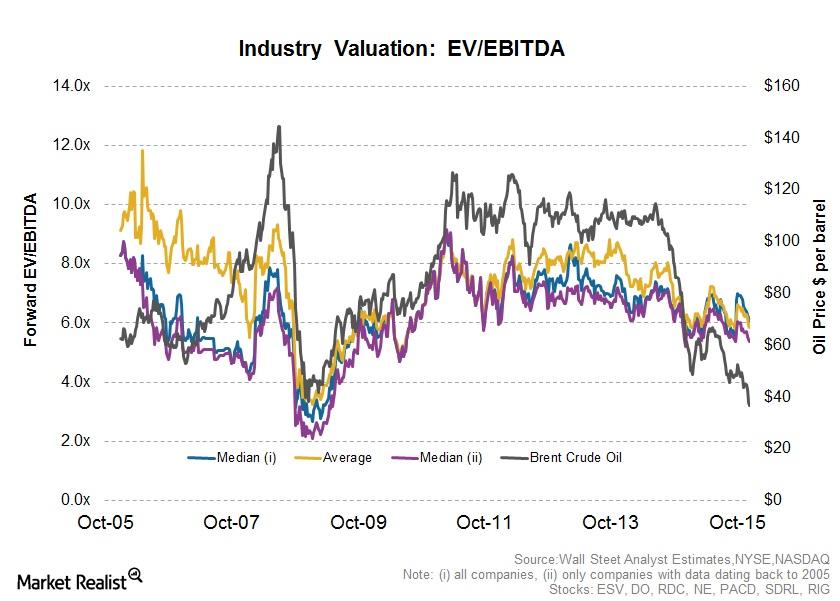

How to Interpret Valuation Multiples in the Offshore Drilling Industry

Offshore drilling companies are capital-intensive and have varying degrees of financial leverage. Thus, we use the EV-to-EBITDA multiple as a valuation.

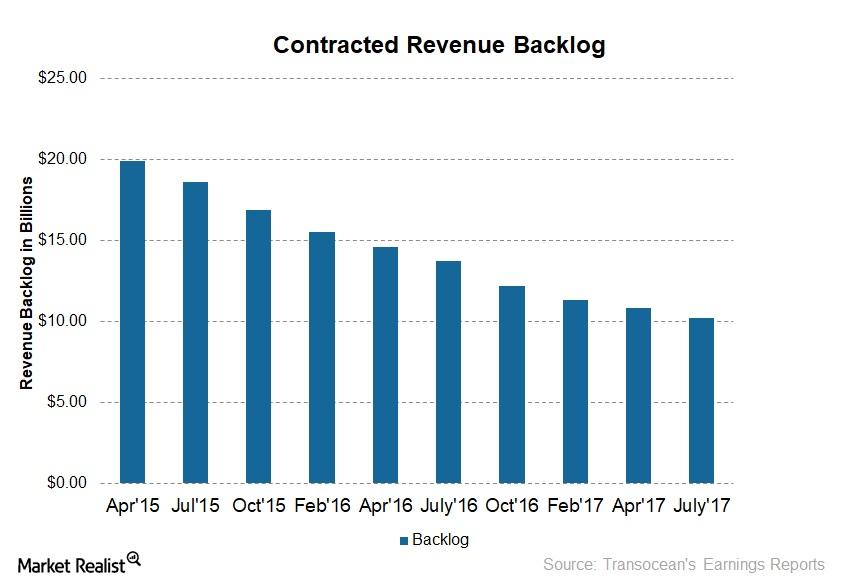

Transocean Secured New Contracts

As of July 25, 2017, Transocean (RIG) had a backlog of $10.2 billion—compared to $10.8 billion in April 2017.

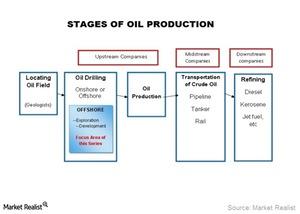

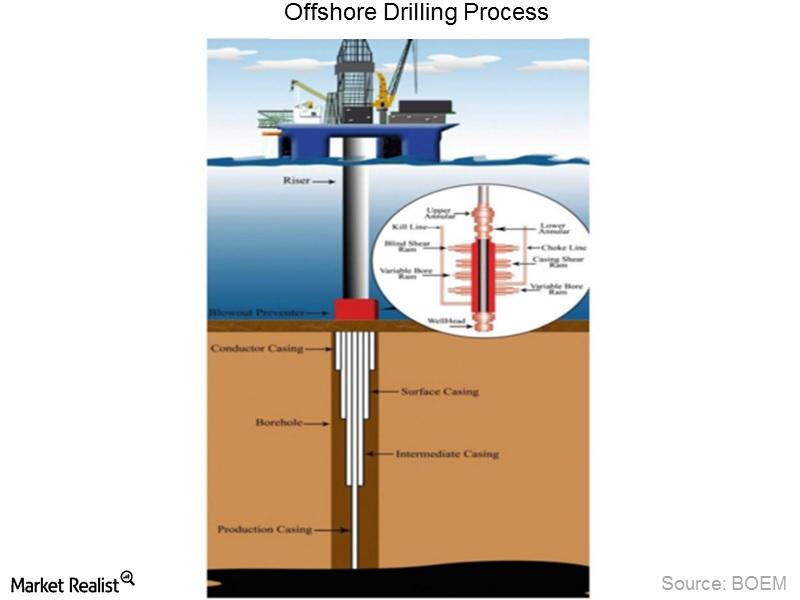

Extracting the Basics: An Introduction to Offshore Drilling

Oil is one of the most important and most frequently traded commodities, and offshore drilling is an integral part of the oil industry.

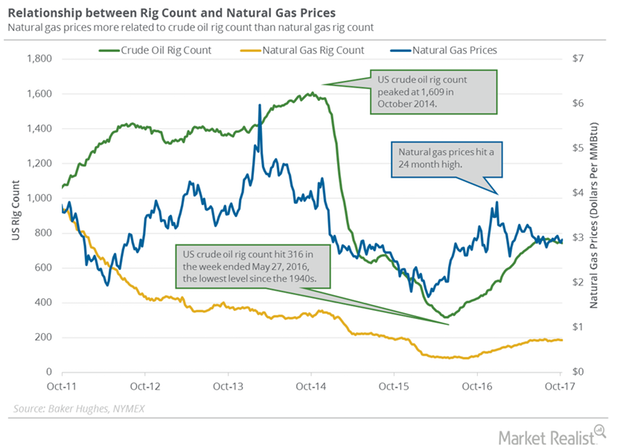

US Crude Oil Prices Could Pressure Natural Gas Futures

Baker Hughes is scheduled to release its US crude oil and natural gas rig count report on November 11, 2017.

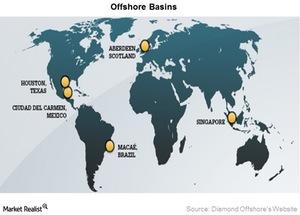

How Geography and Climate Impact Offshore Oil Rig Choices

The majority of offshore operations occur in six key locations worldwide that differ widely in terms of water depth, weather conditions, and remoteness.

Why the Offshore Drilling Process Is so Complex and Costly

The offshore drilling process requires complex machinery and large crews. At every stage, things that can go wrong, so each stage requires special care.