iShares Dow Jones US

Latest iShares Dow Jones US News and Updates

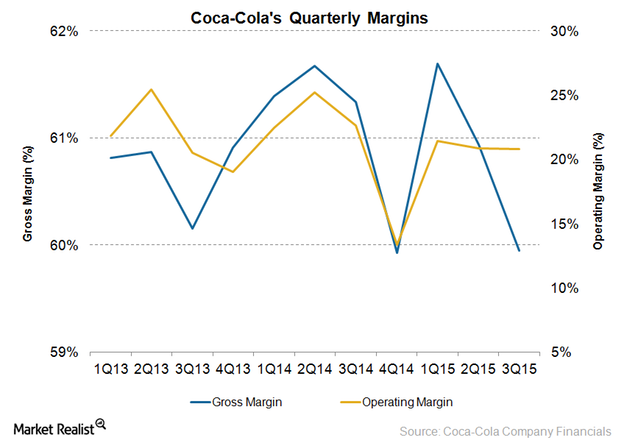

Coca-Cola’s 2015 Productivity Initiatives: A Closer Look at Costs

Coca-Cola has been aggressively implementing productivity initiatives to offset the impact of sluggish soda volumes and macro challenges in key markets.

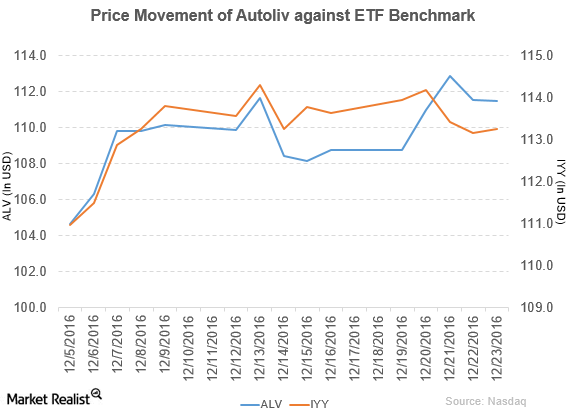

What’s the Latest News on Autoliv?

Autoliv (ALV) rose 2.5% to close at $111.46 per share during the third week of December 2016.

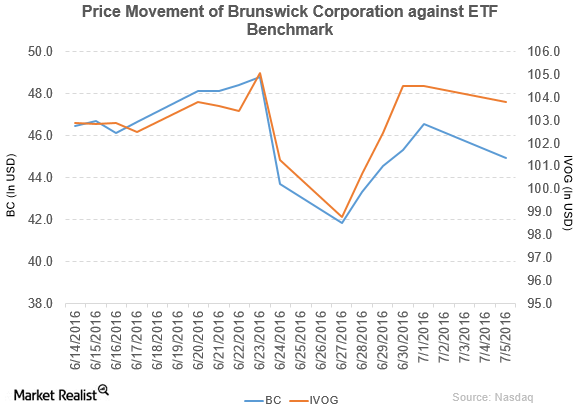

Why Did Brunswick Corporation Acquire Thunder Jet?

Brunswick Corporation (BC) has a market cap of $4.1 billion. Its stock fell by 3.4% to close at $44.95 per share on July 5, 2016.

