Perrigo Co PLC

Latest Perrigo Co PLC News and Updates

Central Nervous System Is Key to Teva’s Specialty Medicines

Revenues for Teva’s (TEVA) Specialty Medicines segment grew by 2.1% to $8,560 million in 2014, from $8,388 million in 2013.

What Are Pfizer’s Revenue Drivers?

Pfizer reported revenues of $13.5 billion during the second quarter—4% growth YoY compared to $12.9 million during the second quarter of 2017.

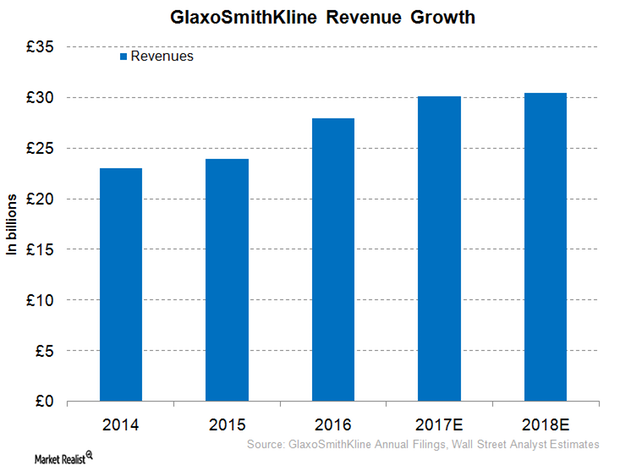

GlaxoSmithKline Could Witness Modest Rise in Revenues in 2017

GlaxoSmithKline (GSK) is a leading player in the global respiratory market with a major focus on the asthma and chronic obstructive pulmonary disease (or COPD) segments.

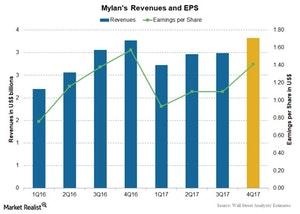

Mylan’s Valuation in January 2018

Mylan (MYL) is a leading pharmaceutical company with over 1,400 generic and specialty pharmaceutical products in its portfolio.

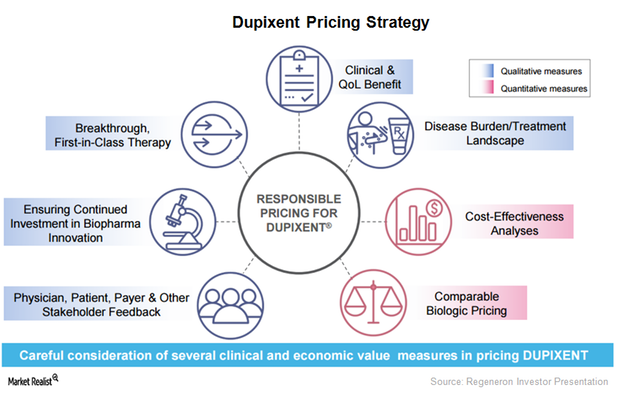

Dupixent May Be a Major Growth Driver for Regeneron in 2017

After Dupixent’s commercial launch, Regeneron has been involved in creating awareness for the drug among physicians who have been treating AD patients.

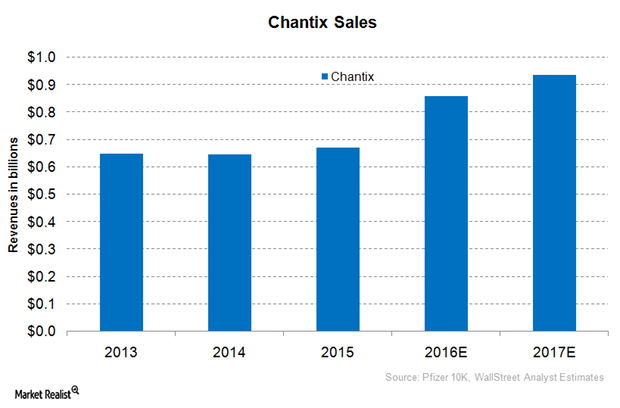

Pfizer Has a Revenue-Boosting Treatment to Help Smokers Quit

Approved by the FDA on May 11, 2006, Chantix, also known as Champix, is used as an aid to help cigarette smokers quit the habit of smoking.

