First Trust NASDAQ-100 ex-Tech Sect ETF

Latest First Trust NASDAQ-100 ex-Tech Sect ETF News and Updates

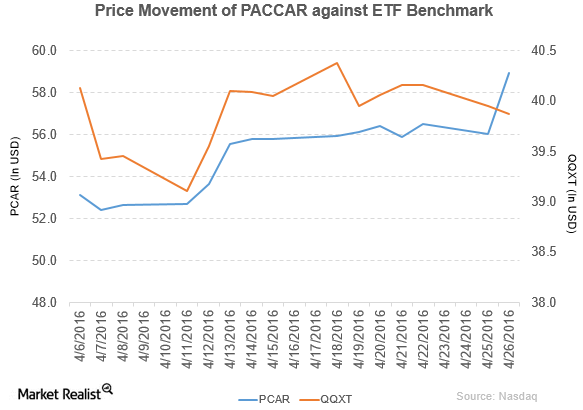

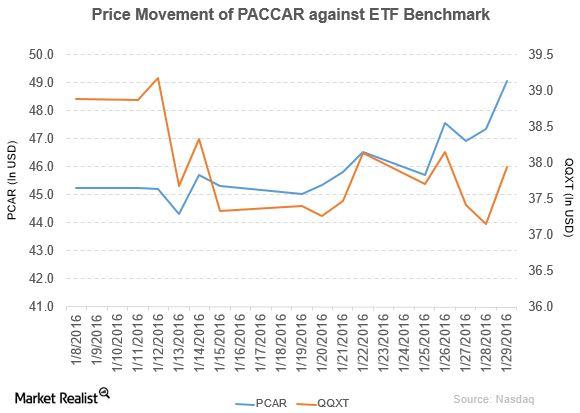

How Did PACCAR Perform in 1Q16?

PACCAR (PCAR) has a market cap of $20.5 billion. PCAR rose by 5.1% to close at $58.93 per share on April 26, 2016.

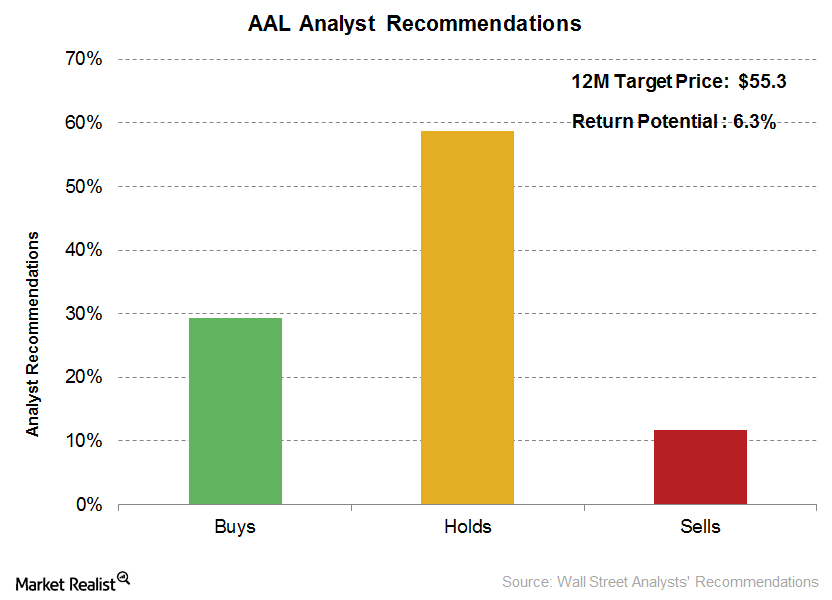

Wall Street Analysts’ Recommendations for American Airlines

According to Reuters, of the 17 analysts tracking American Airlines (AAL), 23.5% (or four) have “strong buy” ratings on the stock.

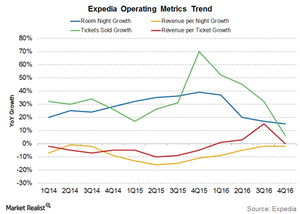

Takeaways from Expedia’s 4Q16 Key Metrics Performance

Hotel reservations accounted for 61% of Expedia’s 4Q16 revenue and remain the most important contributor to Expedia’s revenues.