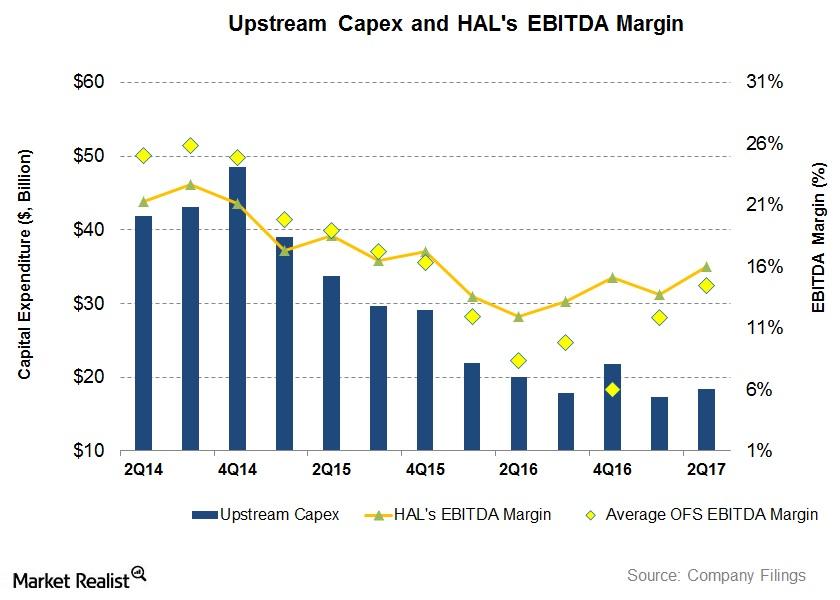

What Halliburton’s Margin Has to Do with Upstream Operators’ Capex

From 2Q16 to 2Q17, Halliburton’s (HAL) EBITDA margin (or EBITDA as a percentage of revenues) rose from 12% to 16%.

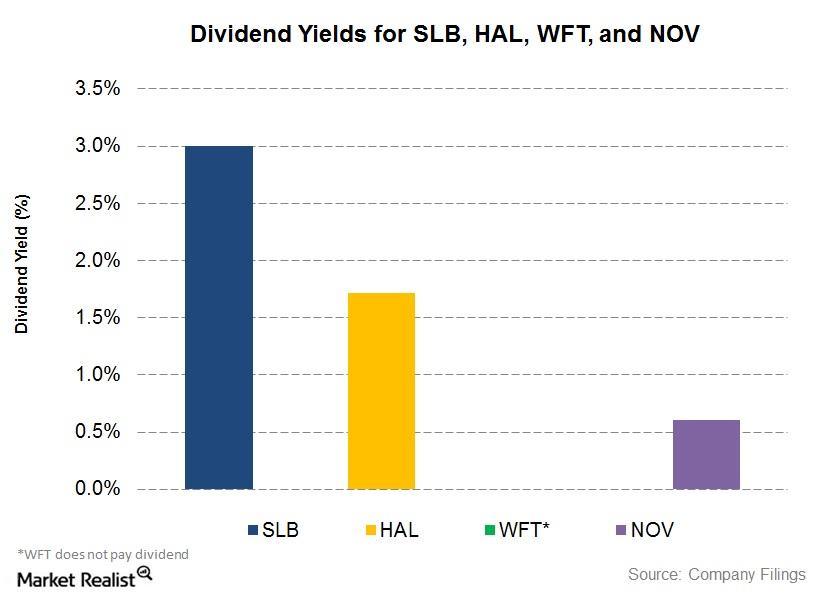

Dividend Yield in 2Q17: Comparing SLB, HAL, and NOV

Schlumberger’s (SLB) quarterly dividend per share remained unchanged from 2Q16 to 2Q17. In 2Q17, Schlumberger’s quarterly DPS is $0.50.

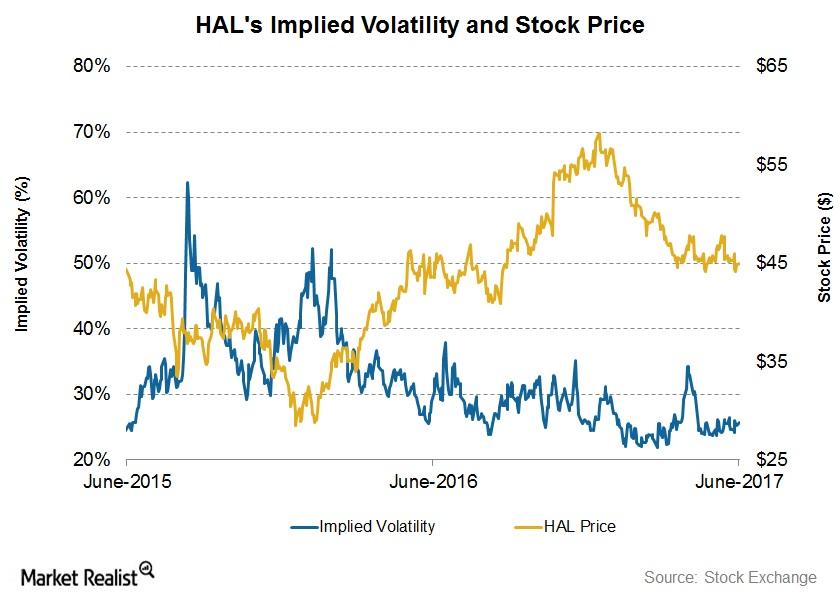

What Investors Can Expect from Halliburton

On June 13, Halliburton’s implied volatility was 24.1%. Since its 1Q17 financial results were announced on April 24, its implied volatility has fallen.

