First Trust United Kingdom AlphaDEX Fund

Latest First Trust United Kingdom AlphaDEX Fund News and Updates

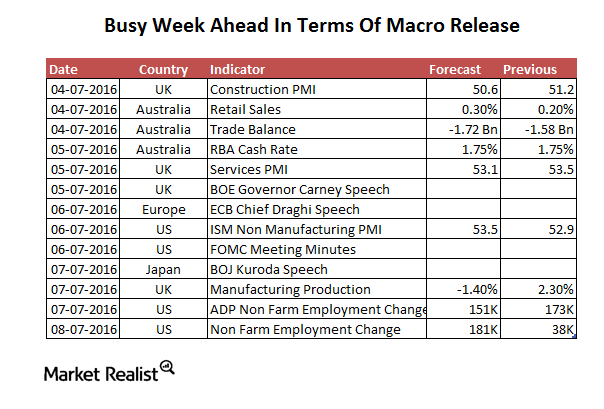

Why Employment Numbers Are this Week’s Center of Attention

Strong non-farm employment required to maintain any rate hike hopes Non-farm employment changes are one of the most important indicators the US Fed considers in deciding on monetary policy. May non-farm employment changes hit a multi-year low, which took away all probabilities of a June hike. Check out the following article for further detail on May’s […]

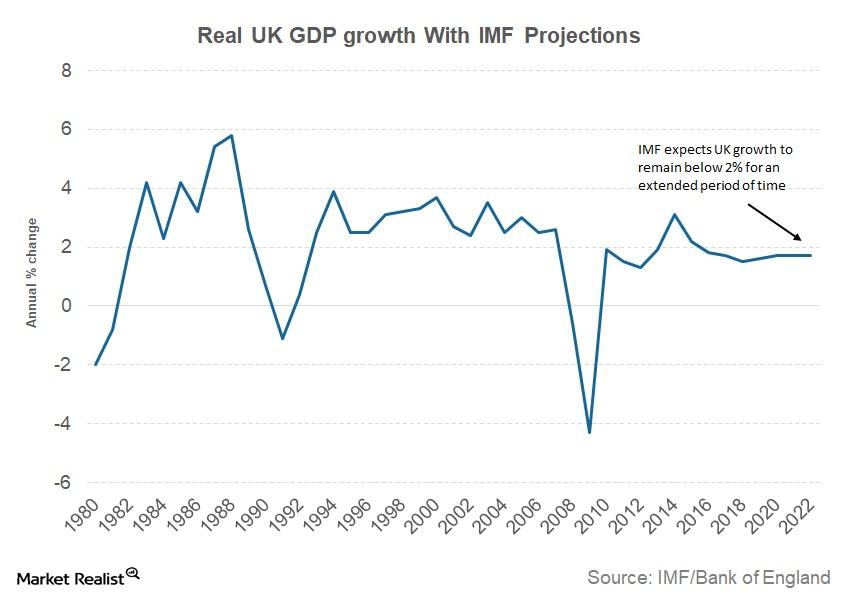

Why the IMF Sees Continued Uncertainty in the UK

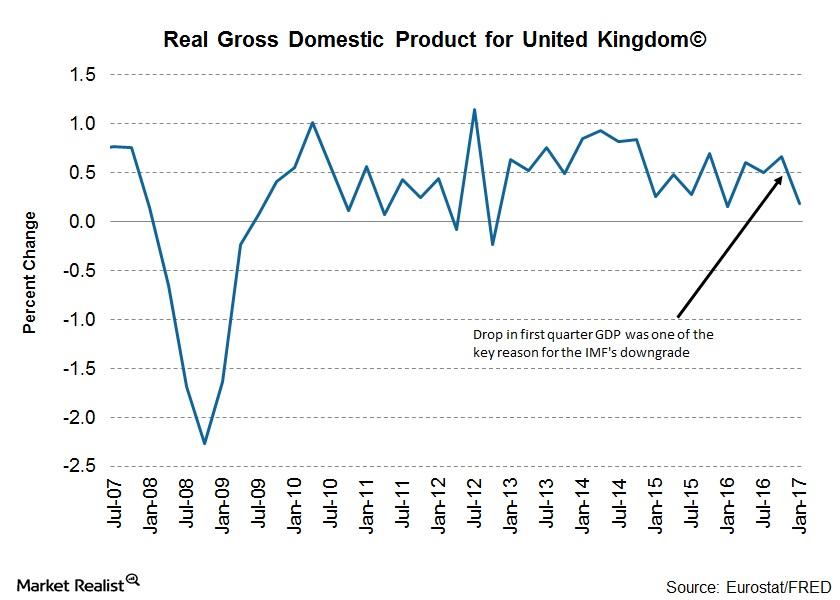

The International Monetary Fund (or IMF), in its October world economic outlook, downgraded its growth outlook for the United Kingdom.

