BTC iShares iBoxx USD Investment Grade Corporate Bond ETF

Latest BTC iShares iBoxx USD Investment Grade Corporate Bond ETF News and Updates

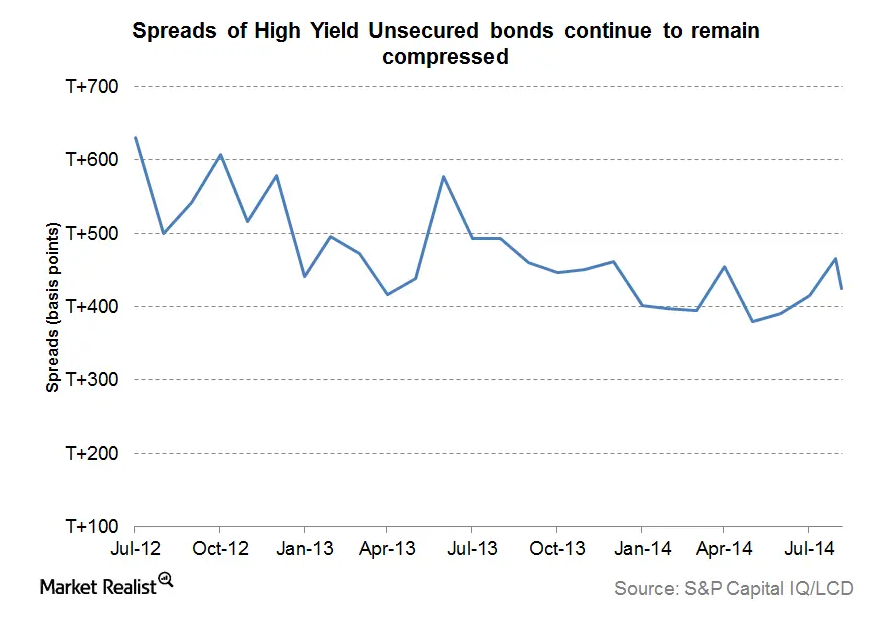

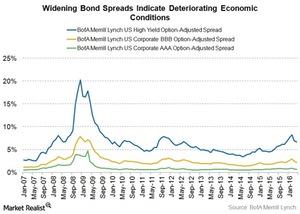

Why tight credit spreads usually mean a period of global expansion

Today, most measures of credit conditions are positive, with tight spreads across all of fixed income. Even high yield spreads have come in after a short scare last month.

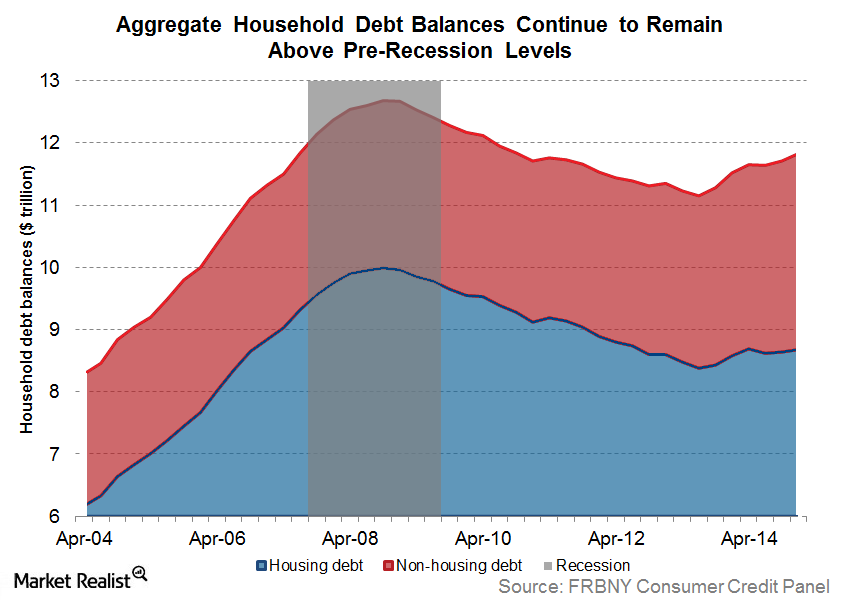

The Great American Deleveraging: Fact or Myth?

