Xtrackers MSCI EAFE Hedged Equity ETF

Latest Xtrackers MSCI EAFE Hedged Equity ETF News and Updates

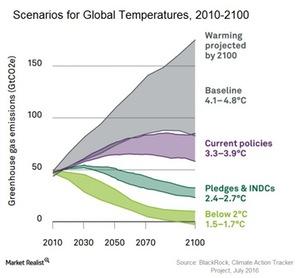

How the World Is Dealing with the Climate Challenge

Extreme climate change events hamper productivity, thus affecting industries such as agriculture, fishing, energy, trade, transportation, and tourism.

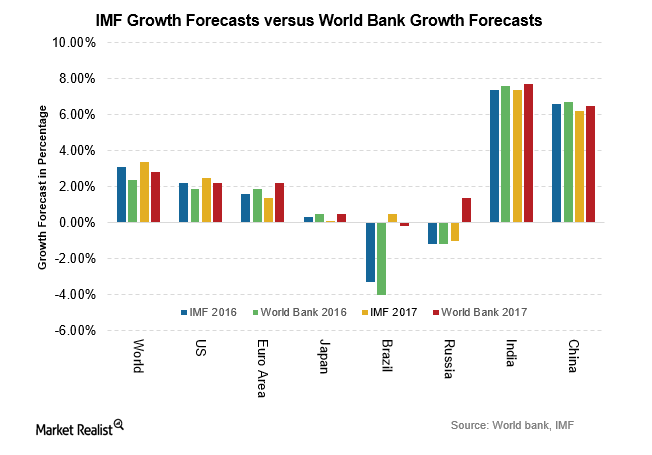

Outlook Projections: IMF Cuts Global Growth Forecasts

The IMF cut its global economic growth forecasts, according to the latest IMF World Economic Output Update dated July 19. The cut in forecasts was expected.

Why Are Global Markets Range Bound?

The contrasting movement among the global markets was primarily due to caution ahead of the Bank of England’s monetary policy release on July 14.

Labeled Green Bonds’ Significance to Investors

Global climate leaders have set a $1 trillion target for green finance by 2020, which would require a tenfold increase in global green bonds issuance.

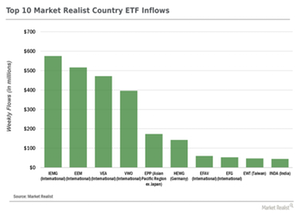

Country ETFs: Hungry Emerging Market Bulls

Investor appetite for emerging market exposure has been growing steadily, and last week’s fund flows showed that emerging market bulls are still hungry.

