Noble Energy Inc

Latest Noble Energy Inc News and Updates

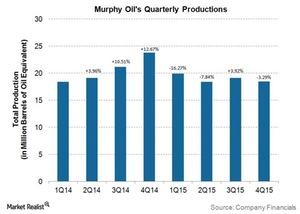

Murphy Oil’s 4Q15 Operational Performance, Management Strategies

Along with its 4Q15 earnings, Murphy Oil announced the divestiture of its Montney midstream assets located in Canada. The transaction includes the sale of existing infrastructure capable of processing up to 320 million cubic feet per day.

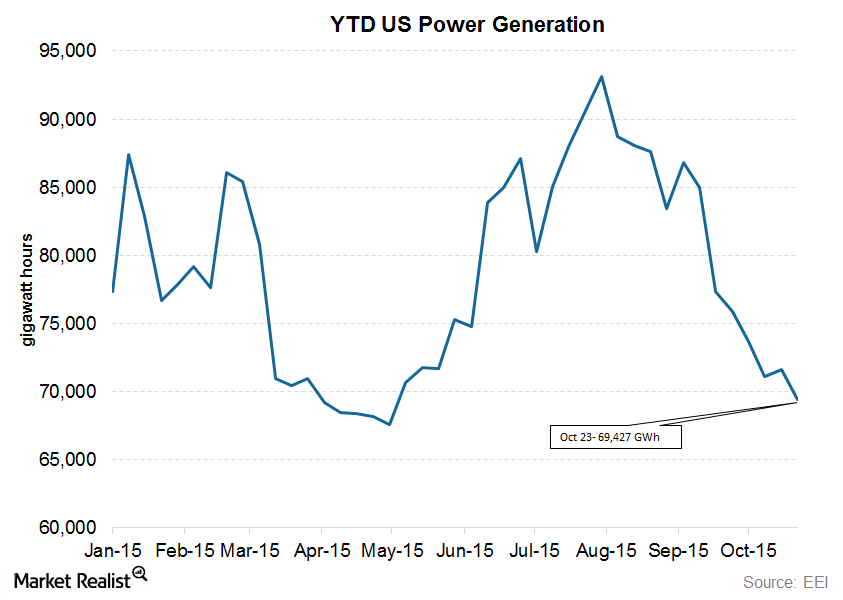

US Power Generation Down Again: An Analysis of Trends

An increase in US power generation numbers is expected for the week ended October 30, 2015.

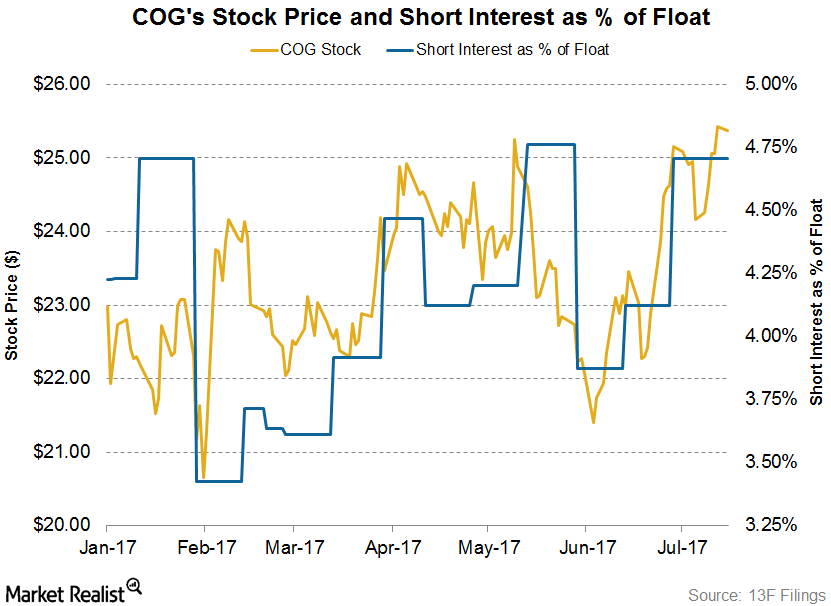

Cabot Oil & Gas: Short Interest Trends in Its Stock

On July 18, 2017, Cabot Oil & Gas’s (COG) short interest ratio was ~4.7%. At the beginning of the year, its short interest ratio was 4.2%.