The great American deleveraging has largely been limited to the financial sector (XLF) (IYF). Non-financial debt is still much higher than historical averages.

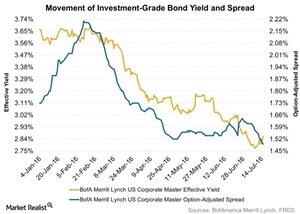

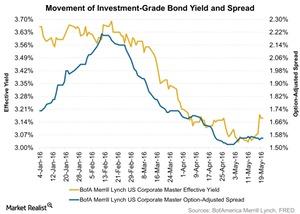

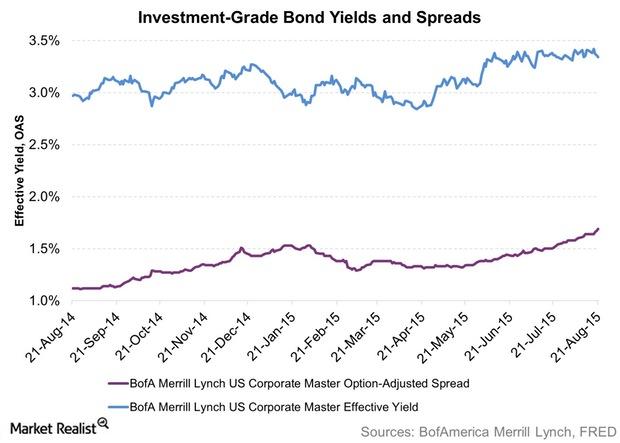

High-Grade Bond Yields Rose as Spreads Touched Their Lowest Level

Last week, high-grade bond yields rose after upbeat US inflation and retail sales data raised the possibility of a rate hike by the year’s end.

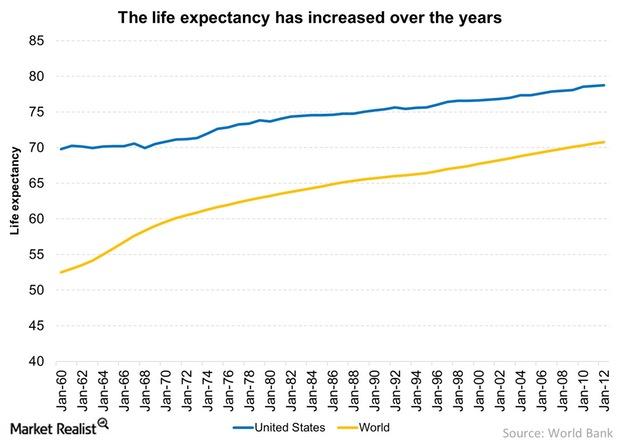

Increased Life Expectancy Means A Longer Investment Horizon

Increased life expectancy means a longer investment horizon. With life expectancy increasing, young investors should invest in equities aggressively.

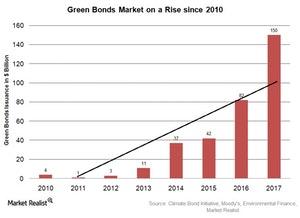

Green Bonds Issuance Show Signs of Growth in 2017

Green bonds carry the same risk-return profile as conventional bonds. However, these bonds fund projects focused on energy efficiency, clean water, transportation, biodiversity, and sustainable waste management.

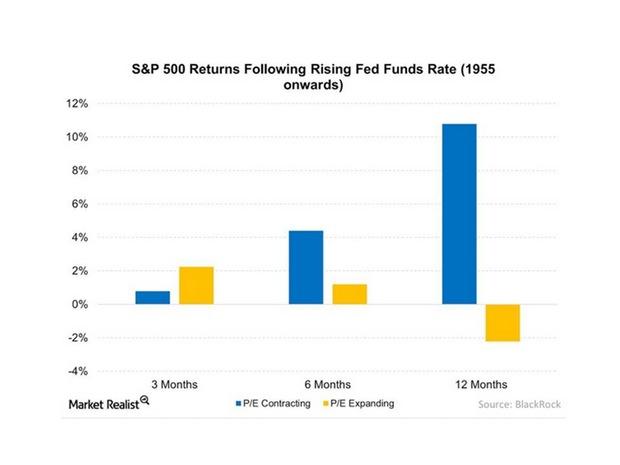

Why To Expect Muted Returns from US Equities

We can expect muted returns from US equities going forward. US stocks face the prospect of higher interest rates, albeit gradual and from unusually low levels.Financials Risks you should know before investing in international bond funds

