Sibanye Gold Ltd

Latest Sibanye Gold Ltd News and Updates

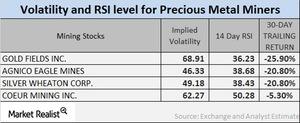

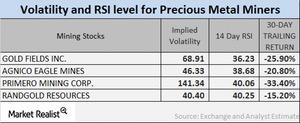

What Are Miners’ Volatility and RSI Levels?

Precious-metal-based funds such as the ProShares Ultra Silver (AGQ) and the Direxion Daily Gold Miners (NUGT) have seen a revival in their price during the last month.

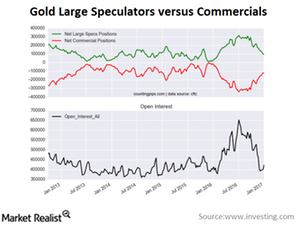

Reading Speculators’and Hedgers’ Positions in Gold

Large speculators and traders continued to reduce their bullish net positions in gold futures markets last week for the eighth consecutive week.

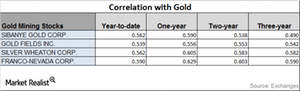

What Were Mining Stocks’ Correlations during December?

Precious metals had a great start to 2016. Franco-Nevada’s correlation rose from an ~0.59 three-year correlation to an ~0.63 one-year correlation.

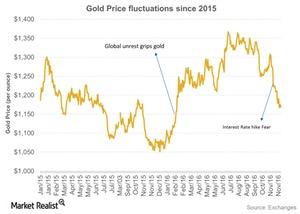

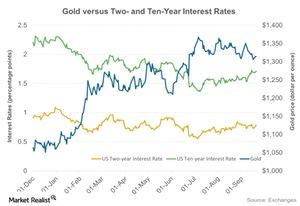

Why Did Gold Fluctuate in 2016?

Gold prices for February expiration fell on the last trading day of the year. Gold fell 0.53% and closed at $1,152 per ounce on December 30, 2016.

Analyzing Upward and Downward Correlations among Miners

Precious metals had a great start to 2016, but they’ve been falling since Donald Trump won the US presidential election. As a result, mining stocks have also been falling.

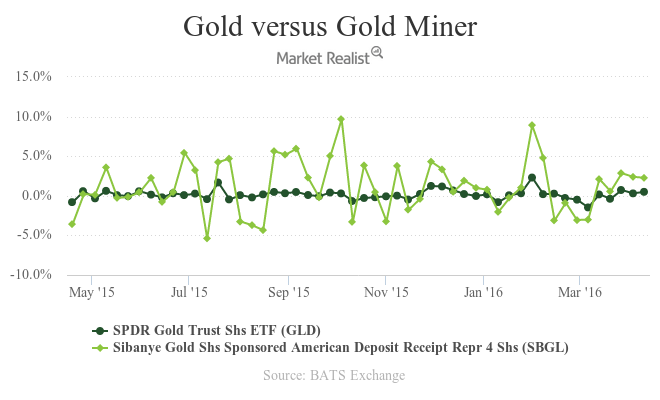

Which Mining Stock Is Most Correlated to Gold?

Mining companies that have high correlations with gold include Sibanye Gold (SBGL), Gold Fields (GFI), Silver Wheaton (SLW), and Franco-Nevada (FNV).

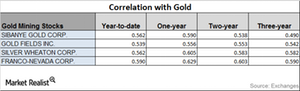

What’s Affecting the Gold-Palladium Spread?

Palladium has seen a year-to-date rise of 24.9%, which is higher than the increase in platinum, silver, and gold.

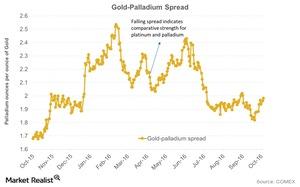

Will Gold Keep a Close Watch on Inflation Numbers?

Donald Trump’s recent victory is shining a light on the possibility of a rise in inflation and how such a rise could work for gold.

Fed’s Hawkish Stance: Why It Impacted Precious Metals

Last week was rough for precious metals. Gold, silver, platinum, and palladium all fell. Gold had the biggest weekly fall in about three years.

Why Are Precious Metals Showing Weakness?

Gold broke its key level of $1,300 per ounce on Tuesday, October 4, 2016. But investors are seeing gold’s 200-day moving average of $1,258 per ounce as a resistance level.Macroeconomic Analysis How Has the US Dollar Affected Platinum Prices?

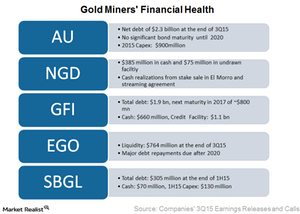

The current weakness in the rand made it fall to all-time lows against the US dollar in early 2016 but has helped mining companies.

How Much Can Brexit Affect the Precious Metals?

Brexit could send jitters around the globe, and investors may jump to safe-haven assets such as gold and silver, which have risen 21.2% and 25.6%, respectively, on a YTD (year-to-date) basis.

