Public Storage

Latest Public Storage News and Updates

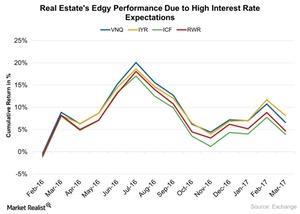

The Real Estate Reaction: Gauging the Impact of the Fed’s Rate Hikes

The rising interest rate is expected to boost the economy in the long run, but it could severely impact sectors like real estate.

Simon Property Group’s Key Business Segments

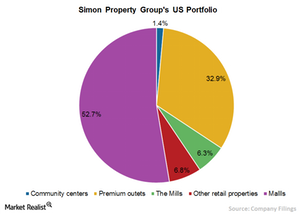

Simon Property is the only REIT in the S&P 100 Index and has heavy asset concentration on the US east coast and in the central US.

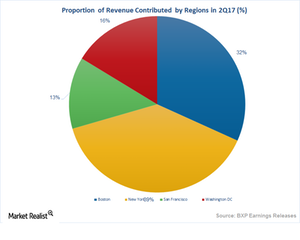

Boston Properties Could Ride High on These Factors

Boston Property (BXP) has strong business momentum and has been maintaining a decent growth trajectory for the past few years.

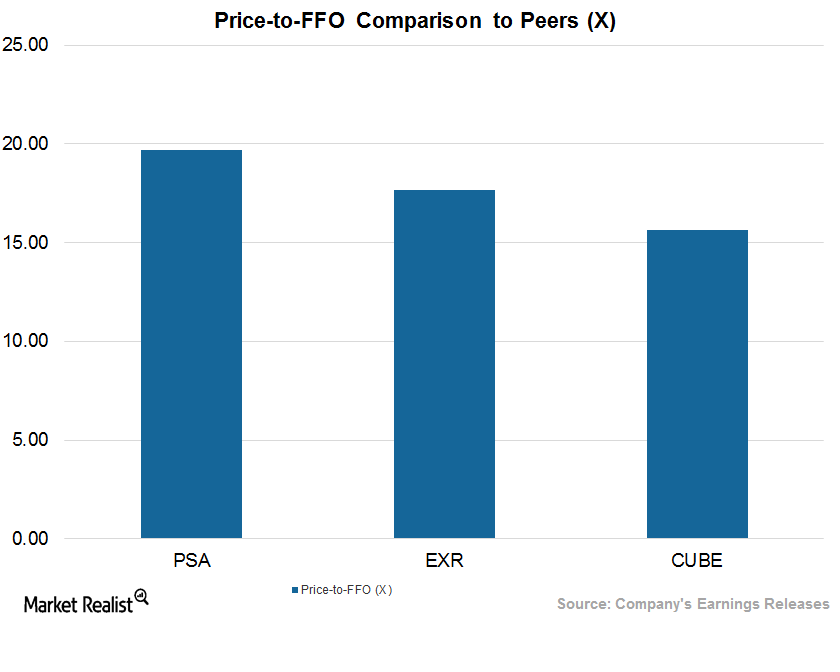

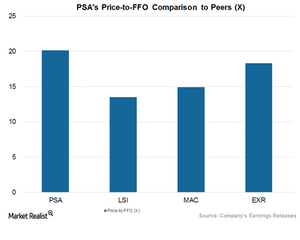

Comparing the Valuations of 3 Leading Self-Storage REITs after 2Q17

Public Storage (PSA) trades at an EV-to-EBITDA multiple of ~21.5x.

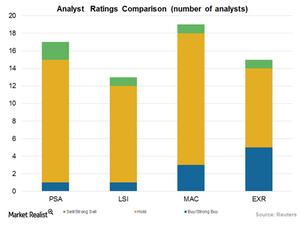

How Analysts View Public Storage

Analysts have assigned PSA a mean price target of $217.67, which is 4.9% higher than its current price level.

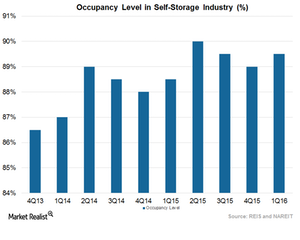

Where Public Storage Stands among Other Major Players

Public Storage has consistently been able to return capital value as well as shareholder returns in the form of dividends and share buybacks.

