Deutsche Bank AG

Latest Deutsche Bank AG News and Updates

Is Deutsche Bank Corrupt? — Why the Financial Institution Was Raided

Not to anyone's surprise, Deutsche Bank has once again been raided by authorities over money laundering suspicions. Is the bank corrupt?

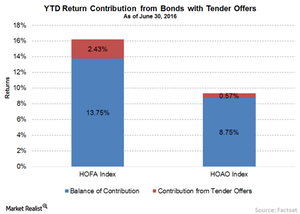

How Bond Buybacks Add Value

As of June 30, 11 fallen angel companies had issued tender offers YTD, boosting their bond prices by 5% on average.

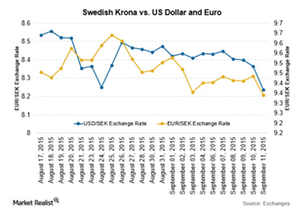

Swedish Krona Gains on Positive Growth Figures

The Swedish krona gained by more than 1.5% against the US dollar and 1.0% against the euro on September 11, 2015, as the economy grew at a faster rate than expected in 2Q15.

Why Are Deutsche Bank Investors So Concerned About AT1 Coupons?

Shares of Deutsche Bank (DB) have fallen nearly 10% in the last three trading sessions. Efforts to reassure investors about its ability to pay coupons on its AT1 bonds were in vain.

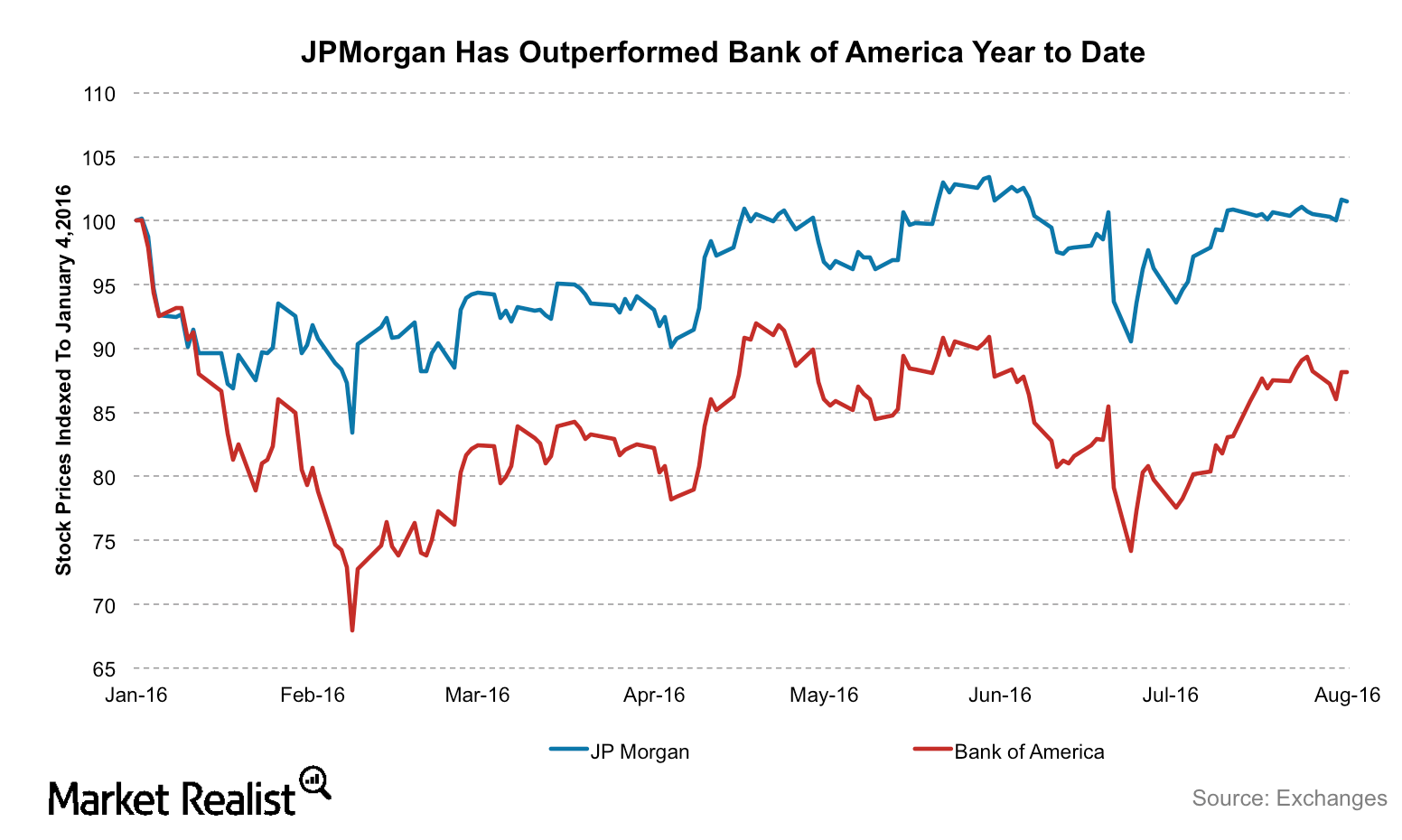

Why Deutsche Bank Prefers Bank of America over J.P. Morgan

In this series, we’ll compare Bank of America and J.P. Morgan on the basis of their 2Q earnings, profitability, cost-cutting initiatives, and interest rate sensitivities.