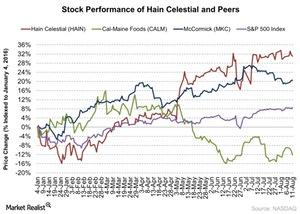

How Has Hain Celestial’s Stock Fared ahead of Fiscal 4Q16 Results?

So far, Hain Celestial’s stock has shown tremendous growth of 31% in 2016, led by an exceptional performance each quarter. The stock has gained 16% since its last quarterly earnings release on May 4.

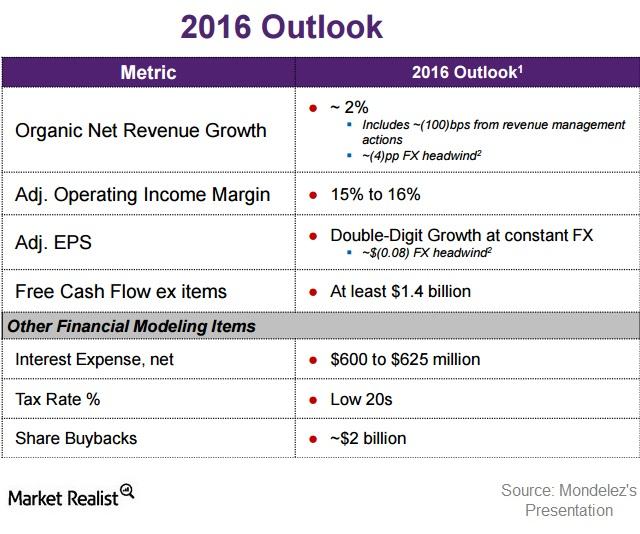

What’s Mondelez’s Outlook for Fiscal 2016?

Mondelez provided its fiscal 2016 outlook during the second quarter earnings call. It reduced its estimate for organic net revenue growth to ~2%.

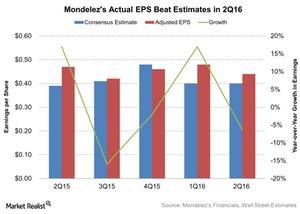

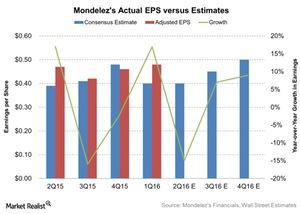

Did Mondelez’s Earnings Manage to Beat Estimates in 2Q16?

Mondelez exceeded analysts’ earnings estimates of $0.40 by 10% for 2Q16. The adjusted EPS (earnings per share) was ~$0.44 for the quarter.

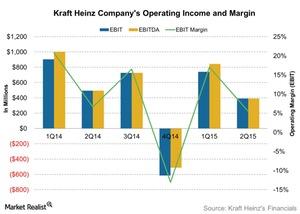

What’s Kraft Heinz’s Outlook for 2016?

Kraft Heinz’s management discussed its fiscal 2016 outlook during its last quarter’s earnings call. KHC remains on track or ahead in its areas of integration.

