Kellogg Co

Latest Kellogg Co News and Updates

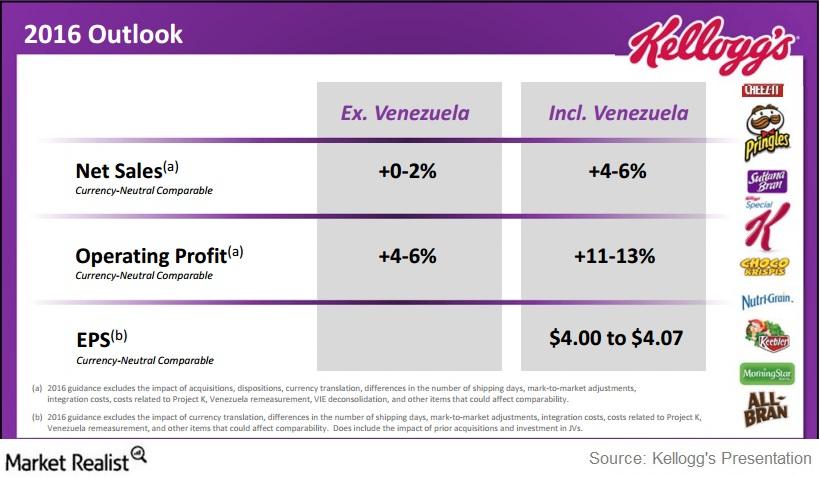

What’s Kellogg’s Updated Guidance for Fiscal 2016?

Kellogg (K) updated its fiscal 2016 guidance for currency-neutral comparable net sales, operating profit, and earnings per share.

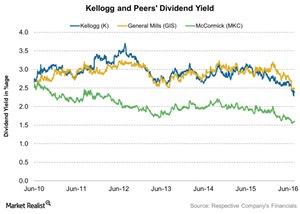

How Much Did Kellogg Return to Shareholders?

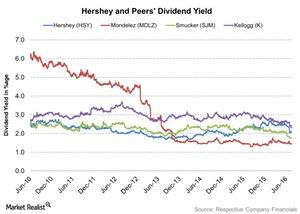

Kellogg announced a quarterly dividend of $0.50 per share on its common stock—paid on June 15 to shareowners of record at the close of business on June 1.

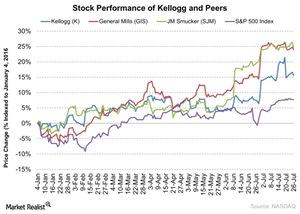

What Can Investors Expect from Kellogg’s 2Q16 Results?

Kellogg Company (K) is headquartered in Battle Creek, Michigan. It’s set to report its fiscal 2Q16 results on August 4, 2016, before the market opens.

Why Did General Mills Expand the Recall of Its Products?

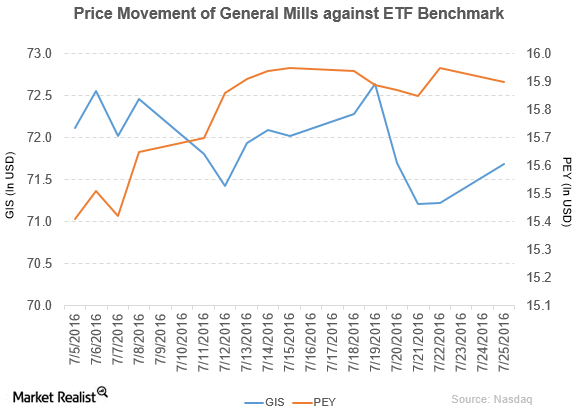

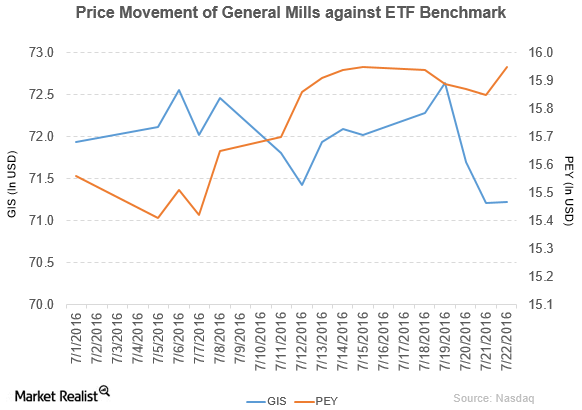

General Mills rose by 0.66% to close at $71.69 per share on July 25. The stock’s weekly, monthly, and YTD price movements were -0.82%, 8.1%, and 27.1%.

Hershey Shareholders Thrive on 346 Straight Dividend Payouts

On May 4, Hershey (HSY) announced that its board of directors approved quarterly dividends of $0.58 on the common stock and $0.53 on the Class B common stock.