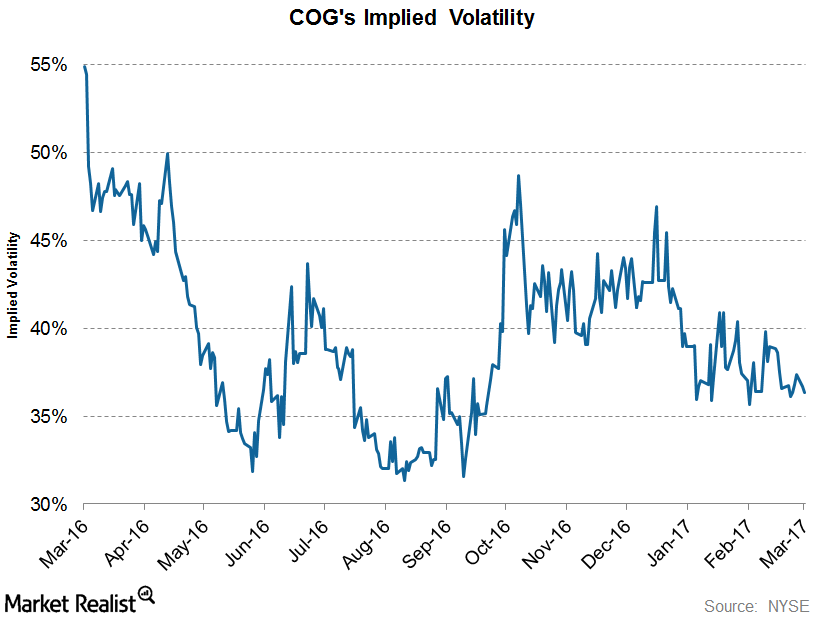

COG’s Implied Volatility Has Fallen Significantly since Early 2016

Cabot Oil and Gas’s (COG) current implied volatility is ~36.4%, ~3% lower than its 15-day average of 37.4%.

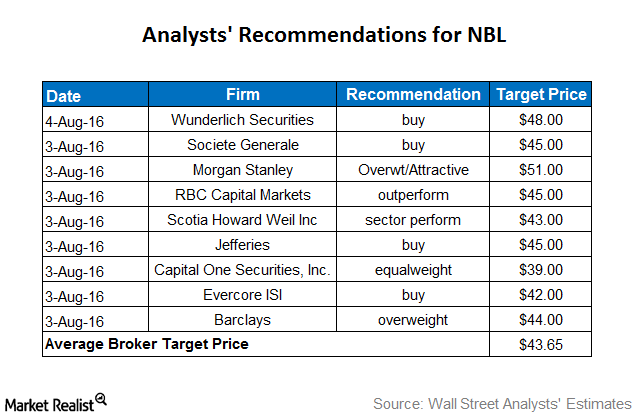

Noble Energy: Analysts’ Recommendations

Among the 23 analysts tracking Noble Energy (NBL), 29% recommended a “hold,” 68% recommended a “buy,” and 3% recommended a “sell.”

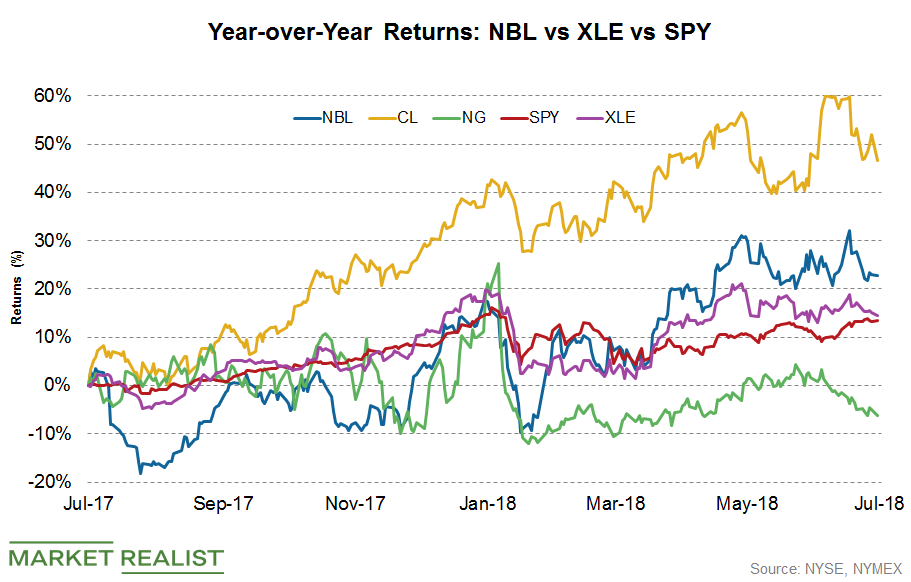

How Has Noble Energy Stock Been Performing Recently?