Could Ford’s Electric SUV Take On the Tesla Model Y?

Ford is set to unveil its “Mustang-inspired” crossover SUV, the Mach-E, on November 17. The company is positioning it against the Tesla Model Y.

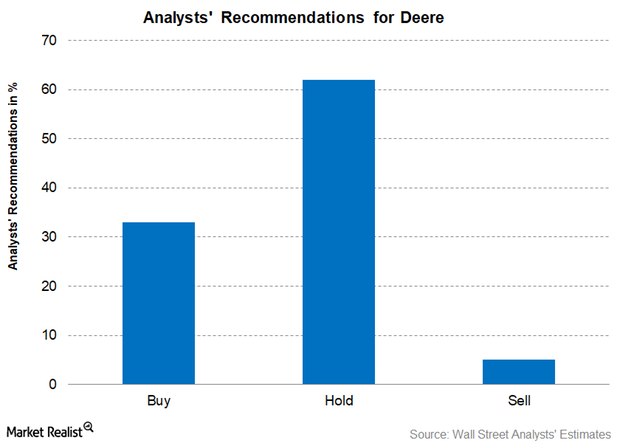

Deere: Analysts’ Recommendations and Target Prices

For Deere, 33% of the analysts recommended the stock as a “buy,” 62% recommended the stock as a “hold,” and 5% recommended the stock as a “sell.”

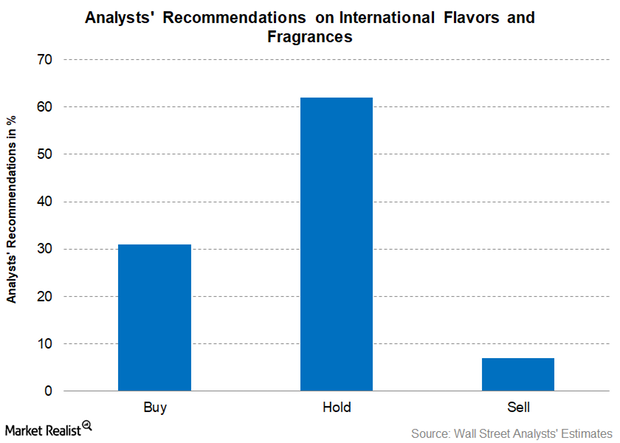

Why Most Wall Street Analysts Recommend a ‘Hold’ for IFF

International Flavors and Fragrances continues to work towards its 2020 vision of increasing its revenue by $500 million by way of acquisitions.

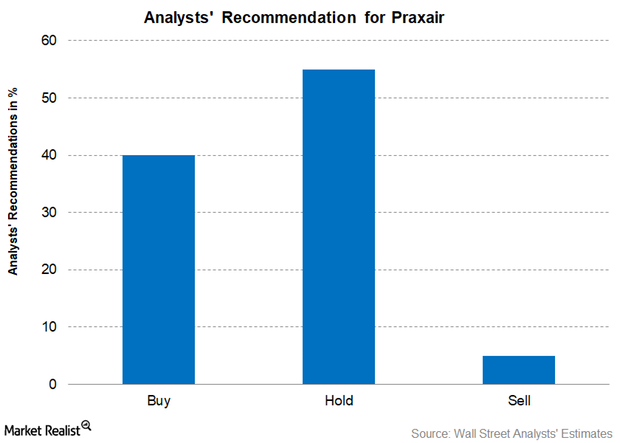

Praxair in the Crosshairs: Analyst Recommendations and Target Prices

On May 26, of the 20 firms tracking Praxair (PX) stock, about 40.0% recommended “buys,” while 55.0% recommended “holds.”

