Rite Aid Corp

Latest Rite Aid Corp News and Updates

Could the Rite Aid–Walgreens Merger Get Competitive?

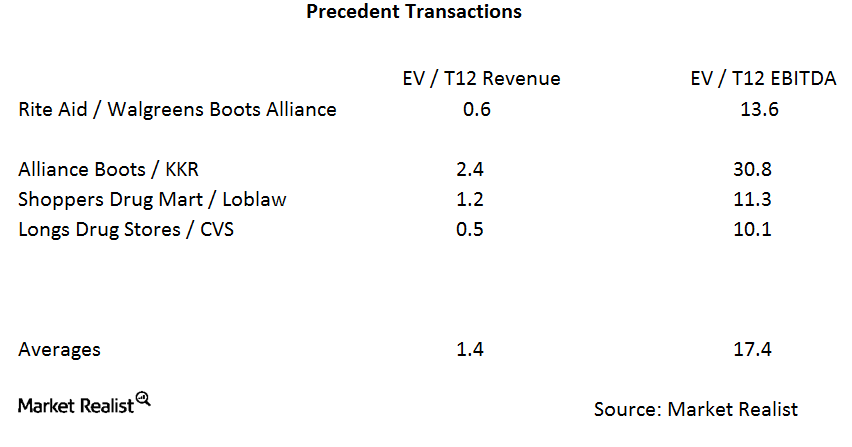

In the Rite Aid–Walgreens merger, Walgreens is paying about 0.6x trailing-12-month revenues and 13.6x trailing-12-month EBITDA.

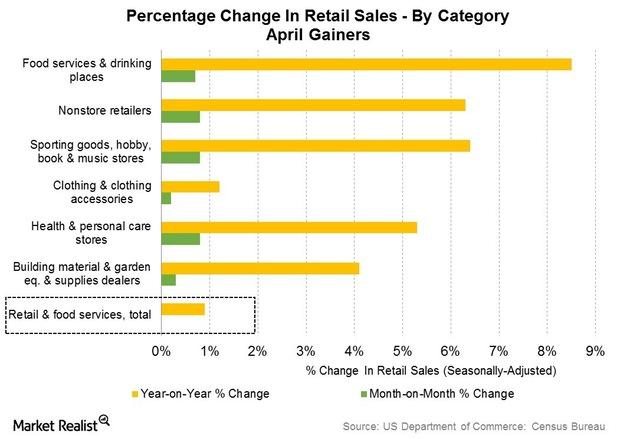

The 6 Positive Things about April’s Retail Sales Report

The advance retail sales report for April 2015 was on the whole, mixed. The mixed readings in the retail sales report brought about indifferent reactions from markets.

