VanEck Vectors High-Yield Municipal Index ETF

Latest VanEck Vectors High-Yield Municipal Index ETF News and Updates

What a Trump Presidency Means for Municipal Bonds

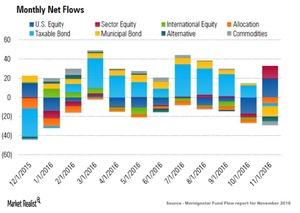

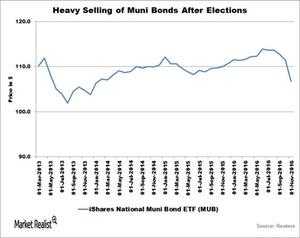

After investors’ post-election U-turn, some tailwinds turned to headwinds for municipal bonds. Investors moved money out of bond funds amid expectations of a Fed rate hike.Financials Must-know: Why expense ratios have affected TLT and MUB

We note that net or effective returns (that is, returns after expenses) fall to 7.95% versus perceived returns of 8.44% for TLT for the past three years.Financials How to measure your portfolio’s interest rate risk with convexity

Portfolio durations differ from key rate durations, as even though the durations of two portfolios may match, both portfolios may differ in the maturity profiles of the bonds they comprise, which will result in differing key rate durations.

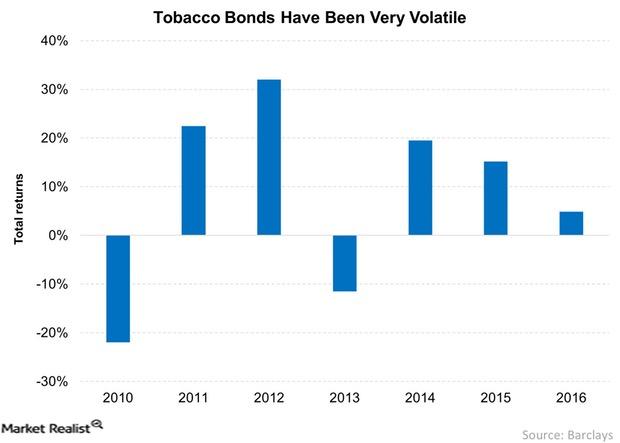

Do Tobacco Bonds Warrant a Place in Your Portfolio?

Tobacco bonds have been volatile in the last seven years. Falling MSA payments caused the volatility. Tobacco bonds offer relatively good cash flow returns.

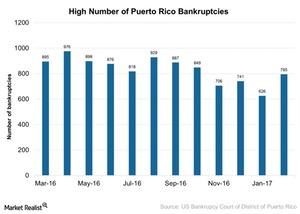

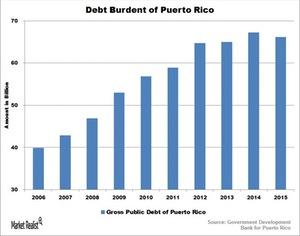

Puerto Rico’s Increasing Defaults Lead to Bankruptcy in 2017

The board overseeing Puerto Rico (PZT) (HYMB) filed for bankruptcy protection in a much-anticipated move in 2017.

Is There an Opportunity in a Muni Sell-Off?

With their high yields, low prices, and tax-efficient returns, muni bonds (HYD) (ITM) could be available to investors at a dirt cheap rate in the coming months.

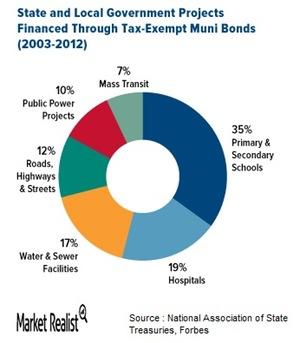

Increased Muni Issues to Fund Infrastructure Spending

The downfall for muni bonds (HYD) (ITM) (MLN) began in October 2016 after the muni market was flooded with new issues for state and local governments.

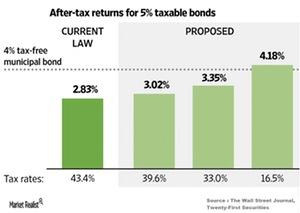

Tax Reform Is Full of Unknowns

President-elect Donald Trump’s tax reforms could bring cheers from taxpayers, but the tax bracket changes may not be well received by muni bond investors.

Looming Uncertainty of Puerto Rico’s Debt Crisis

Puerto Rico is currently in a meltdown mode. Over the past decade, it has accumulated $70.0 billion in public debt, which is close to 68.0% of its GDP.

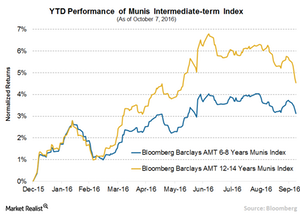

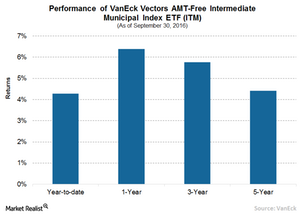

VanEck Launches Two New Intermediate-Term Municipal Bond Funds

In September 2016, VanEck introduced two new ETFs that provide exposure to intermediate-term municipal bonds.

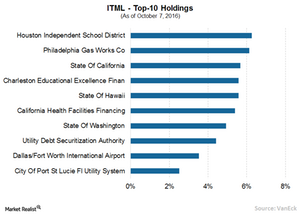

ITML: Taking a Less Conservative View of the Marketplace

With a longer duration of the intermediate bonds rate curve, ITML is best suited for investors who are uncertain about the movement of interest rates in the near future.

Intermediate-Term Municipal Bonds Are in a Sweet Spot

Immediate-term bonds (ITM) are better placed since investors take less of an interest rate risk.

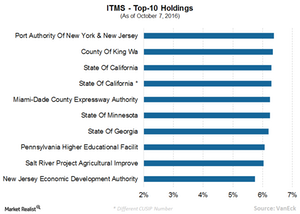

ITMS: Taking a Very Narrow View of the Municipal Yield Curve

As of September 30, 2016, ITMS has all of its investments in US dollar-denominated bonds with a credit rating of “A” or higher, thus ensuring lower risks.

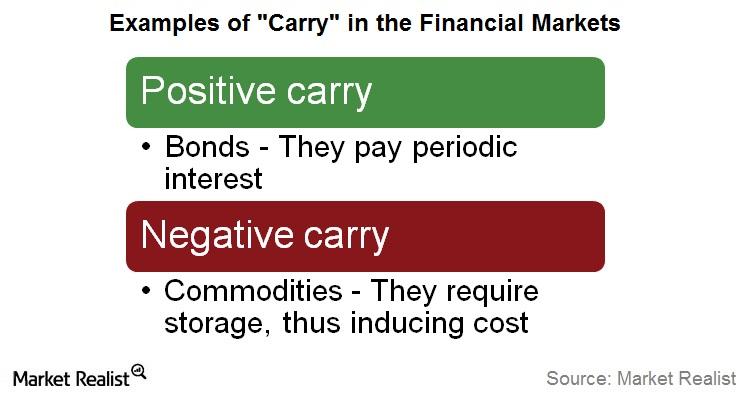

Bill Gross Talks about Compressed ‘Carry’ in Financial Markets

In his latest monthly investment outlook for June 2016, bond market veteran Bill Gross talked about “carry” in financial markets.