Restaurant Brands International Inc

Latest Restaurant Brands International Inc News and Updates

Restaurant Brands International Buys Firehouse Subs for $1 Billion

Is Firehouse Subs publicly traded? Learn more about the restaurant chain now that Restaurant Brands International is acquiring it for $1 billion.

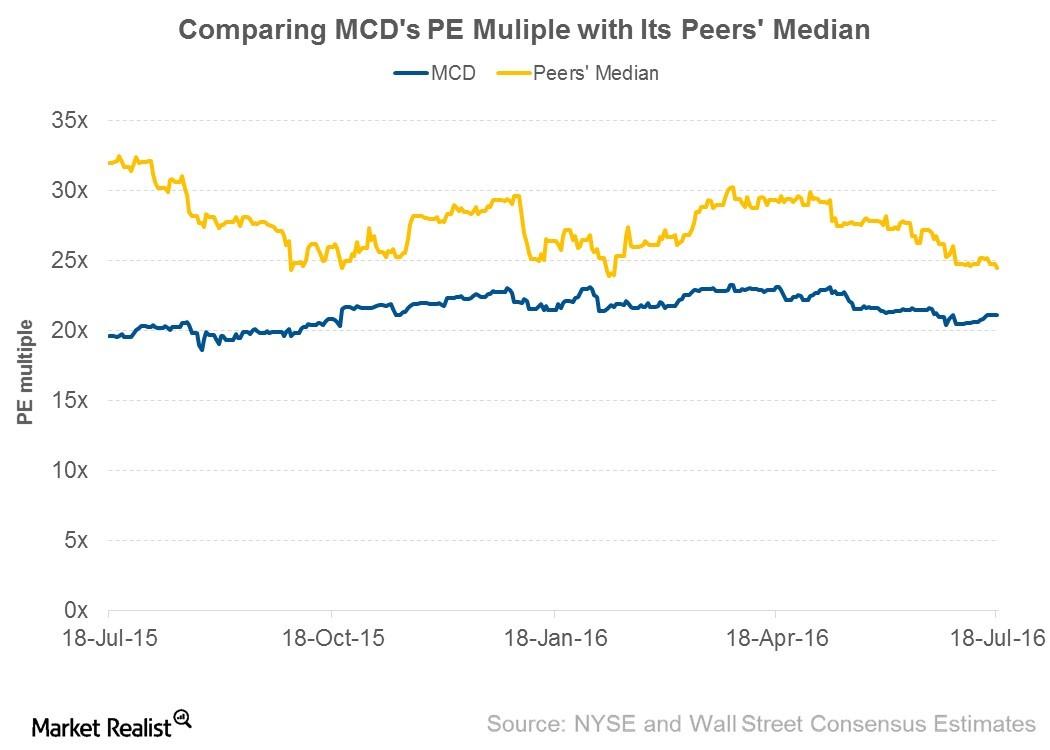

Can 2Q16 Results Drive McDonald’s Valuation Multiple Up?

Valuation multiple Investors should look at valuation multiples when deciding whether to enter or exit a stock. Valuation multiples are driven by perceived growth, risk and uncertainties, and investors’ willingness to pay for a stock. There are various multiples to evaluate a stock. In this article, we’ll use the PE (price-to-earnings) ratio due to its […]

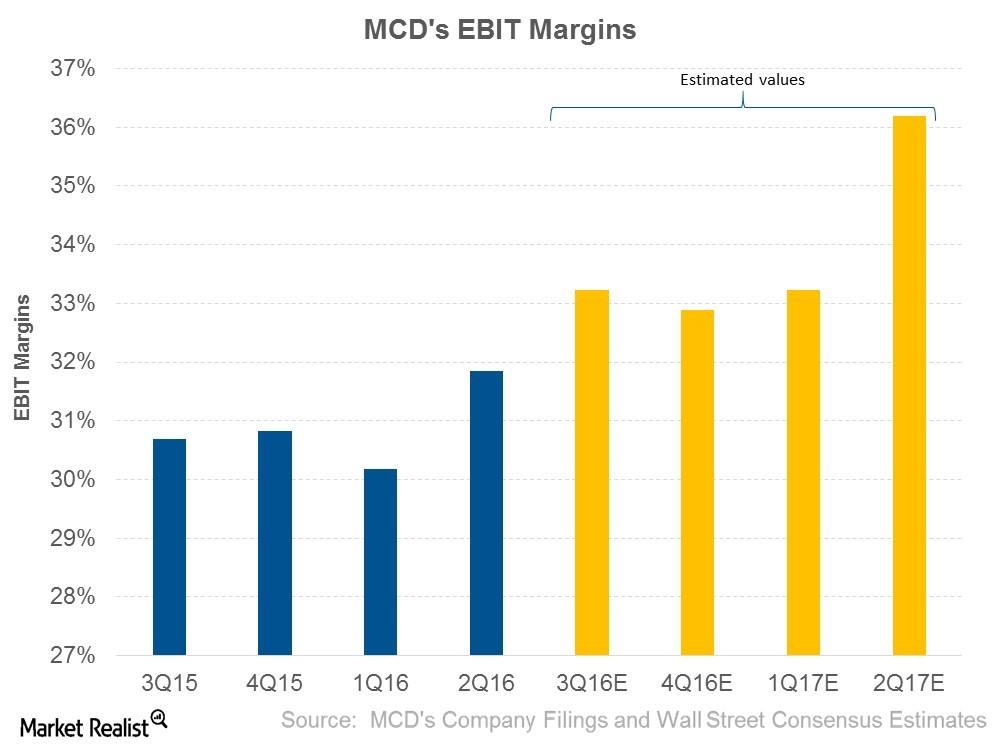

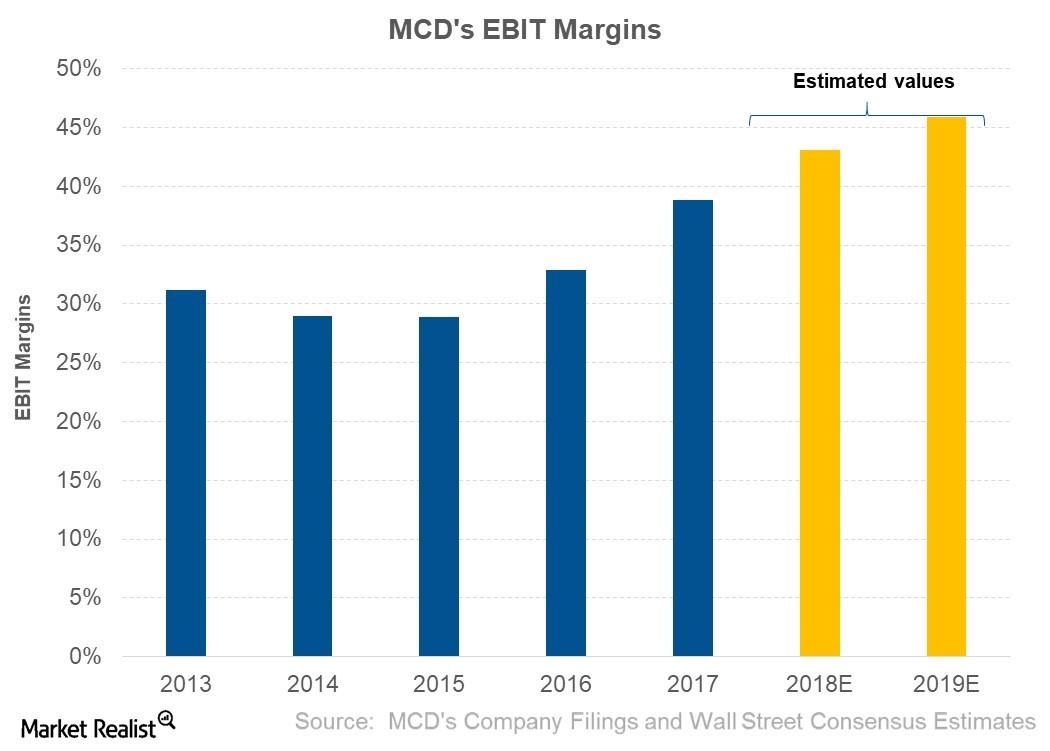

How Will McDonald’s Expand Its EBIT Margins?

Wall Street analysts are expecting McDonald’s (MCD) to post EBIT of $2.1 billion in 3Q16. This represents an EBIT margin of 33.2% compared to 30.7% in 3Q15.