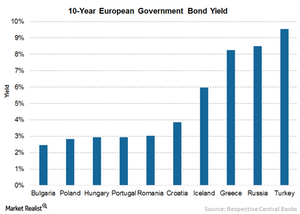

In this article, we’ll discuss some of the risks an investor must consider before investing in international bonds. Some of these risks are unique to this asset class.

Why Does Fixed Income Look Promising?

Under the current uncertain economic circumstances, investors searching for higher yield might turn to fixed income.

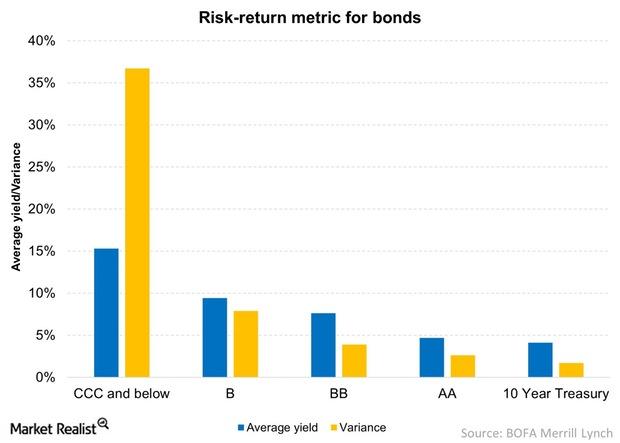

How Various Asset Classes Compare Using The Risk-Return Metric

The risk-return metric for ten-year Treasuries (IEF) are lowest, but also the safest, with a paltry 1.3% volatility and with an average yield of 4.1%.

Why Elliott Management Might Be in Trouble

Last week, Elliott Management filed its 13F for the first quarter of 2020. In the last quarter, the hedge fund’s AUM was worth around $73.15 billion.

The Difference between Corporate Bonds and Treasuries

Bond investors should understand the difference between Corporate Bonds and Treasuries. Below is a list of the key differences between the two.Financials How bond prices, interest rates, and credit spreads correlate

Bond prices and interest rates have an inverse relationship. If an interest rate increases, the price on a bond declines, and vice versa.Financials Why do floating rate notes, or FRNs, differ from regular bonds?

The U.S. Treasury Department’s latest issue on January 29, the floating rate note (or FRN) will fulfill two investor needs: participating in anticipated future interest rates increases and protecting principal against default.Financials Why investors should look at floating rate notes as an option

On January 29, 2014, the U.S. Treasury Department issued a new class of security: the floating rate note (or FRN). This is the first new security introduced by the Treasury since 1997.Financials An investor’s guide to the US leveraged financial market

According to the Securities Industry and Financial Market Association, SIFMA, the total U.S. fixed income market size is about $38.6 trillion.