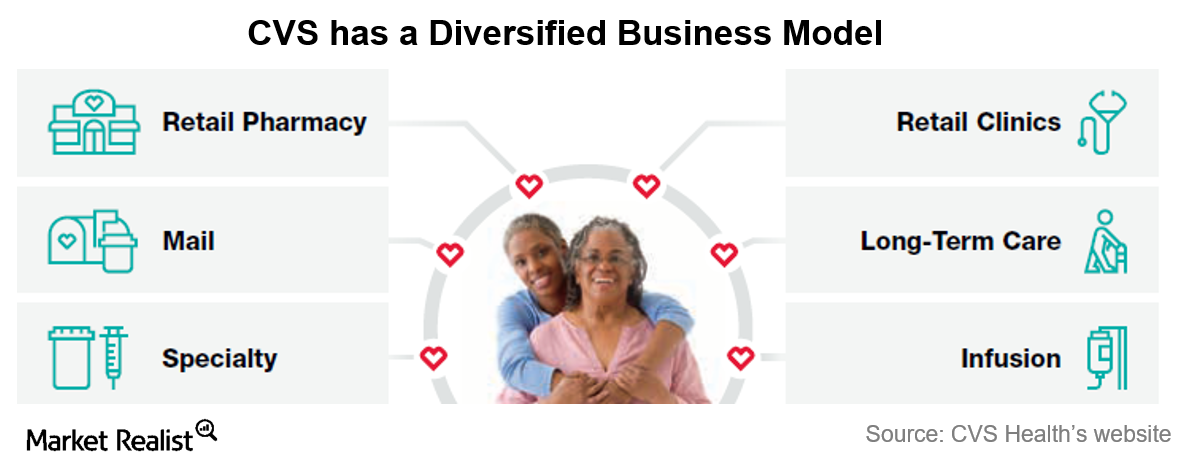

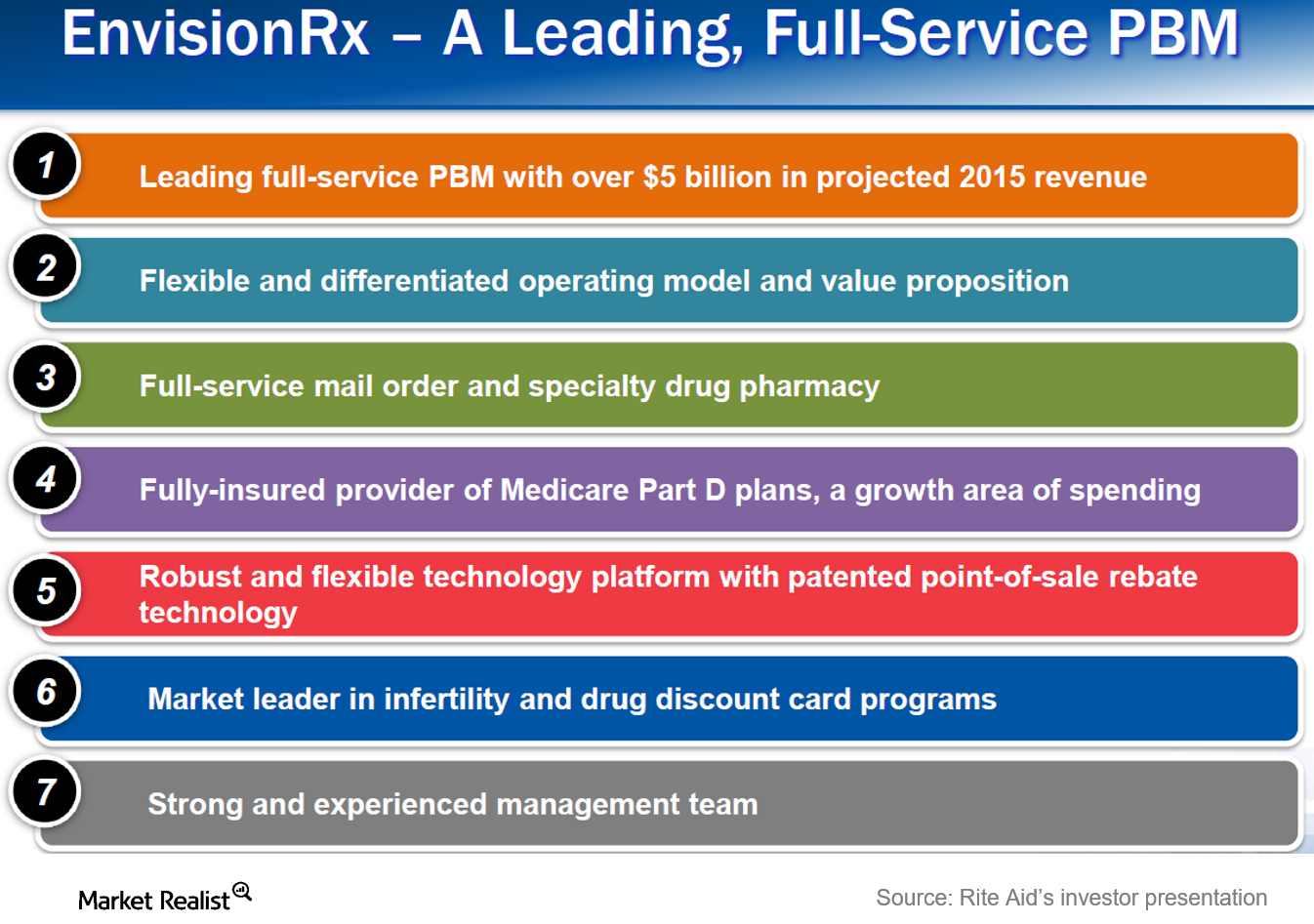

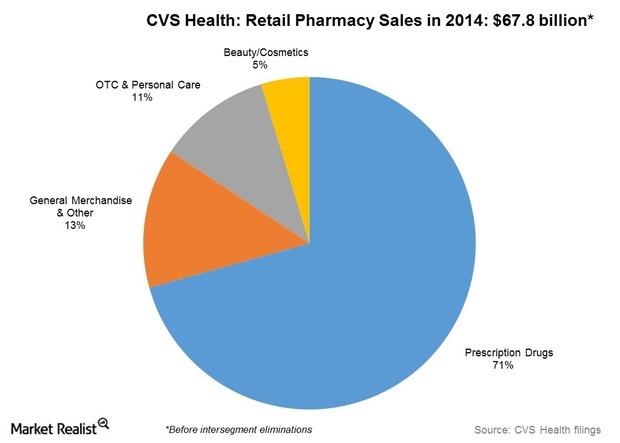

CVS versus Walgreens: Which Has a More Diversified Business Model?