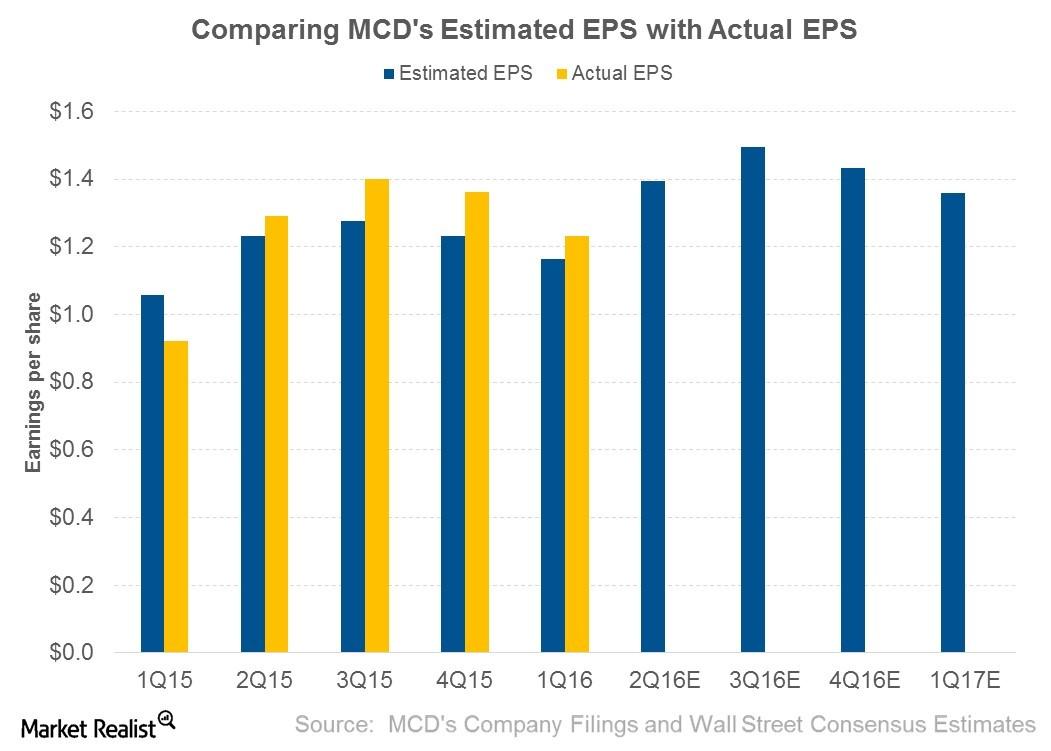

Will McDonald’s 2Q16 Earnings Beat Analysts’ Estimates?

So far in this series, we’ve discussed McDonald’s (MCD) estimated revenue, sources of revenue, and estimated EBIT (earnings before interest and tax) margins.

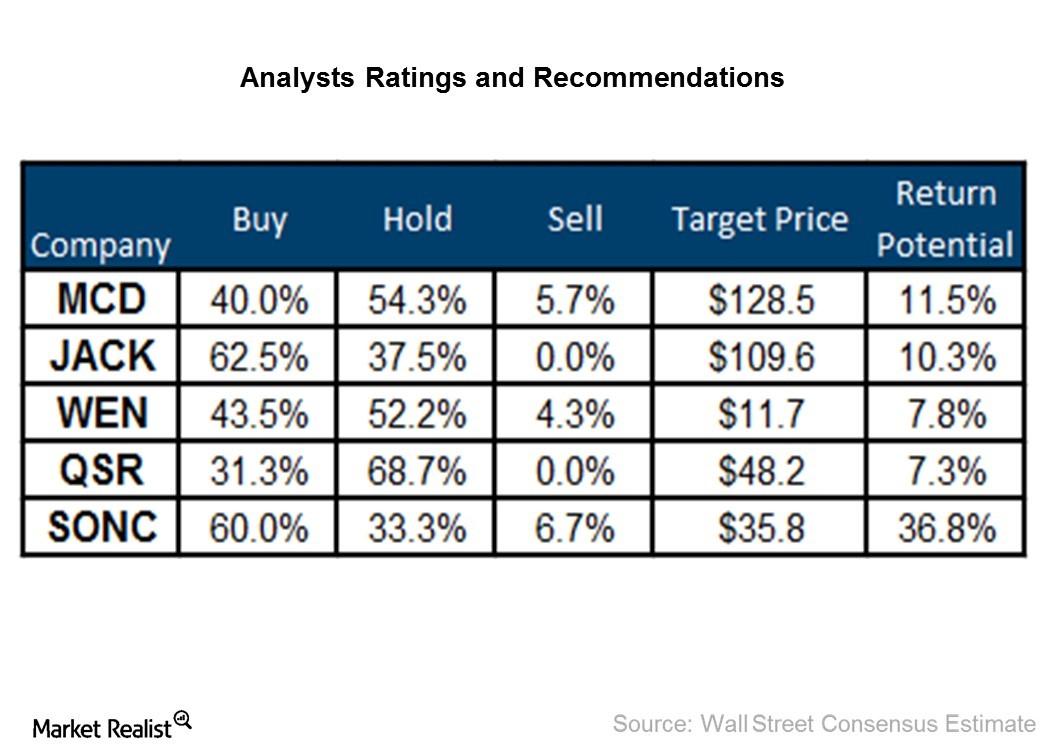

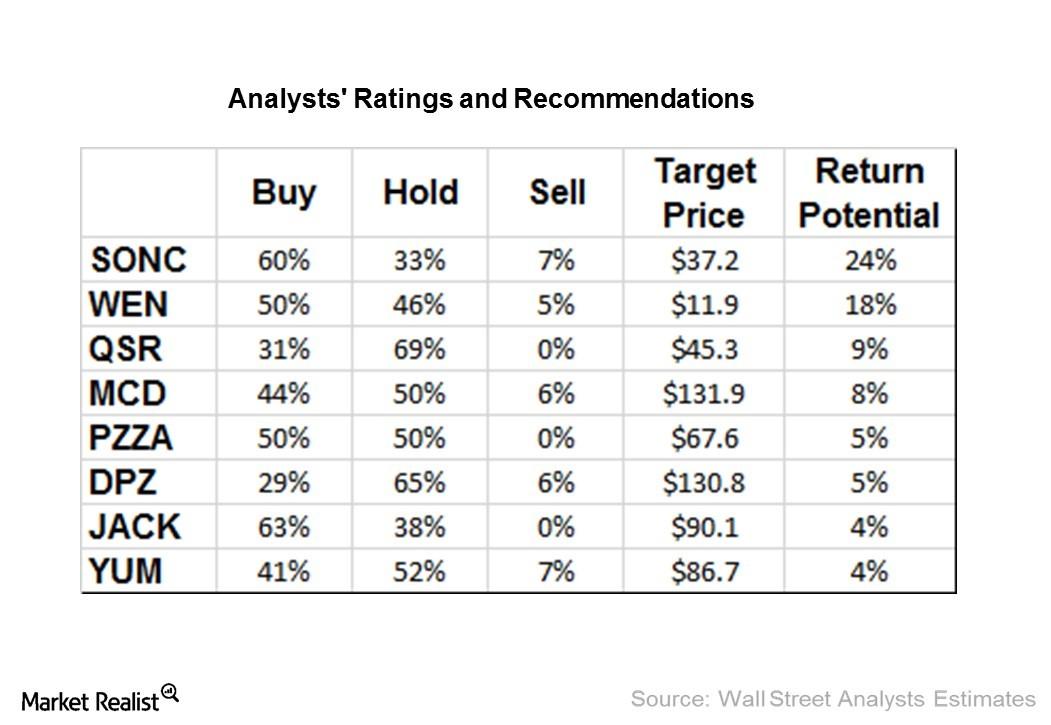

Which Fast Food Restaurants Do Analysts Favor?

Jack in the Box (JACK) and Restaurant Brands International (QSR) are analysts’ favorites among the companies we’ve reviewed in this series.

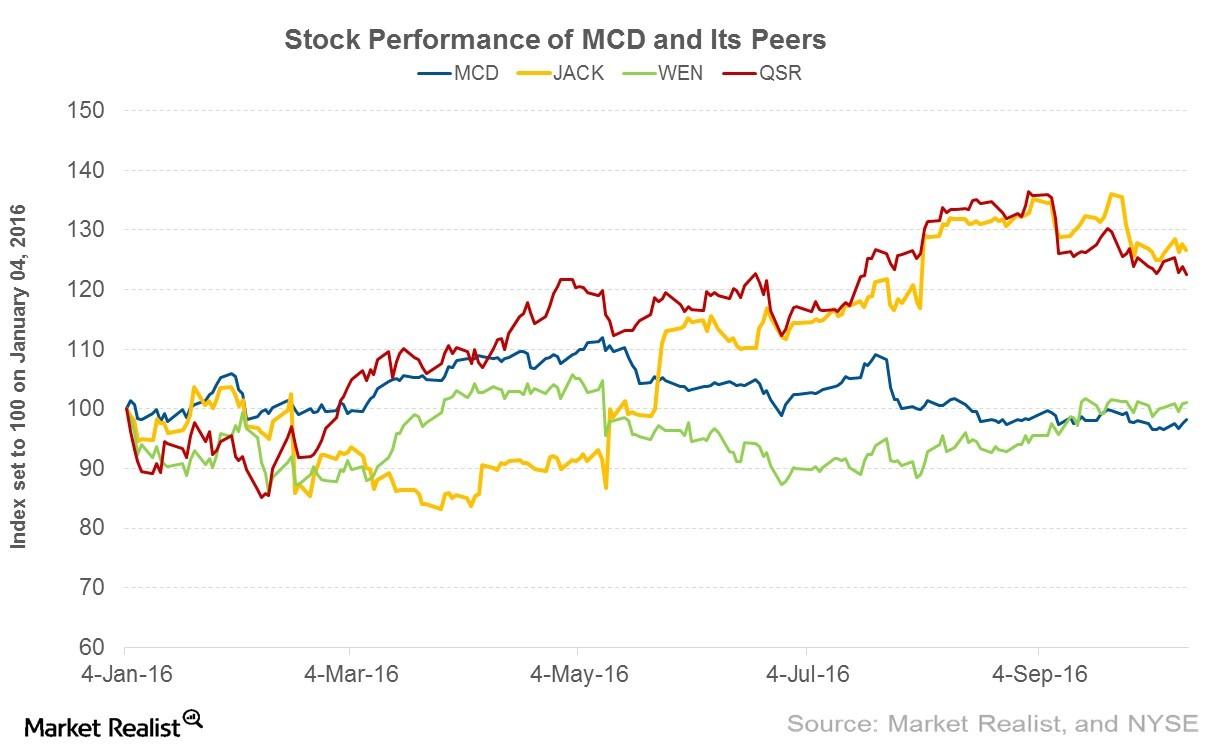

Can Investors Expect Momentum from McDonald’s 3Q16 Earnings?