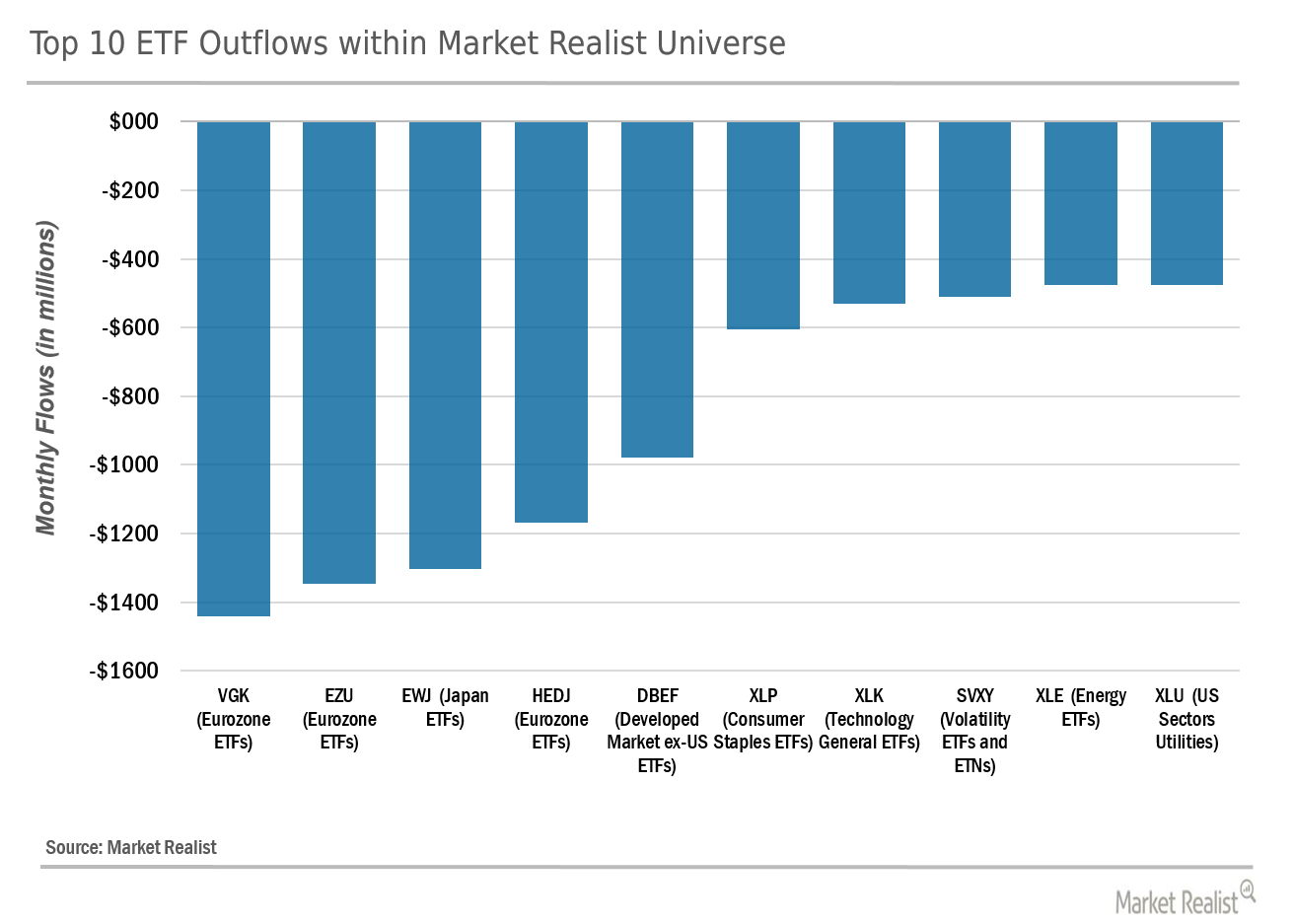

ETF Flows in 30 Seconds: 5 Things That Matter

Last week‘s ETF fund flows showed the beginning of a remarkable shift in investor behavior and asset allocation.

Category Flows: ETF Construction Matters!

The iShares Core S&P Total U.S. Stock Market ETF (ITOT) saw by far the largest inflows within our ETF universe last week.

Why Did the Bank of England Relax Regulatory Requirements?

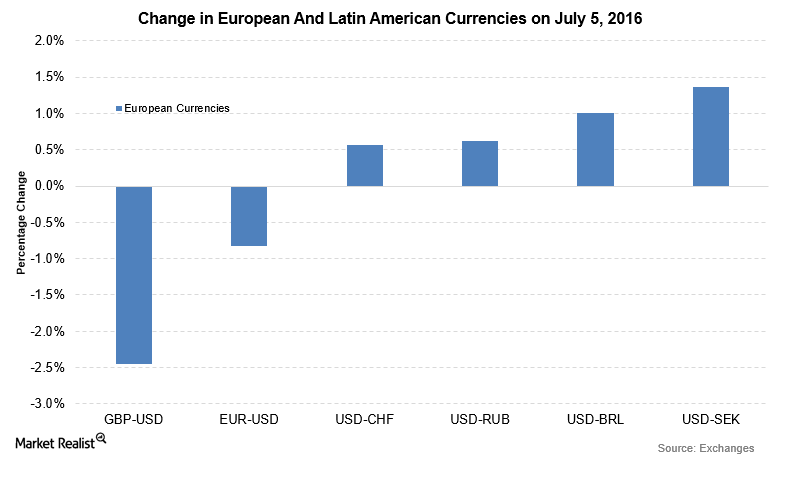

The BOE (Bank of England) released the Financial Stability Report on July 5, 2016. It warned multiple times about the repercussions of a Brexit.