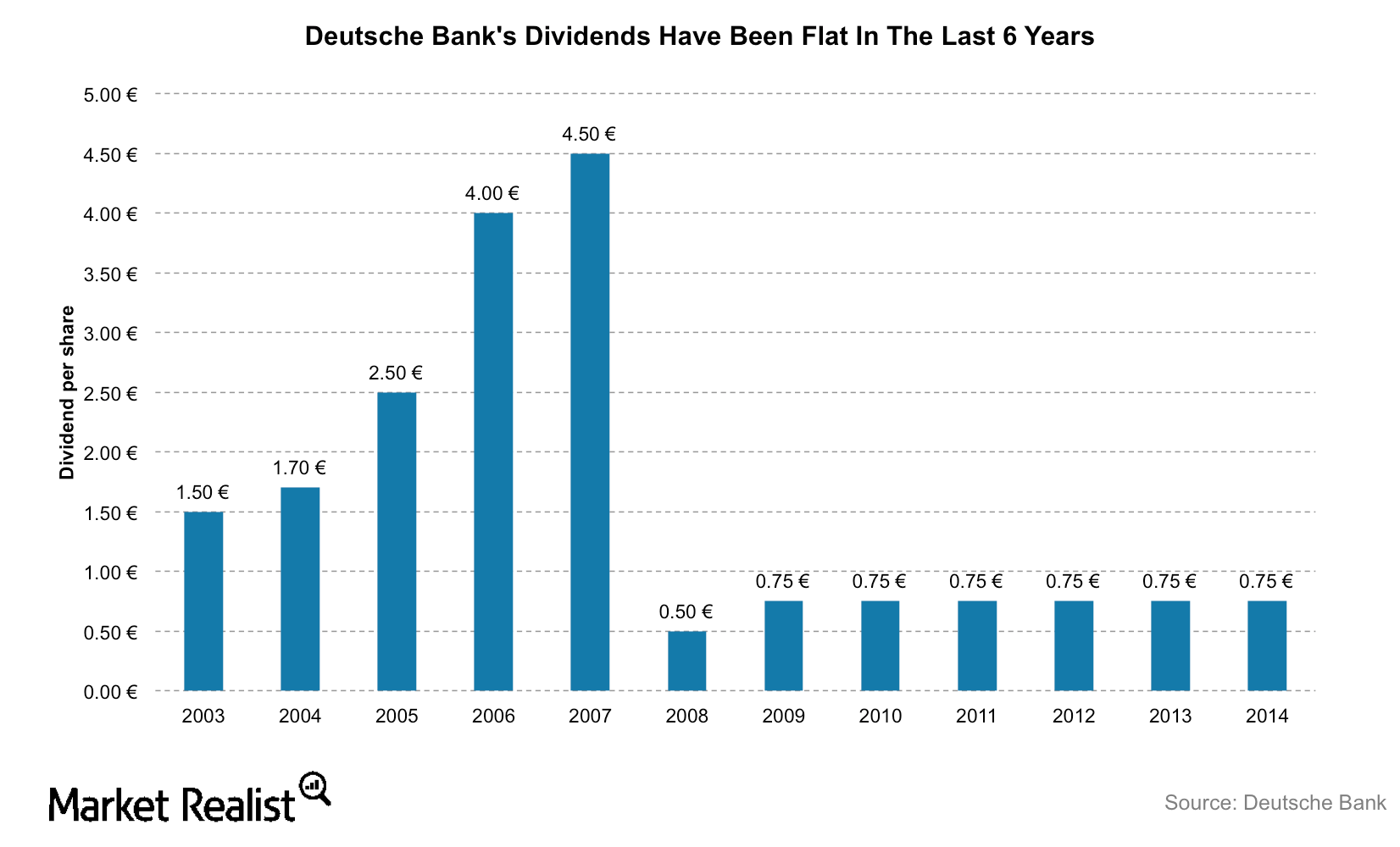

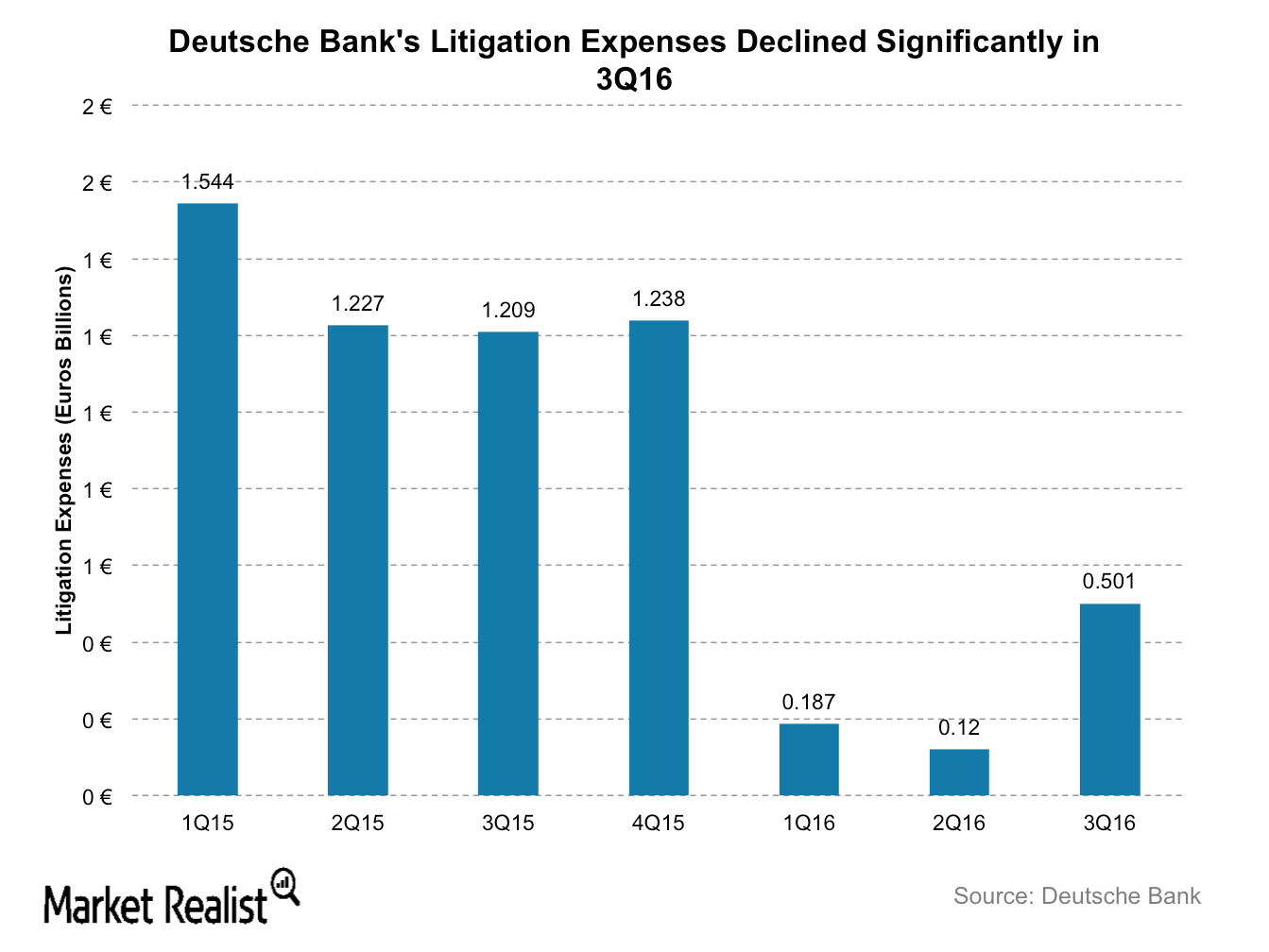

Why Deutsche Bank Scrapped Dividends in 2016

Germany-based Deutsche Bank (DB) announced plans to cut dividend payments for 2015 and 2016 as part of its plans to strengthen the bank’s capital.