McDonald’s (MCD) is scheduled to announce its 3Q16 results on October 21, 2016. As of October 13, 2016, it was trading at $115.40, a fall of 9.4% from July 25.

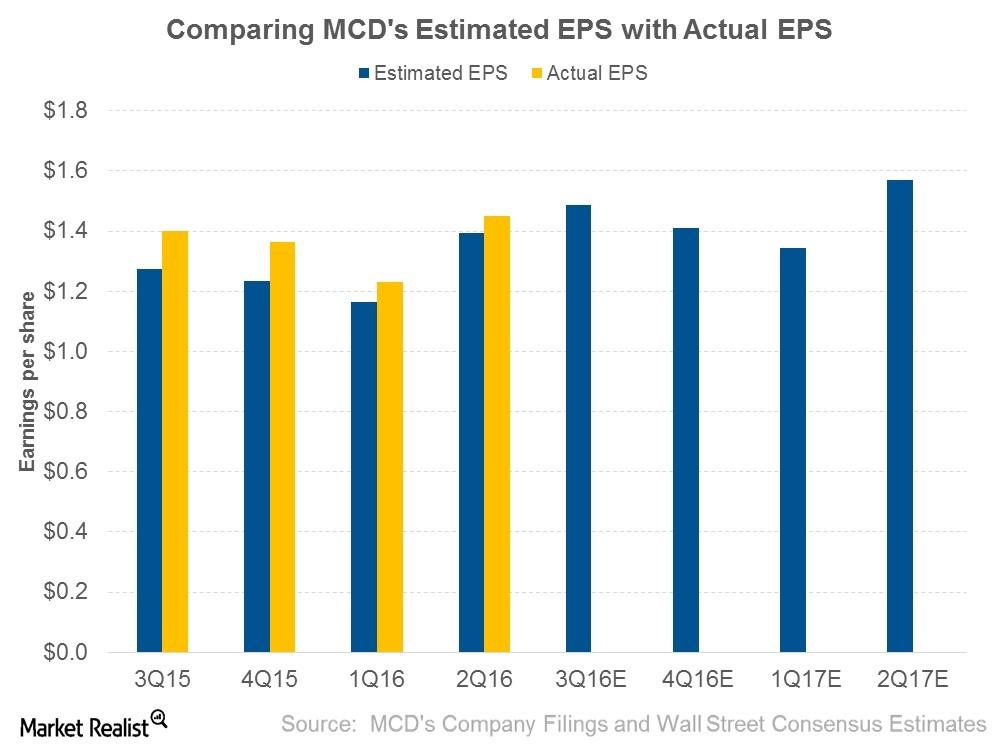

Can McDonald’s Beat Analysts’ Earnings Estimates Again in 3Q16?

In the last four quarters, McDonald’s has beaten analysts’ estimates. In 3Q16, analysts are expecting the company to post EPS of $1.48, a year-over-year rise of 6.1%.

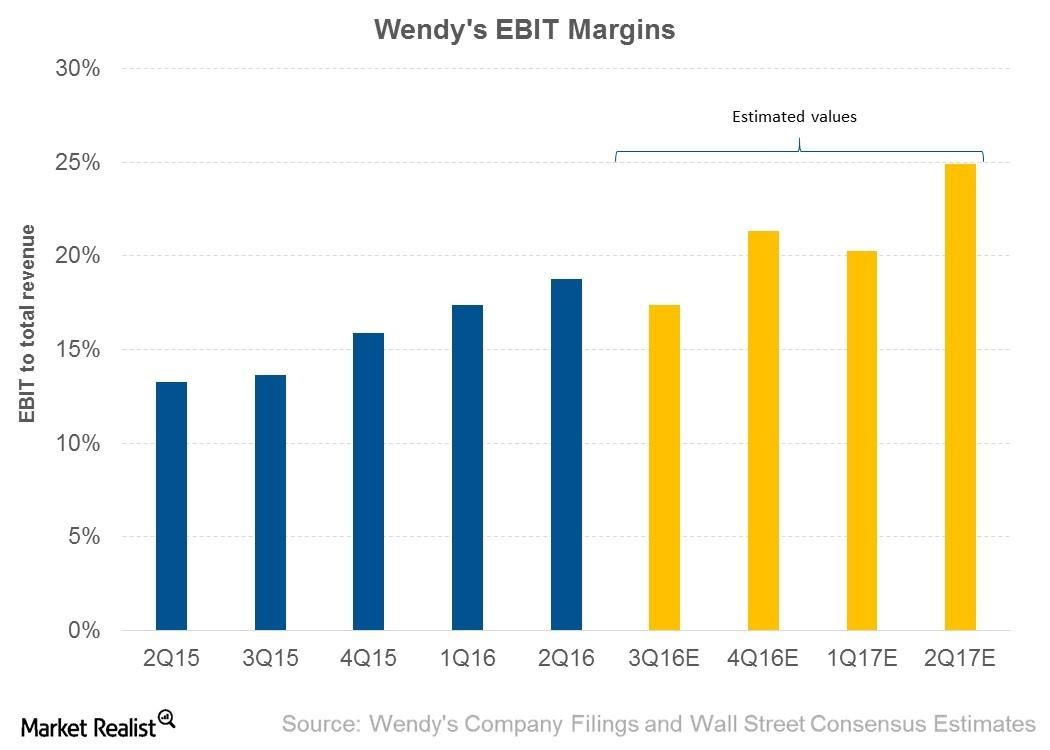

Why Did Wendy’s EBIT Margins Expand in 2Q16?

In 2Q16, Wendy’s posted EBIT of $71.7 million—an EBIT margin of 18.7% compared to 13.3% in 2Q15. Analysts expected the EBIT margin to be 16.7%.

The Word on the Street: What Analysts Are Recommending for Fast-Food and Pizza Companies after 1Q16

JACK, PZZA, and QSR are the most favored stocks in our group of eight fast-food restaurants, with no analyst recommending a “sell” for their stocks.

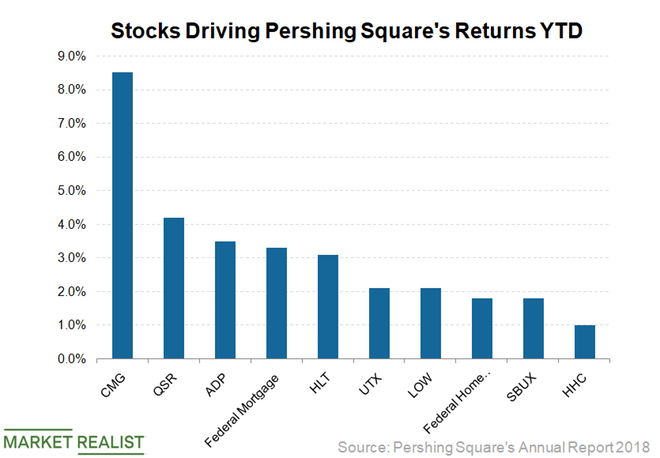

Q1 13F: How Bill Ackman Played the US Stock Market Crash

So far in 2020, Bill Ackman’s timing has been impeccable. He made over $2 billion by shorting stocks as US stock markets crashed in the first quarter.

The Restaurant Industry: An Overview

More Americans are eating out, and they’re eating out more often. The restaurant industry’s share of the food dollar is 51%, up from 25% in 1955.

Bill Ackman Thanks Warren Buffett for His Fund’s Comeback in 2019

Bill Ackman has made a huge comeback in 2019.

Why McDonald’s EBIT Margin Expanded in 2018

McDonald’s (MCD) has posted EBIT (earnings before interest and tax) of ~$8.9 billion, which represents an EBIT margin of 38.8%.