Year-over-year, NBL stock has risen ~22.7%, while crude oil prices have surged 46.5% in the same period.

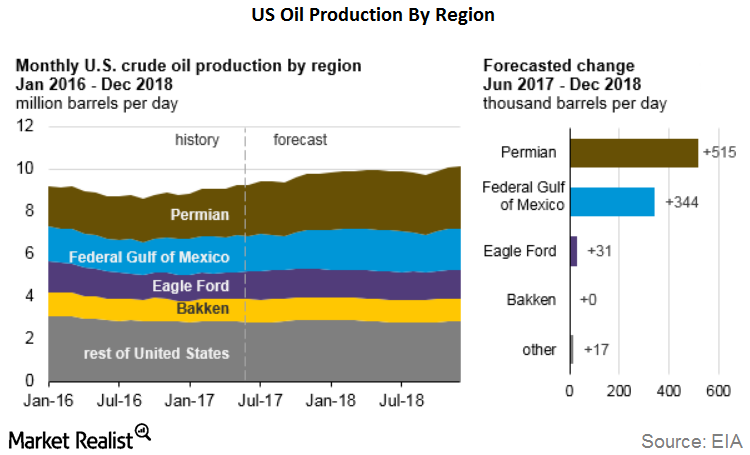

Could Permian Basin Drive Growth in US Crude Oil Production?

In its November Short-Term Energy Outlook (or STEO) report, the EIA forecast that US crude oil production in 2017 would average 9.2 million barrels per day.

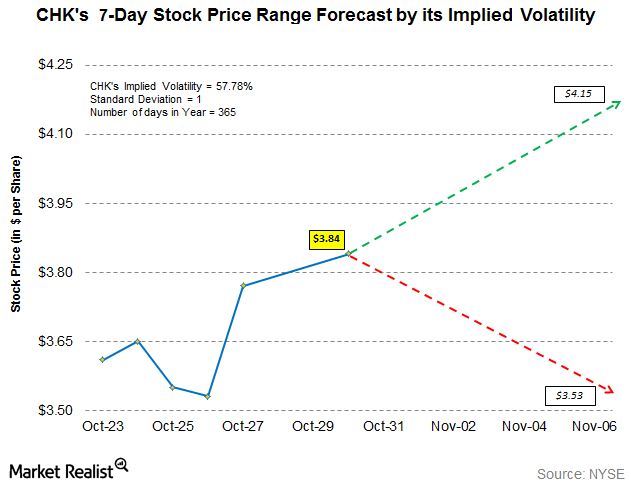

Chesapeake’s Implied Volatility: Stock Price Range Forecast

Chesapeake Energy’s (CHK) implied volatility as of October 30, 2017, was ~58%—9% higher than its 15-day average of ~53%.

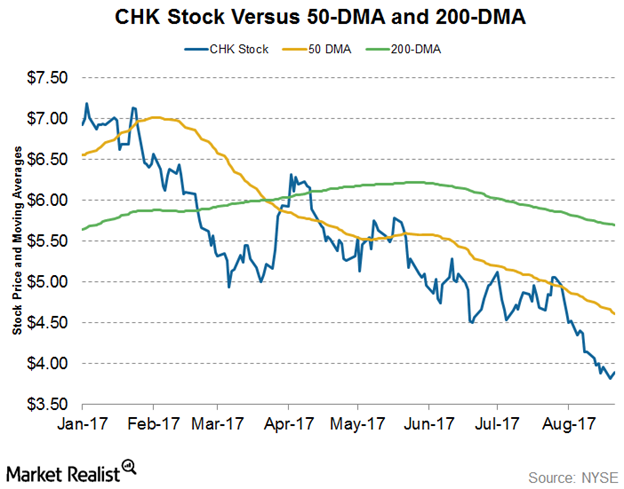

Can Chesapeake Energy Stock Rise from the Doldrums?

Chesapeake Energy stock (CHK) has fallen for most of this year. It picked up slightly in April but wasn’t able to hold those levels.