International Monetary Fund Sees Renewed Brexit Pain for the UK

International Monetary Fund slashes UK growth forecast In its World Economic Outlook update, released on July 23, the International Monetary Fund (or IMF) downgraded its growth outlook for the United Kingdom. The IMF said that it expects the UK economy (EWU) to grow at a rate of 1.7% this year, compared with its previous forecast […]

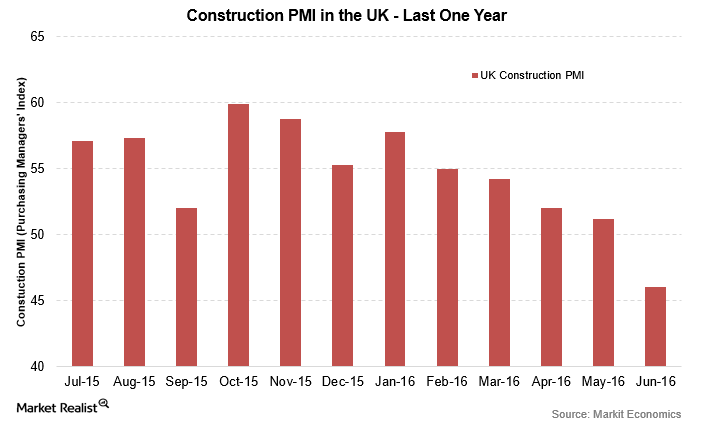

UK Construction PMI Contracts Due to Uncertain Brexit Implications

The United Kingdom’s construction PMI (purchasing managers’ index) came in at 46 for June—compared to 51.2 in the previous month.

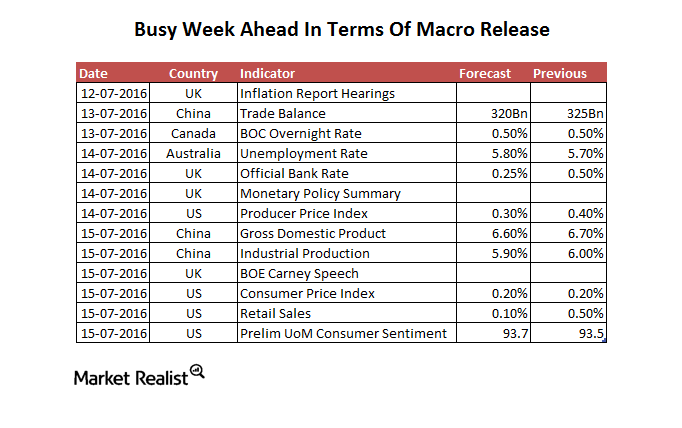

BOE Monetary Policy Will Be the Highlight This Week

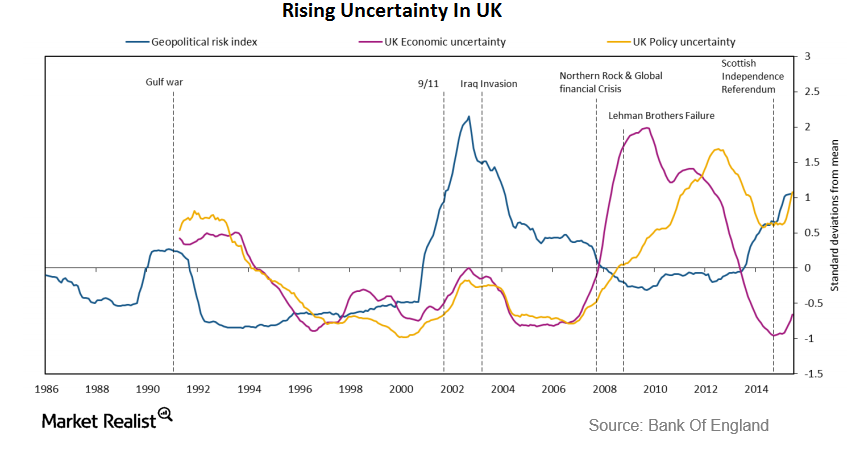

The BOE is scheduled to release it monetary policy on July 14—the first after the United Kingdom decided to leave the European Union in a historic referendum.

Why Did the Bank of England Relax Regulatory Requirements?