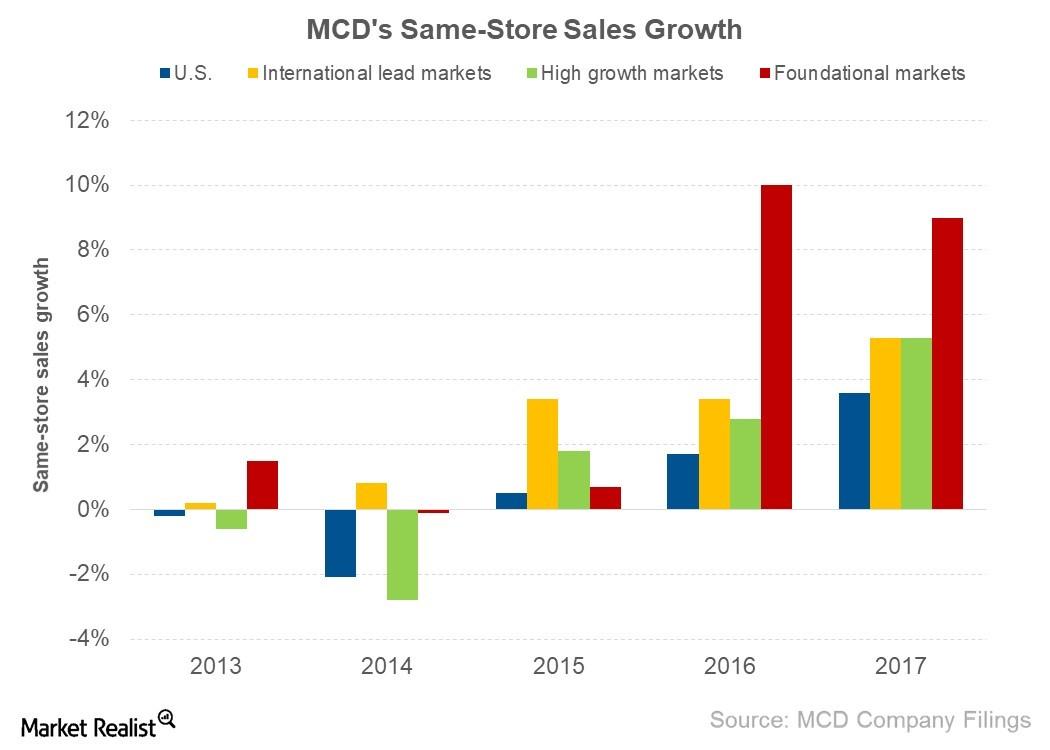

McDonald’s Posts Strong Same-Store Sales Growth in 2017

MCD posted SSSG of 3.8%, 1.5%, -1.0%, and 0.2% in 2016, 2015, 2014, and 2013, respectively.

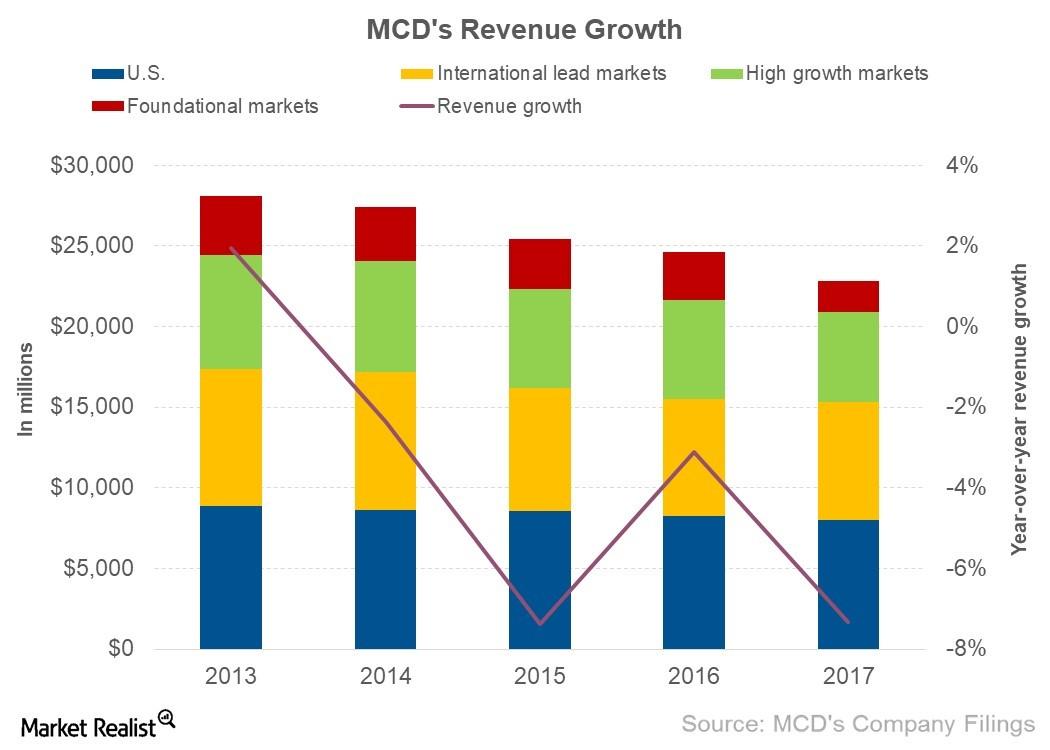

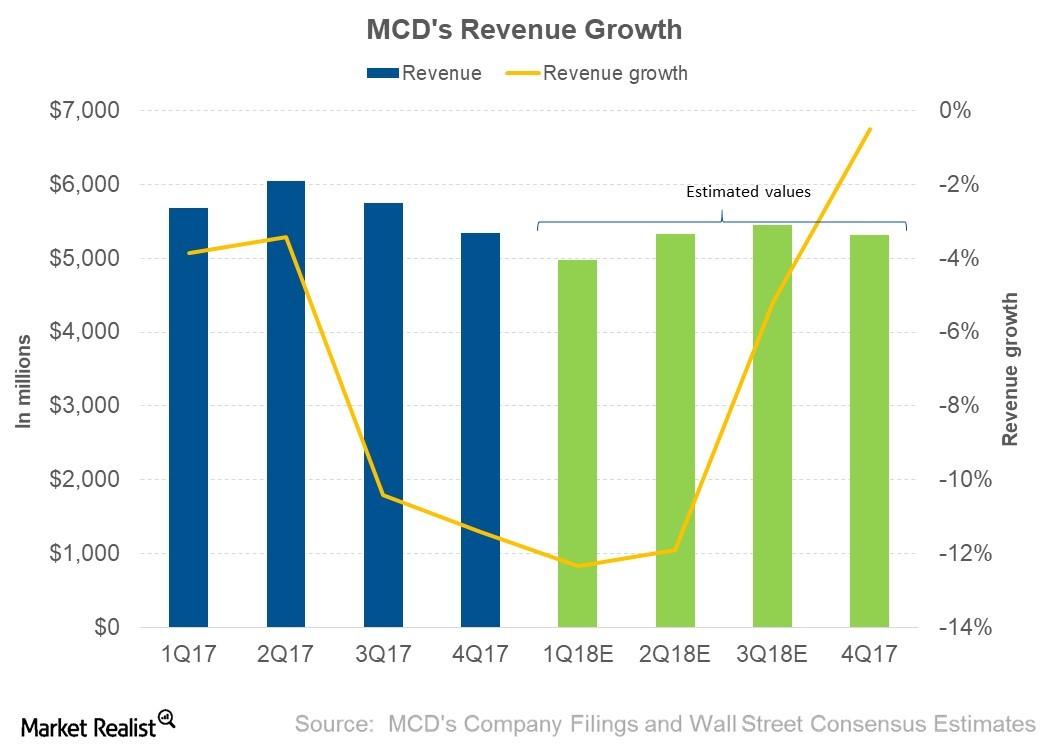

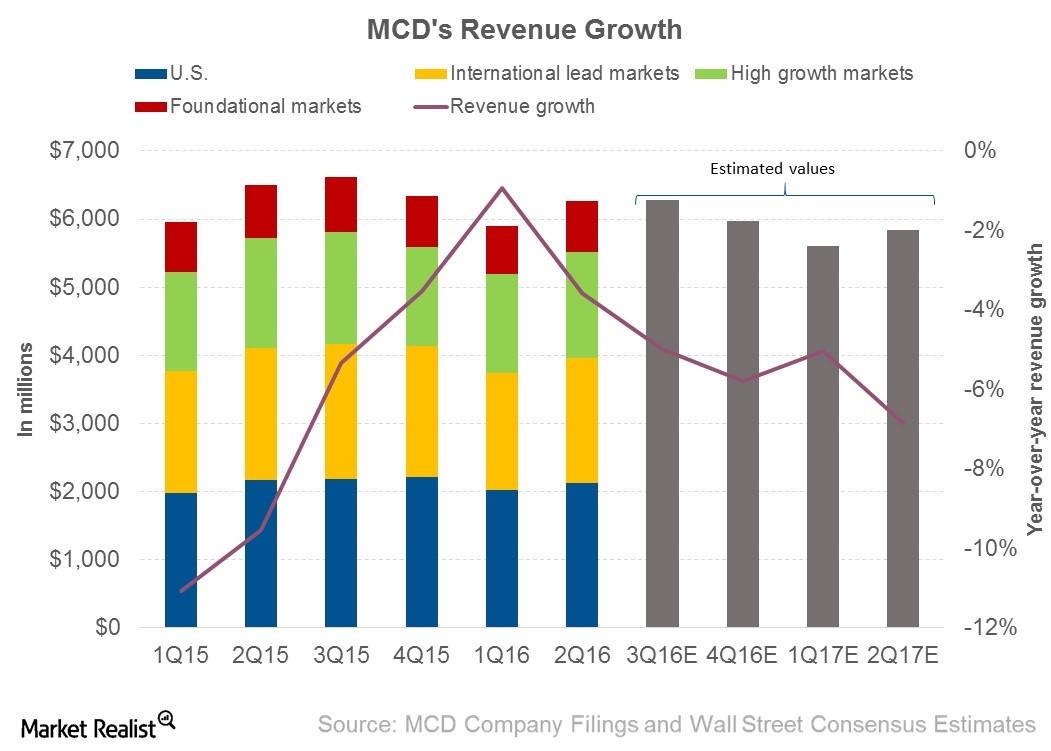

Why McDonald’s Revenues Declined in 2017

In 2017, McDonald’s (MCD) posted revenues of ~$22.8 billion, which represents a fall of 7.3% from ~$24.6 billion in 2016.

