Are US Crude Oil Supply and Demand Tightening?

WTI (West Texas Intermediate) crude oil (XLE)(XOP)(USO) futures contracts for October delivery rose 2.2% to $49.3 per barrel on September 13.

Sept. 14 2017, Published 2:10 p.m. ET

US crude oil futures

WTI (West Texas Intermediate) crude oil (XLE)(XOP)(USO) futures contracts for October delivery rose 2.2% to $49.3 per barrel on September 13. Crude oil prices rose due to the record drop in US gasoline inventories by 8.4 MMbbls (million barrels) from September 1 to 8. The IEA (or International Energy Agency) estimates that global crude oil supply and demand are narrowing. It also supported oil prices.

WTI crude oil (PXI)(USL)(DBO) futures are at a one-month high. Higher crude oil prices have a positive impact on oil and gas producers like SM Energy (SM), Sanchez Energy (SN), and Goodrich Petroleum (GDP).

IEA global demand growth estimates

The IEA estimates that global crude oil demand growth will rise by 100,000 bpd or 1.7% to 1.6 MMbpd in 2017, which would be the highest increase since 2015. The IEA upgraded its crude oil demand forecast for the third straight month. The expectation of a rise in demand from the United States and Europe could support global demand.

IEA global crude oil supply estimates

The IEA estimates that global crude oil supply fell by 720,000 bpd to 97.7 MMbpd in August 2017 from July 2017. But global crude oil supply is 1,200,000 bpd higher than the same period in 2016.

Supplies fell for the first time in four months in August 2017 due to Hurricane Harvey, a fall in OPEC crude oil production, and summer maintenance work.

The IEA estimates that global product inventories will fall below their five-year average due to Hurricane Harvey. It also expects the impact from the hurricane to be shortlived.

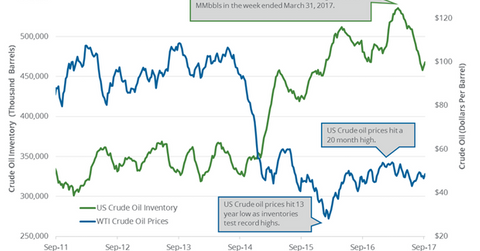

EIA crude oil inventories

The EIA (U.S. Energy Information Administration) released its weekly crude oil and gasoline inventory report on September 13. US crude oil inventories rose more than 10 MMbbls in the last two weeks. US crude oil production also rose last week. The rise in US supplies could pressure oil (RYE)(VDE)(IEZ) prices.

Series overview

In this series, we’ll review US crude oil inventories, refinery demand, production, and gasoline and distillate inventories.