iShares Russell Mid-Cap

Latest iShares Russell Mid-Cap News and Updates

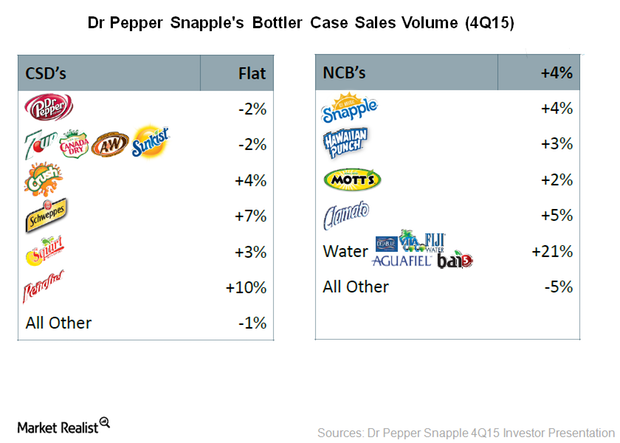

Did Dr Pepper Snapple’s Non-Carbonated Beverages Call the Shots in 4Q15?

Dr Pepper Snapple (DPS) saw higher volume growth in non-carbonated beverages in all the quarters of fiscal 2015 compared to CSDs.

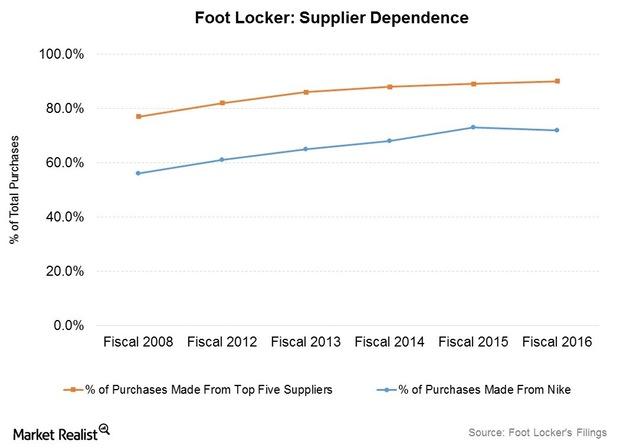

Analyzing the Cogs in Foot Locker’s Supply Chain

Foot Locker’s distribution and supply chain includes five distribution centers around the world. It owns two of them and leases three.

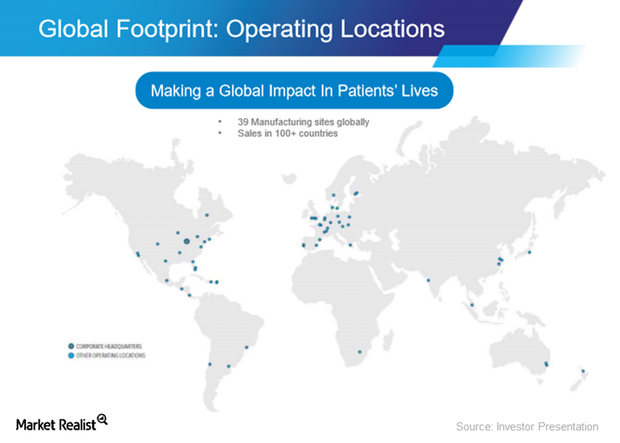

Asia-Pacific Still Zimmer Biomet’s Strongest Geography

Zimmer Biomet Holdings witnessed a strong performance in its Asia-Pacific region. It contributed 16% to the company’s total sales.