CVS generates close to 70% of its annual sales by offering a full range of pharmacy benefit management services.

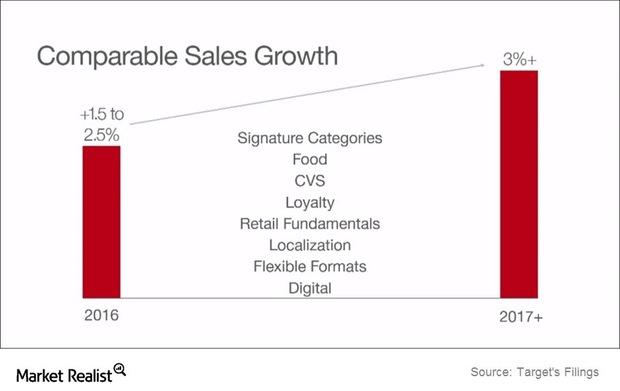

Why Target Is Focusing on Its Signature Categories to Drive Sales

Target has identified four signature categories it’s concentrating on to provide higher store and web traffic and sales: Baby, Style, Wellness, and Kids.

How the Drug Store Industry Is Changing

The top three drugstore chains in the US are in the process of forming new associations through mergers and acquisitions to create a more diversified portfolio and protect themselves from the growing online threat.