General Mills Announces Restructuring Plans

General Mills fell by 1.1% to close at $71.22 per share in the third week of July. Its weekly, monthly, and YTD price movements were -1.1%, 8.0%, and 26.2%.

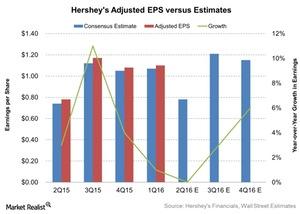

Why Hershey’s Earnings Could Have Been Pressured in 2Q16

Analysts expect Hershey’s adjusted EPS to be $0.78, which is in line with 2Q15 EPS.

What Analysts Recommend for Mead Johnson ahead of 2Q16 Results

As of July 15, 2016, Mead Johnson (MJN) was trading at $91.38.

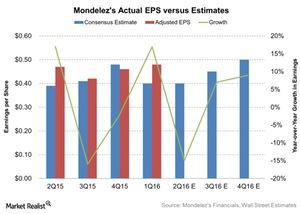

What’s Expected of Mondelez’s Earnings for 2Q16?

Analysts expect Mondelez’s adjusted EPS to be $0.40 compared to $0.47 in 2Q15.

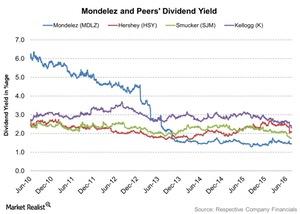

Mondelez Returns Billions of Dollars in Capital to Shareholders

In fiscal 1Q16, Mondelez returned a total of $1.5 billion in capital to shareholders through dividends and share repurchases.

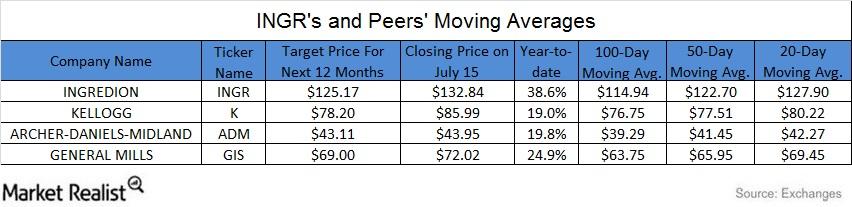

How Does Ingredion Compare to Peers on Key Moving Averages?

On July 15, 2016, Ingredion (INGR) closed at $132.84. It traded 15.6% above its 100-day moving average, 8.3% above its 50-day moving average, and 3.9% above its 20-day moving average.

How Has Mead Johnson Grown through Innovation?

Mead Johnson (MJN) participated and discussed some key strategies in the Deutsche Bank Global Consumer Conference held last month.

Why Are Analysts So Positive about General Mills?

About 64% of analysts rate General Mills a “hold,” 18% rate it a “sell,” and 18% rate it a “buy.”

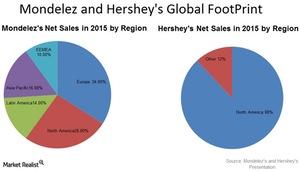

Why Was Mondelez Interested in Hershey?

Mondelez wanted a greater share in the North American market to recover from its declining revenue growth. Hershey would have benefited Mondelez’s revenue.

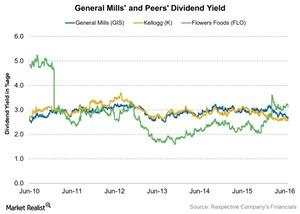

General Mills Declared Increased Dividend in Fiscal 4Q16

With its fiscal 4Q16 earnings release, the General Mills board approved a quarterly dividend of $0.48 per share. It will be paid on August 1, 2016.

What’s Kellogg’s 2020 Vision Strategy?

Kellogg plans to return its “Kashi” brand to growth in 2016. It aims to lead in plant-based nutrition and win with “food forward” consumers.

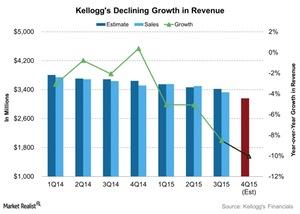

Kellogg Is Expected to Report a 10% Revenue Drop for Fiscal 4Q15

In its fiscal 4Q15 results, Kellogg is expected to report sales of $3,160 million, a fall of 10% YoY (year-over-year). For the full year, analysts expect revenue of $13.5 billion, a decline of ~7% YoY.

Kellogg’s Acquisitions and Their Benefits

The price of Kellogg’s acquisition of Diamond Foods is expected to reach over $1.5 billion, and Kellogg could offer the company between $35 and $40 per share.

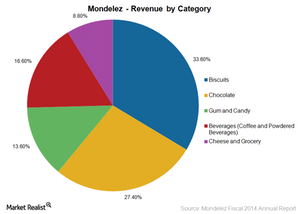

The Rationale behind the Sale of Mondelez’s Coffee Business

The primary reason behind the sale of Mondelez’s coffee business was so Mondelez could focus more on its core snack food business.