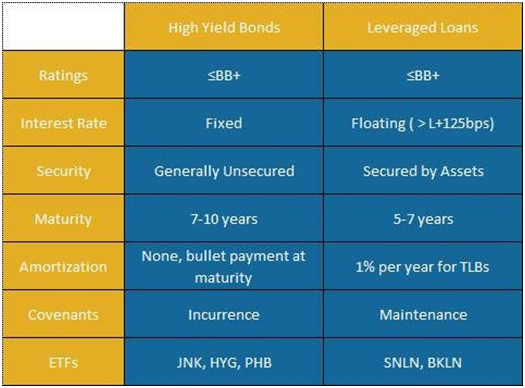

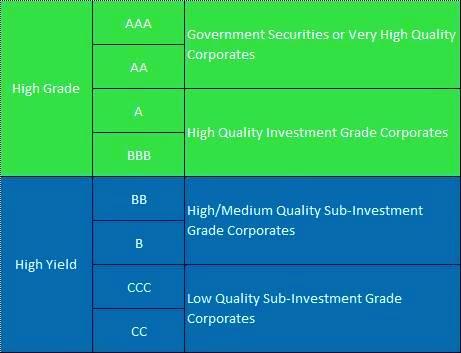

Comparing leveraged loans and high yield bonds: Credit rating

Credit rating measures the credit-worthiness of a debtor with respect to its financial and operational stability. Rating agencies such as Moody’s and Standard & Poor’s specialize in rating credit to government agencies and corporates.Financials Comparing leveraged loans and high yield bonds: Key distinctions

Leveraged loans (BKLN) are almost always secured or backed by a specific pledged asset or some form collateral. On the other hand, high yield bonds (JNK) may be secured or unsecured.Financials Comparing leveraged loans and high yield bonds: Debt terms

Another item that differentiates leveraged loans from high yield bonds is “covenants,” or the financial health metrics that issuers must adhere to.

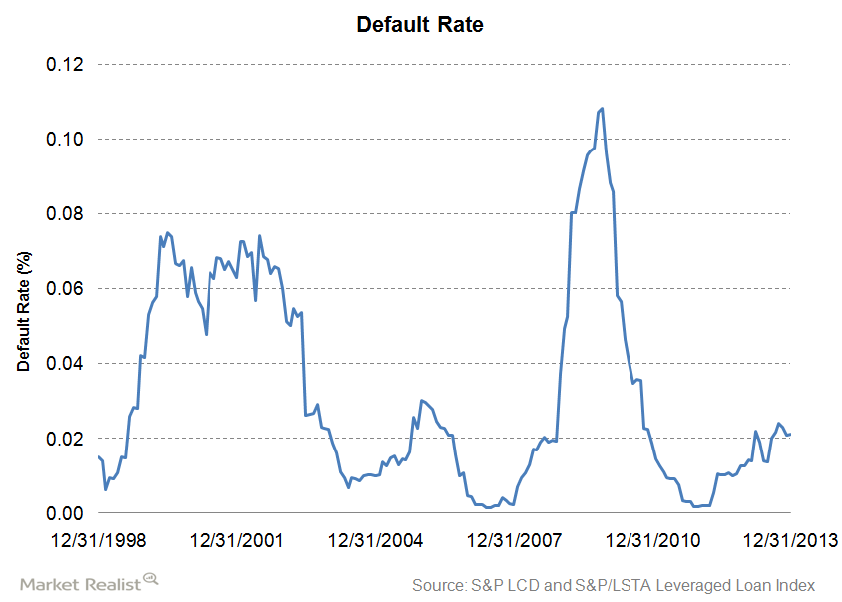

The default rate and its relation to bond and loan prices

Default rate is a key metric of credit risk and is defined as the risk that the counterparty will default on its financial obligations.

Must know: How credit rating affects default rate and bond price

A lower credit rating means higher risk, and therefore, higher yield as investors look for the premium to take the risk and vice versa.Financials Why we need to relook at the consumer in this week’s releases

This week is full of indicators, with most of them being measures of national-level economic activity.Financials Key drivers affecting investment-grade bond funds flows

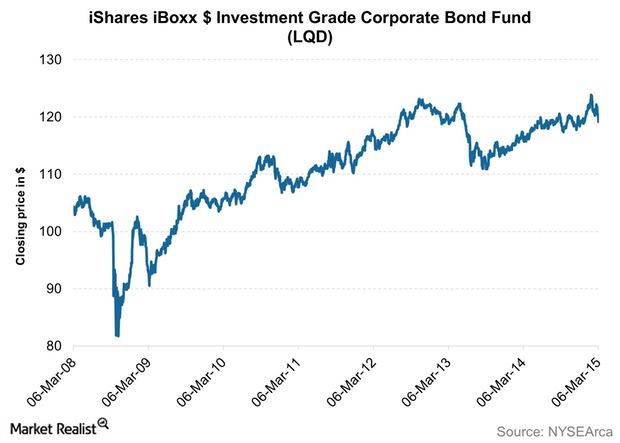

Bond yields and prices move in opposite directions. As a result, returns on high-quality corporate bonds were positive. This year, demand for U.S. investment-grade debt benefited from geopolitical tensions overseas and economic growth fears in the first quarter. This raised prices and lowered yields on high-quality corporate bonds.Financials Overview: Investment-grade bond ETFs