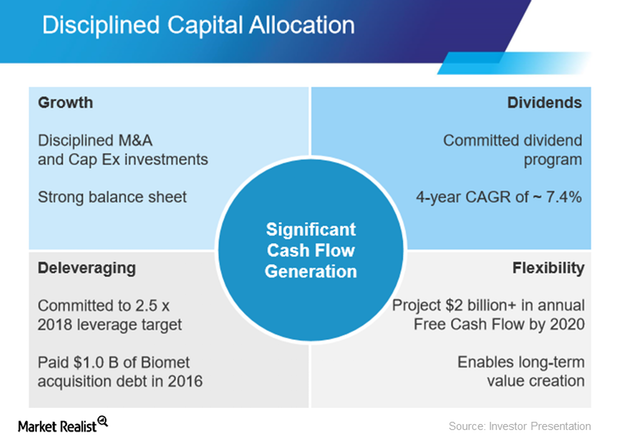

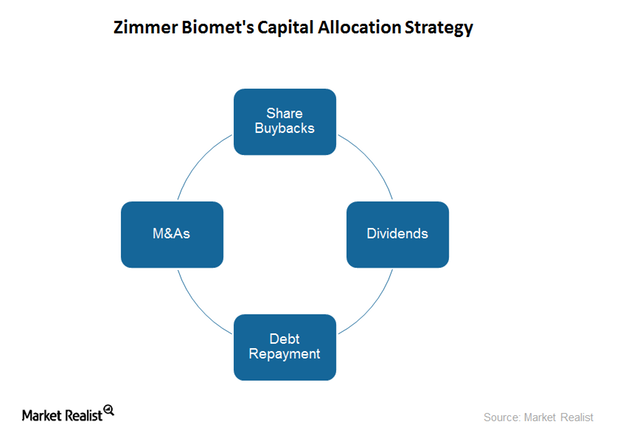

Zimmer Biomet’s Capital Allocation Strategy to Create Value

In February 2016, Zimmer Biomet authorized up to $1.0 billion of the company’s common stock for share repurchases, all of which remains authorized to date.

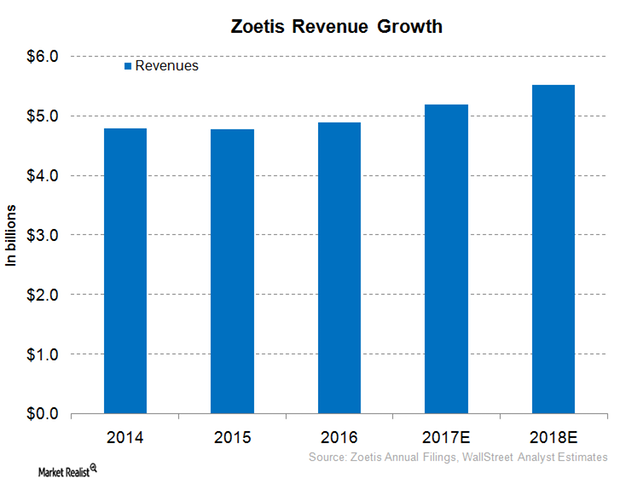

Why Zoetis Expects to See Robust Revenue Growth in 2017

Zoetis (ZTS) has adopted a targeted R&D strategy that has resulted in multiple new product launches.

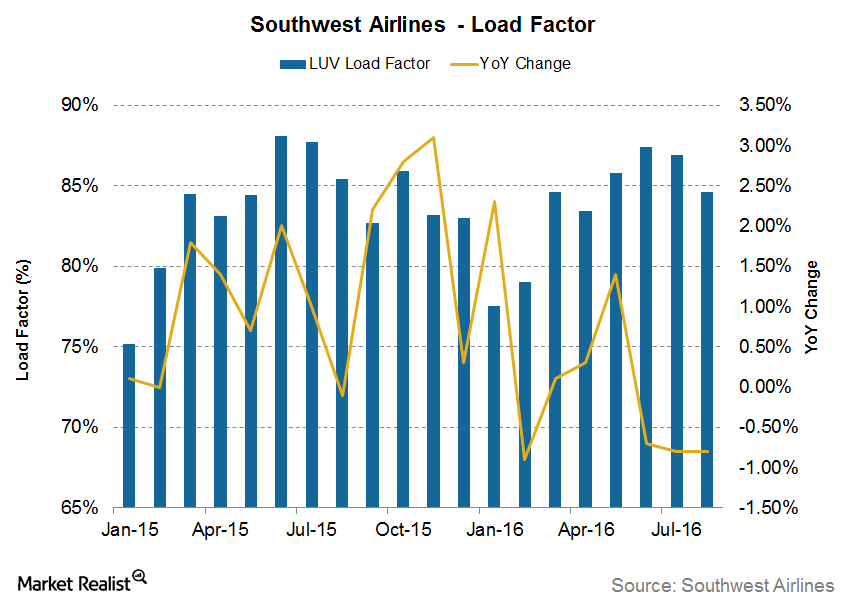

Is Southwest Airlines On Track to Achieve Its Utilization Goals?