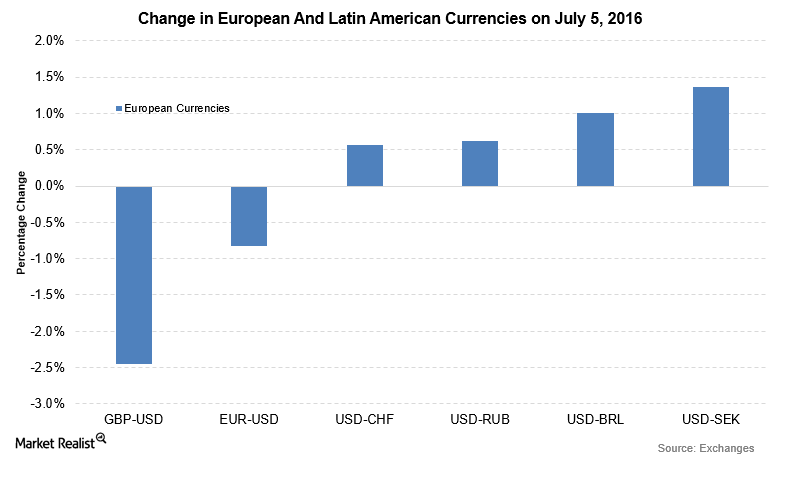

The BOE (Bank of England) released the Financial Stability Report on July 5, 2016. It warned multiple times about the repercussions of a Brexit.

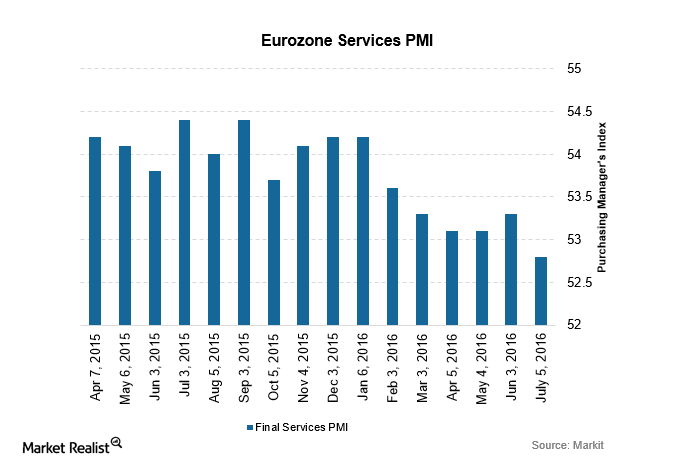

Contrasting Services PMI from the Eurozone and the UK

The composite PMI came out at 53.1—above the flash estimates of 52.8. The rise was primarily due to the rise in manufacturing production.

Pound Falls, BOE Summer Stimulus Hopes Rise after Carney’s Speech

On June 30, BOE (Bank of England) governor, Mark Carney, gave a speech signaling the BOE’s possible actions after the Brexit referendum on June 23.

Is the Rebound in Global Markets Sustainable?

The SPDR Euro STOXX 50 ETF (FEZ) rose by 2.6%. The United Kingdom’s (FKU) FTSE 100 was among the leaders in European markets. It rose by 2.6%.

