NVIDIA Corp

Latest NVIDIA Corp News and Updates

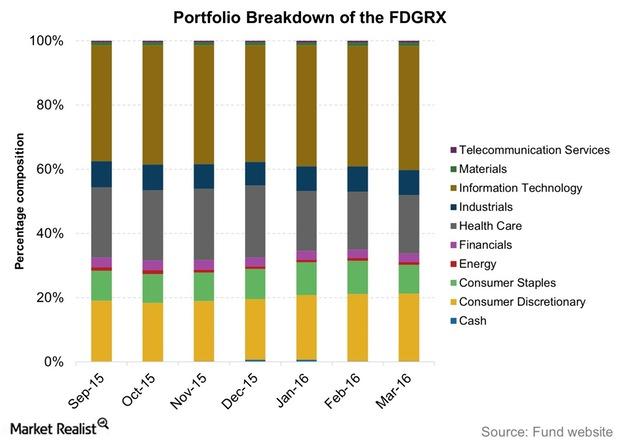

What Moves Did FDGRX Make Leading Up to 1Q16?

FDGRX’s assets were invested across 394 holdings as of March 2016, two more than a quarter ago. It was managing assets worth $37.8 billion as of March’s end.

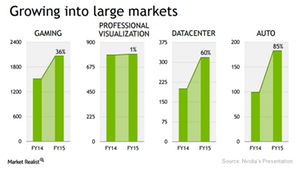

NVIDIA Upgrades Its GPU Portfolio to Capitalize on Future Trends

NVIDIA (NVDA), a popular name among PC gamers, made news at the GTC (GPU Technology Conference) 2016 from April 4 to 7, 2016.

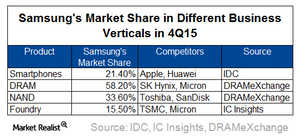

Samsung: A Semiconductor Foundry, Competitor, and Customer

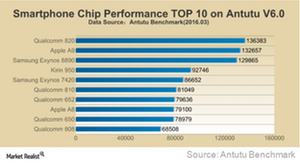

Through its foundry business, Samsung provides chip manufacturing services to companies such as Qualcomm (QCOM), NVIDIA (NVDA), and Apple (AAPL).

What Is Samsung’s Growth Strategy in the Smartphone Market?

South Korea–based (EWY) Samsung (SSNLF) is making efforts to boost revenue and maintain a double-digit margin amid slowing smartphone sales.

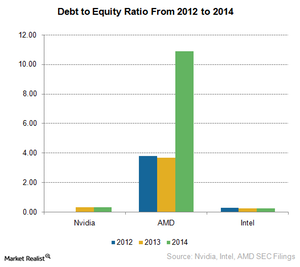

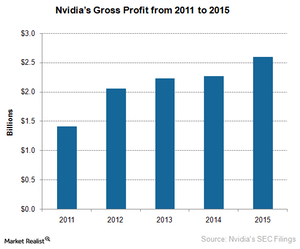

How Is Nvidia’s Capital Structure Compared to Its Rivals’?

Nvidia’s free cash flow to net income ratio indicates that it has a strong capital structure to withstand headwinds and bear significant capital expenditure.

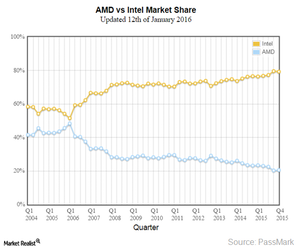

Intel and AMD’s Duopoly in the PC Processor and Server Market

AMD and Intel seem to have a duopoly in the PC processor and server market, with Intel accounting for more than 80% share in the PC processor space and a 99% share in the server space.

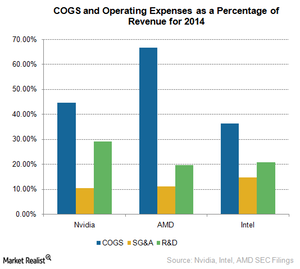

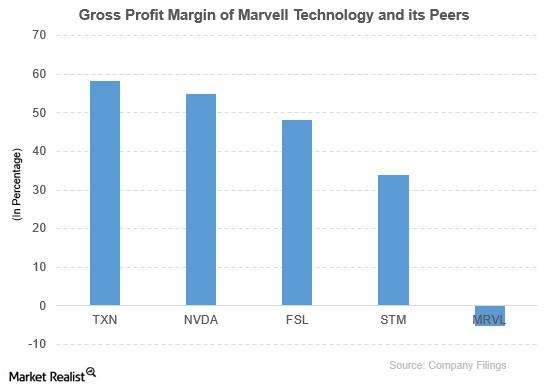

Is Nvidia’s Cost Structure Favorable for Investors?

Nvidia’s cost of goods sold is around 40% of its revenue, whereas Advanced Micro Devices’ COGS is more than 65%. Intel’s (INTC) COGS is below 40%.

What External Risks Pose Threats to Nvidia?

Any defects found in Nvidia’s products would incur significant costs. Greater risks would arise if a defect were found after commercial shipment had begun.

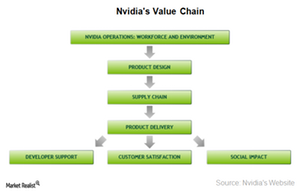

How Product Design Wins Impact Nvidia’s Revenues

Nvidia’s revenue depends on design wins. The company maintains strong relationships with customers to assist them in defining their new products.

What Risks Does a Limited Customer Base Pose for Nvidia?

Nvidia is looking to diversify its revenue stream by targeting customers in the automotive market. In fiscal 3Q16, its revenue from automotive rose 52% YoY.

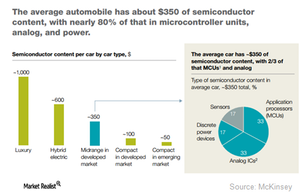

Automotive Segment to Drive Growth in the Semiconductor Market

Automotive semiconductor revenue has grown at a CAGR (compounded annual growth rate) of 8% between 2002 and 2012, according to McKinsey.

How Did Marvell Technology Compare to Its Peers?

Marvell Technology was outperformed by its peers based on the gross profit margin and PBV ratio. ETFs outperformed it based on the price movement and PBV ratio.Earnings Report What concerns are hovering around NVIDIA’s stock?

A loss of technology leadership means that NVIDIA will lose its competitive advantage. This will lead to lower margins through lower revenues and increased R&D spending.Earnings Report The main challenges facing Texas instruments

Consumer demand for the latest features and applications is huge. Endless technological innovation addresses that demand to a point, but has led to consistently shorter product life cycles.