General Dynamics Corp

Latest General Dynamics Corp News and Updates

Industrials Comparing Lockheed Martin with other major defense contractors

With total sales of $45,358 million in 2013, Lockheed Martin is the largest defense contractor in the world. The other major defense contractors in the world include The Boeing Company and Raytheon Company.

An investor’s introduction to Lockheed Martin Corporation

In 2013, Lockheed Martin clocked revenues of $45.4 billion. Of its revenues, 82% come from the U.S. government, around 17% from international customers, and 1% from other U.S. commercial customers.

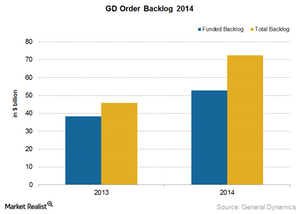

What does General Dynamics’ order backlog reflect?

General Dynamics’ total backlog grew from $45.9 billion at the end of 2013 and to $72.4 billion at the end of 2014. This was a whooping 58% increase.

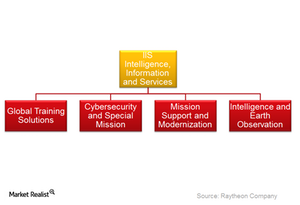

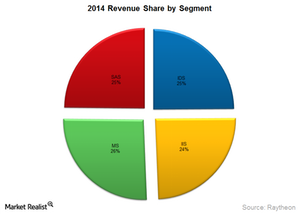

Raytheon’s Intelligence, Information and Services Segment

The Intelligence, Information and Services segment was almost in line with last year. So were the operating income and margins, all of which saw marginal declines.

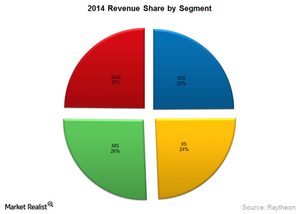

Raytheon Company: An Introduction

Raytheon is a global technology leader and US defense contractor. It primarily develops and manufactures weapons and military and commercial electronics.

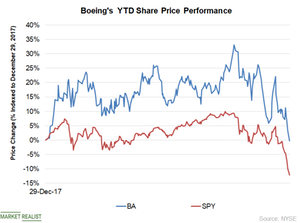

How Boeing Stock Has Fared in 2018

Boeing (BA) stock started 2018 on a positive note and carried this momentum forward up to November 7, with a return of ~26%.

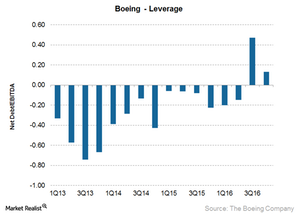

Why Boeing’s Increasing Leverage May Mean Higher Risk

At the end of 4Q16, Boeing’s leverage fell to ~$10 billion as compared to $10.5 billion at the end of 3Q16 and $11 billion at the end of 2Q16.

How Did Boeing Stock React?

Immediately after Donald Trump’s tweet, Boeing (BA) stock fell 1%. Other defense contractor stocks also had to bear the brunt.

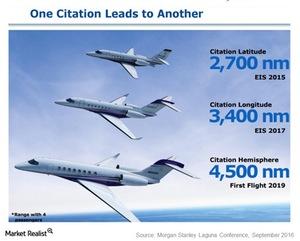

NetJets Orders Secure Textron Aviation amid Business Jet Weakness

Textron Aviation increase its sales in the last two quarters after gaining traction for its new Latitude business jets. It has secured 150 orders from NetJets.

