CF Industries Holdings Inc

Latest CF Industries Holdings Inc News and Updates

Why Have Mosaic’s Potash Shipments Declined?

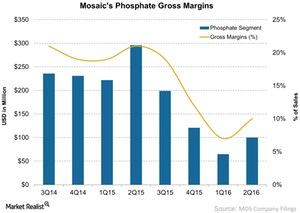

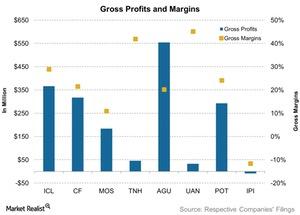

The gross margin rate for Mosaic’s Phosphate segment fell significantly in 2Q16, to 10% from 21% in 2Q15.

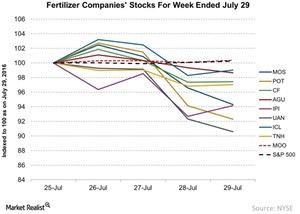

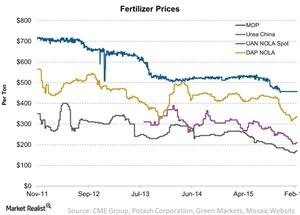

Which Fertilizer Stock Was the Top Loser Due to Price Movements?

Fertilizer prices are one of the key drivers for fertilizer stocks. So investors and analysts watch fertilizer prices closely.

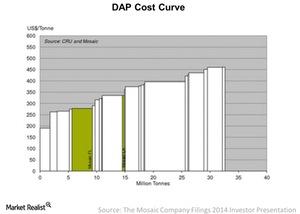

How DAP- and MAP-Producing Countries Stack Up on the Cost Curve

In 2014, the cost of production for DAP per ton ranged from $190 to $450 per metric ton, as we can see in the chart.

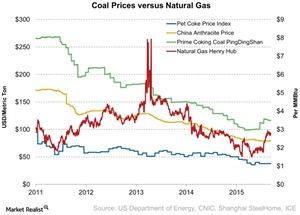

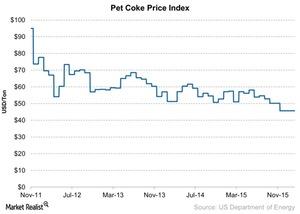

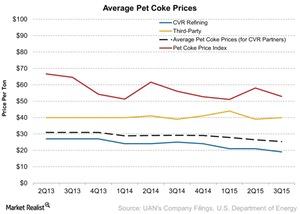

How Are Pet Coke, Coal, and Natural Gas Prices Trending?

The petroleum (or pet) coke index remained unchanged from the previous week during the week ending July 22, 2016.

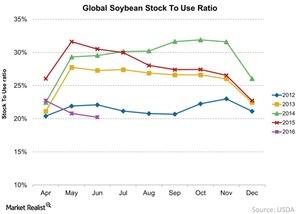

What Could Explain Soybeans’ Low Stock-to-Use Ratio?

In June 2016, the global soybean stock-to-use ratio stood at 20.2%, which was at its lowest point compared to the past four years.

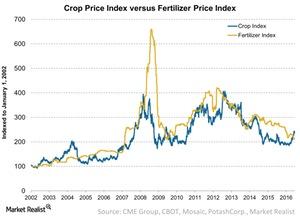

Agricultural Chemical Companies: Crop and Fertilizer Price Impact

Investors in the fertilizer industry (XLB) must actively track the relationship between crop prices and fertilizer prices. This, in turn, impacts agricultural chemical companies.

How Fertilizer Companies’ Gross Margins Were Pressured in 1Q16

The fertilizer industry moves in cycles and with most companies experiencing a decline in margins, the industry seems to be in the bottom cycle.

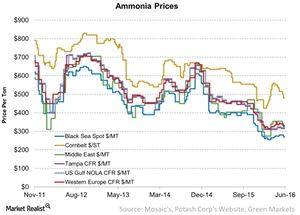

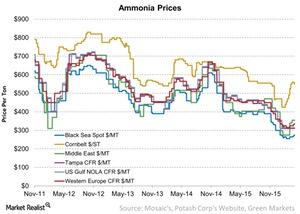

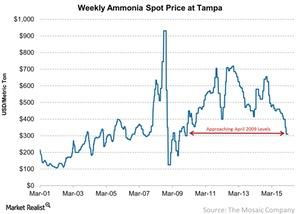

How Did Ammonia Prices Move Last Week?

Last week, nitrogen producers CF Industries (CF), CVR Partners (UAN), Terra Nitrogen (TNH), and PotashCorp (POT) ended in the red.

Urea Prices: Still a Concern for Nitrogen Fertilizer Stocks

As most global ammonia production is upgrading to urea, ammonia prices may affect urea prices.