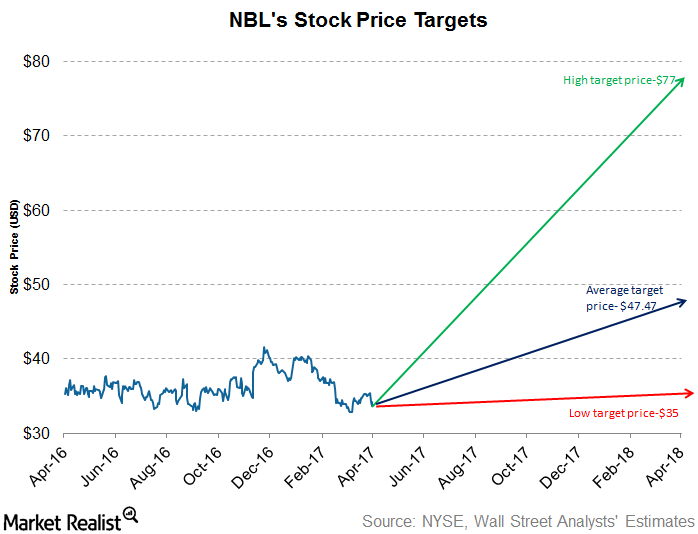

What Are Analysts’ Recommendations for Noble Energy?

Approximately 53% of the analysts rate Noble Energy (NBL) as a “buy” and 32.3% rate it as a “hold.” The average broker target price is $47.47.

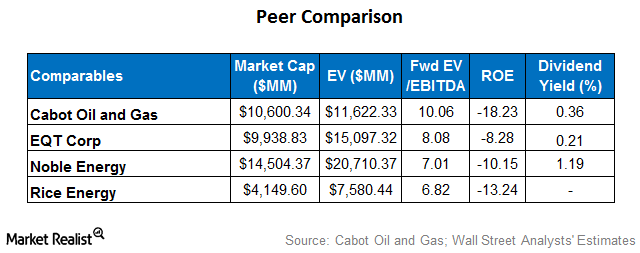

How Cabot Oil and Gas’s Relative Valuation Compares to Peers

A peer group comparison shows that Cabot’s forward EV-to-EBITDA multiple of ~10.1x is higher than that of its peers.

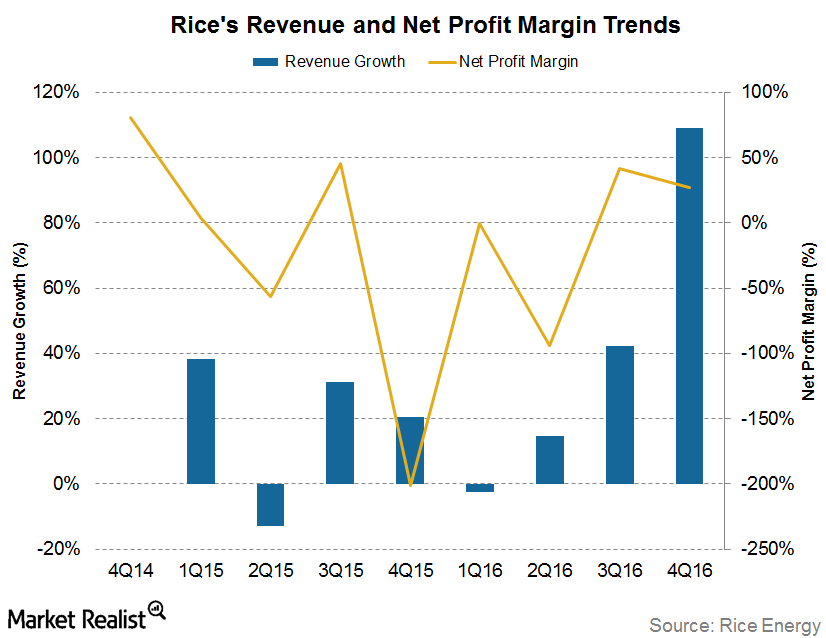

Rice Energy’s Revenue Growth and Net Profit Margin Trends

Rice Energy’s (RICE) 4Q16 revenue rose ~109.0% YoY (year-over-year).