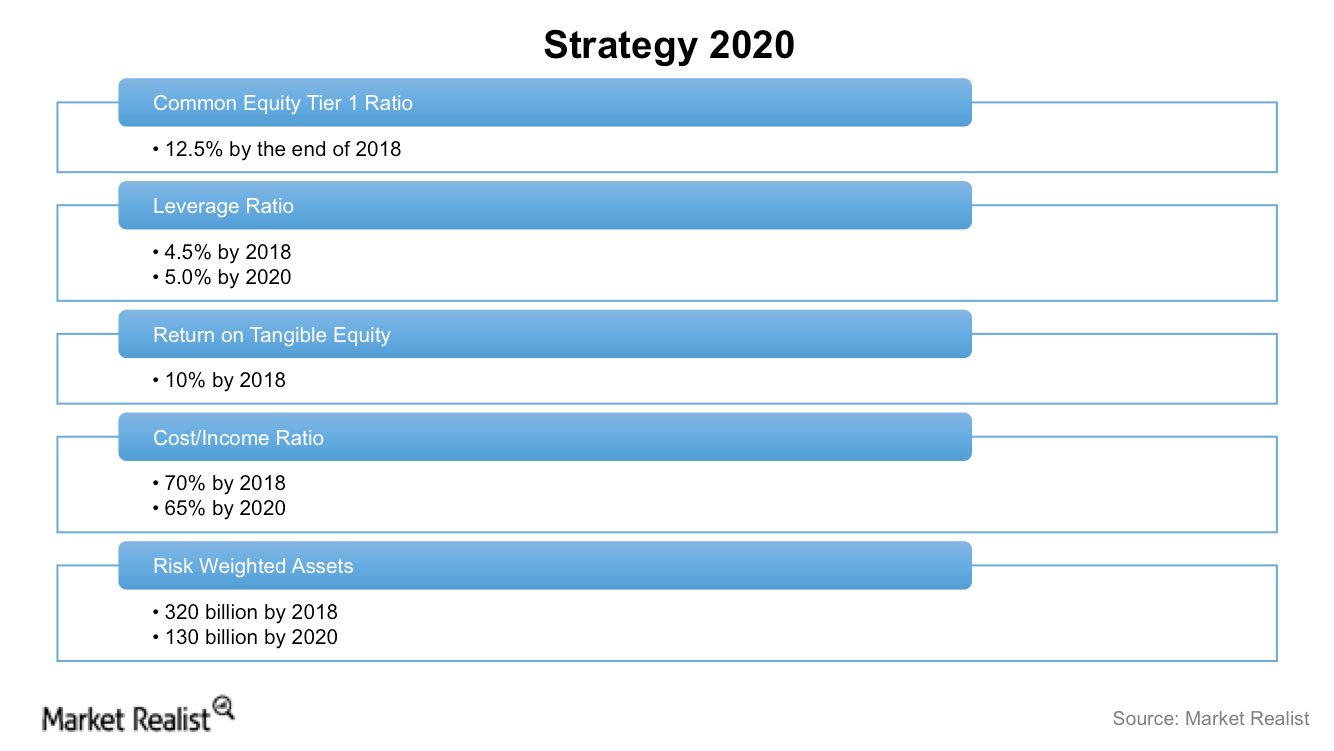

Will Deutsche Bank’s Overhaul Plan Work?

Investors who are concerned about Deutsche Bank’s bankruptcy are looking at CEO John Cryan’s plan to restructure the company’s operations.