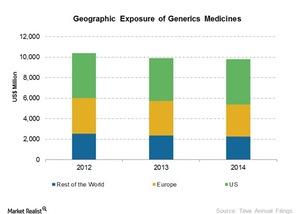

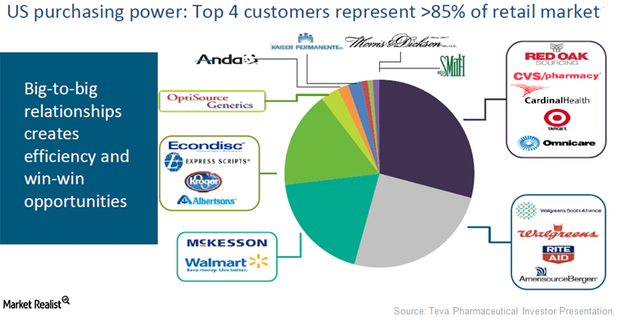

Teva Is Well Positioned for New Trends in the US Generic Market

Because of its drug portfolio, manufacturing operations, and customer relationships, Teva expects to benefit from new trends in the US generic market.

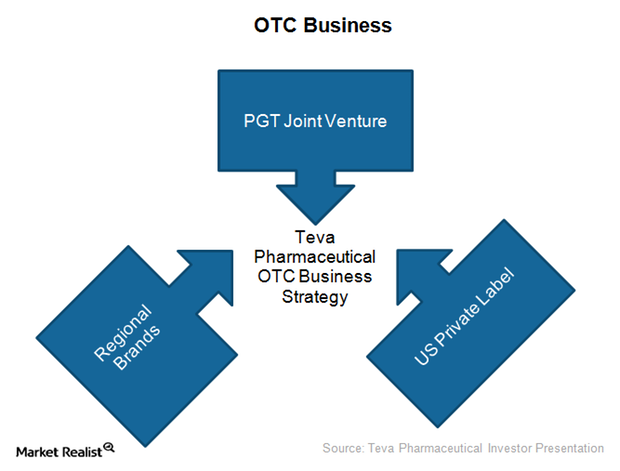

Teva’s OTC Business Is Playing out to Be a Key Growth Driver

In addition to its generic pharmaceutical business, Teva Pharmaceutical also has a significant presence in the major categories of the OTC drug business.

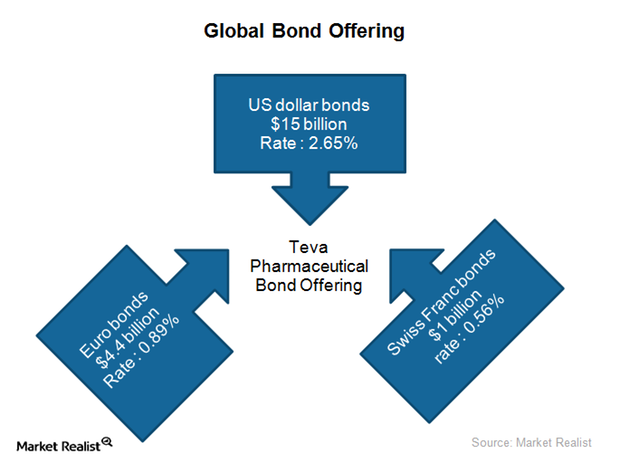

Teva Pharmaceutical: A Successful Bond Financing Program in 2016

To finance the acquisition of Allergan Generics (AGN), Teva Pharmaceutical (TEVA) successfully completed a global bond offering on July 21, 2016.