In 2015, Southwest Airlines’ prudent approach to capacity growth resulted in the better utilization of its capacity.

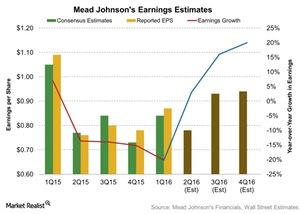

What Could Help Mead Johnson’s Earnings in 2Q16?

Analysts are expecting Mead Johnson’s adjusted EPS to be $0.78 compared to $0.76 in 2Q15.

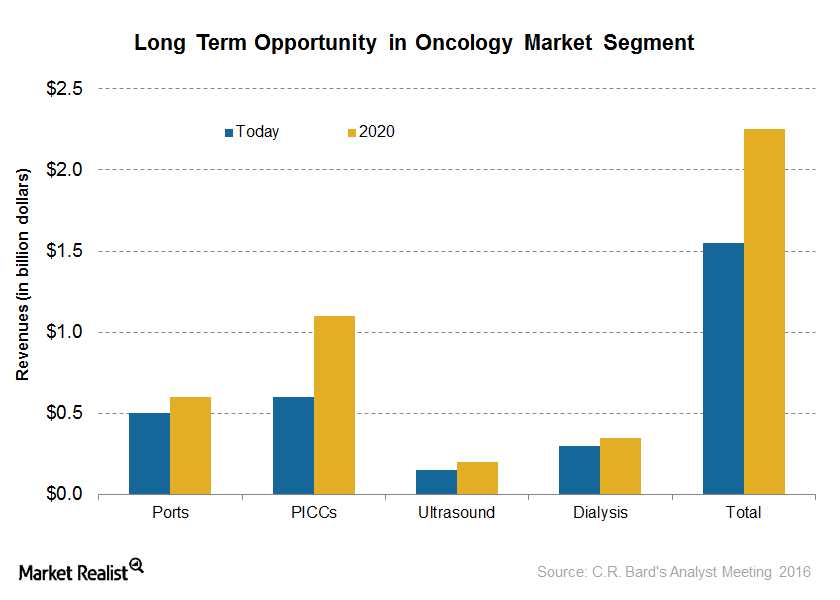

A Look at C. R. Bard’s Oncology Business Segment

C. R. Bard’s (BCR) Oncology segment contributes around 27% of the total revenues of the company.

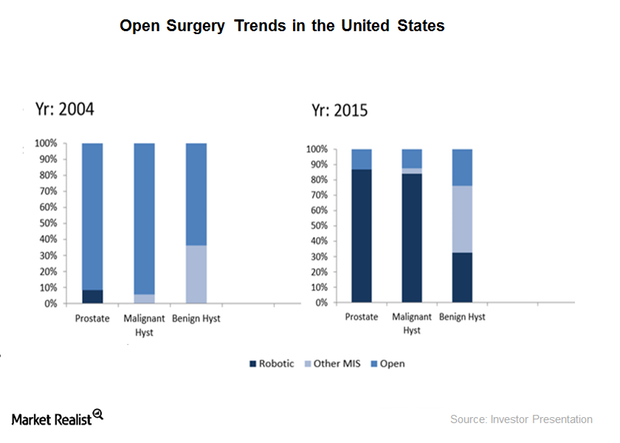

A Closer Look at Intuitive Surgical’s Business Strategy

Intuitive Surgical aims to include a larger patient population under its MIS treatments and to provide better surgery outcomes and lower recovery times.

Zimmer Biomet’s Capital Allocation Strategy and Shareholder Value

Zimmer Biomet has spent $125 million in share repurchases so far in 2016. In February, it authorized up to $1 billion of the company’s common stock for share repurchases.