U.S. investment-grade bonds can provide investors with a safe and steady income stream. They’re issued by the U.S. Department of the Treasury and corporates. The issuers have a very high ability to service the debt issued. There’s little risk of default.Financials Why Treasury auctions impact investors and financial markets

The purpose of Treasury auctions is to obtain financing from markets at the most competitive cost. The yield on these securities is determined through a public auction process. These yields affect the secondary market for U.S. Treasuries. Yields and bond prices move in opposite directions.

What Do Widening Bond Spreads Indicate?

Widening spreads indicate a slowing economy. Since companies are more likely to default in a slowing economy, credit risk related to their bonds rises.Financials Must-know: The difference between high-yield and leveraged loans

Historically, high-yield securities have outperformed investment grade securities in good times and vice versa in hard times.

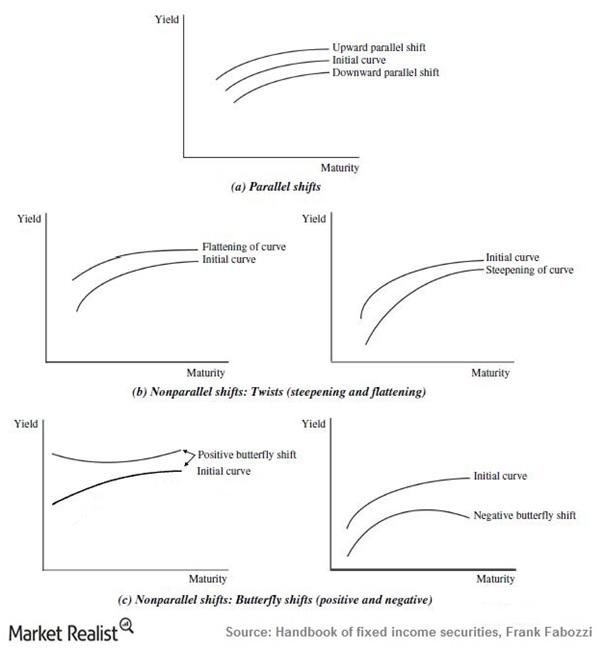

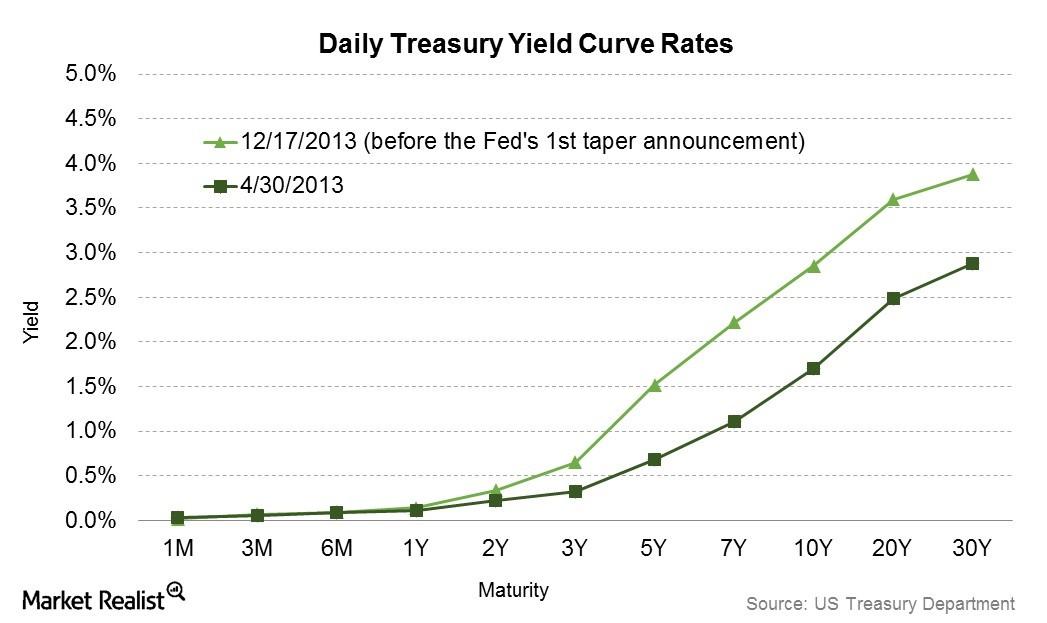

Why investors should follow shifts and twists in the yield curve

Yields on bonds don’t remain constant. When they change by the same magnitude across maturities, we call the change a “parallel shift.”Financials Key takeaways: Why is the yield curve normally upward-sloping?