What Analysts Expect for McDonald’s Revenue in 2018

Revenue expectations In 2018, analysts expect McDonald’s (MCD) to post revenue of $21.1 billion, which represents a fall of 7.7% from its revenue of $22.8 billion in 2017. As part of its optimizing strategy, McDonald’s has been refranchising its company-owned restaurants. The refranchising is expected to lower the company’s revenue in 2018. However, some of […]

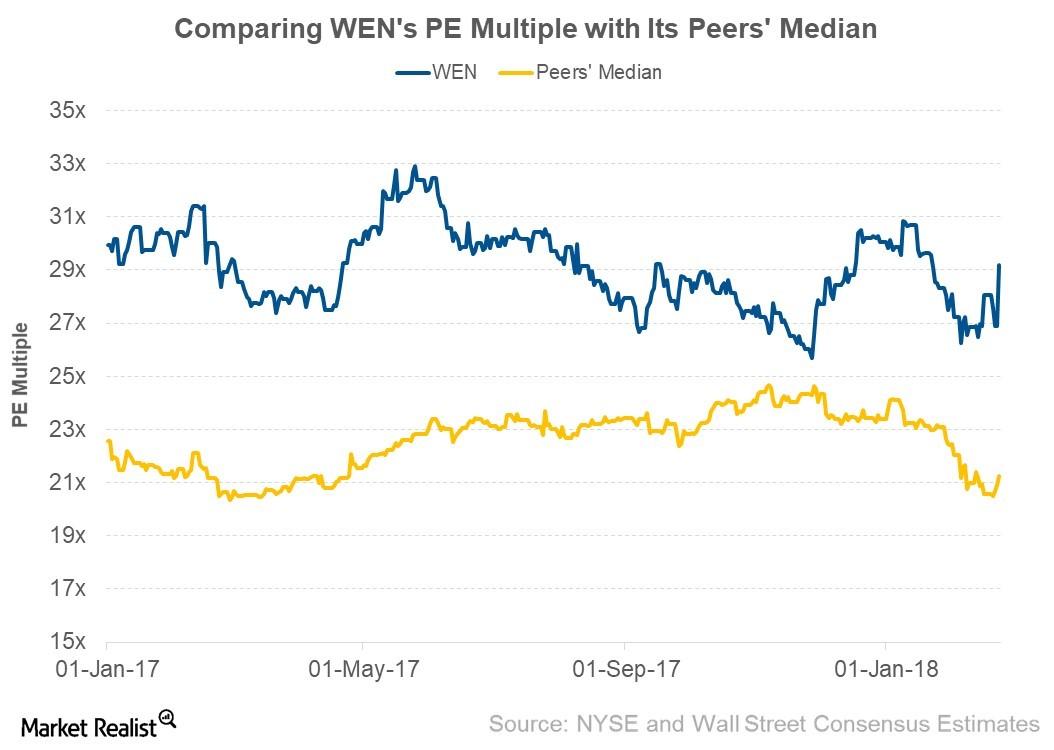

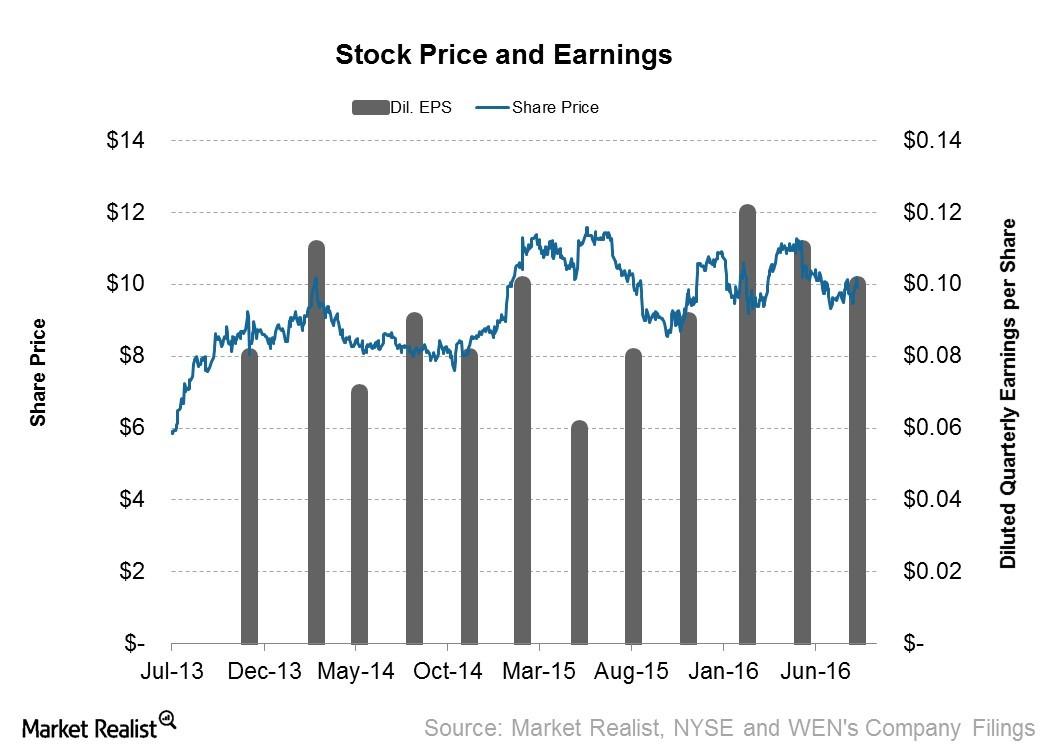

How Wendy’s Valuation Multiple Compares to Its Peers

The initiatives taken by Wendy’s management to drive SSSG appear to have led to a rise in WEN stock and a higher valuation multiple.

What Analysts Expect for Wendy’s Revenue in 2018

For 2018, analysts are expecting Wendy’s (WEN) to post revenue of $1.3 billion, which represents a growth of 2.6%.

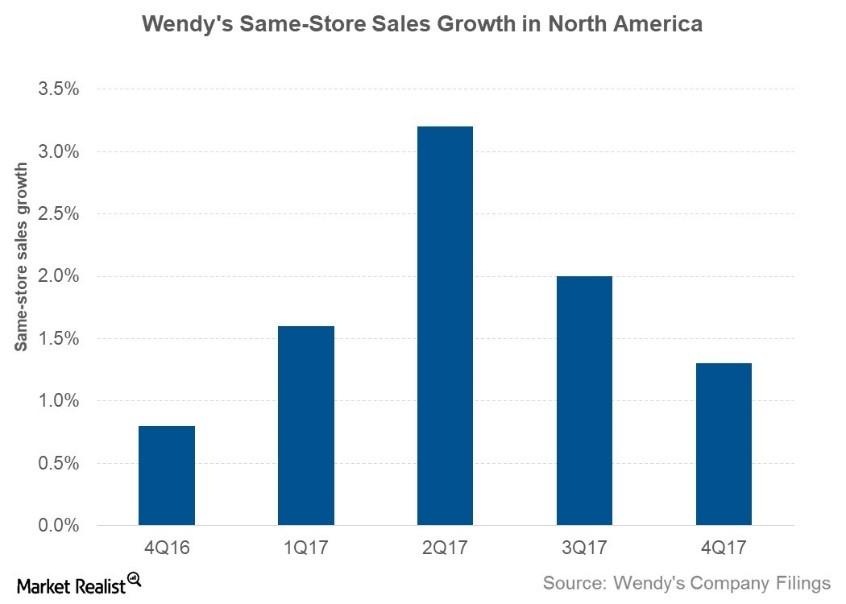

What Drove Wendy’s Same-Store Sales Growth in 4Q17?

Wendy’s (WEN) posted SSSG (same-store sales growth) of 1.3% in the North American region compared to 0.8% in 4Q16.

