Harmony Gold Mining Co Ltd

Latest Harmony Gold Mining Co Ltd News and Updates

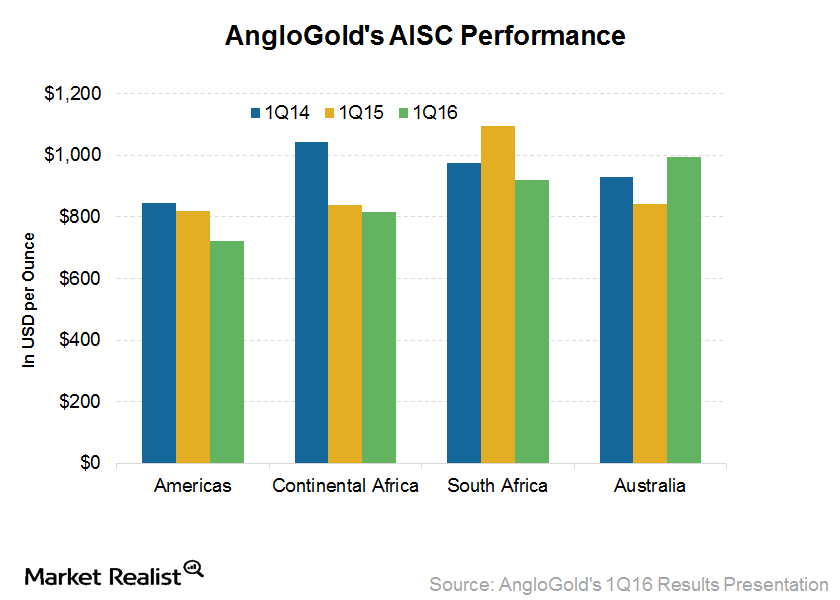

How Did AngloGold Reduce Its Costs despite Lower Production?

AngloGold Ashanti that for the last three years, its management’s focus has been on the widening of its margins on a sustainable basis.

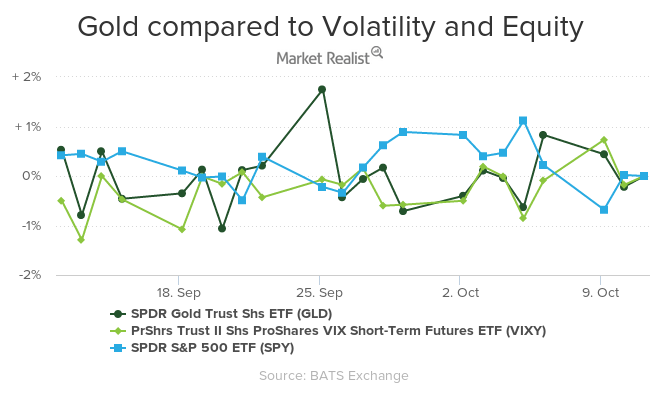

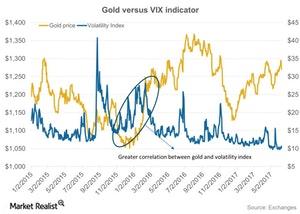

How Investor Appetite for Risk Impacts Precious Metals

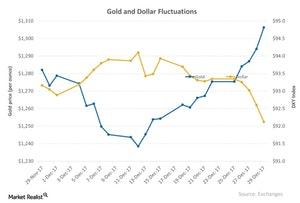

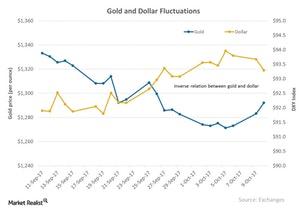

Gold and silver have seen trailing-five-day losses of 0.9% and 2.7%, respectively. The reason behind the fall in the precious metals is the buoyancy of the equity markets and the gains in the US dollar.

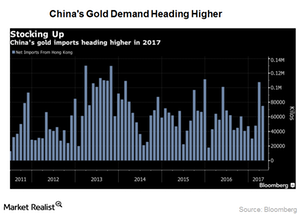

What Rising Physical Gold Demand Could Mean for Prices

After falling 18% in 1Q17, physical demand for gold seems to have picked up in 2Q17.

A Quick Look at the Technicals of the 4 Precious Metals

Gold’s price dipped 0.13% to $1,312.8 per ounce on May 9. The fall in gold was extended for a number of reasons.