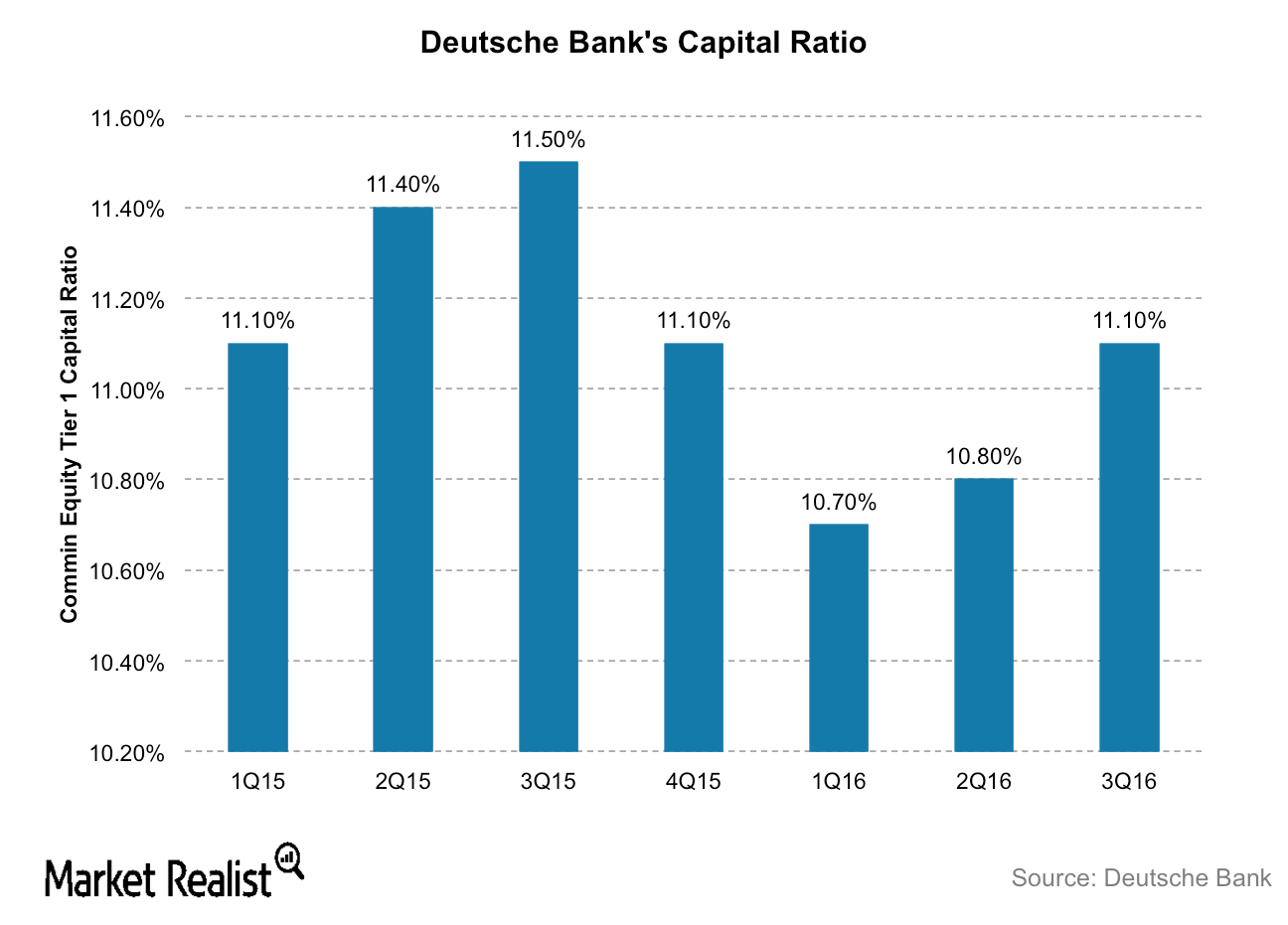

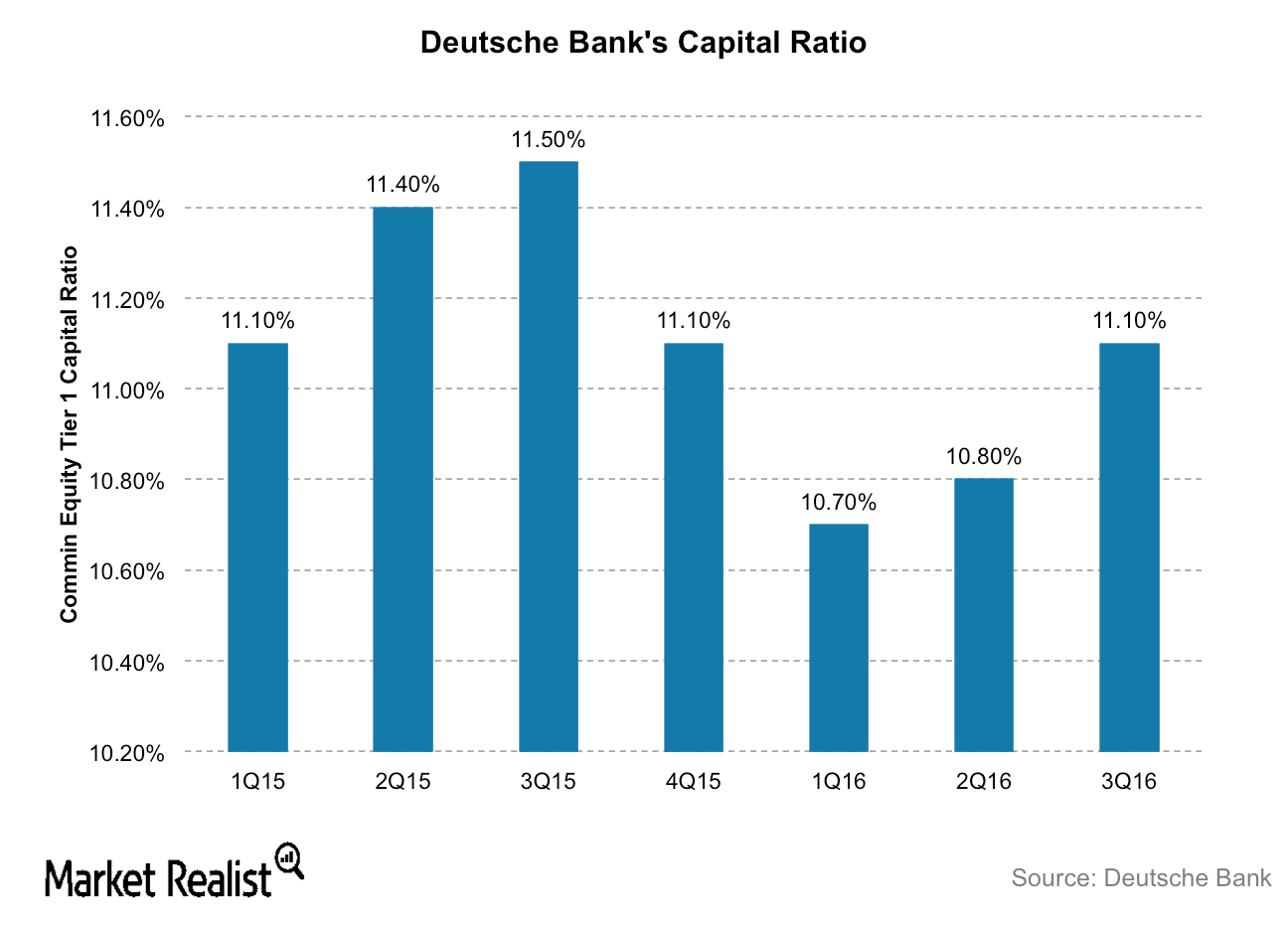

Deutsche Bank: Analyzing Its Capital Levels

Deutsche Bank is proving to be the most dangerous bank to the global economy. It failed the Fed’s 2016 stress tests in June 2016.

Can Trump Save Deutsche Bank from Bankruptcy?

Deutsche Bank could be the biggest beneficiary under Trump, having been on the brink of bankruptcy until its stock spiked nearly 20% after the election.