What’s Next for Gold Investors?

Gold gave steady returns to investors for the first two months of 2016 as unrest and instability continued in the markets. However, March started with some ups as well as downs for gold.

Which Intermediate Gold Miners Could Run into Financial Concerns?

Eldorado Gold is well placed financially. It had a liquidity of $763.8 million, including $388.8 million in cash, cash equivalents, and term deposits.

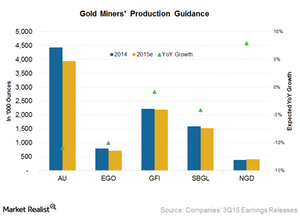

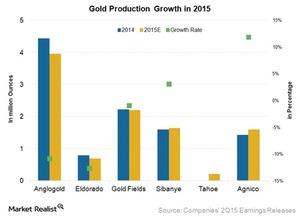

Decelerating Production Growth for Some Intermediate Gold Miners

New Gold produced 123,000 ounces in 3Q15. It has guided for a production toward the higher end of the guidance range of 390,000–410,000 ounces for 2015.

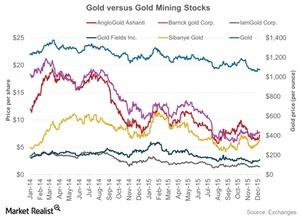

How the Gold Price Is Influencing Pure Gold Miners

In the precious metals mining industry, there are some stocks that to an extent follow the price and market sentiment of the precious metals.

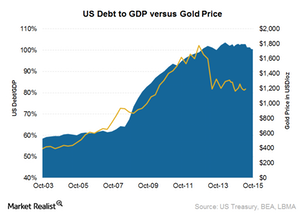

Could Rising Government Debt Mean Long-Term Upside for Gold?

If you expect this positive correlation to resume, then gold would seem very cheap at its current levels, suggesting an upside in gold prices in the long term.

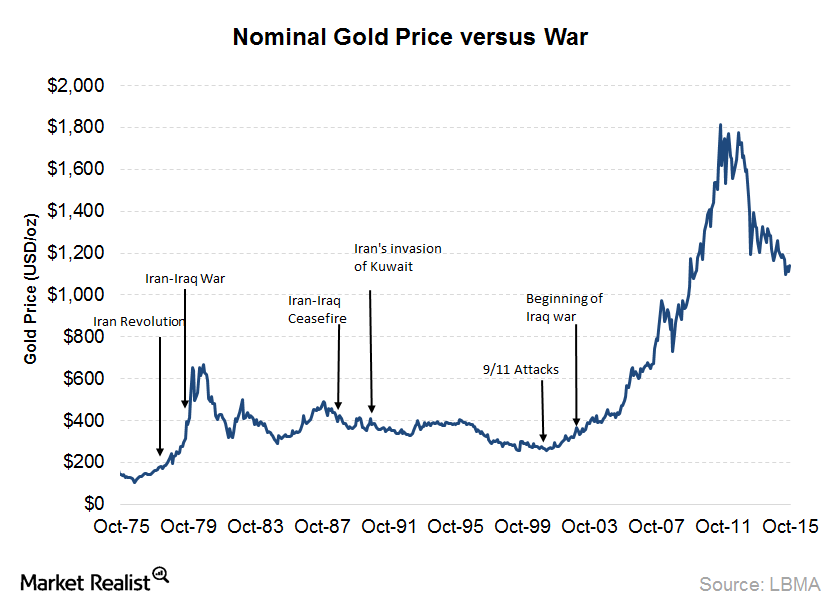

How the Threat of War Affects Gold Prices

Gold’s safe haven appeal might lead investors to gold and other precious metals in terms of heightened geopolitical tensions and war.

Why Growth in Gold Production Is Important for Gold Miners

Future gold production growth is important because the gold market is forward-looking, making future gold production a key driver of gold miners’ revenue.

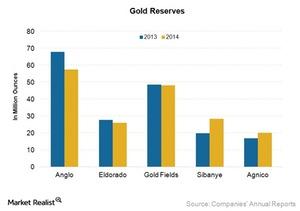

Assessing the Importance of Gold Reserves for Future Growth

Gold reserve growth is a key revenue driver for miners. It’s thus important for gold miners to continue replacing every ounce of gold they produce and sell.

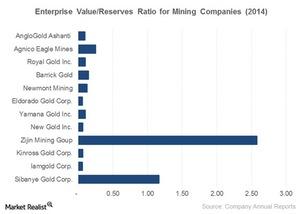

Analyzing the EV-to-Reserves Ratio for Tracking Miners

The EV-to-reserves ratio is good for the mining industry. “Enterprise value” reflects the company’s total value. “Reserves” refers to geologic reserves that the business owns.

Inflation Rates: How They’re Related to Precious Metals

With the looming fears of inflation reaching its target 2% level, the Fed is likely waiting for assertions from the economy.