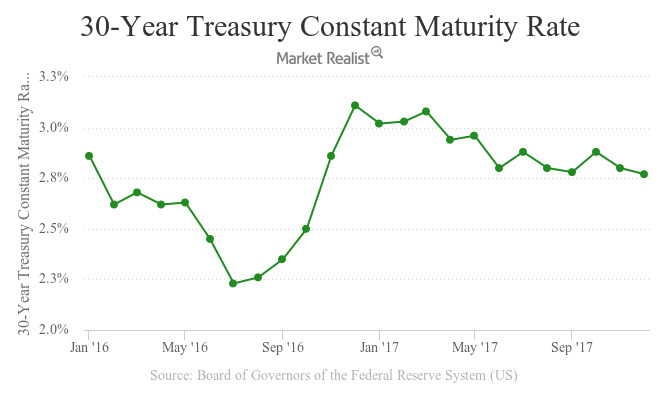

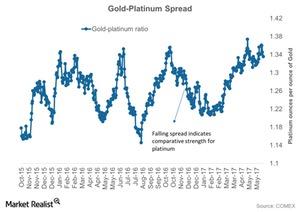

Is Gold Keeping Tabs on the US Interest Rate?

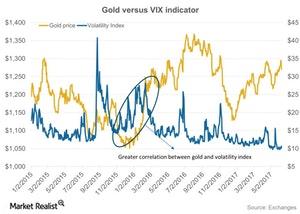

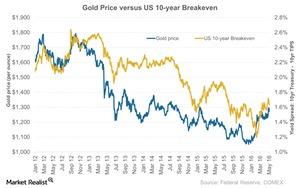

As we know, precious metals are closely tied to movements in US interest rates. Bonds and equities are both yield-bearing assets, so a rise in yields often causes a slump in demand for assets such as gold and silver.

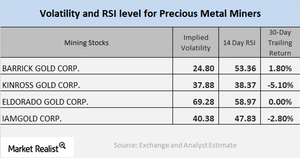

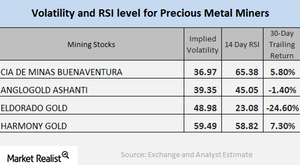

How Do Miners’ Technical Details Look?

Most of the mining companies have risen during the past few weeks. The miners tend to move according to precious metal prices rather than the equities market in general.

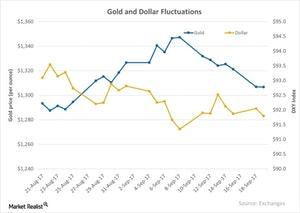

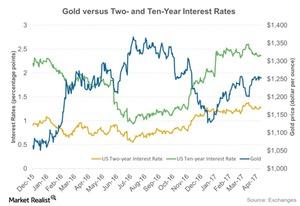

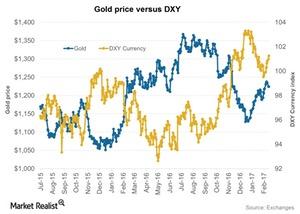

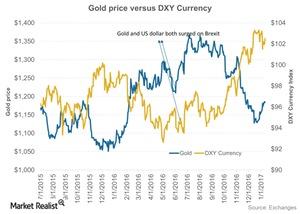

Analyzing Precious Metals: Dollar Had Its Worst Year since 2003

Although most of the upswing in precious metals has been due to the rise in geopolitical risks in 2017, the dollar has been the most crucial factor.

Reading Key Mining Stock Technicals as of December

Most of the mining companies have increased during the past two weeks due to the rise of gold and silver.

Miners: Analyzing Core Indicators for Investors

A brief analysis of mining stocks is crucial when investors are parking their money in the precious metals market, specifically in mining companies.

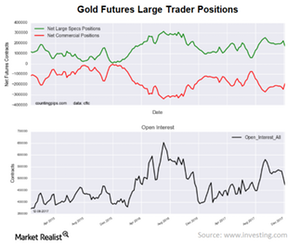

How Is Gold, Commercial and Non-Commercial, Moving?

Speculative positions fell sharply last week. It was the most significant one-week fall since May 2016.

How Inflation Becomes a Core Determinant of the Price of Gold

The possible interest rate hike is taking a lot of market participants’ attention. Many policymakers are also focusing on inflation numbers.