Walgreens versus CVS: Comparing Pharmacy Giants

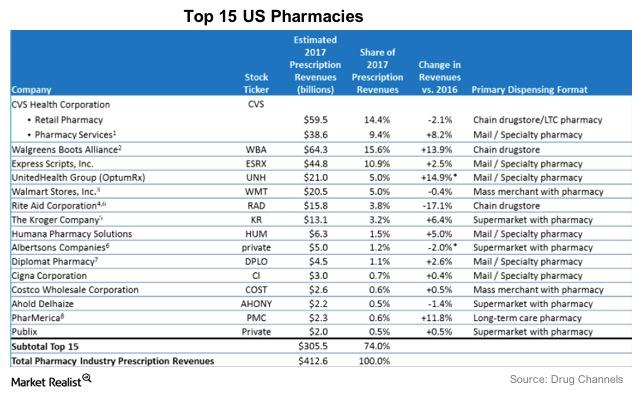

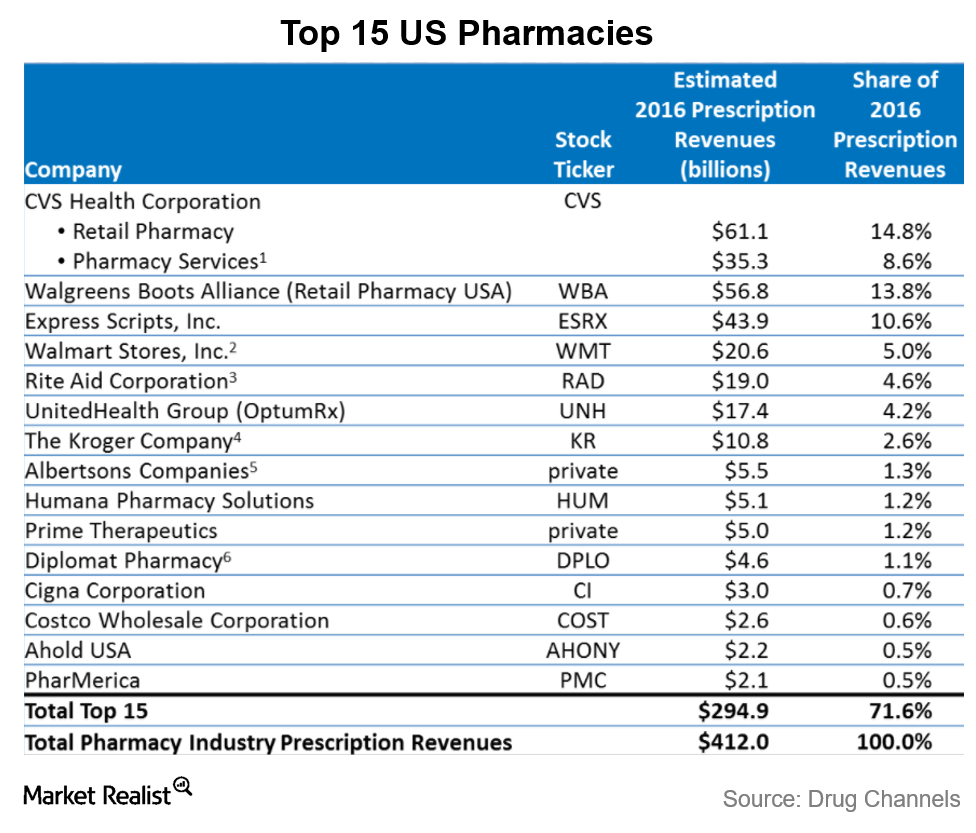

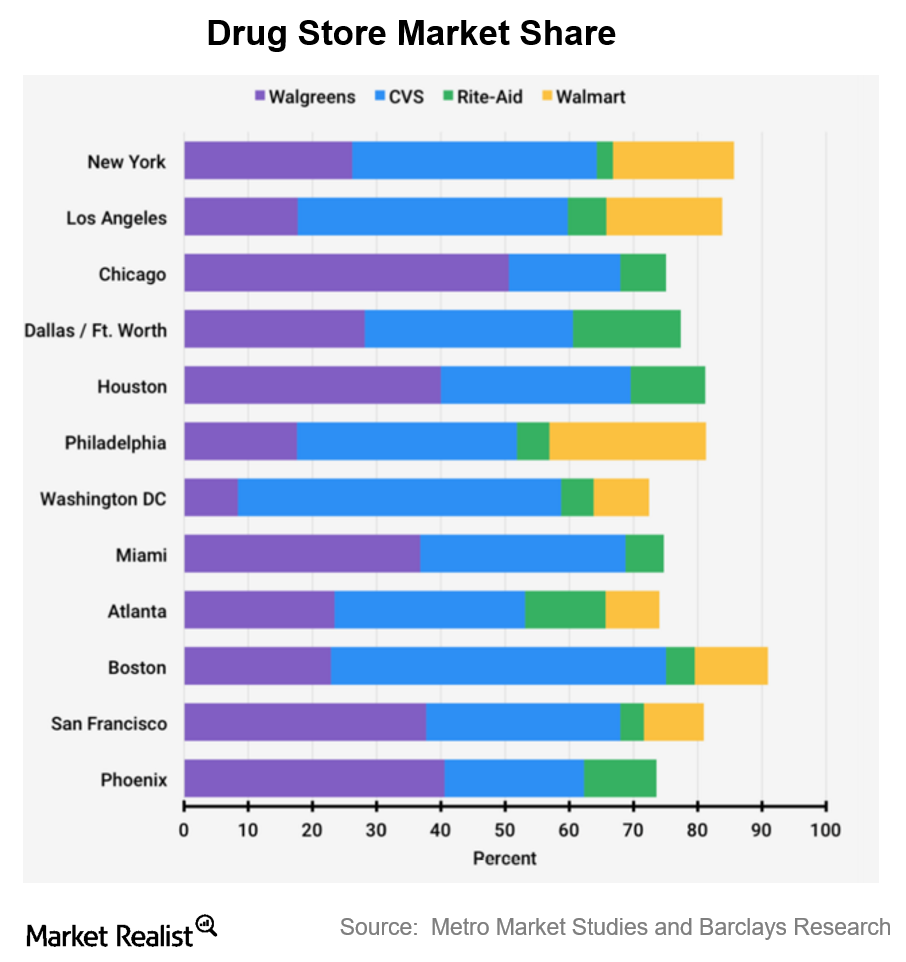

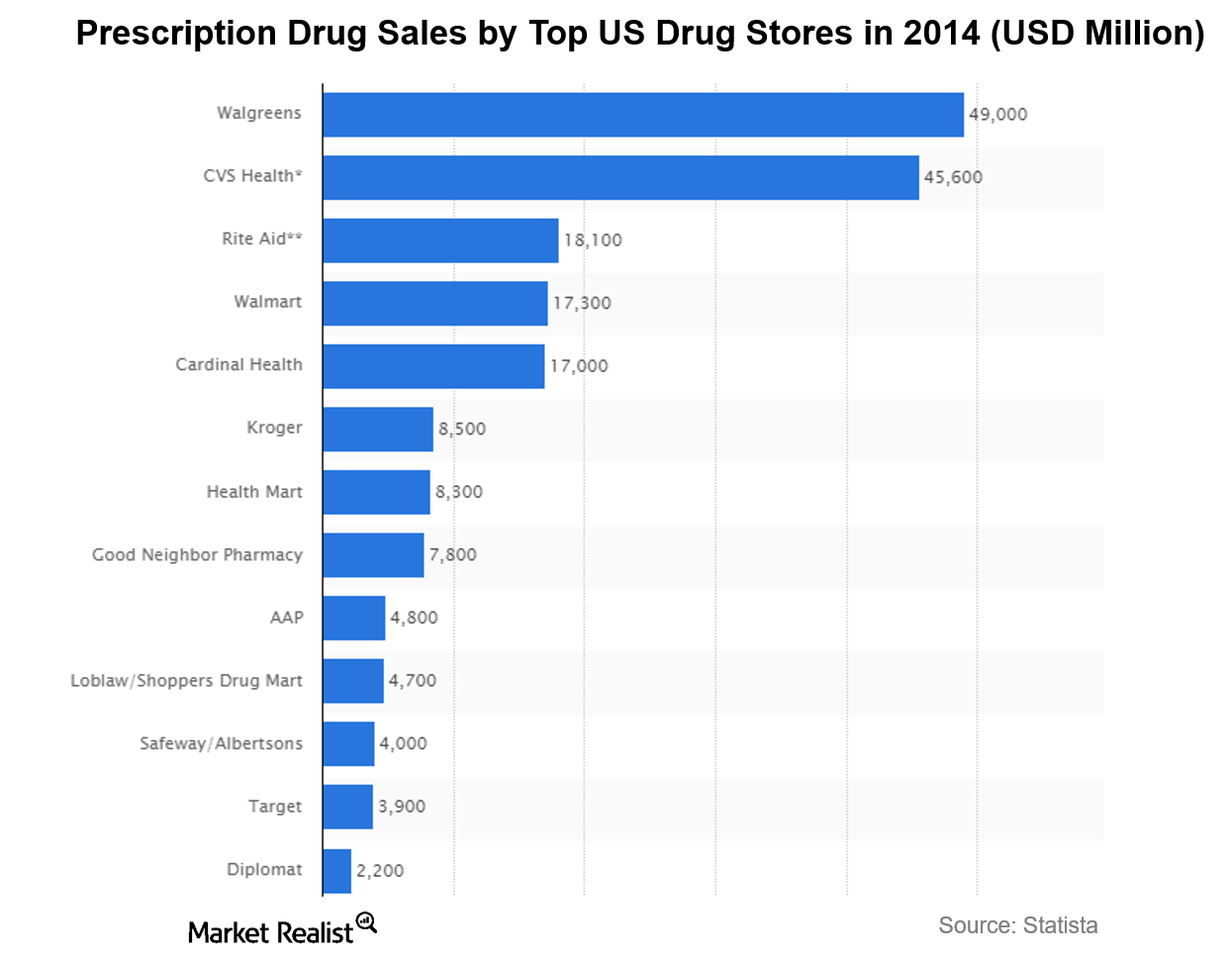

The US drugstore market is dominated by two major players—CVS Health (CVS) and Walgreens Boots Alliance (WBA). CVS and WBA accounted for ~29% of the country’s prescription dispensing revenues in 2016.