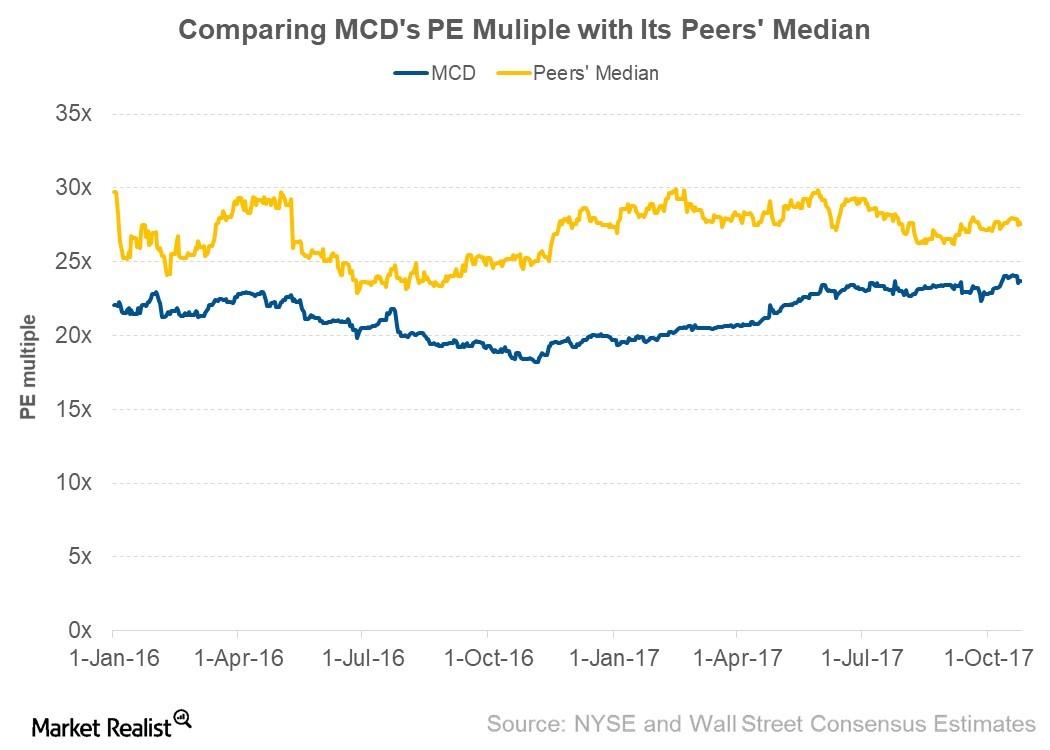

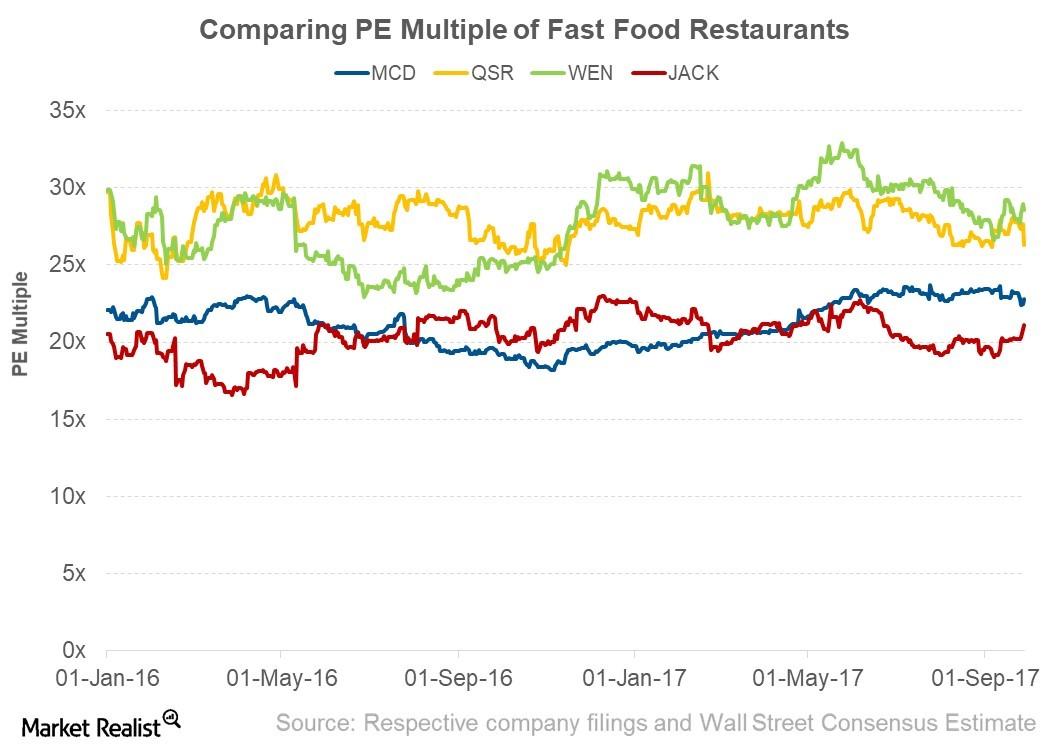

McDonald’s Valuation Multiple Compared to Its Peers

As of October 25, 2017, McDonald’s was trading at a forward PE multiple of 23.66x compared to 23.57x before the announcement of 3Q17 earnings.

How Fast Food Restaurants’ Valuation Multiples Stack Up

Wendy’s (WEN) has been trading above its peers’ valuation multiple.

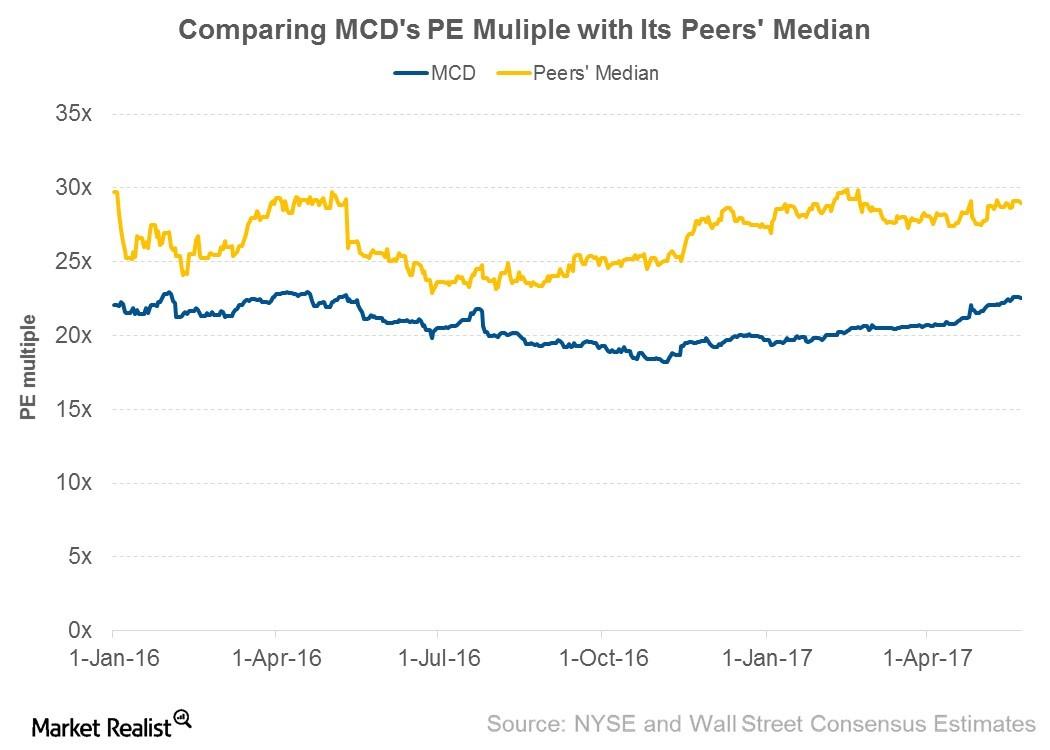

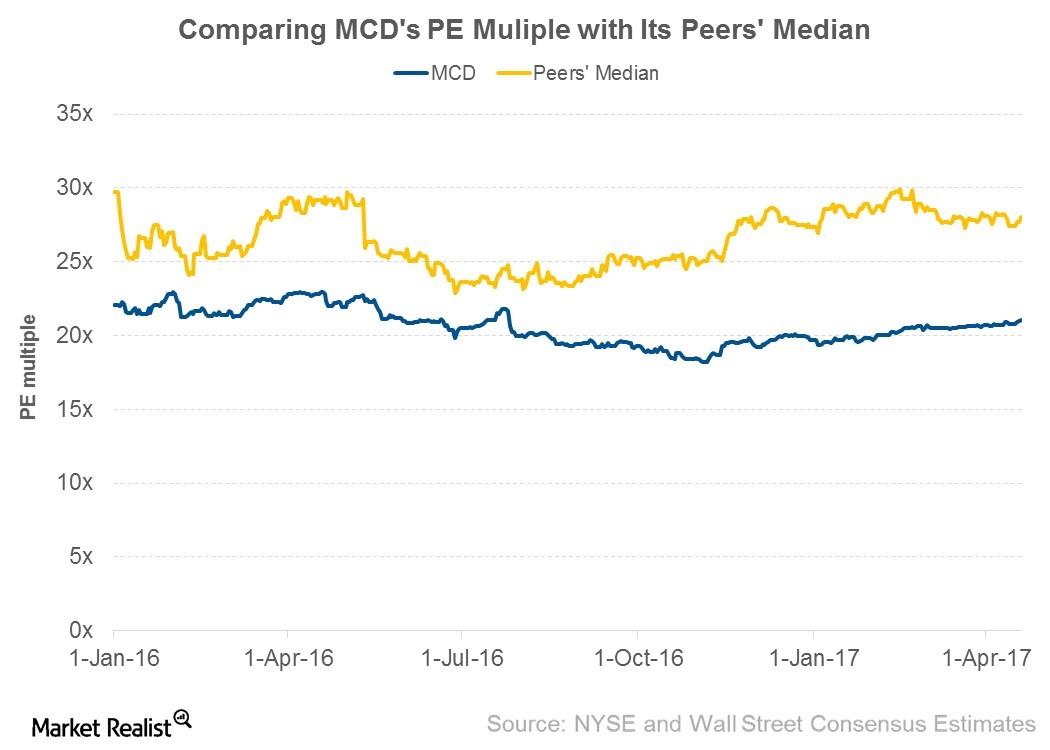

Analyzing McDonald’s Valuation Multiple

As of May 24, 2017, McDonald’s was trading at a PE multiple of 22.6x—compared to 21.3x before the announcement of its 1Q17 earnings.