Mining Stocks: Analyzing the Technical Details

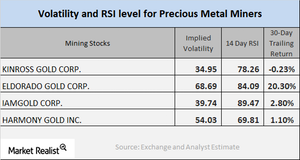

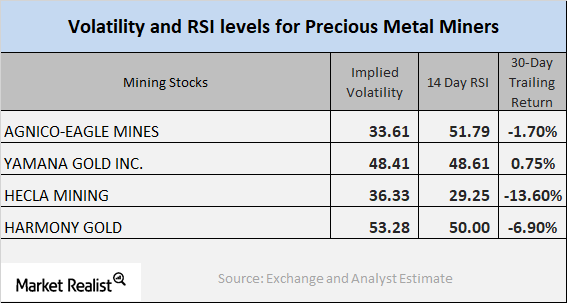

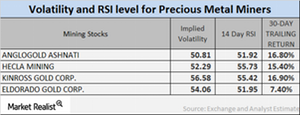

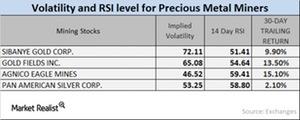

In this part, we’ll concentrate on the technical readings of key mining stocks, including their call implied volatilities and RSI (relative strength index) levels.

A Brief Analysis of Mining Stocks in November 2017

On November 7, Agnico-Eagle Mines (AEM), Yamana Gold (AUY), Hecla Mining (HL), and Harmony Gold (HMY) had implied volatility readings of 33.6%, 48.4%, 36.3%, and 53.3%, respectively.

These Factors Are Affecting Gold

Gold, silver, platinum, and palladium have a five-day trailing loss of 0.67%, 0.44%, 1.1%, and 1.5%, respectively.

Which Elements Impact Precious Metals?

Gold fell for the third consecutive day on October 18, 2017, as the US dollar regained strength. However, October 19 was an up day for gold and silver.

How Global Indicators Are Affecting Precious Metals

Gold reached its two-week high price of $1,294.5 an ounce on Tuesday, October 10, and ended the day at $1292.1 per ounce.

Could North Korea Be Affecting Precious Metal Prices?

North Korean tensions Like the US dollar, global tensions can be responsible for precious metal price fluctuations. North Korea has interpreted US president Donald Trump’s comments as a declaration of war, stating that Pyongyang has the right to take countermeasures, including shooting down US bombers outside of its airspace. The ongoing unrest in the Korean peninsula has led to a global […]

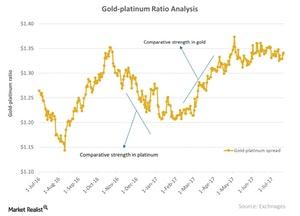

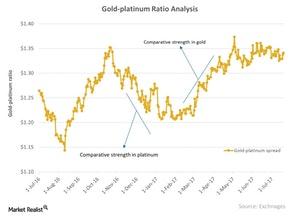

How Gold and Platinum Are Moving in Tandem

Like silver, platinum has industrial uses and has seen growing demand in China.

Precious Metals, Miners and the Scaling Dollar

Later in the day on September 20, after rising gold prices fell on the US Federal Reserve’s indication of one more interest rate hike in 2017.

How Gold, Silver, and Mining Companies Performed on September 18

On September 18, gold fell 1.1% and closed at $1,306.90 per ounce. Of the precious metals, silver fell 3.1% and closed at $17.10 per ounce.

How North Korea Has Affected the Precious Metal Market

Precious metals have been buoyed by tension in North Korea. If North Korea does another missile test, it could prompt investors to move to haven assets such as gold, silver, Treasuries, and major currencies.

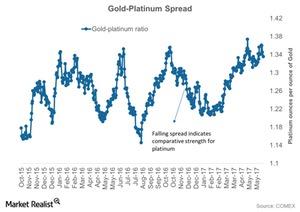

Platinum Market: Reading the Gold-Platinum Ratio

When reading the platinum market, it’s important to look at the relative performance of platinum and gold by using the gold-platinum ratio.

What Miners’ Technical Indicators Suggest

Most of the miners have seen an upswing in their prices over the past week.

Gold-Platinum Ratio: Is Platinum a Long-Term ‘Buy’?

When reading the platinum market, it’s important to analyze the comparative performance of platinum and gold by using the gold-platinum ratio or spread.

Inside the Gold-Platinum Spread Now

The platinum industry is now headed for its third-straight year of surplus, likely due to the higher demand for petroleum-based cars.