In normal conditions, the yield curve is upward-sloping. As bonds pay only interest (the coupon) until maturity and pay face value at maturity, investors take longer to recover their principal.

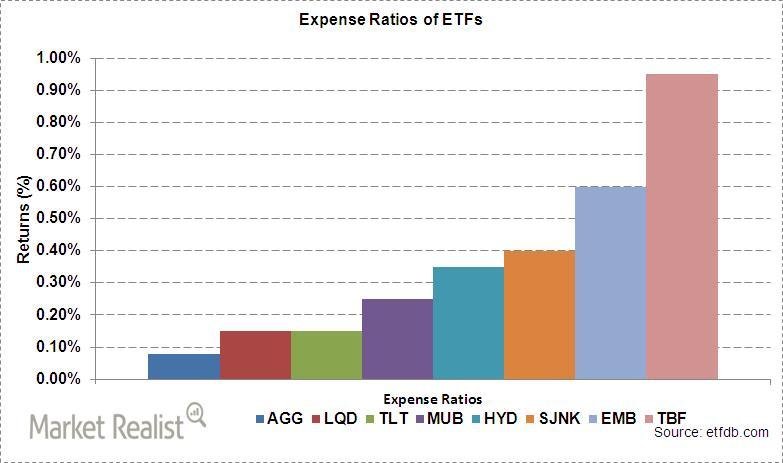

Must-know: Important costs involved in owning an ETF

Owning an ETF comes with some fees. These fees are called “expense ratios” because they’re expressed as a percentage of a fund’s assets.Financials Why bid-ask spread costs are so important to ETF investors

Other than the operating costs of an ETF, the other hidden cost that affects the return for investors is the bid-ask spread.Financials Why expense ratios affect ETF investors’ returns

To see how expense ratios can affect investments over time, let’s compare the returns of several fixed income ETFs that differ only in expense ratio.Financials Why do floating rate notes, or FRNs, differ from leveraged loans?

FRNs are usually issued in capital markets, whereas leveraged loans are arranged by commercial and investment banks. While FRNs are typically unsecured and investment-grade, leveraged loans are secured.

How do interest rate expectations impact financial markets?

The inflation and interest rate expectations of consumers and firms are important variables determining bond prices.Financials Issuers like Wells Fargo and Verizon take advantage of low yields

Major deals included debt issues by Wells Fargo (WFC), Baidu, AT&T, and Verizon (VZ).

