NeuStar Inc

Latest NeuStar Inc News and Updates

Emerging Markets Drive Abbott’s Nutritional Business Growth

In 1Q17, Abbott Laboratories’ (ABT) Nutritional segment reported revenue of nearly $1.6 billion, a year-over-year (or YoY) fall of ~1%.

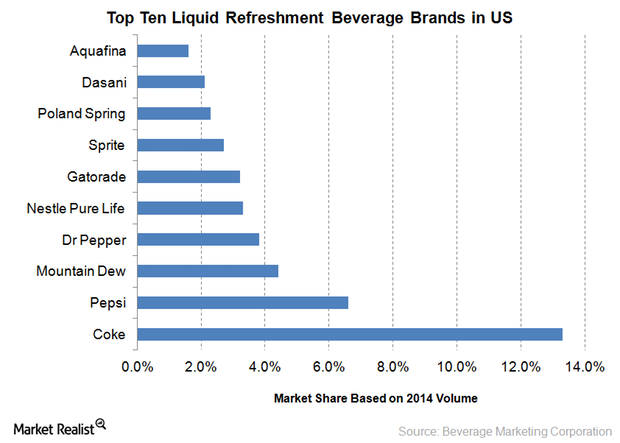

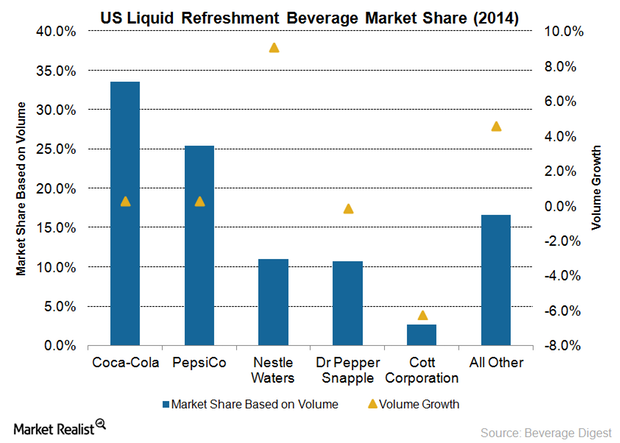

An Overview of the US Nonalcoholic Beverage Industry

The US nonalcoholic beverage market comprises categories like carbonated soft drinks, ready-to-drink tea and coffee, bottled water, sports drinks, and energy drinks.

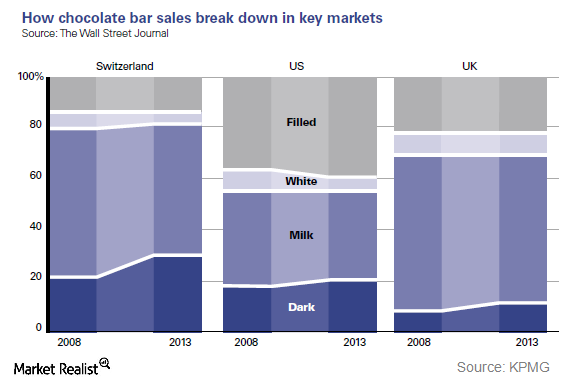

Analyzing Hershey’s Emphasis on Product Innovation

Hershey plans to position dark chocolate as a lifestyle choice in the US. It has thus begun promoting its dark chocolate brands for specific consumption.

Mead Johnson Plans to Focus on R&D to Support Innovations

Mead Johnson follows a strategy of investments in innovation, having expanded its liquids portfolio and rolled out its key specialty formulas across Asia.