Gold and Other Precious Metals Fell on May 18

Gold futures for June expiration fell 0.47% and ended May 18 at $1,252.8 per ounce. The call implied volatility in gold rose to 11.3%.

How the Dollar’s Revival Is Impacting Precious Metals in May

The US Dollar Index, which prices the dollar against a basket of six major world currencies, has risen ~0.46% on a trailing-five-day basis.

Behind Mining RSI Levels and Volatility Now

Leveraged mining funds including the Direxion Daily Gold Miners (NUGT) and the Proshares Ultra Silver (AGQ) saw big jumps in early 2017 due to the revival in precious metals.

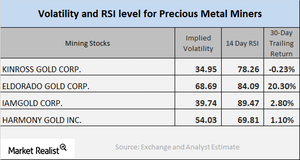

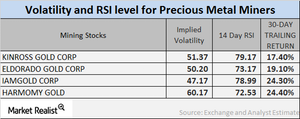

Reading Mining Companies’ Volatilities and RSI Levels

Mining companies’ volatilities are significant to the buying process. The mining shares we’ve selected in this article are Kinross Gold, Eldorado Gold, IAMGOLD, and Harmony Gold.

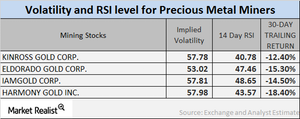

What the Latest Volatility and RSI Numbers Indicate

It’s important to monitor the implied volatilities of large mining stocks as well as their RSI levels, particularly after changes in precious metal prices.

How GDP Numbers Impacted Gold and the Dollar

The reason behind the fall of the dollar on Friday, January 27, 2017, was lower-than-expected GDP numbers. The DXY ended the day 0.10% higher.

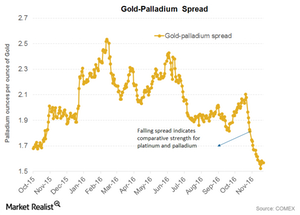

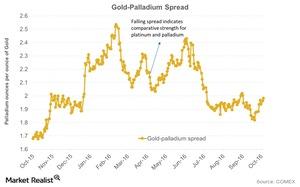

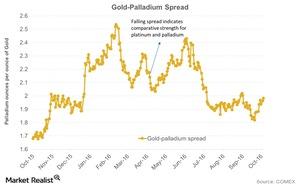

Reading the Movement in the Gold-Palladium Spread

The gold-platinum spread was approximately 1.6 on January 11, 2017. Its RSI (relative strength index) was as low as 40.

Why Mining Stocks Are Seeing Rising RSI Levels

In this part, we’ll look at the implied volatilities of large mining stocks and their RSI levels in the wake of precious metal prices.

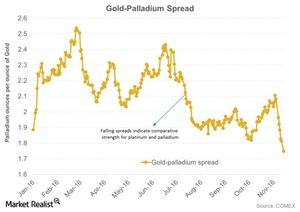

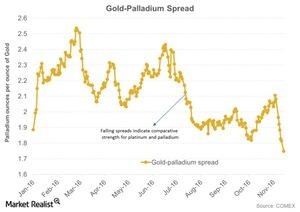

Why the Gold-Palladium Spread Is Falling Drastically

Palladium has seen a YTD rise of a whopping 32.5%, which is higher than the rise in platinum, silver, and gold. Earlier, palladium was underperforming its precious metal peers.

How Palladium Outperformed Gold: The Gold-Palladium Spread

Palladium has seen a year-to-date rise of a whopping 32.5%, which is higher than the rise in platinum, silver, and gold. Earlier, palladium was underperforming its precious metal peers.

What’s Affecting the Gold-Palladium Spread?

Palladium has seen a year-to-date rise of 24.9%, which is higher than the increase in platinum, silver, and gold.

Where Is the Gold-Palladium Spread Headed?

The gold-palladium spread has seen its ups and downs over the past few months. But the United Kingdom’s Brexit vote resulted in some strength for palladium.

Are Inflation Concerns Likely to Boost Gold’s Performance?

The difference between yields on ten-year US notes and similar-maturity TIPS, a gauge of price expectations, expanded to as much as 1.7% last Tuesday.

Why Are Precious Metals Showing Weakness?

Gold broke its key level of $1,300 per ounce on Tuesday, October 4, 2016. But investors are seeing gold’s 200-day moving average of $1,258 per ounce as a resistance level.