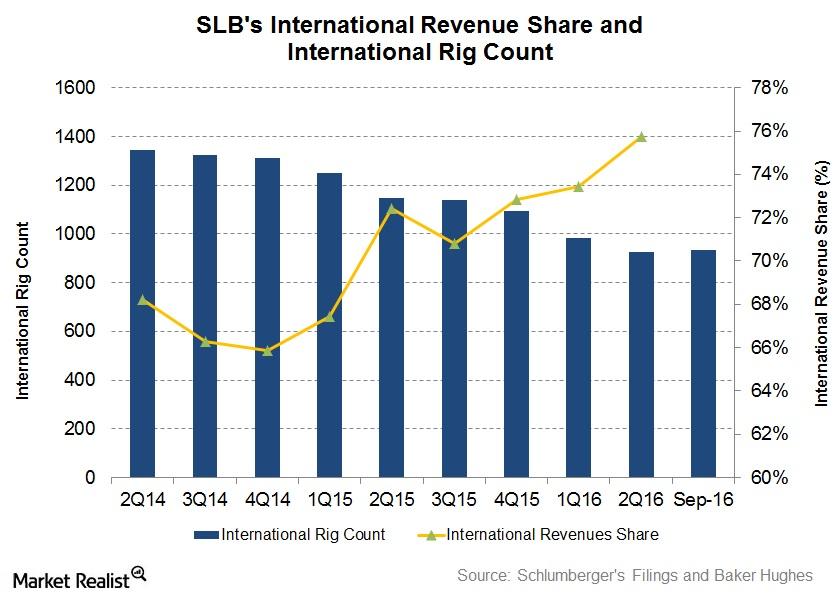

How Important Are International Rig Counts to Schlumberger?

SLB’s international revenues rose to 76% of its total revenues in 2Q16, as compared to 72% in 2Q15.

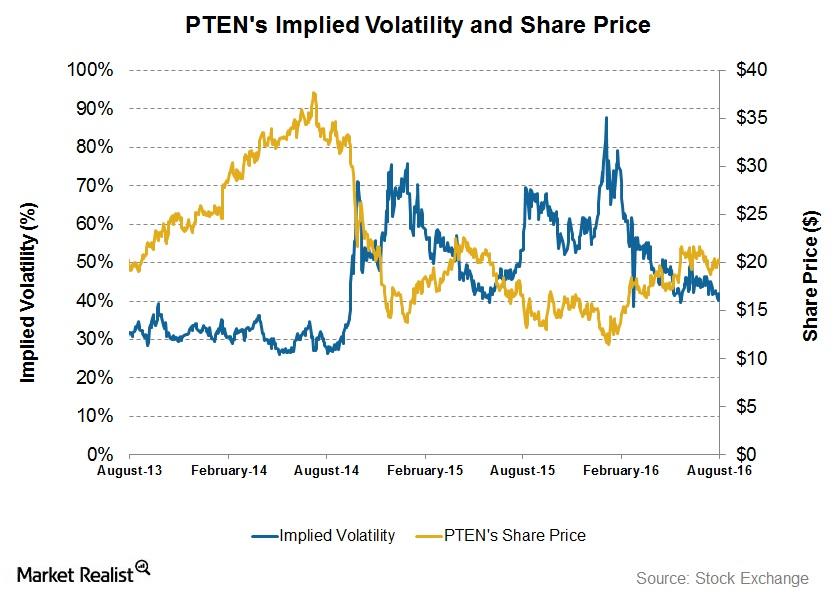

How Volatile Is Patterson-UTI Energy after 2Q16?

On August 19, Patterson-UTI Energy had an implied volatility of ~40%. Since its 2Q16 results were announced, its implied volatility has fallen from ~45%.

