Income Tax

Latest Income Tax News and Updates

Surprised by Your Tax Bill? Why You're Paying More Taxes This Year

You may owe taxes this year because you received unemployment benefits, a bonus, or you no longer qualify for certain tax credits and deductions.

Take Control of Your Taxes: How to Set Up a Payment Plan With the IRS

If you can't pay your owed taxes all at once, you may be able to set up a monthly payment plan with the IRS. Get the details on how to set it up here.

Here's What Happens If You Miss the Tax Filing Deadline by One Day

The IRS may impose penalties if you file your taxes a day late, but there are exceptions. The IRS also offers penalty waivers to some taxpayers.

Here's When the IRS Might Consider Your Tax Refund as Income

Tax refunds are only considered income in certain state tax refund circumstances. Find out more about when your tax refund might be considered income.

What to Do If a Past Employer Isn’t Sending You a W-2 Form

Want to know how to get W-2 forms from past employers? See when to expect the tax document — and what to do if your former employer doesn’t send it.

When Are Nursing Home and Assisted Living Expenses Tax Deductible?

Are assisting living expenses tax deductible? What about nursing home costs? Learn more about when you can deduct these expenses on your tax return.

IRS Issues Guidance About Disaster-Related Distributions From Retirement Plans

What is a disaster distribution? Learn more about reporting income from disaster-related retirement plan distributions on your tax return.

IRS Free File Online and MilTax Make Tax Season Easier on Military Families

How do military members file taxes? The IRS’ Free File Online service and the Department of Defense’s MilTax service can streamline the process.

Some Grandparents Can Claim the Child Tax Credit and the EITC

Can grandparents claim the Child Tax Credit for 2021? Yes, if they’re eligible. They might also be eligible for the Earned Income Tax Credit, too.

The IRS Is Opening Tax Assistance Centers on Saturdays To Provide In-Person Help

Does the IRS work on weekends? Some of the agency's employees are during this year’s tax season. Here's more about the Saturday hours.

Early Filers Report “Tax Topic 152” Error When Tracking Their Tax Refunds

What does “Tax Topic 152” mean? Here's more about the IRS message some early filers have gotten when checking the status of their tax refund.

COVID-19 Is a Federally Declared Disaster—What Does That Mean For Your Taxes?

Is COVID a natural disaster for taxes? See what the IRS and tax experts say about the disaster designation of the COVID-19 pandemic.

Understanding Gift Taxes: Who Has to Pay and When?

Who pays the taxes on a gift? Learn more about when a gift is taxable, who’s responsible for filing a gift tax return, and what exclusions apply.

Where Can I Get My Taxes Done for Free? Check These Services

Tax filing for 2022 starts on Jan. 24 and there are a variety of services you can choose from to file. But which services let you file for free?

Did You Receive the Child Tax Payment? Expect a Letter From the IRS

People who received child tax payments can expect a letter in the mail from the IRS starting in December 2021 through January 2022. Why are people getting a letter?

How Many Tax Exemptions Should You Claim in 2021?

Claiming tax exemptions directly impacts your take-home each pay period depending on your tax withholding. How many tax exemptions should you claim in 2021?

Who Has the Top 1 Percent Income in the U.S., and How Are They Taxed?

The top 1 percent in the U.S make a lot of money and are wealthy. But how are they taxed?

Members of Congress Must Pay Income Taxes Like All Other U.S. Citizens

Do congressmen and congresswomen pay taxes? Yes—it’s a myth that representatives and senators are exempt from income tax.