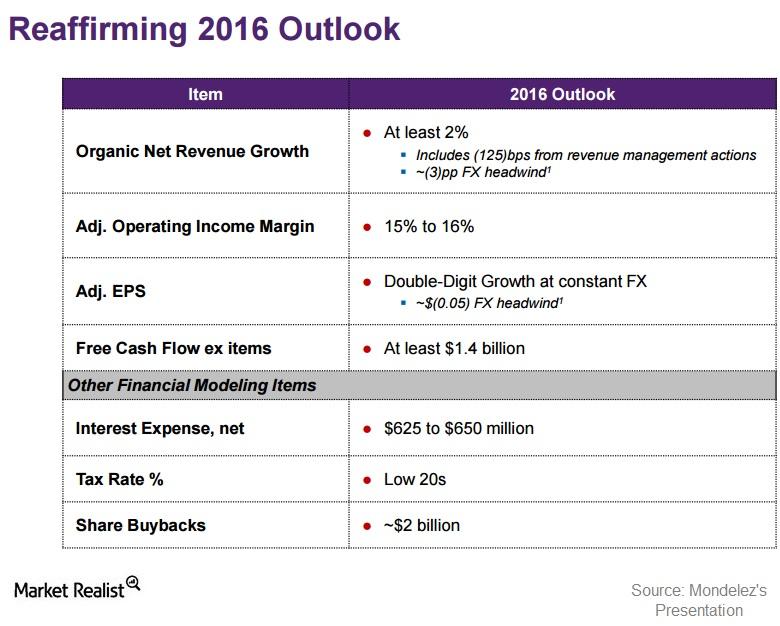

Mondelez’s Revenue Expectations for Rest of Fiscal 2016

In its fiscal 1Q16, Mondelez International (MDLZ) reaffirmed the fiscal 2016 outlook it announced during its 4Q15 results.

What’s Expected of Mondelez’s Earnings for 2Q16?

Analysts expect Mondelez’s adjusted EPS to be $0.40 compared to $0.47 in 2Q15.

PACCAR’s Revenue and Income Rose in 2015

PACCAR (PCAR) rose by 5.5% to close at $49.07 per share at the end of the last week of January 2016.

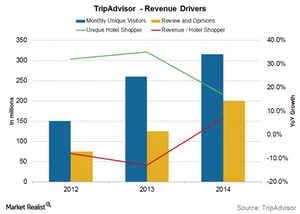

TripAdvisor’s Revenue Drivers for Its Largest Revenue Stream

What are the key revenue drivers of TripAdvisor’s (TRIP) click-based advertisement revenue? We can break them down into a few key metrics.

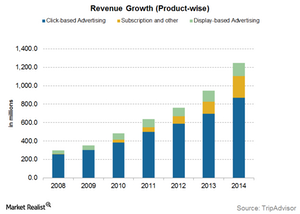

TripAdvisor’s Revenue Streams: A Cost-per-Click Model

Since all the content provided on TripAdvisor’s (TRIP) website is free and predominantly user-generated, the company shifted from earning on a per-query basis to a cost-per-click model.

TripAdvisor’s Business Model: What Investors Need to Know

In 1999, TripAdvisor founders Stephen Kaufer and his wife, Caroline Lipson Kaufer, decided to take a vacation. The vacation would have turned out to be a disaster if they hadn’t decided to check out the place online.

Which Segment Will Continue to Drive TripAdvisor’s Growth?

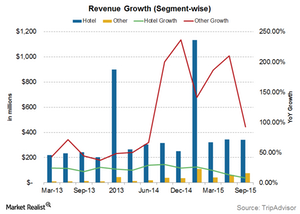

The hotels segment is TripAdvisor’s main segment, contributing about 82% of the company’s total revenues.

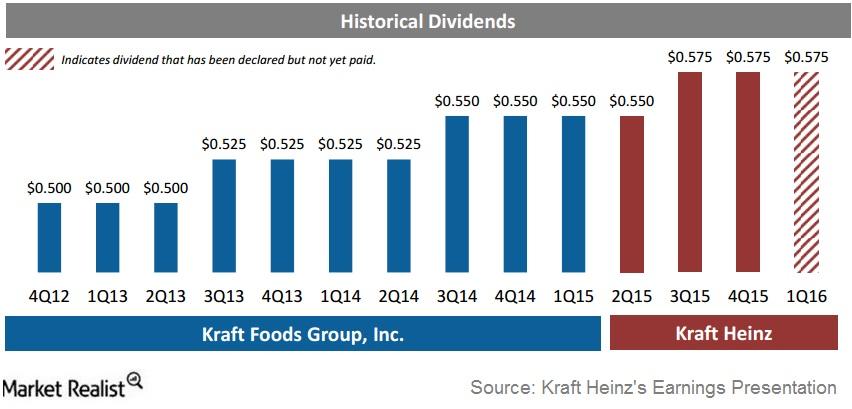

The Kraft Heinz Merger and Its Benefits

Pittsburgh-based H.J. Heinz Holding Corporation acquired Kraft Foods in October. After the merger, the company changed its name to Kraft Heinz.