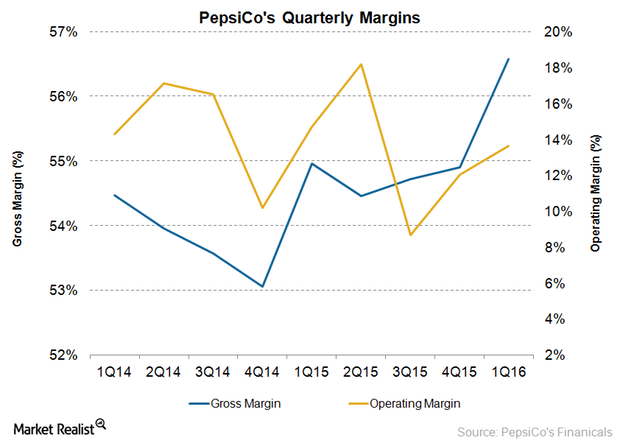

What Drove PepsiCo’s Margin Expansion in 2Q16?

PepsiCo’s gross margin expanded to 55.6% in 2Q16 from 54.5% in 2Q15.

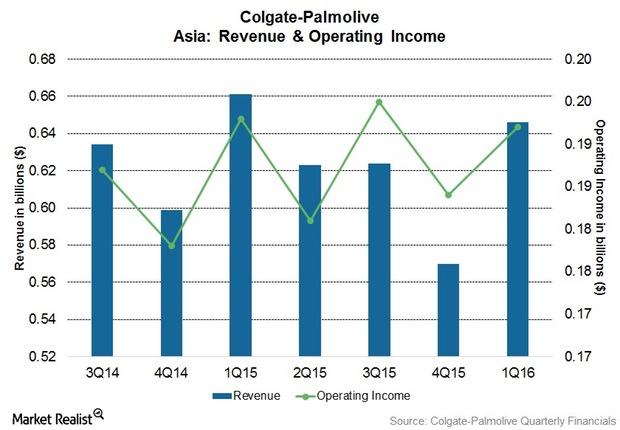

How Colgate Improved Market Share in Its Asia Segment in 1Q16

Colgate’s (CL) Asia segment’s net revenue decreased 2.3% to $0.6 billion in 1Q16.

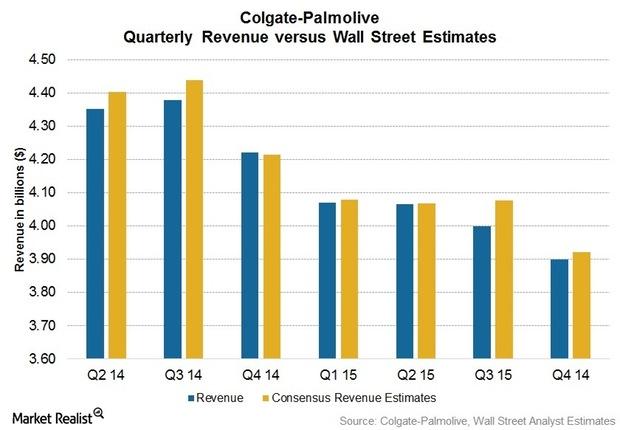

Why Does Colgate’s Revenue Keep Falling?

Colgate’s (CL) revenue declined 7.5% to $3.9 billion in 4Q15. The reported revenue was negatively impacted by foreign exchange and divestitures.

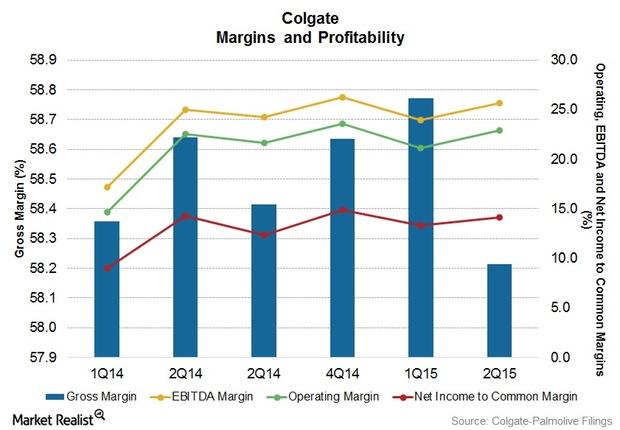

How Colgate is Gaining Share in Key Global Markets

Colgate faces stiff competition from large international and local players worldwide. However, the company aims to have a disciplined approach to pricing management.