Where McDonald’s Valuation Multiple Stands Next to Peers

As of April 19, 2017, McDonald’s was trading at a PE multiple of 21.1x, as compared to 19.9x before the announcement of its 4Q16 earnings.

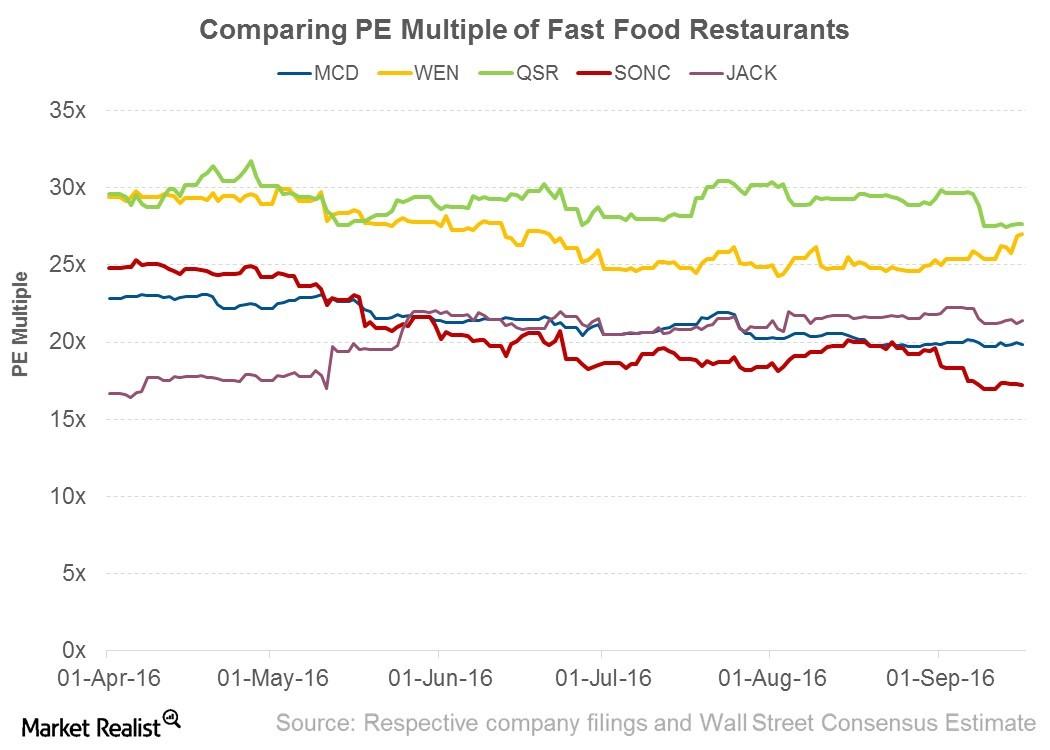

Behind the Valuation Multiples of Fast Food Restaurants

As of September 16, 2016, these five fast food restaurants were trading at a median PE multiple of 21.4x.

Wendy’s Stock Fell Due to Declining Sales

Wendy’s (WEN) posted its 2Q16 results on August 10, 2016. The company posted adjusted EPS (earnings per share) of $0.11 on revenue of $382.7 million.

Why Did McDonald’s Revenue Decline in 2Q16?

In 2Q16, McDonald’s revenue declined by 3.6% from $6.5 billion to $6.3 billion.

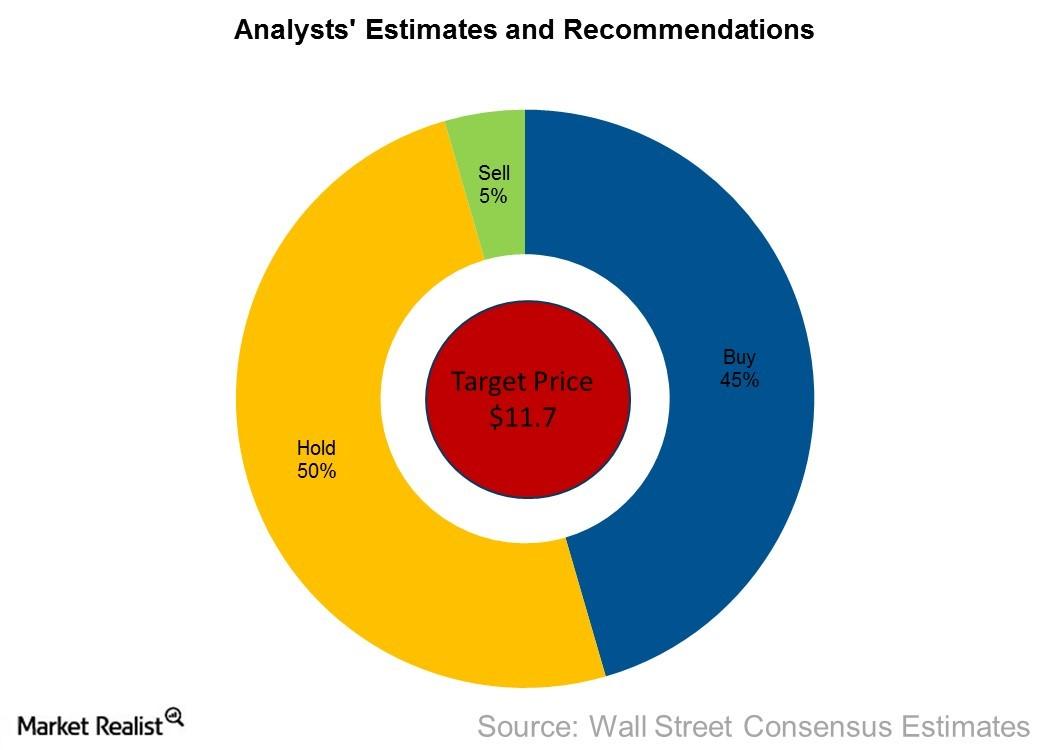

The Word on the Street: What Analysts Are Saying about Wendy’s

According to Bloomberg, of the ten analysts surveyed, 45.5% have issued “buy” recommendations for Wendy’s, while 50% have issued “hold” recommendations.

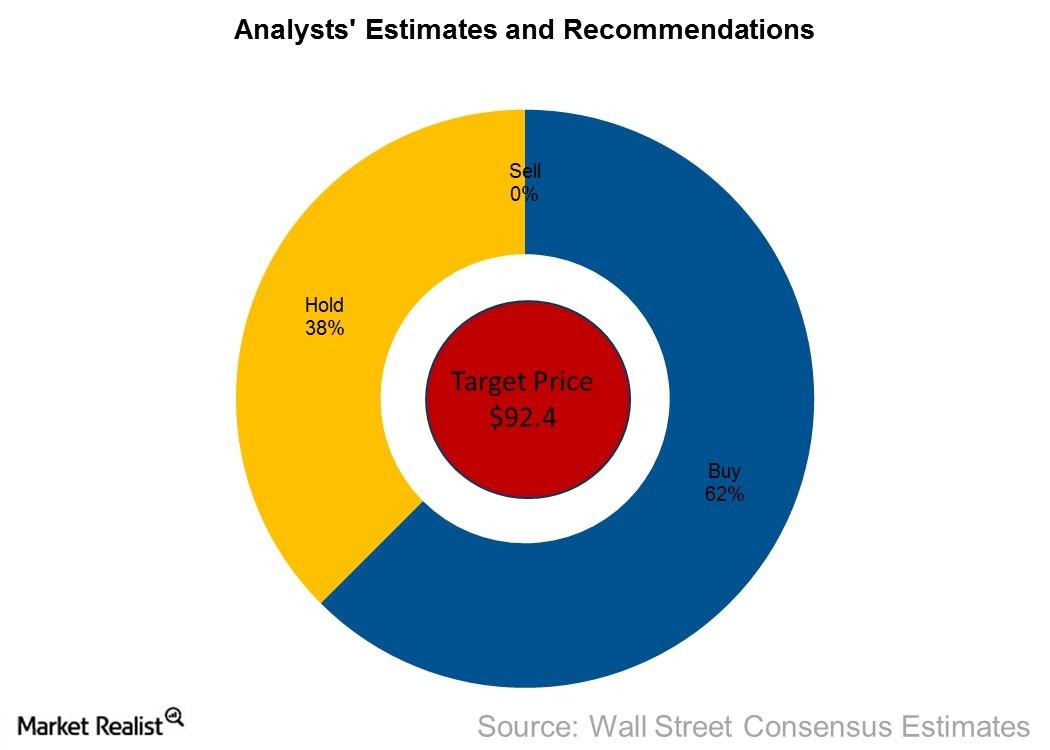

The Word on the Street: How Analysts See JACK

According to a Bloomberg survey of 16 analysts, 62.5% have given “buy” recommendations for JACK, and 37.5% have given “hold” recommendations.