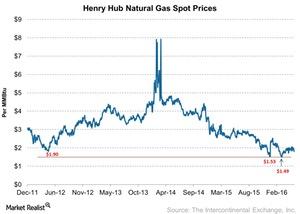

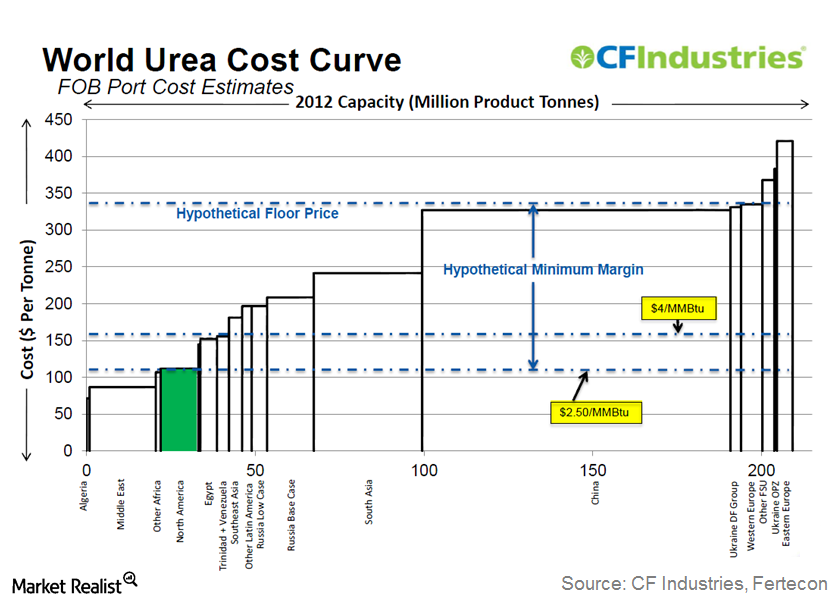

How Do Natural Gas Price Forecasts Impact Fertilizer Companies?

Natural gas is the key raw material for the production of nitrogen fertilizers such as ammonia and urea.

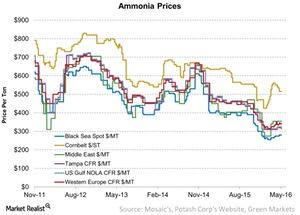

How Did Ammonia Prices Trend Last Week?

Ammonia prices for Tampa CFR (cost and freight) moved down 1.6% to $315 per metric ton compared to $320 per metric ton in the previous week.

Ammonia Prices in the International Market Inch Up

In the international market, ammonia at the Black Sea, Ukraine, inched up to $275 per metric ton FOB, a rise of 1.9% from the previous week.

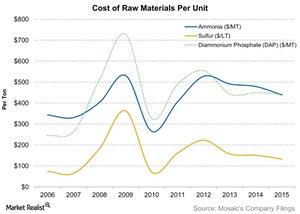

How Has Mosaic Done in Terms of Raw Material Costs?

Mosaic purchases certain raw materials at fixed costs to be consumed over time, but the selling prices of its finished goods can fluctuate rapidly.

Ammonia Prices Fell Slightly from the Previous Week

Ammonia was trading at $310 per metric ton as of the week ending March 4, 2016. It fell $1 from the previous week ending February 26, 2016.

An Update on NPK Fertilizer Price Trends

Fertilizer prices have fallen significantly over the years. But more recently, prices are showing a trend reversal for urea, UAN, and phosphate fertilizer.

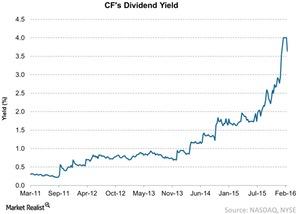

Checking in with CF Industries’ Dividend Yield

As of February 19, CF Industries pays a quarterly dividend of $0.3 per share. In 2015, it paid an annual dividend per share of $3.6—down from $5 in 2014.

What’s Happening to Pet Coke Prices?

Coal, or petroleum coke, is widely used by nitrogen fertilizers producers in China. Declining coal prices negatively impact natural gas-based producers.

The Prevalent Price of Potash in 2016

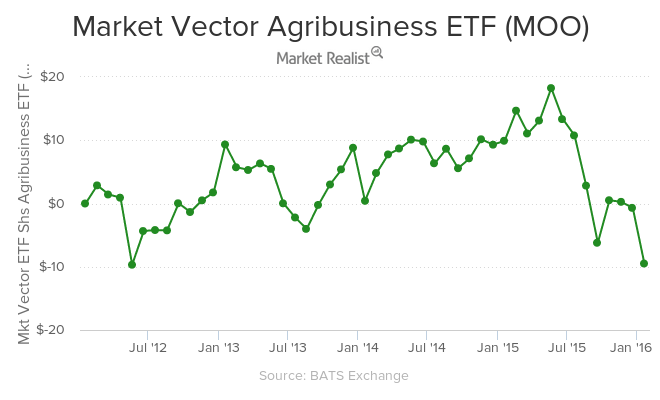

As of January 19, 2016, the VanEck Vectors Agribusiness ETF (MOO) returned -12.7% in 2015. YTD as of January 19, the ETF is down by 8%.