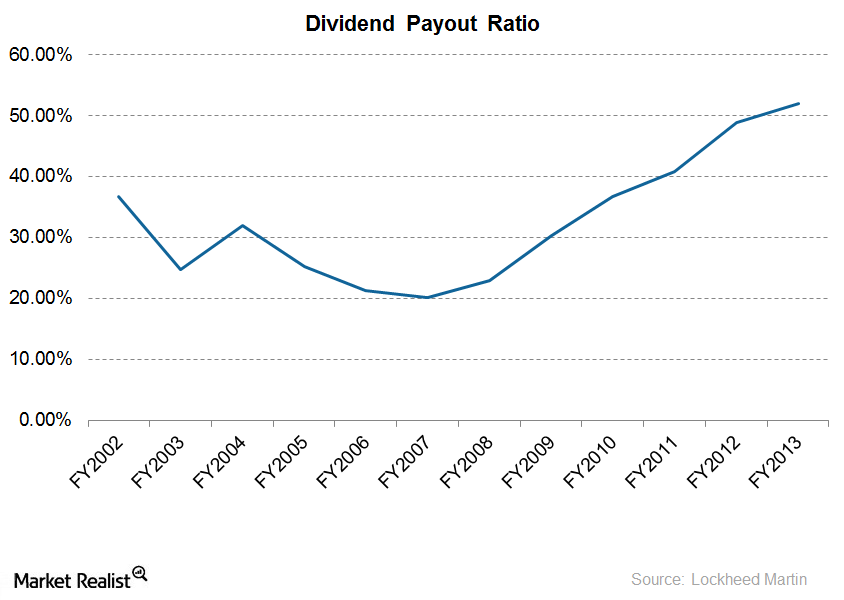

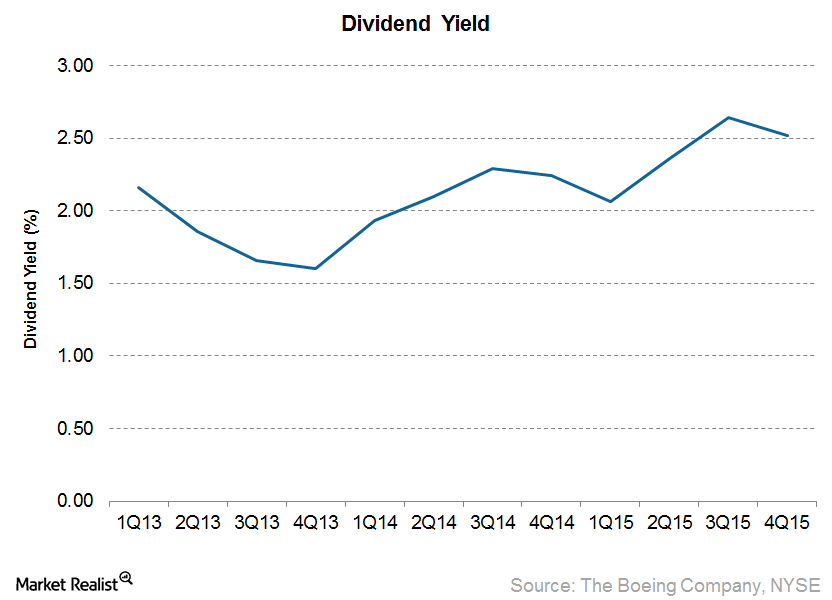

Will Boeing’s Dividend Payout Increase in the Rest of 2016?

Looking at Boeing’s dividends, we see that it has been a consistent dividend payer for more than two decades. For 2Q16, it paid a total of $691 million in dividends.