A Look at Rite Aid’s Stock Crash This Year

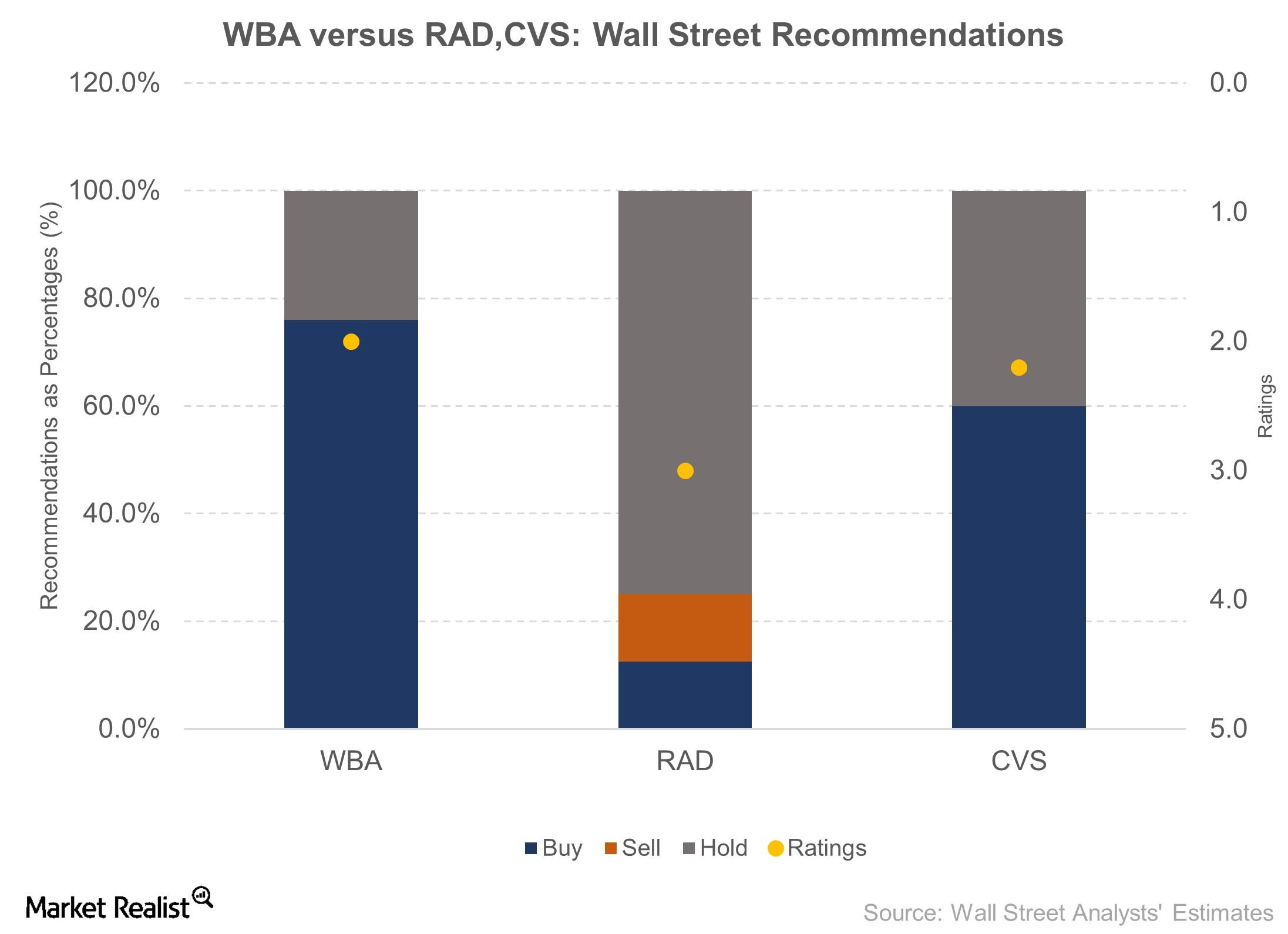

Rite Aid’s shareholders have been the real losers from the delay and eventual termination of the deal between Rite Aid (RAD) and Walgreens Boots Alliance (WBA) in October 2015.