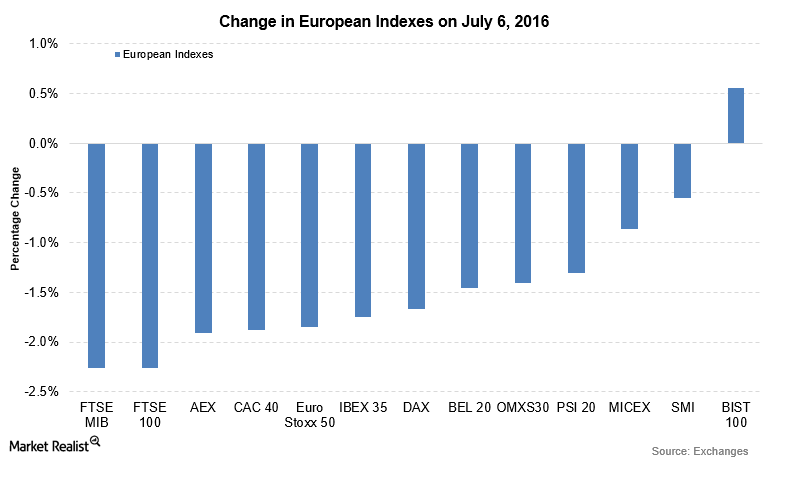

Weak Data Puts Downward Pressure on European Indexes

On July 6, major European indexes were trading lower for the second day. The fall in the indexes was led by the Italian FTSE MIB and the UK-based FTSE 100.

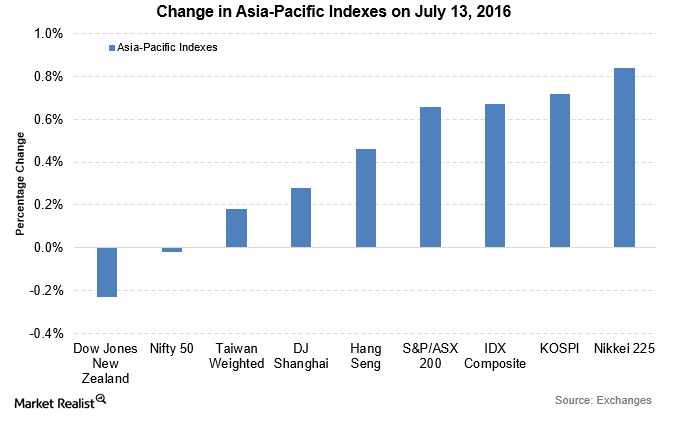

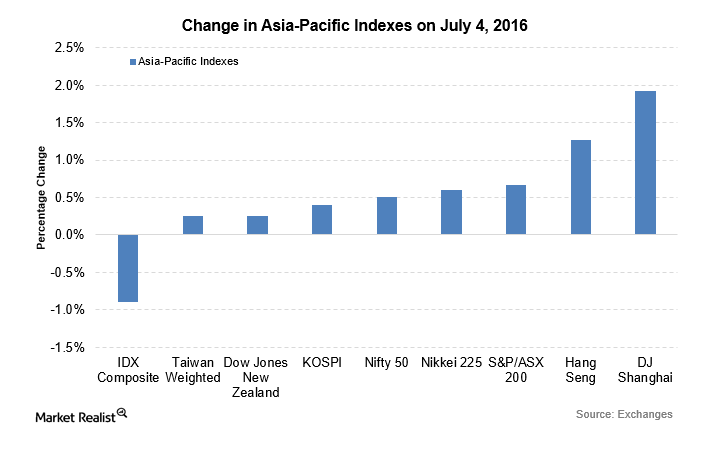

Asian Markets Rise as Australian Housing Data Disappoint

Key Asian indexes (AAXJ) were trading higher on July 4. This week, the major data release on the Asian front will be Australian monetary policy.