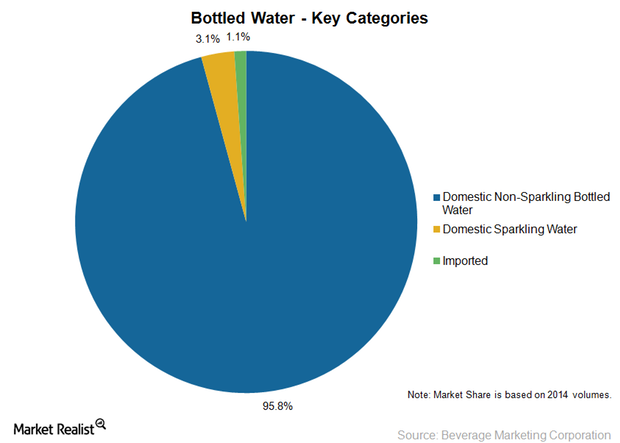

Non-Sparkling Water Is the Largest Bottled Water Segment in the US

The domestic non-sparkling bottled water category is the largest segment of bottled water in the US.

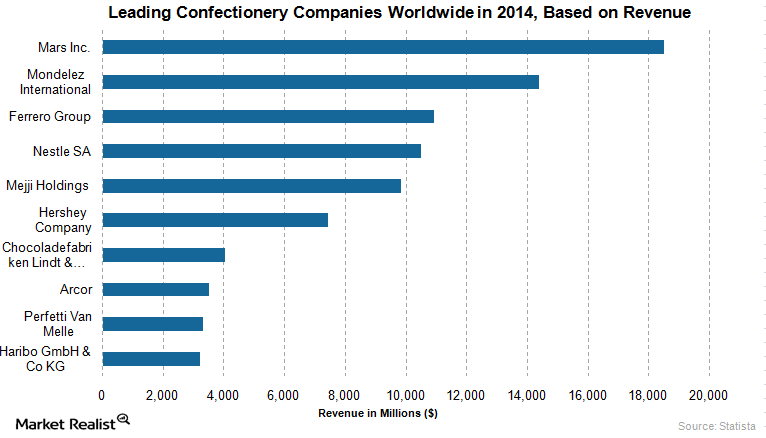

An Overview of Hershey, America’s Largest Chocolatier

Hershey is the largest producer of chocolate in North America. It is a global leader in chocolate, sugar confectionery, and chocolate-related products.

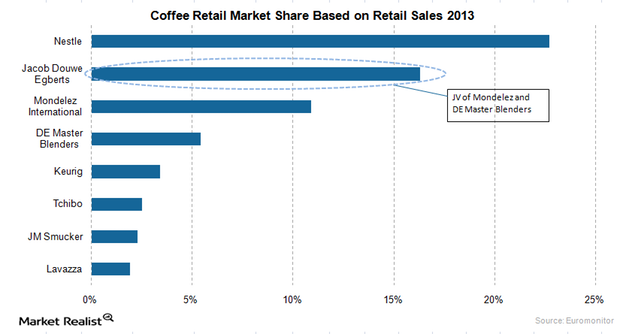

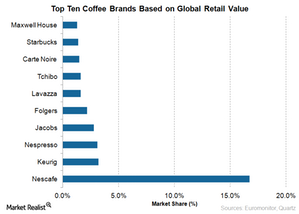

JAB to Challenge Nestle, Global Leader of Portioned Coffee Market

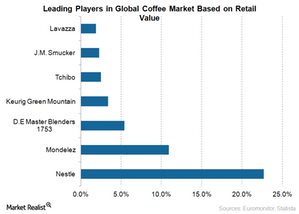

JAB’s share in the global coffee market is estimated to reach approximately 20% with the addition of Keurig’s brands and products to its portfolio.

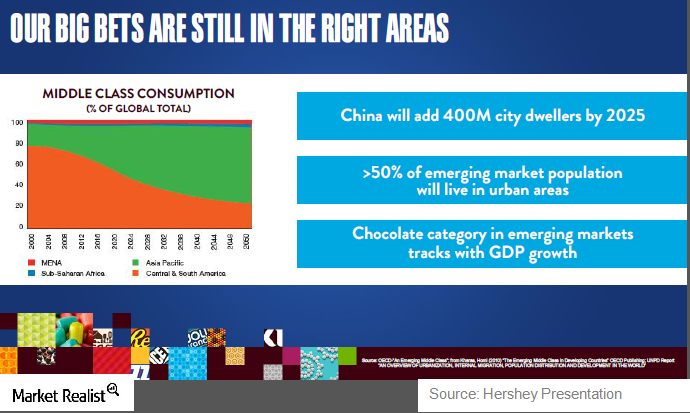

Why China Is Such an Important Market for Hershey in 2015

Hershey is the fastest-growing confectionery company in China, and Hershey expects China to become its second-largest market behind the US by 2017.