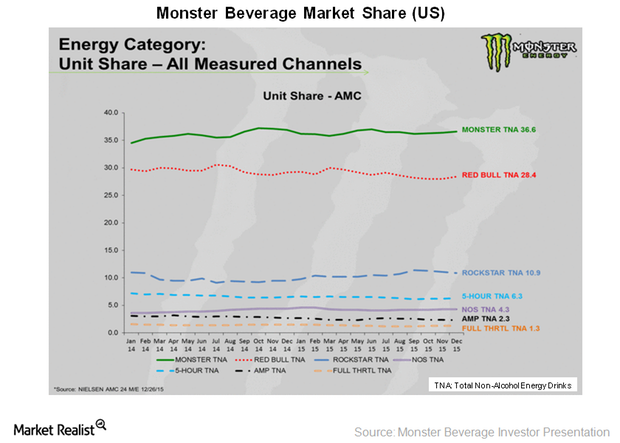

Are Strategic Brands Boosting Monster Beverage’s Sales?

According to Nielsen’s data, for the period ending December 26, 2015, the Monster Beverage brand held a 36.6% share of the US energy drink market in terms of unit sales.

Universal Health Services Explores Growth Opportunities in 3Q15

In 3Q15, Universal Health Services was actively involved in exploring growth opportunities, both in its acute care as well as behavioral health business.

Coty Inc.’s Heritage and Power Brand Portfolio

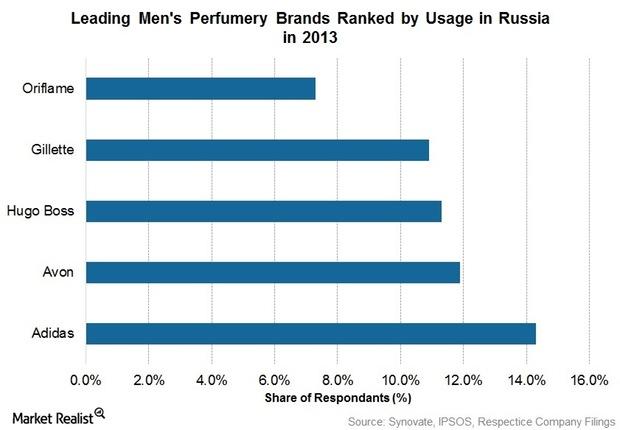

Coty’s biggest licensed brand in the global mass skin and beauty care segment, Adidas maintains a significant presence in deodorants. It faces stiff global competition from Unilever’s Axe deodorants.

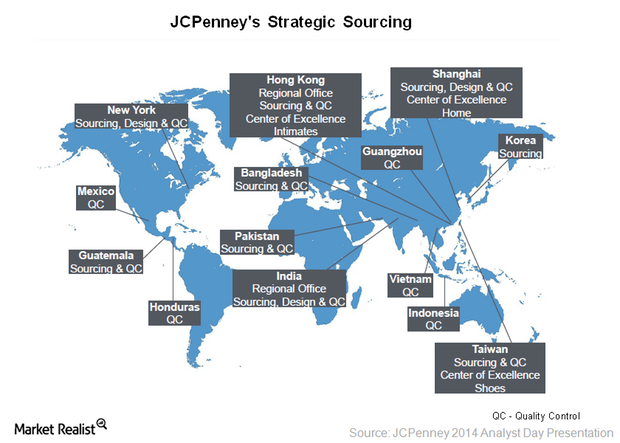

Why Has JCPenney Been Restoring Its Private Brands?

The year 2014 marked 100 years of JCPenney’s (JCP) first private brand Marathon Hats. One of the major focus points of JCPenney’s turnaround strategy was to bring back its private brands.

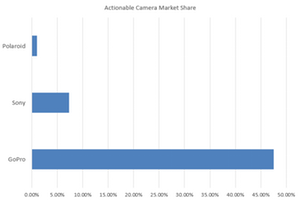

GoPro’s Market Shares and Earnings Trend

In the camcorder market, GoPro (GPRO) has the leading market share of 47.50%. It’s followed by ION, Sony (SNE), and Polaroid.

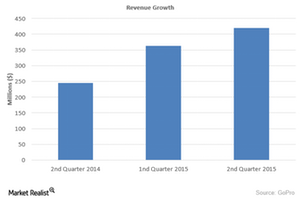

GoPro Increased Its Revenue and Geographical Reach

GoPro has expanded geographically to the EMEA and APAC countries. It has 40,000 retail outlets. GoPro’s revenue rose 126% in 2Q15.