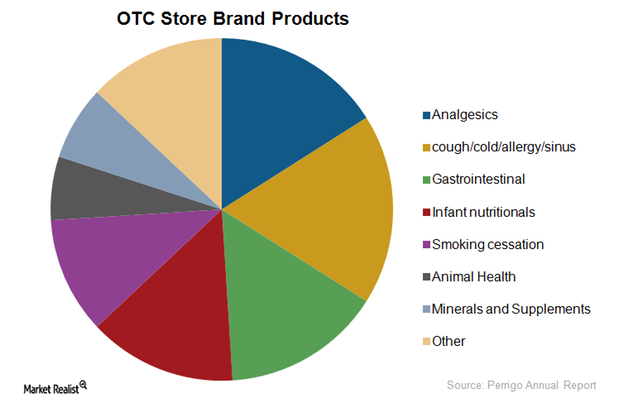

Perrigo Leads the Over-the-Counter Store-Branded Products Market

Perrigo is a market leader in over-the-counter store-branded products. Its leadership position extends to major geographies such as the US, the UK, and Mexico.

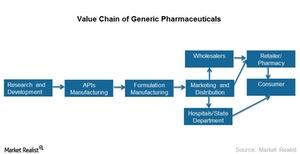

Generics Are Climbing up the Value Chain

Severe cost pressure can lead to the commoditization of generics. it’s important to adjust the value chain to achieve higher efficiencies, flexibility, and reliability.

Are Generics the Only Affordable Drugs?

Drugs are used to treat, cure, or prevent diseases. The drug market is broadly categorized into prescription drugs and OTC (over-the-counter) drugs.

What Investors Need to Know about Branded and Generic Drugs

The prescription drug market is divided into two categories—branded or generic drugs. Branded drugs are patented drugs. Generics are off-patented drugs.

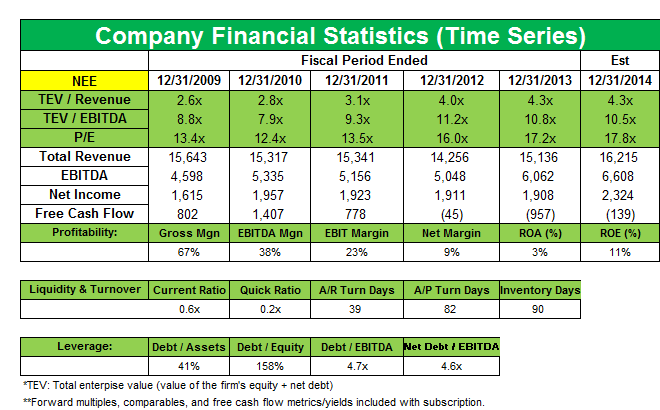

Millennium Management increases its stake in NextEra Energy

Millennium Management increased its stake in renewable energy generator NextEra Energy Inc. (NEE) from 1,789,954 shares to 3,333,627 shares.

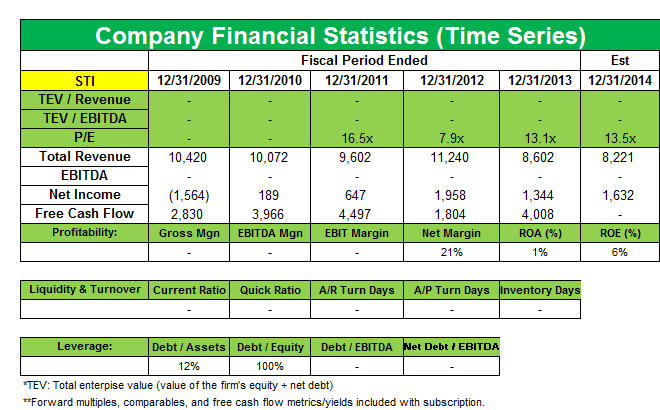

Millennium Management buys a new position in SunTrust Banks

Millennium Management started a new position in SunTrust Banks (STI) that accounts for 0.15% of the fund’s portfolio.