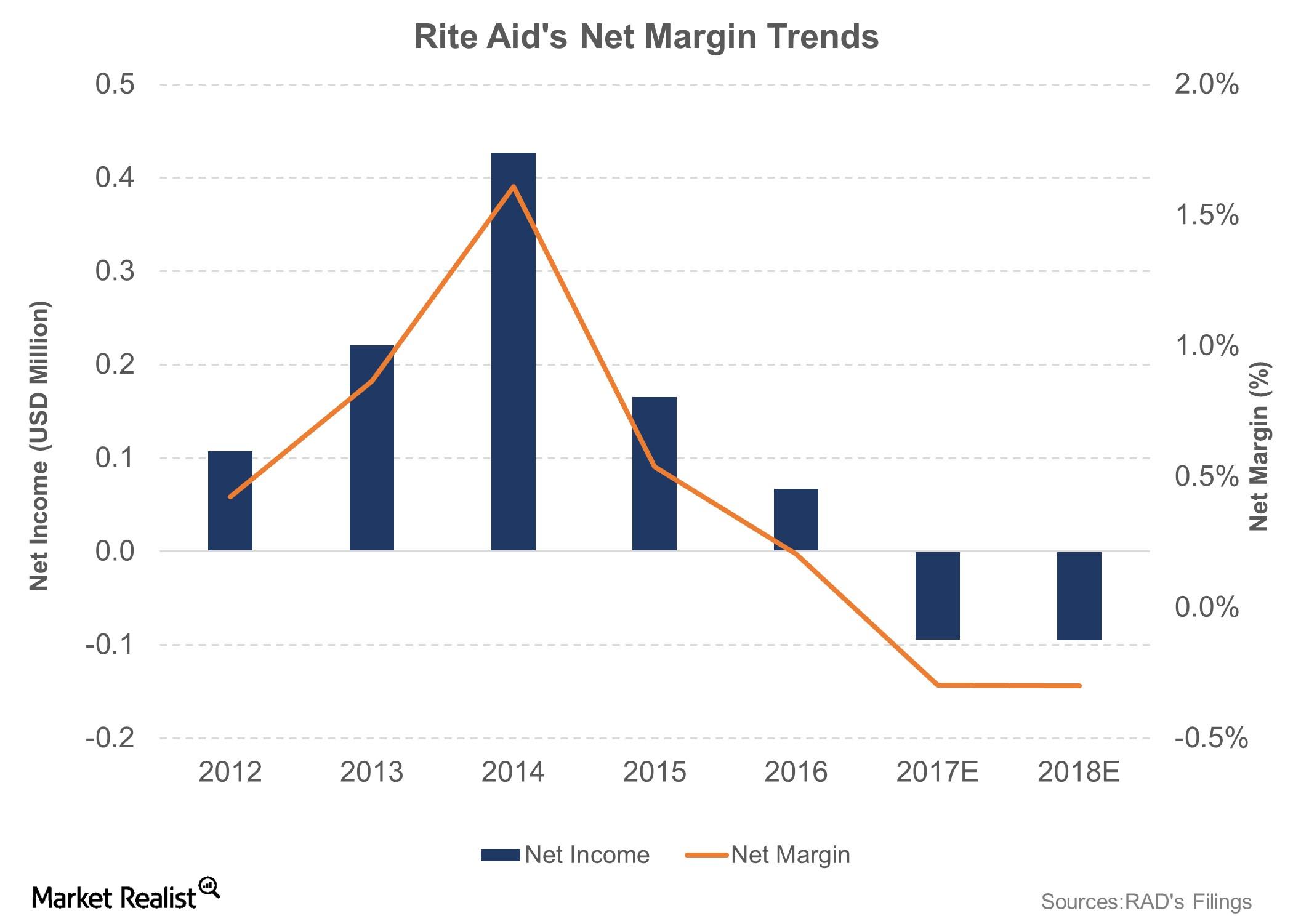

Here’s Why Rite Aid’s Margins Have Deteriorated over the Years

Rite Aid’s profitability has worsened over the years. Its gross margin has fallen from 29.0% in fiscal 2013 to just 22.6% in the first quarter of the current fiscal year.

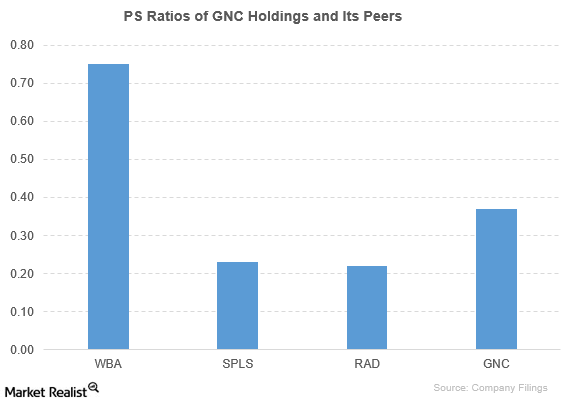

How Does GNC Holdings Compare to Its Peers?

GNC’s peers have outperformed GNC Holdings based on PE and PBV ratios. But GNC has mostly outperformed its peers based on PS ratios.

Upcoming Opportunities and Potential Threats for Walgreens Boots

In this part, we’ll discuss the company’s upcoming opportunities and potential threats.

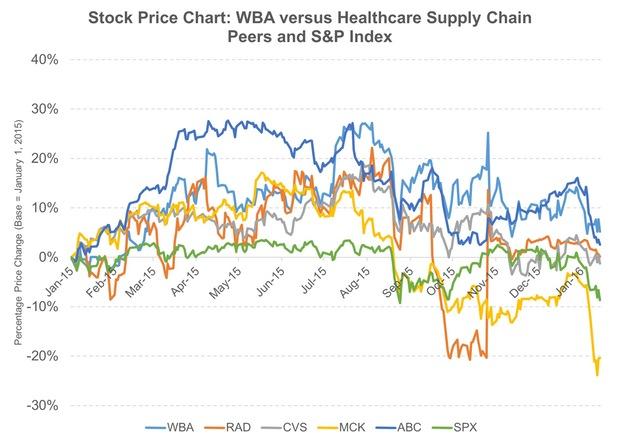

An Analysis of Walgreens Boots Alliance’s Stock Returns

Walgreen Boots Alliance’s (WBA) common stock trades on the NASDAQ under the symbol “WBA.”

Comparing the Pharmacy Giants: Walgreens versus CVS Health

Walgreens Boots Alliance (WBA) and CVS Health (CVS) largely dominate the US drug store market.

An Overview of the US Drugstore Industry

US drugstores typically generate revenues by selling prescription drugs, over-the-counter medications, health and beauty products, and general merchandise.