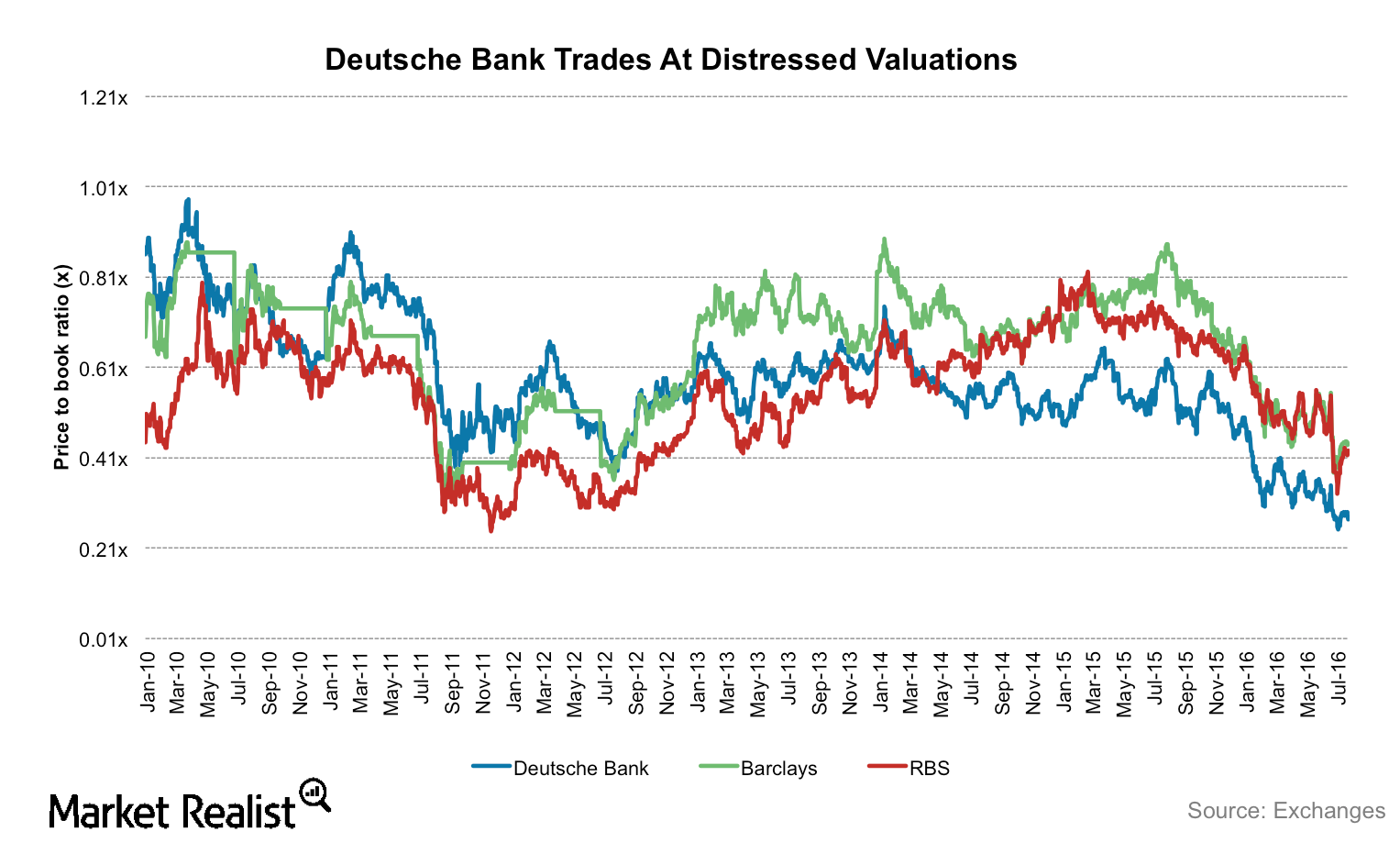

Do Distressed Valuations Offer a Good Chance to Buy Deutsche Bank?

Deutsche Bank’s (DB) shares are currently trading at distressed valuations. The bank’s shares are trading at the steepest discount to its book value, worse than the 2008 financial crisis.

Deutsche Bank’s Capital Levels Struggle to Meet Regulatory Requirements

Deutsche Bank’s stock is down nearly 40% in 2016 so far. Capital reserves are important to restore the confidence of regulators and investors.

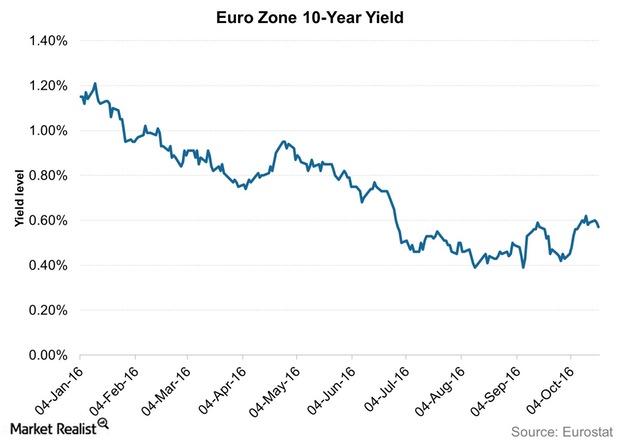

No Tapering, No Extension: ECB Avoids Future Talk on QE

ECB chief Mario Draghi had nothing to say about either tapering or extension of the bond buying program.