Will Coffee Peers Step Up Their Game with Jacobs Douwe Egberts?

With the emergence of Jacobs Douwe Egberts, Keurig and other coffee producers will focus more on expanding their product portfolios. They’ll also focus on an international presence to capture the growing global demand for coffee.

Kirkland Signature: Costco’s Key Differentiator in Fiscal 2Q16?

Costco has seen traffic growth averaging 4.3% per year in the period between fiscal 2009 and fiscal 2015. In fiscal 1Q16, club traffic rose by 3.5% YoY.

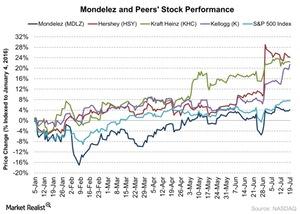

Did Oreo Cookies, Trident Gum Sales Boost Mondelez’s 2Q Earnings?

Mondelez International (MDLZ), maker of Cadbury chocolates and Oreo cookies, is all set to report its fiscal 2Q16 earnings results on July 27 before the market opens.Company & Industry Overviews The Energy and Materials Sectors Pulled VEURX into the Red in 2015

The Vanguard European Stock Index Fund was the worst performer for 2015 among the ten funds in this review.

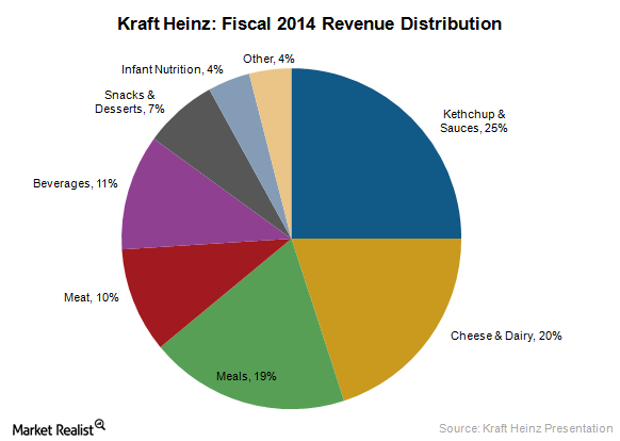

What’s on the Table with Kraft Heinz? Getting to Know the Company’s Product Offerings

Kraft Heinz operates more than 200 brands in nearly 200 countries. Its eight iconic brands contribute more than $1 billion in sales apiece to total revenue.

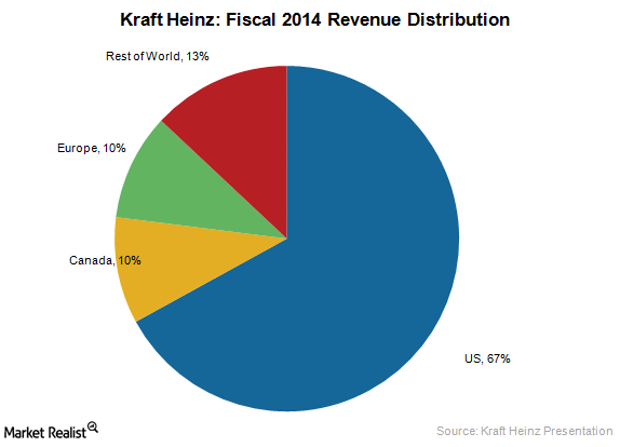

Breaking down Kraft Heinz: A Segmental and Geographical Overview

The US accounted for 67% of Kraft Heinz’s fiscal 2014 pro forma sales, with Canada and Europe each contributing 10% of total sales.

