How Will Weather Affect Natural Gas Prices This Week?

Lower temperatures decrease the use of natural gas (UNG) (DGAZ) (BOIL) (FCG) (UGAZ) (GASL) for cooling purposes during the summer.

Aug. 22 2016, Published 11:39 a.m. ET

What’s the weather forecast?

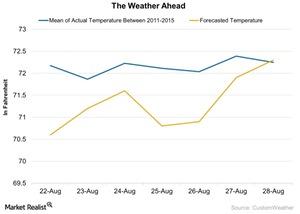

The weather forecast for August 22–27, 2016, indicates that temperatures in the US could remain lower than the five-year average for the same period, except on August 28. Lower temperatures decrease the use of natural gas (UNG) (DGAZ) (BOIL) (FCG) (UGAZ) (GASL) for cooling purposes during the summer. The weather could be a bearish catalyst for natural gas this week.

El Niño anomalies

Natural gas usage for heating during the 2015–2016 winter season was low due to mild weather. El Niño’s intensity kept temperatures warmer than normal. As a result, at the end of March 2016, US natural gas inventories were at 2.5 trillion cubic feet, 67% higher than their 2015 levels and 53% higher than their five-year average.

In the week ending August 19, 2016, temperatures were higher than the forecast for the week. However, natural gas futures were almost flat for the week ending on August 19, 2016.

On August 18, 2016, the EIA (U.S. Energy Information Administration) announced a 22 Bcf (billion cubic feet) addition in natural gas inventory levels for the week ending August 12, 2016. Markets expected an addition of 26 Bcf to the inventory, according to a report by the Wall Street Journal. The smaller-than-expected build led to a 2.1% rise in natural gas futures (UNG) (DGAZ) (BOIL) (FCG) (UGAZ) (GASL) on August 18, 2016. However, natural gas fell 3.4% on August 19, 2016, as analysts expect a record build-up in inventory before the winter season.

The above analysis could be important for natural-gas-tracking commodity ETFs such as the ProShares Ultra Bloomberg Natural Gas (BOIL), the Direxion Daily Natural Gas Related Bear 3X ETF (GASX), and the Direxion Daily Natural Gas Related Bull 3X ETF (GASL).

In the next part of this series, we’ll take a look at the recent performances of natural gas, crude oil, and the S&P 500 Index (SPY) (SPXL).