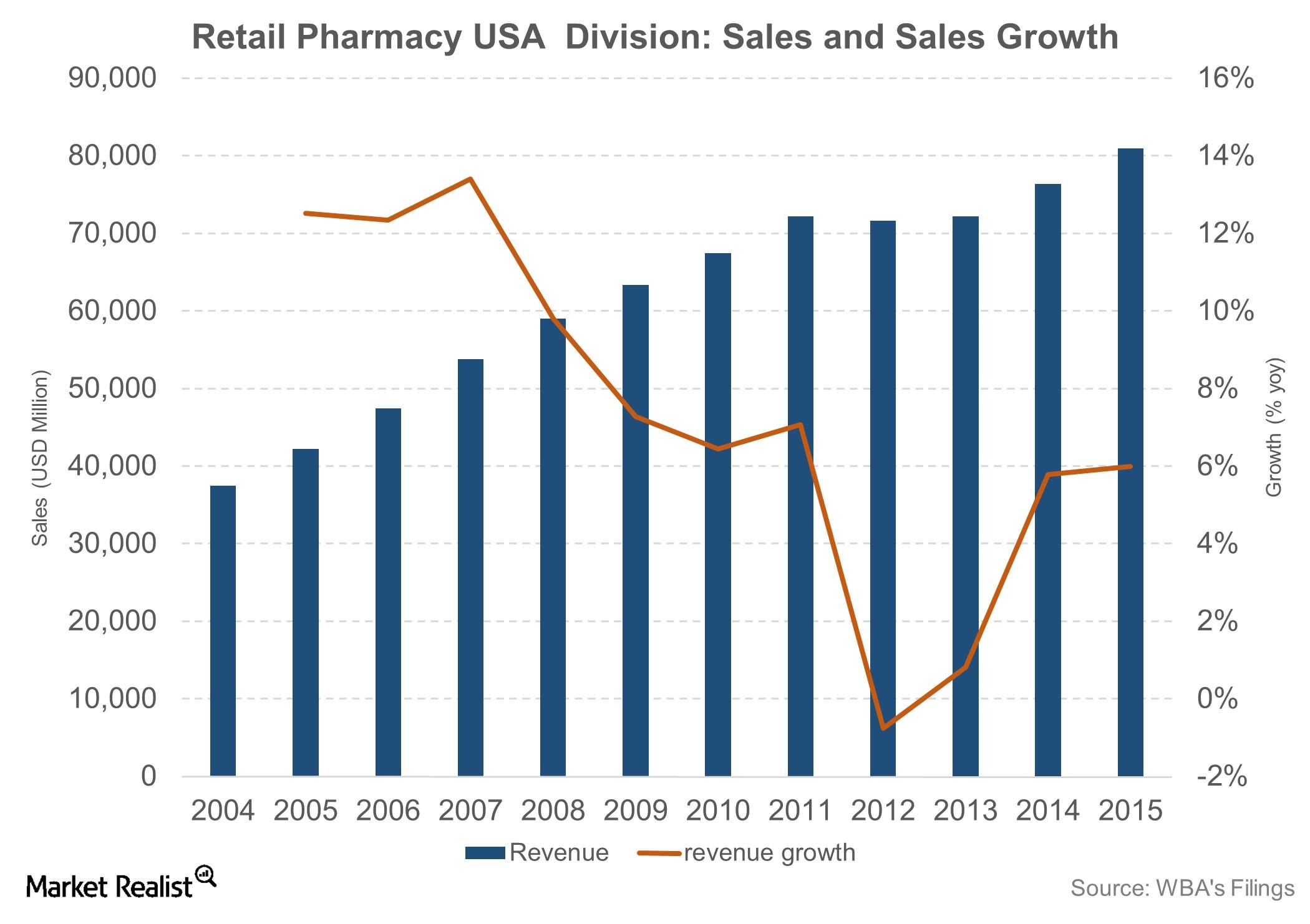

A Look at Walgreens Boots Alliance’s Retail Pharmacy USA Division

The Retail Pharmacy USA division is Walgreens Boots Alliance’s (WBA) largest revenue generator.

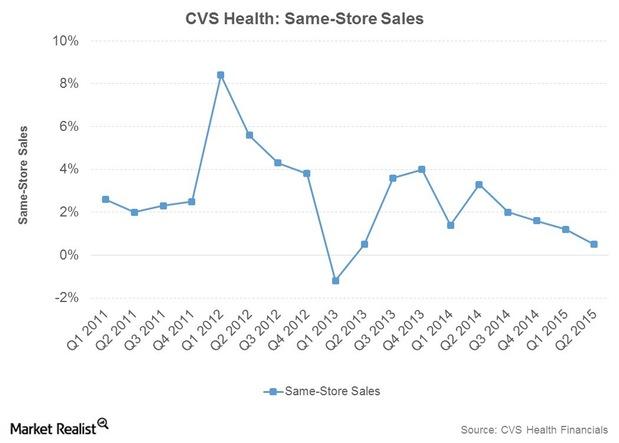

CVS’ Retail Pharmacy Market Share Rises in 2Q15 on Scripts Growth

CVS Health’s Retail Pharmacy segment reported sales of $17.2 billion in 2Q15, an increase of 2.2% over 2Q14. CVS boosted its share of the retail pharmacy market to 21.6% in 1Q15, from 21% in 2Q14.

Major Factors Driving CVS’s Retail Pharmacy Segment Growth

CVS Health (CVS) expects Retail Pharmacy sales growth between 0.5% and 2% year-over-year in 2Q15. Total same-store sales are expected to be in the range of -1.25% to 0.25%.