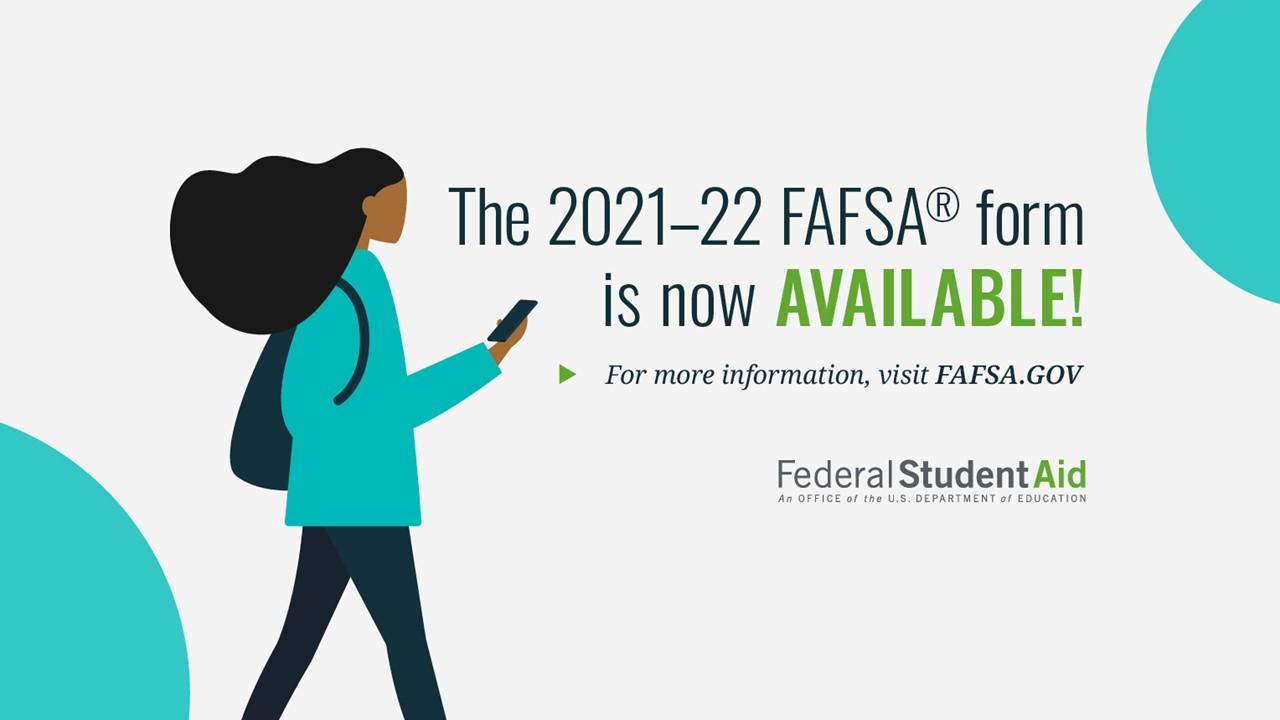

FAFSA Is Asking for 2019 Tax and Income Information—Here's Why

FAFSA (Free Application for Federal Student Aid) is asking for 2019 tax and income information because it evaluates applications based on previous income.

Why Federal Income Tax Wasn't Withheld From Your Paycheck

Here are a few reasons why no federal income tax may be withheld from your paycheck. If taxes aren't withheld from your paycheck, you need to know why.

Why You Should File Taxes Even If You Didn't Have Any Income

The deadline to file taxes for 2020 is May 17, 2021. It's a good idea file taxes even if you didn't have any income. Here's why.

How to Determine If You Qualify for an Earned Income Tax Credit

Many taxpayers don’t know they qualify for the IRS’s earned income tax credit. Without a professional, it might be overlooked.

Biden Administration Sets New Income Limits for the Child Tax Credit

The Biden administration just passed the American Rescue Plan Act. What are the income limits for the new version of the child tax credit?

Is the Earned Income Tax Credit Lower in 2021?

The earned income tax credit has been around for decades, but is the U.S. government minimizing its reach? What can you expect in 2021?

Why Are Bonuses Taxed Higher Than Ordinary Income?

Your bonuses are taxed higher compared to your regular income because the IRS treats bonuses differently. How does the IRS tax bonuses?

Do Capital Gains Count as Income and How Will You Be Taxed?

Capital gains do count as income. The rate at which they are taxed depends on your tax filing status and the amount of the gain.