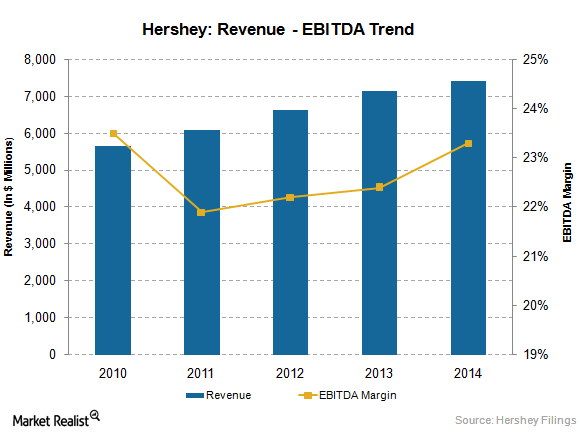

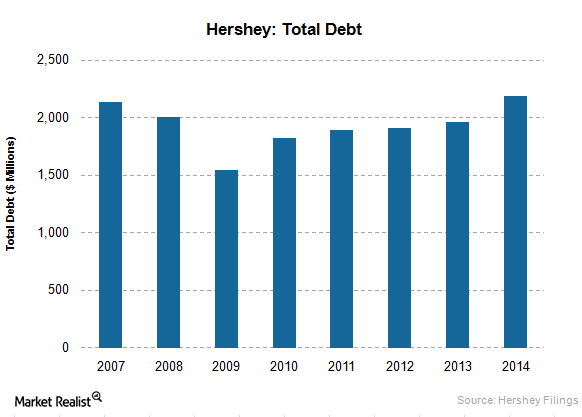

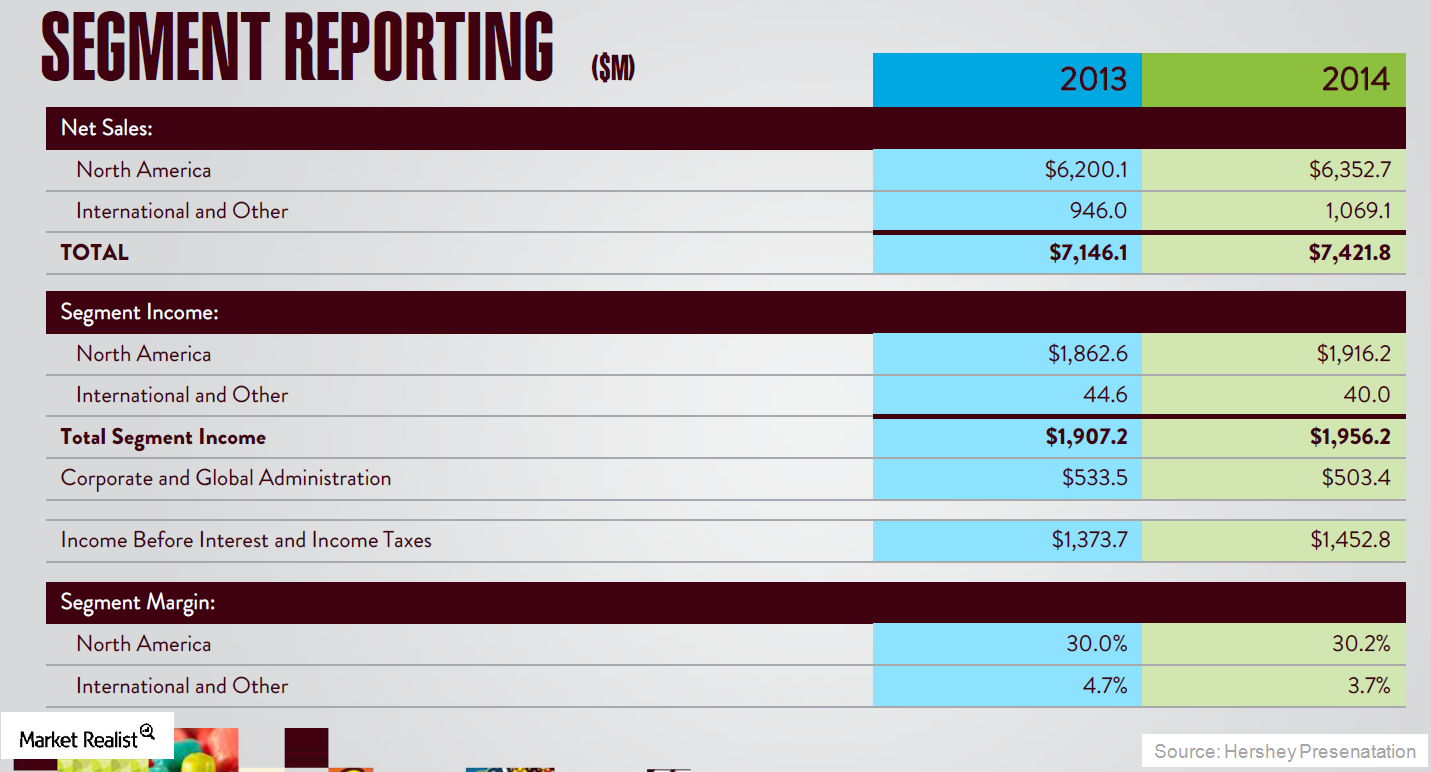

Evaluating Hershey’s Financials Against Its Competitors

Hershey had a total debt of $2.4 billion on its balance sheet in 2014. It had a total debt-to-equity ratio of 195% during the same period.

Hershey’s New Focus on International Growth Opportunities in 2015

Hershey’s international segment contributes only ~30% of total revenues. Its goal is to increase international revenues to ~50% of total revenues by 2018.

Hershey’s Competitive Strategies for North America in 2015

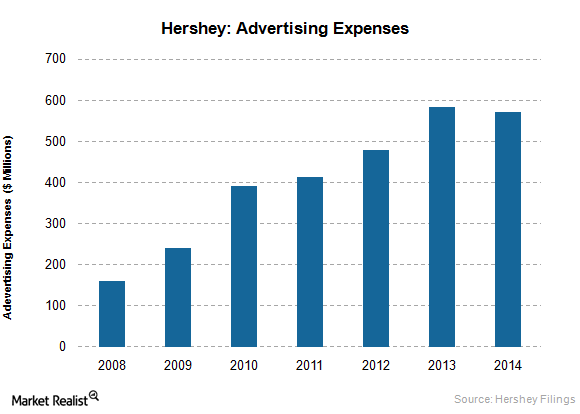

Along with advertising, Hershey is focusing on cross-merchandising complimentary products like beverages and snacks, which should help expand consumption.

Evaluating Hershey’s Marketing Strategies and Initiatives

Hershey applies a micro-marketing concept to its businesses, which means that it markets certain products to small target audiences.

Analyzing Hershey’s Segments and Product Offerings

In its international business, Hershey is mainly focusing in emerging markets of Mexico, Brazil, India, and China.

A Glance at Hershey’s Leadership in the US Confectionery Industry

Hershey is a leading player in the confectionery industry, which grew globally at a CAGR of 4.9% from 2009–2014, reaching $198.4 billion in 2014.

Nestle Continues to Dominate the US Bottled Water Industry

Nestle Waters North America is the market leader of the US bottled water industry.

Jacobs Douwe Egberts: Its Impact on Coffee Industry Rivals

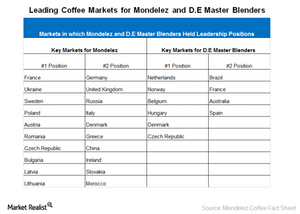

Jacobs Douwe Egberts will be a leading player in the coffee industry with powerful brands like Jacobs, Maxwell House, and Pilão. It will have a strong presence in emerging countries like China.

Jacobs Douwe Egberts: What It Took to Seal the Deal

According to Jacobs Douwe Egberts’s website, the company holds either the number-one or number-two position in coffee markets for more than 18 countries in Europe, Latin America, and Australia.