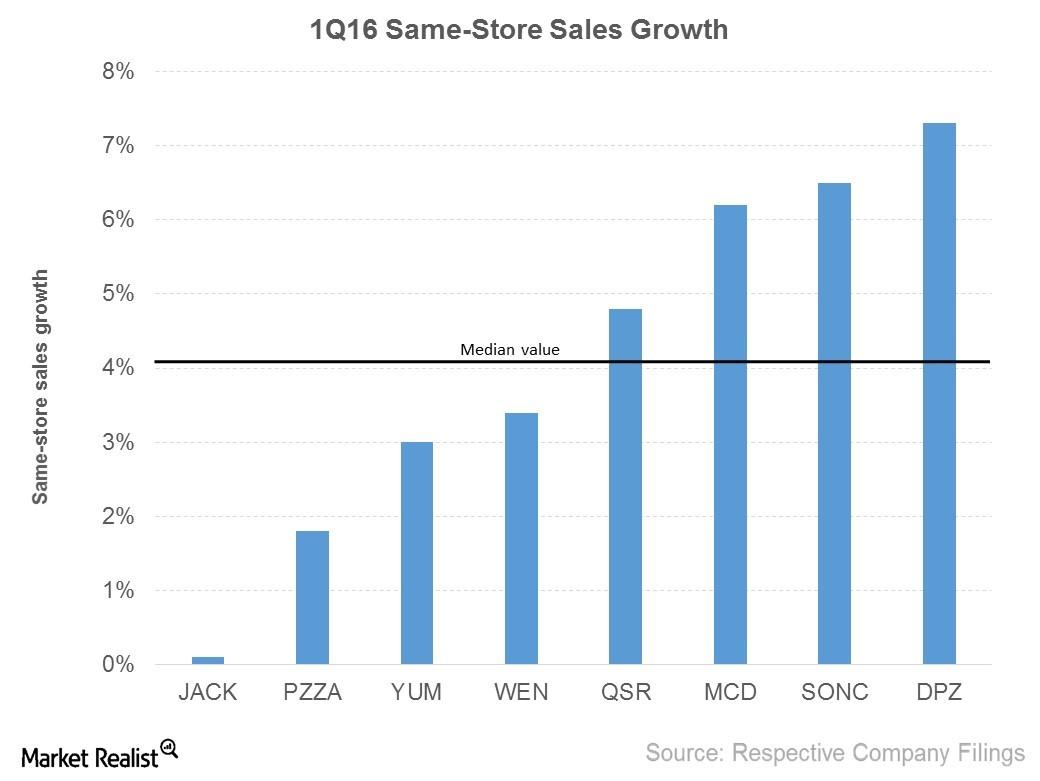

Why Domino’s Outperformed Other Fast-Food and Pizza Companies in Same-Store Sales Growth in 1Q16

SSSG is an important metric for investors to monitor because it increases a fast-food company’s revenue without increasing capital investment.

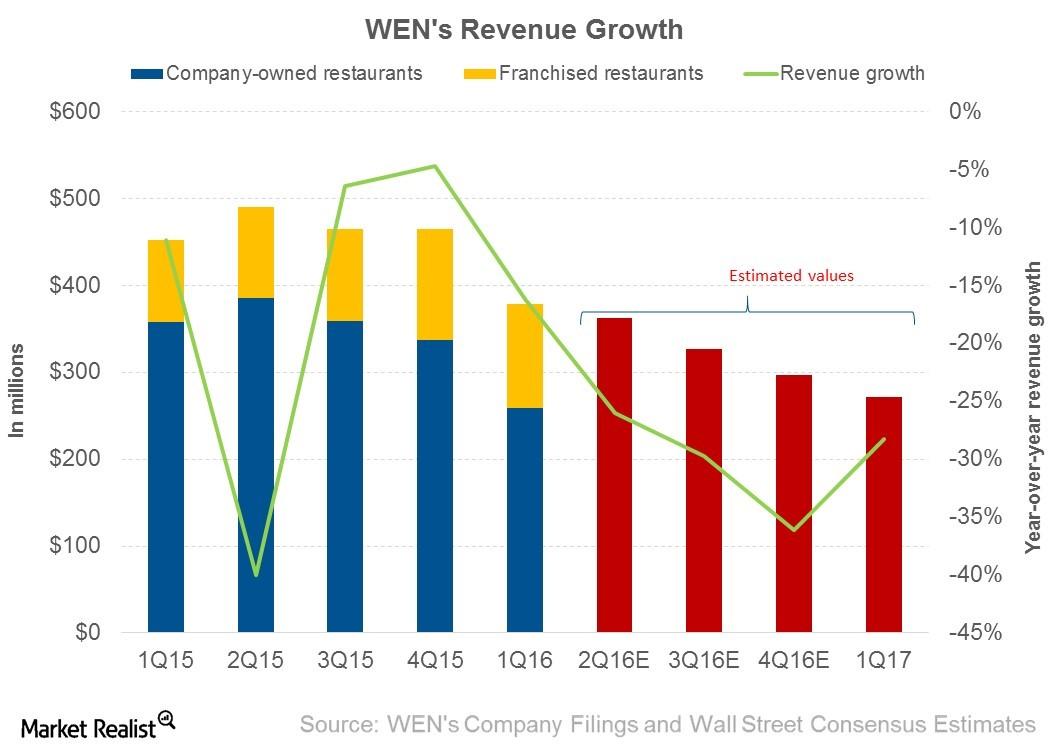

Why Did Wendy’s Revenue Fall in 1Q16?

Wendy’s Company (WEN) generates its revenue through company-owned restaurant sales, franchisee fees, rental income, and royalty collected from franchisees.

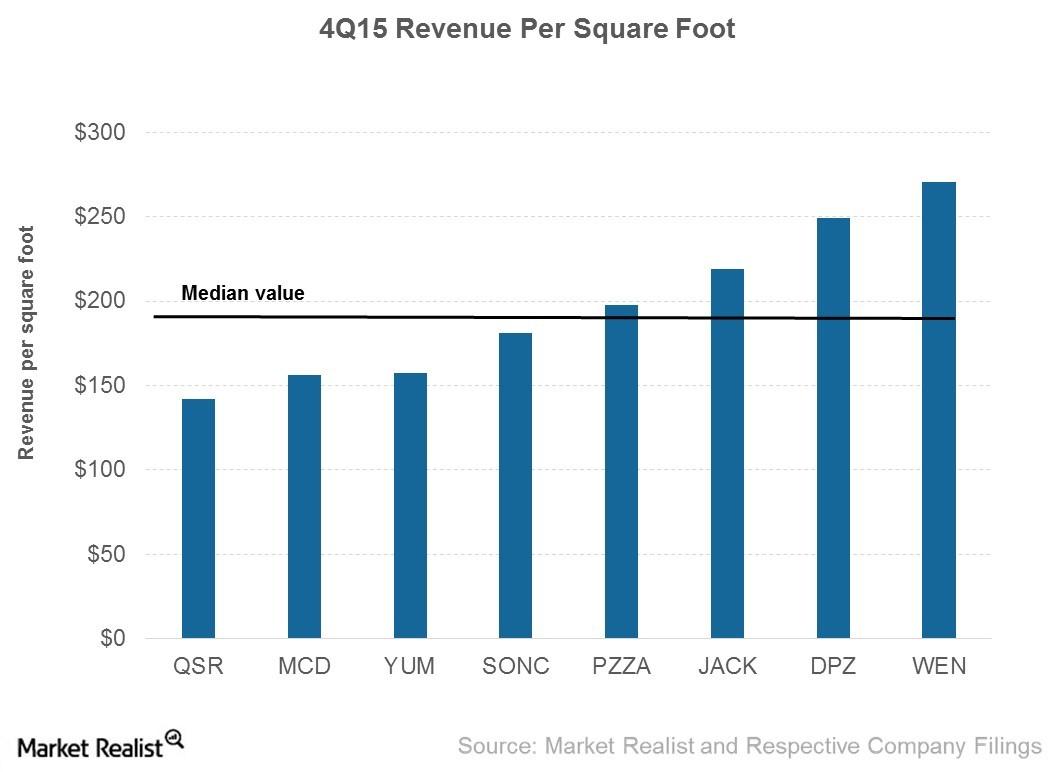

Which Fast Food Restaurant Led in 4Q15 Revenue Per Square Foot?

In 4Q15, MCD, YUM, WEN, QSR, JACK, SONC, PZZA, and DPZ generated an average revenue of $189 per square foot.