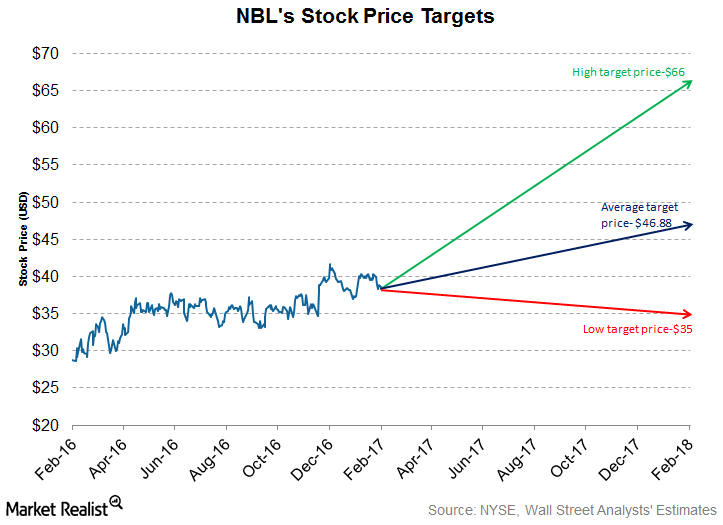

What Analysts Recommend for Noble Energy after Its Earnings

Approximately 67.0% of the analysts rate Noble Energy (NBL) as a “buy” and 33.0% rate it as a “hold.” The average broker target price is $46.88.

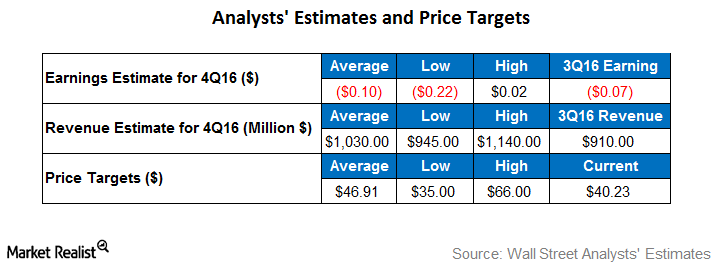

What Are Analysts’ Recommendations and Forecasts for NBL?

For 4Q16, analysts have an average earnings estimate of -$0.10 per share for Noble Energy (NBL). The low estimate stands at ~-$0.22 per share.

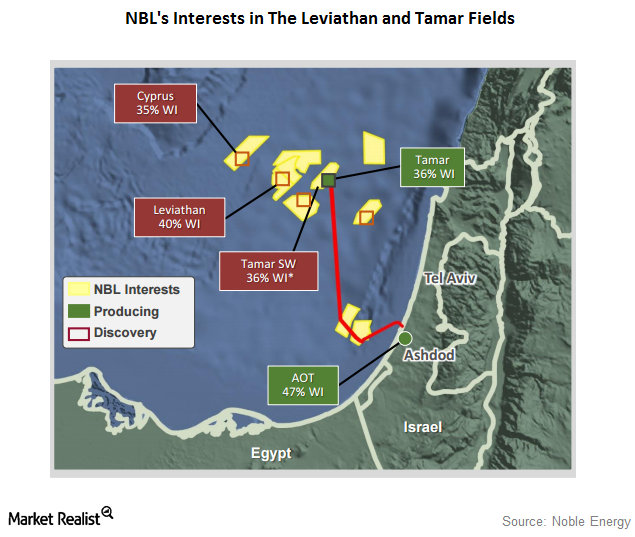

The Leviathan Gas Field: Noble Energy’s Key Discovery

In December 2010, Noble Energy (NBL) announced a major natural gas discovery at Leviathan, off the shore of Israel.

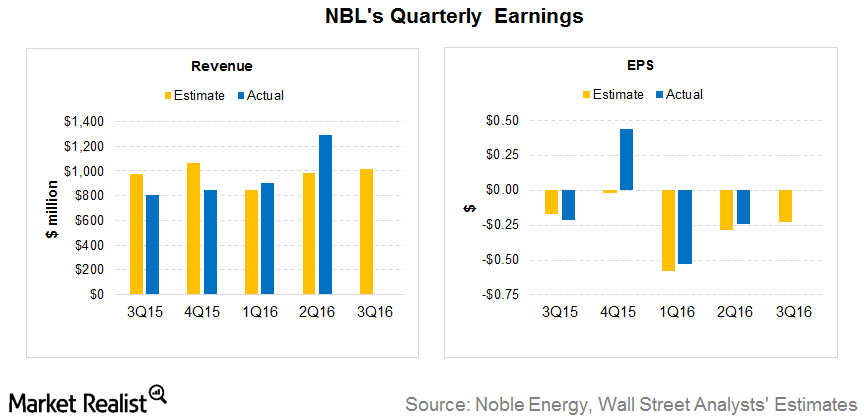

Noble Energy Sets the Stage for Another Earnings Beat in 3Q16

Noble Energy (NBL) is expected to release its 3Q16 earnings results on November 2, 2016. What can investors expect?