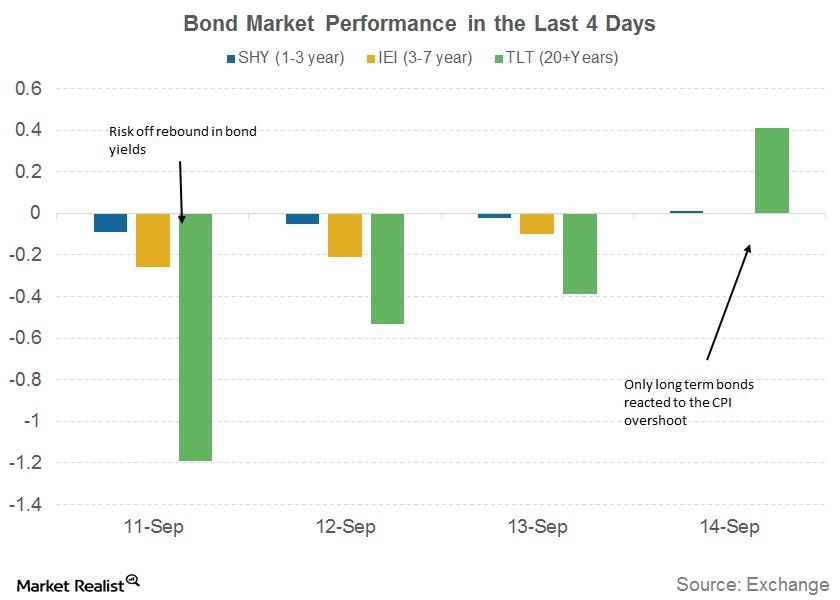

The Bond Market’s Reaction to New Rate Hike Hopes

After three weeks of continuous falls, US bond yields rose in the week of September 10. The benchmark ten-year US Treasury yield (BSV) rose by 10 basis points to 2.20% but remains far from the December 2016 high of 2.64%.

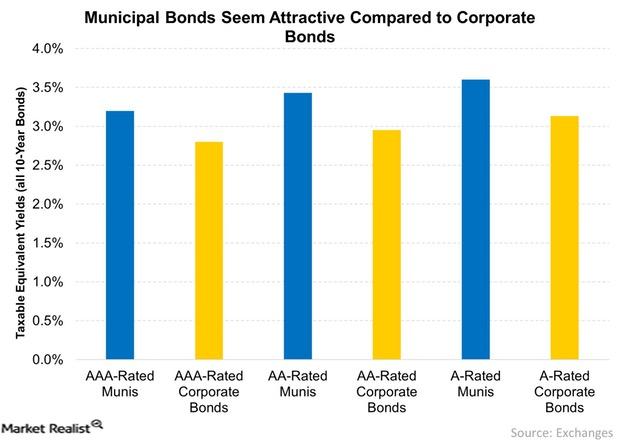

Could Lower Tax Rates Affect Municipal Bonds Negatively?

For investors in the top tax bracket, municipal bond (XMPT) yields on a tax-equivalent basis are roughly 5.0%.

High-Grade Bond Yields Rise on Better Odds of a Rate Hike

Last week, investment-grade bond yields jumped 12 basis points and ended at 3.16%, the highest level since April 5, 2016.

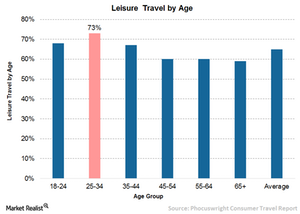

Why Quality of Life Is the New Money for Millennials

I believe that consumption demand patterns among millennials, including an emphasis on quality of life, is somewhat influencing this demand for travel and leisure, tech products and personal services.

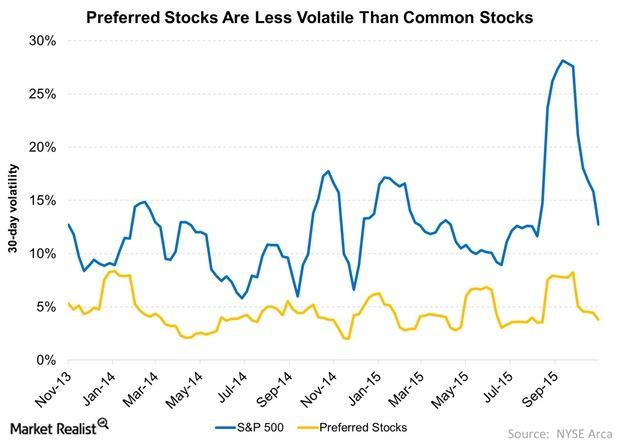

Why Preferred Stocks Are Less Volatile than Common Equities

Preferred stocks are less volatile compared to common equities. This is mainly because a larger portion of the returns comes from dividends, which tend to be stable.