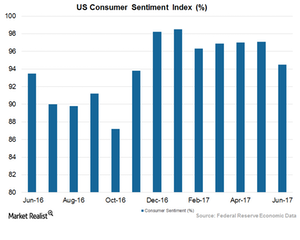

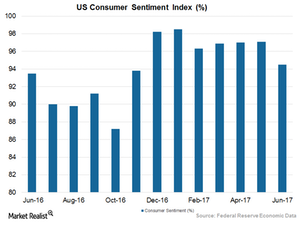

Public Storage and the Growing US Economy

Public Storage (PSA) is expected to witness a higher cost of debt in 2Q17, mainly due to the Fed’s rate hikes in 2017.

Inside Public Storage’s 2Q17 Battle with Macro Headwinds

Public Storage (PSA) is expected to post flat top-line and bottom-line results in 2Q17.

What’s Really Driving Public Storage’s Expected 2Q17 Upbeat Results

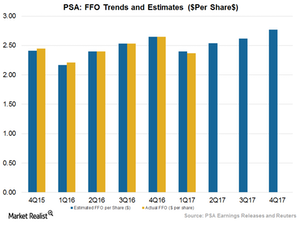

Wall Street expects PSA to report adjusted FFO (funds from operation) of $2.40, compared with $2.54 in 2Q16.

Will Public Storage’s Cost-Reduction Initiatives Drive Higher NOI in 2Q17?

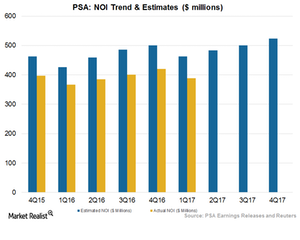

Wall Street analysts expect Public Storage (PSA) to report NOI (net operating income) of $483.7 million for 2Q17.

Will Public Storage Ride High on Top Line in 2Q17?

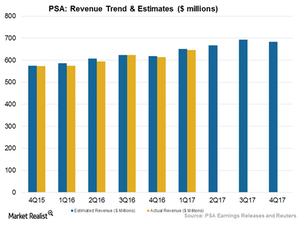

Wall Street expects Public Storage (PSA) to report revenue of $667.9 million for 2Q17. Its earnings call will be on July 27, 2017.

What Lies Ahead for Public Storage in 2Q17

Analysts expect PSA to report adjusted FFO (funds from operation) of $2.40, compared with $2.54 in 2Q16.

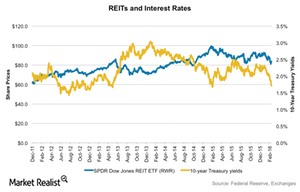

How Would an Interest Rate Hike Affect Real Estate Valuations?

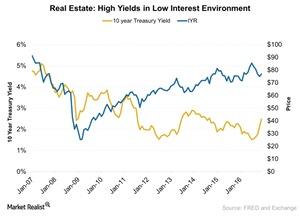

The real estate sector’s (VNQ) (IYR) performance was subdued in 2016 due to its supply-demand dynamics.

How Would Negative Interest Rates Impact REITs?

A fall in interest rates makes REITs more attractive dividend-yielding investments compared to bonds. This is because REITs have been traditionally viewed as dividend-yielding investments.

Specialized REITs: The Unsung Heroes

With the growing economy and global investment horizons, investments have shifted beyond the traditional options to specialized REITs.

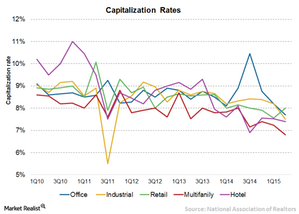

REIT Capitalization Rates Fall as Prices Surge

Average capitalization rates in 2Q15 fell to 7.5% across all the property types compared to 8.35% in 2Q14.

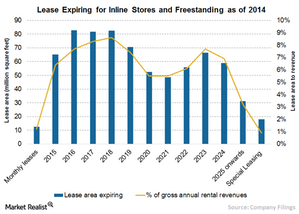

Simon Property Group’s Lease Length Exposure

Only 1.2% of Simon Property’s gross annual revenues from inline or freestanding stores comes from month-to-month leases. 6.5% of leases will expire in 2015.

Simon Property Group’s Acquisition Growth Strategy

Simon Property has a strong track record of aggressive acquisitions. Since its IPO in 1993, the company has completed acquisitions worth $40 billion.

Simon Property Group’s Retail Mall Business

Simon Property’s US properties consist of malls, premium outlets, community centers, and retail properties that make up ~182 million square feet of GLA.

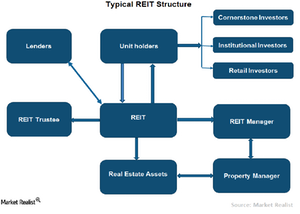

Why Did REITs Come into Existence?

US REITs came into existence in 1960 when President Eisenhower signed the REIT Act contained in the Cigar Excise Tax Extension.