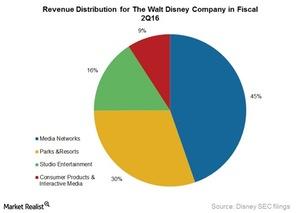

What Is Disney’s Core Strategy for Its US Theme Parks Business?

The Walt Disney Company’s (DIS) theme parks and resorts business is doing extremely well in the United States.

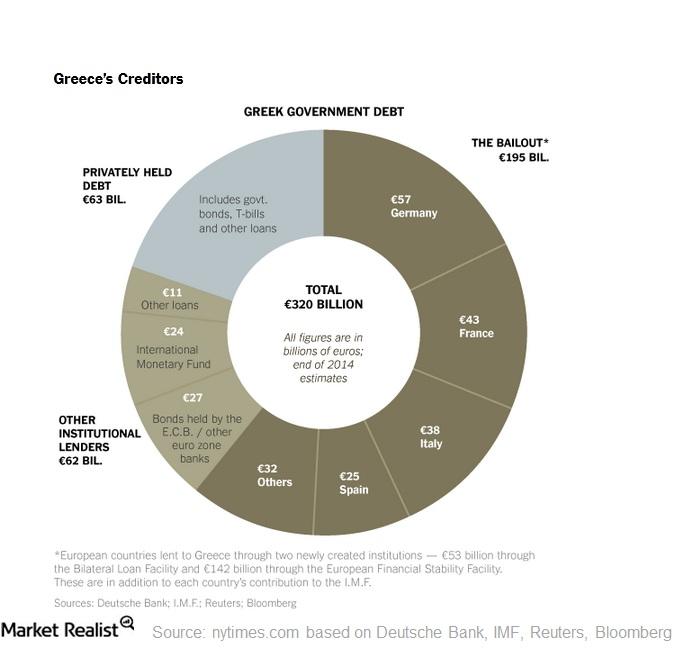

How Does the Greek Debt Crisis Impact the Eurozone?

Greece’s debt was around 250 billion euros. It’s nearly 175% of its 2013 GDP figures. The GDP could fall more in 2016. The debt crisis started in 2010.

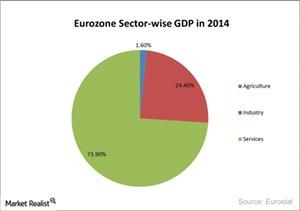

Analyzing the European Union’s GDP Composition

The EU’s (European Union) GDP (gross domestic product) depends on the service sector. The service sector contributes ~73.90% towards the EU’s (EZU) GDP.

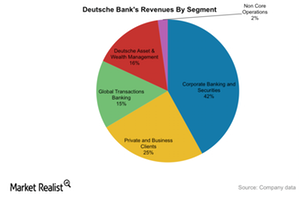

Understanding Deutsche Bank’s Segments

Deutsche Bank operates under five segments. Corporate Banking & Securities contributes 50% to Deutsche Bank’s revenues.

Analyzing US and European Banks’ Leverage Ratios

On average, European banks have higher leverage than US banks. An excess buildup of leverage increases a bank’s exposure to the risk of bankruptcy.

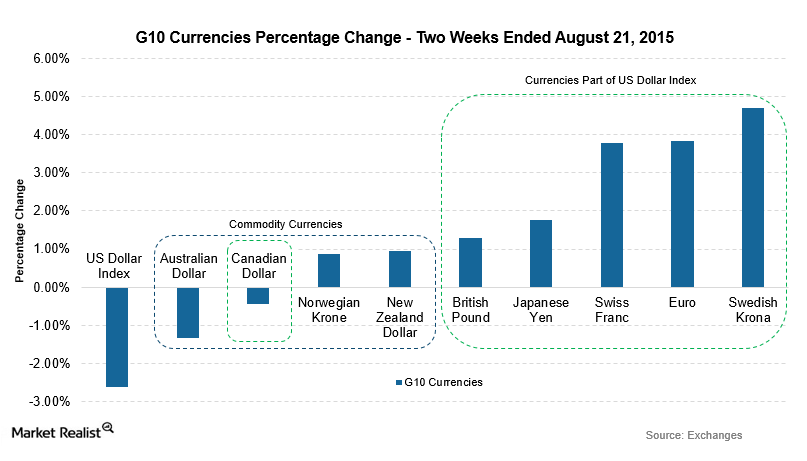

G10 Currencies Gain as US Dollar Index Sinks

The G10 currencies were impacted positively as the US dollar index dropped in value in the two weeks ending August 21, 2015.

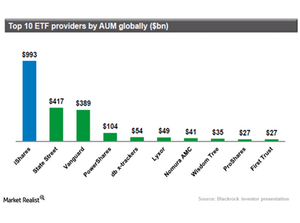

How does BlackRock compare to its peers?

How does BlackRock compare to its peers? BlackRock faces major competition from State Street and Vanguard.