Canadian Solar Inc

Latest Canadian Solar Inc News and Updates

Canadian Solar’s Competitive Advantage

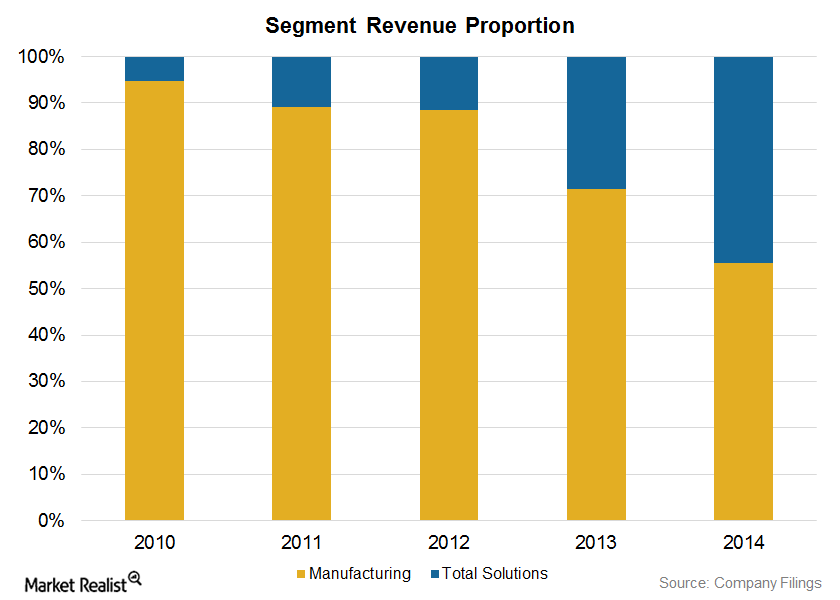

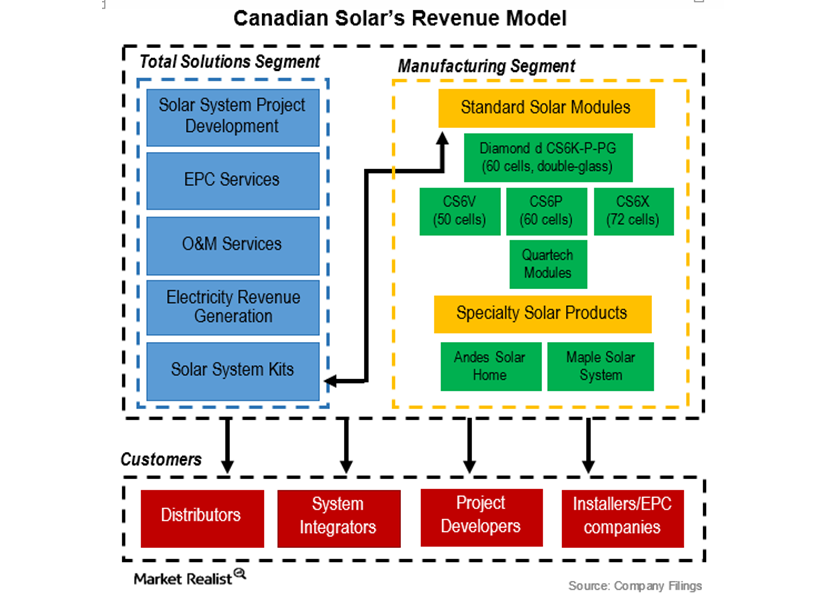

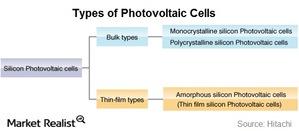

Canadian Solar (CSIQ) derives its competitive advantage from its strategic positioning in the downstream market, its broad range of crystalline silicon solar power products, and its technology.

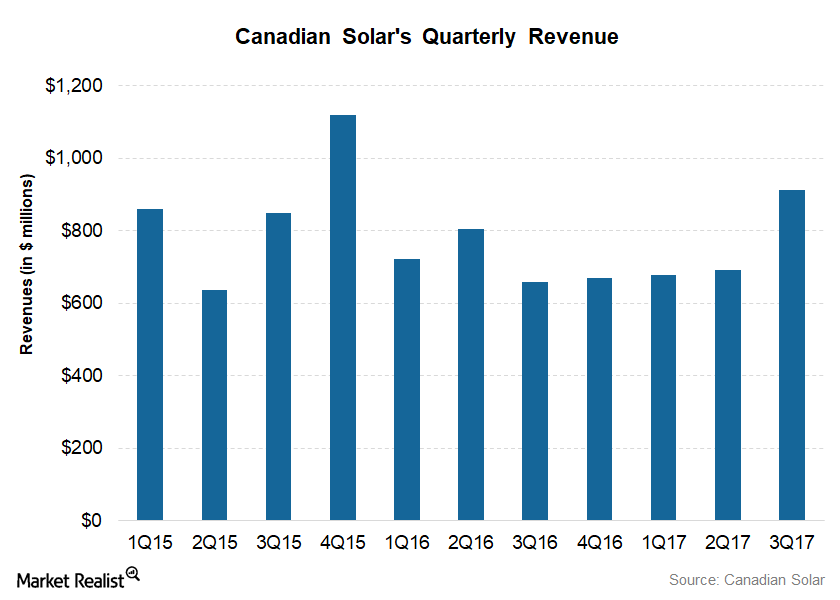

Canadian Solar Beat Analysts’ 3Q17 Revenue Estimates

Canadian Solar’s revenues from the sale of electricity in 3Q17 totaled $9.6 million, which was marginally lower than $9.8 million in 2Q17.