What Analysts Recommend for Noble Energy after Its 2Q16 Earnings

Approximately 63% of analysts rate Noble Energy (NBL) a “buy,” and 34% rate it a “hold.” The remaining ~3% rate it a “sell.”

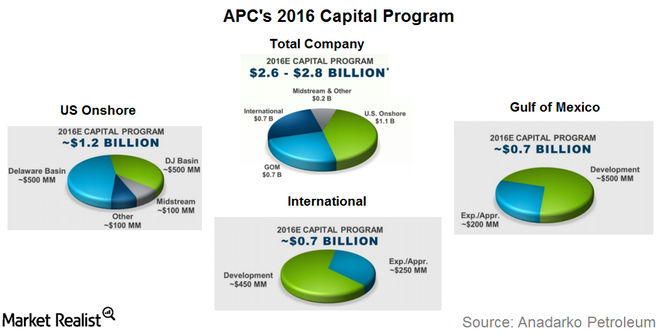

What Are Anadarko’s Capex Plans in 2016?

Anadarko Petroleum’s (APC) 2016 capex (capital expenditures) budget is $2.6 billion–$2.8 billion, a 50% reduction from $5.4 billion in 2015.

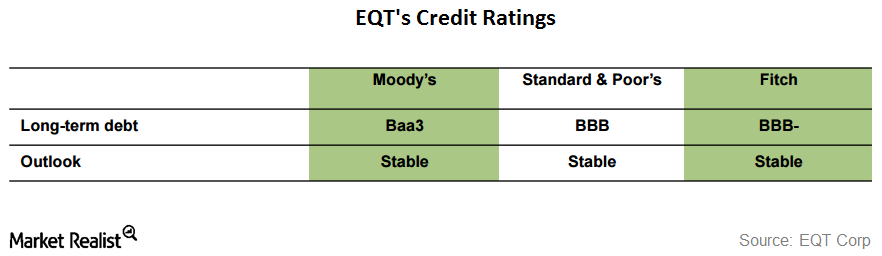

What Are Credit Rating Agencies Saying about EQT?

For EQT (EQT), Moody’s has provided a Baa3 rating. Standard & Poor’s has given it a BBB credit rating, and Fitch has given it a BBB- rating.

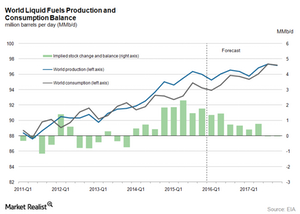

Why Is There a Crude Oil Supply and Demand Gap in 2016 and 2017?

The EIA estimates the global crude oil supply and demand gap to average 1 MMbpd in 2016 and 0.2 MMbpd in 2017. It reported that global consumption should grow 1.2 MMbpd in 2016 and 1.5 MMbpd in 2017.

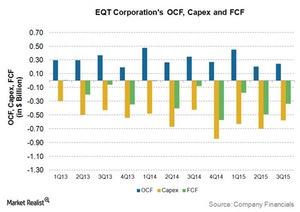

The Downward Trend of EQT’s Free Cash Flow

EQT has been reporting negative free cash flows since 2Q13. In 3Q15, EQT’s free cash flow was -$334 million.

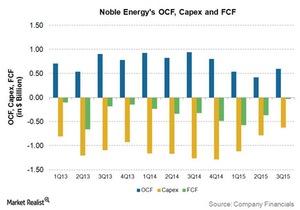

A Look at Noble Energy’s Free Cash Flow Trends

Noble Energy reported negative but improving free cash flows in 2015.

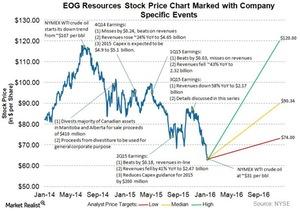

Analyzing EOG Resources’ 3Q15 Earnings Call

Currently, ~67% of Wall Street analysts rate EOG as a “buy” and ~31% of analysts rate it as a “hold.” Only ~2% rate the stock a “sell.”

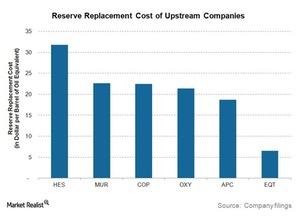

Weighing the Reserve Replacement Cost Metric of Upstream Energy Companies

The Reserve Replacement Cost metric gives us the cost incurred by an upstream company by considering the per-barrel-of-oil equivalent of a new reserve.