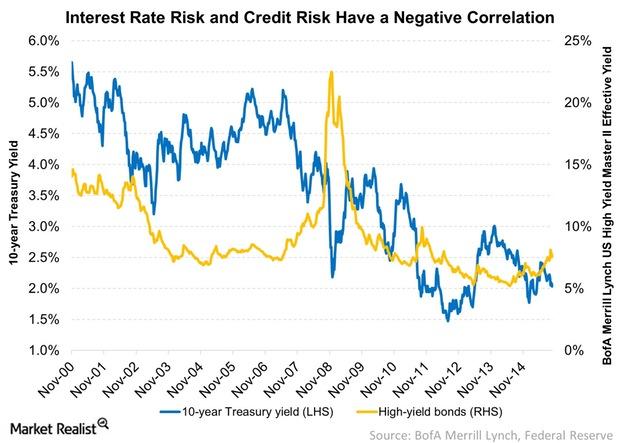

Credit Risk and Interest Rate Risk Have a Negative Correlation

Credit markets tend to improve when the economy is improving. The possibility of a default on corporate bonds (LQD) drops, thus causing their yields to fall.

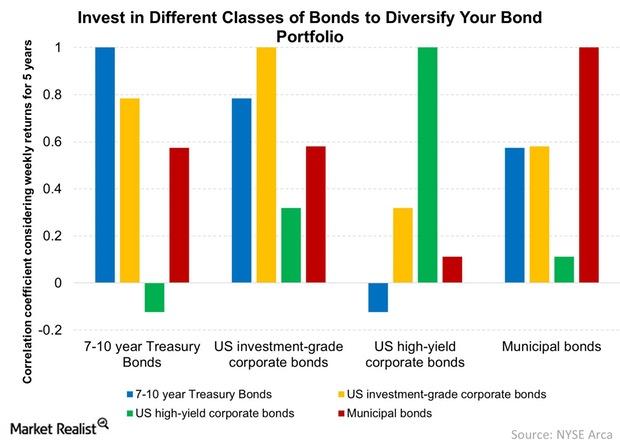

Own Bonds across Credit Quality to Diversify Your Portfolio

Adding bonds across credit classes helps diversify your bond portfolio. The weight of each category depends on your risk appetite and the business cycle.

Spreads between High-Grade Bonds and Treasury Yields

If spreads widen further, high-grade bonds will become more attractive because yields and prices are inversely related. A rise in yields indicates falling prices.

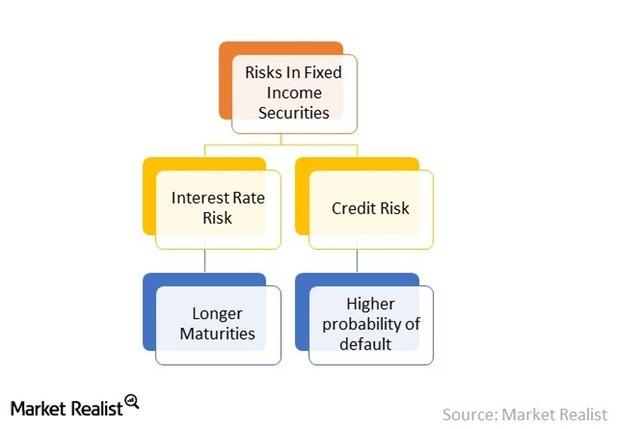

The Must-Know Risks of Fixed Income Investing

There are no free lunches. The risks involved in fixed income investing are two-fold.

What are investment-grade bonds?

Investment-grade bonds are both U.S. Treasuries issued by the U.S. Treasury Department and corporate bonds issued by high-quality corporate borrowers.Healthcare Key differences between investment-grade and high-yield investments

Corporate debt is divided into investment-grade and high-yield on the basis of the credit risk associated with the issuer. Credit rating agencies issue ratings to corporations and debt issuance on the basis of associated credit risk.Industrials Must-know: Do credit spreads only represent credit risk?

While credit spreads do give you a good picture of the credit risk of one bond compared to another, it’s not the only factor they represent.