Understanding Canadian Solar’s Business Model

A significant proportion of Canadian Solar’s revenue comes from its top five customers, a structure that’s not uncommon in the industry.

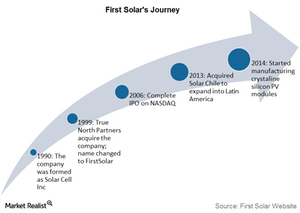

First Solar: A key player in the global solar power industry

First Solar was the first solar power company to join the S&P 500 (SPY). We’ll take a look at the company’s operations before moving on to greater details.

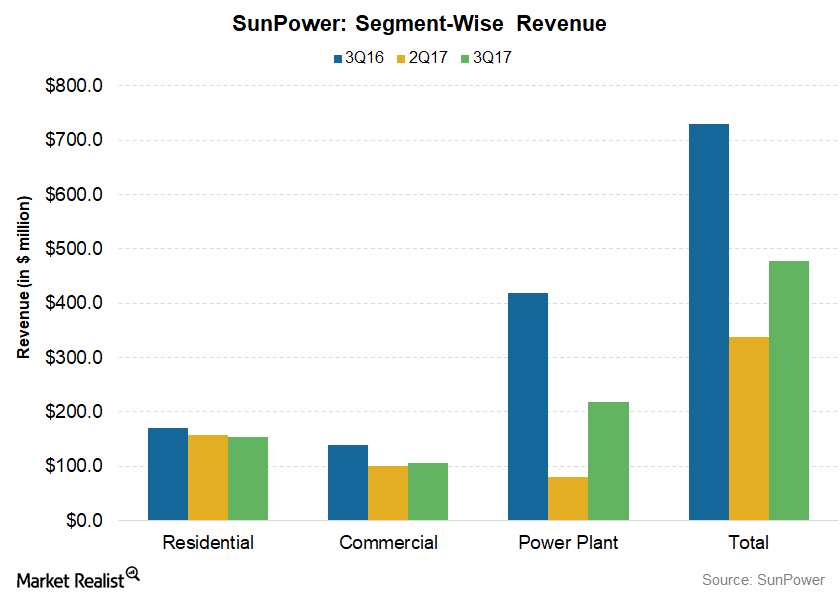

Why SunPower Reported Lower 3Q17 Revenues

SunPower (SPWR) reports its revenue under the power plant, residential, and commercial segments. The latter two segments are together called the distributed generation segments.

First Solar: A Key Player in the Global Solar Power Industry

First Solar (FSLR) produces solar energy equipment. In this series, we’ll look at its performance and the outlook for the industry.

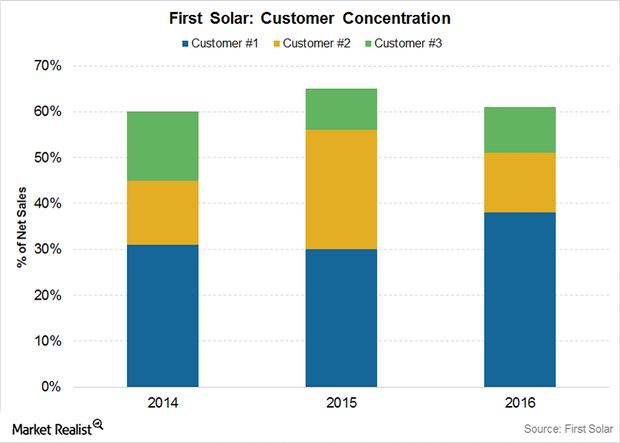

Southern and Nextera Energy: First Solar’s Key Customers

High customer concentration In 2016, First Solar (FSLR) sold solar modules to customers in the United States, India, and the United Arab Emirates. Approximately 23% of its total revenue was from third-party module sales. The majority of First Solar’s customer base is in the United States, which makes up to more than 80% of total […]

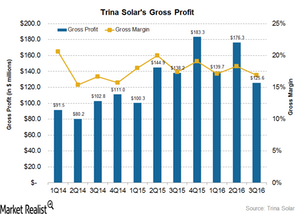

How Did Trina Solar’s Costs Affect Its Gross Margin in 3Q16?

In 3Q16, Trina Solar (TSL) reported a gross profit of $125.6 million compared to $176.3 million in 2Q16. On a YoY basis, the company’s gross profit fell nearly 9.0%.

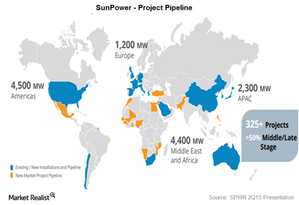

What Does the Future Hold for SunPower?

In 3Q15, SunPower (SPWR) expects to generate $400 million to $450 million in revenues and net losses of $0.50 to $0.60 per share.

SunPower’s Solar Components Business Model: How Does It Work?

SunPower uses solar cells to produce solar panels at its facilities in the Philippines, Mexico, and France. It has a total solar panel capacity of 1.7 GW.