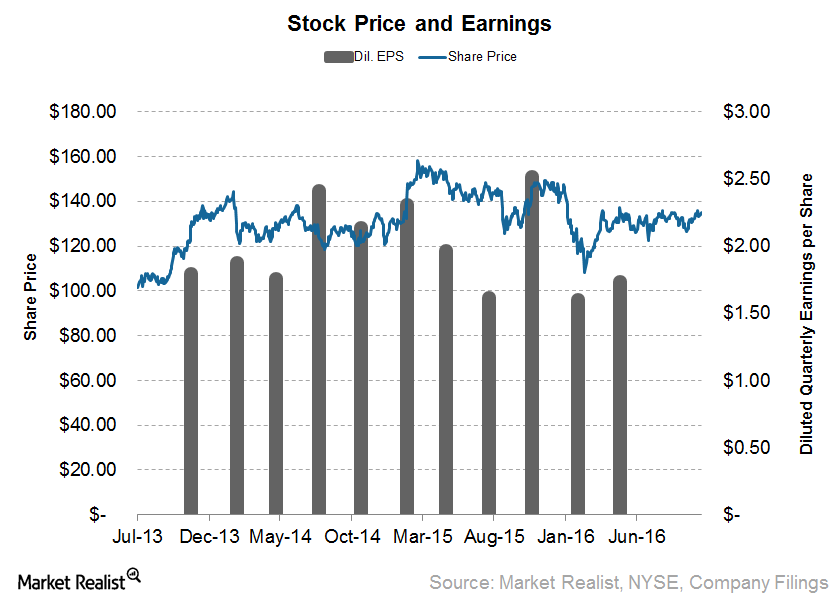

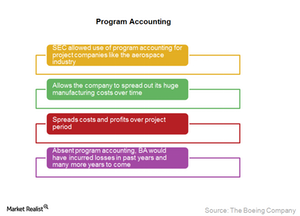

What Is Boeing’s Program Accounting Issue About?

Boeing (BA) uses program accounting, a technique that allows the company to spread out its huge manufacturing costs over time by cutting the cost per plane in the early stages of a project, and smoothening profit margins over time.

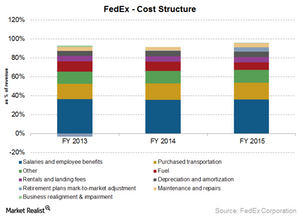

What Are FedEx’s Major Costs?

Salaries and employee benefits form the highest cost for FedEx. They account for ~36% as a percentage of revenue. Salary costs rose 6% for fiscal 2015.

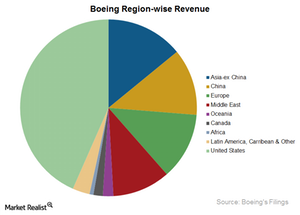

The Boeing Company: From the Beginning

Boeing is the world’s largest aerospace company. It is the largest commercial jet manufacturer in the US and the world’s second largest behind Airbus.

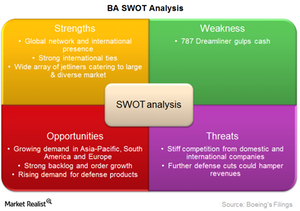

A SWOT Analysis of Boeing

Strengths and weakness are internal factors within a company’s control. Opportunities and threats are external factors outside its control.

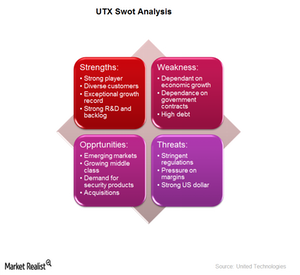

United Technologies Corporation: A SWOT Analysis

In this article, we’ll do a SWOT analysis of United Technologies Corporation (UTX), including its strengths, weaknesses, opportunities, and major threats.

What Should Investors Know About Raytheon?

Raytheon is a leading technology company. It provides products and services in the defense, civil, and security markets globally.

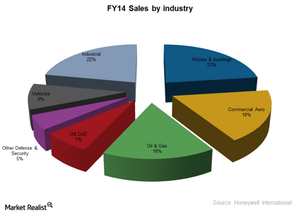

Analyzing how Honeywell makes money

Honeywell International Inc. (HON) is headquartered in Morristown, New Jersey. It was incorporated in 1985. It’s a Fortune 100 company.

SWOT analysis of Rockwell Collins

Rockwell Collins expects its Airborne Solutions/Avionics division to see good growth in the future due to the rising demand in Unmanned Air Vehicles (or UAVs).Earnings Report Analyzing General Dynamics’ business segments

General Dynamics has four major business segments. In this article, we’ll analyze General Dynamics’ business segments.