How CVR Partners Benefits from Pet Coke Prices

Unlike other companies, CVR Partners (UAN) uses petroleum coke, or pet coke, to produce nitrogen fertilizers.

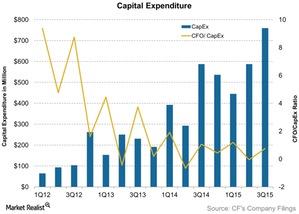

What is CF Industries’ Capital Expenditures Ratio Telling Us?

CF Industries’ cash flow to capital expenditure ratio has been falling. CF Industries’ cash flow to capital expenditure ratio stands at 0.75 as of 3Q15.

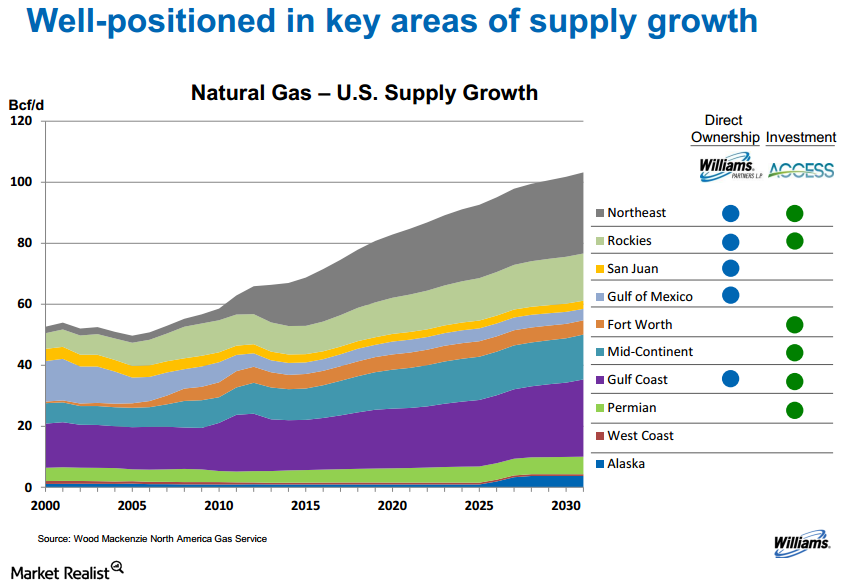

Why Third Point initiated a position in Williams Companies

Third Point started a new 2.83% position in gas pipeline operator Williams Companies, Inc.

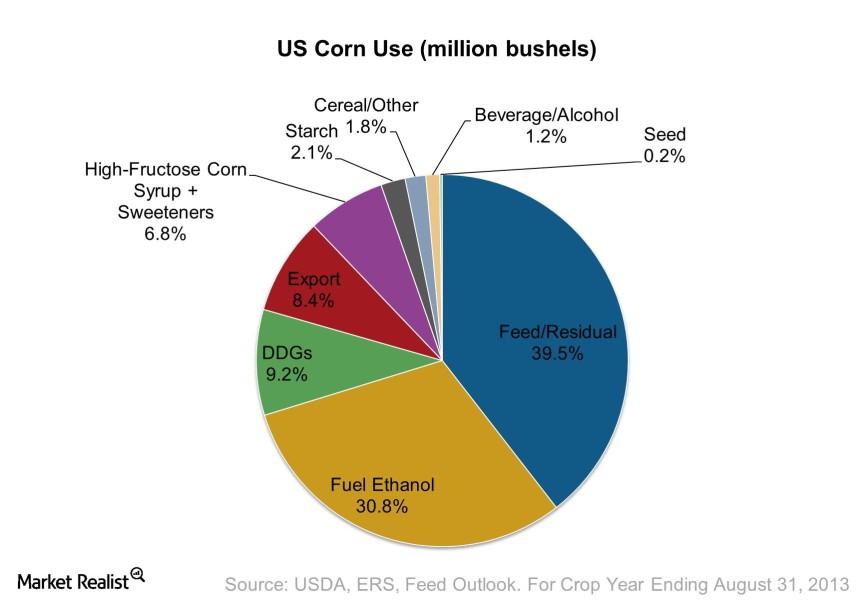

Why the average American uses more than 4 ears of corn per day

The United States is the biggest user of corn, consuming 265 million mt (metric tonnes) of corn in 2012—equivalent to 26% of global consumption.

Overview: The key factors that drive ammonia and urea prices

In this series, we’ll cover how costs in the United States, China, and Europe influence nitrogenous fertilizer prices along with other factors.