VanEck Launches Two New Intermediate-Term Municipal Bond Funds

In September 2016, VanEck introduced two new ETFs that provide exposure to intermediate-term municipal bonds.

Oct. 19 2016, Updated 4:41 p.m. ET

TOM BUTCHER: Jim, VanEck just launched two new intermediate municipal bond funds, tickers ITMS and ITML. What is the rationale behind these new ETFs?

Market Realist – Introduction of two new intermediate-term ETFs

As uncertainty makes a dent in return expectations from equities, investors are turning to municipal bond funds. These funds have provided better returns and diversification benefits than most other asset classes when market volatility is high.

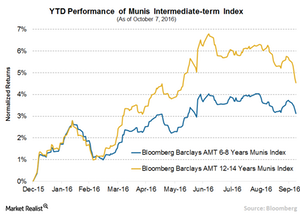

The Bloomberg Barclays AMT-Free 12-17 Year Intermediate Continuous Municipal Index has risen 4.5% year-to-date, and the Bloomberg Barclays AMT-Free 6-8 Year Intermediate Continuous Municipal Index has risen 3.1%.

Exposure to intermediate-term ETFs

Against this backdrop, VanEck introduced two new ETFs in September 2016. They provide exposure to intermediate-term municipal bonds. The VanEck Vectors AMT-Free 6-8 Year Municipal ETF (ITMS) and the VanEck Vectors AMT-Free 12-17 Year Municipal ETF (ITML) are the latest in a series of municipal bond ETFs (SMB) added to VanEck’s leading portfolio.

VanEck’s municipal bonds currently offer investors a range of options from high-yield to short-term municipal bonds. The new ETFs offer exposure to intermediate-term municipal bonds. These new funds along with VanEck’s other popular municipal index ETFs such as the VanEck Vectors AMT-Free Intermediate Municipal ETF (ITM) and the VanEck Vectors High-Yield Municipal ETF (HYD) are expected to help investors manage their municipal debt exposures much better.