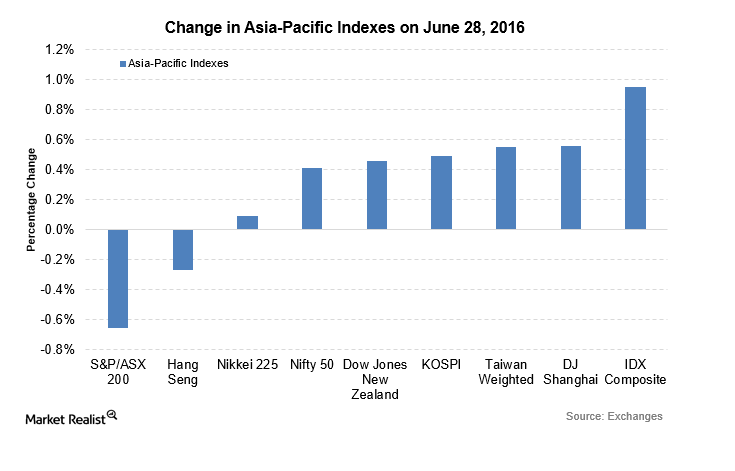

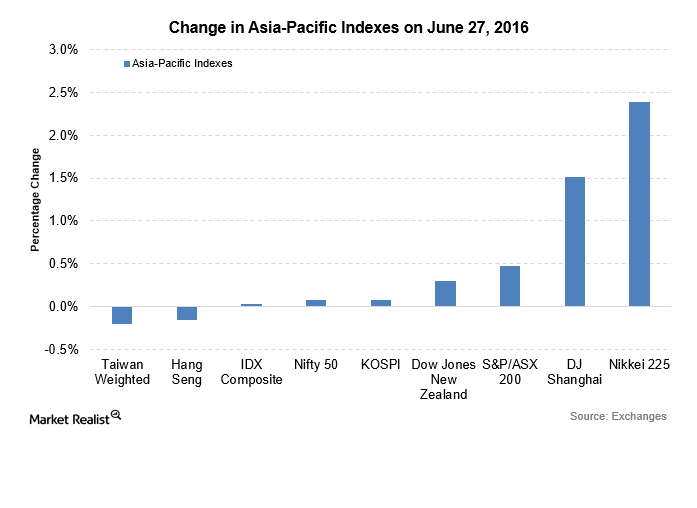

Do Asian Indexes Point to a Recovery in Global Markets?

Critical Asian indexes were trading on a mixed note on June 27 with the Japanese and Chinese indexes leading the gains. The Nikkei 225 posted a significant gain of 2.4%, while the Dow Jones Shanghai Index rose by 1.5%.

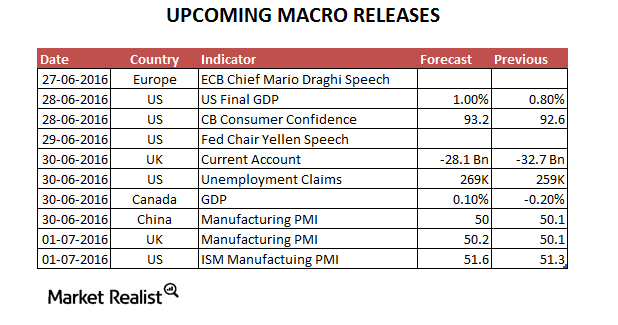

Major Macro Events in the Week Starting June 27

The final GDP is scheduled for June 28, 2016. It will be the major driver of markets in the week starting June 27. The GDP is expected to rise by 1.0%.

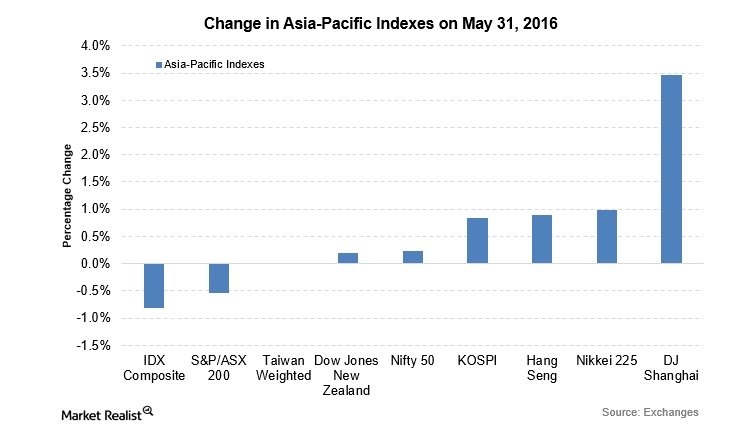

Brexit Threat Spreads Risk around Global Markets

Major European indexes (DBEU) fell on May 31 as polls conducted by the Guardian and ICM suggested voters are in favor of Brexit.

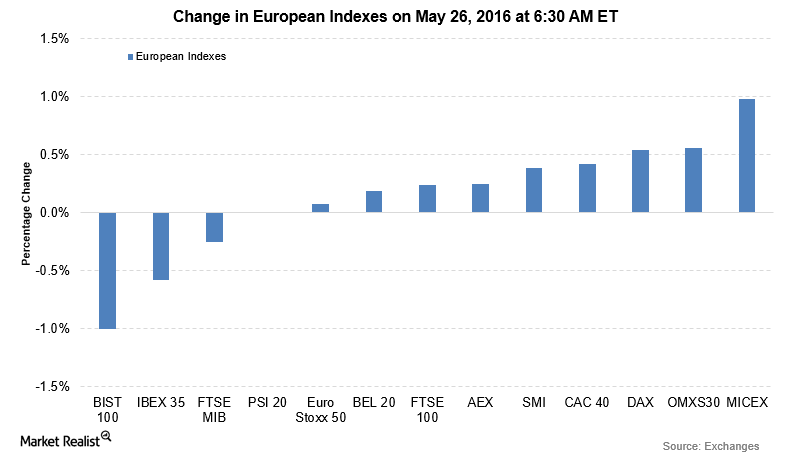

European Market Flat as Investors Await G7 Leaders’ Brexit Views

Major European indexes (DBEU) were trading with caution on May 26, 2016, as they awaited G7 leaders’ views on the Brexit referendum.