American Water Works Co Inc

Latest American Water Works Co Inc News and Updates

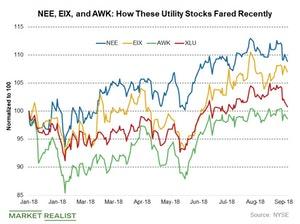

Highest Dividend Growth: Comparing NEE, EIX, and AWK

Utilities have been weak compared to the broader markets this year largely due to the strength in the Treasury yields.

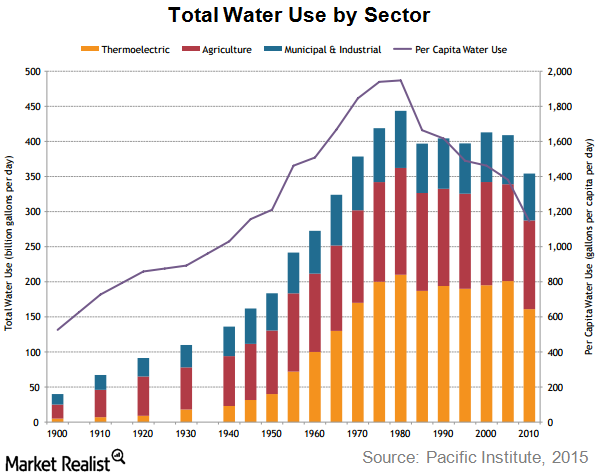

What Does Declining Water Usage Mean for Water Utilities?

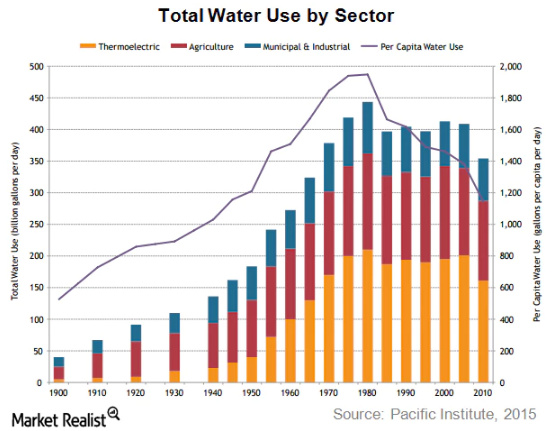

Increasing efficiency with water has been a major reason behind falling water usage. Between 2005 and 2010, total water usage in the US fell by ~13%.

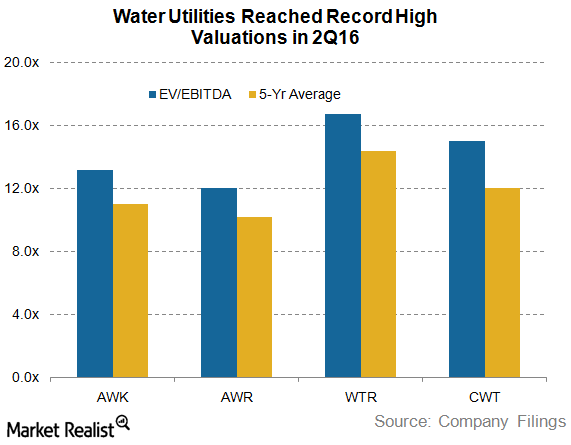

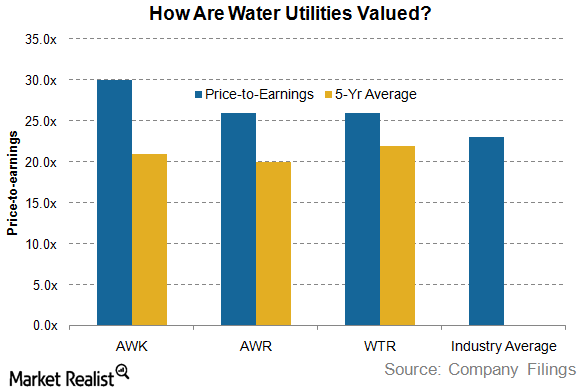

What Do Overvalued Water Utilities Indicate?

Given the sharp rally during the past six months, major water utilities are trading at huge premiums compared to their historical valuation multiples.

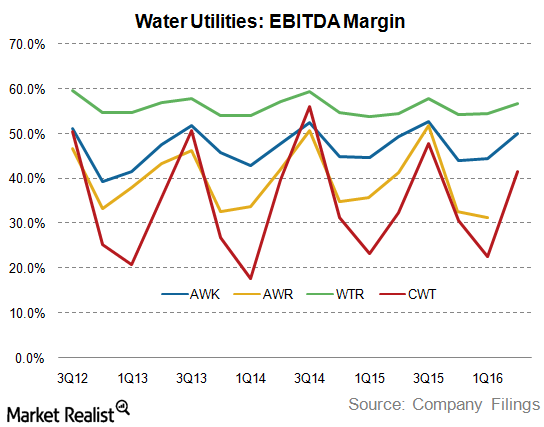

Behind the Earnings of US Water Utilities in 2016

US water utilities have experienced a cyclical but flat earnings growth pattern in the past couple of years.

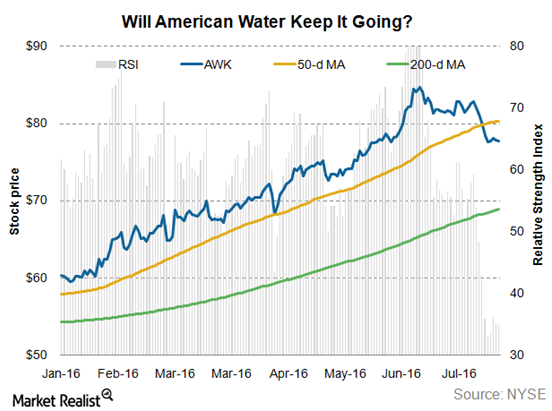

What’s ahead for American Water Works Stock?

American Water Works’ investors are likely concerned by the fact that the stock has corrected by ~12% since July 2016. But it has rallied by ~40% YTD.

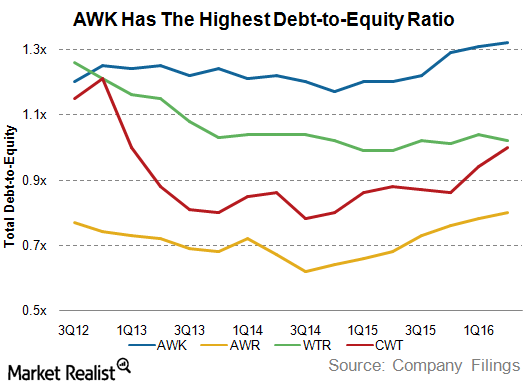

What Does American Water Works’ Leverage Indicate?

American Water Works’ debt-to-equity ratio has stayed in the range of 1.2x–1.4x. Stable debt-to-equity is usually considered a sign of financial discipline.

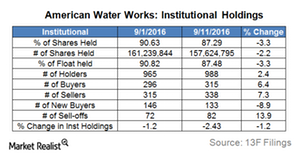

What Are Institutional Investors Doing with American Water Works Holdings?

Institutional investors have decreased their positions in American Water Works (AWK) in the past couple of months.

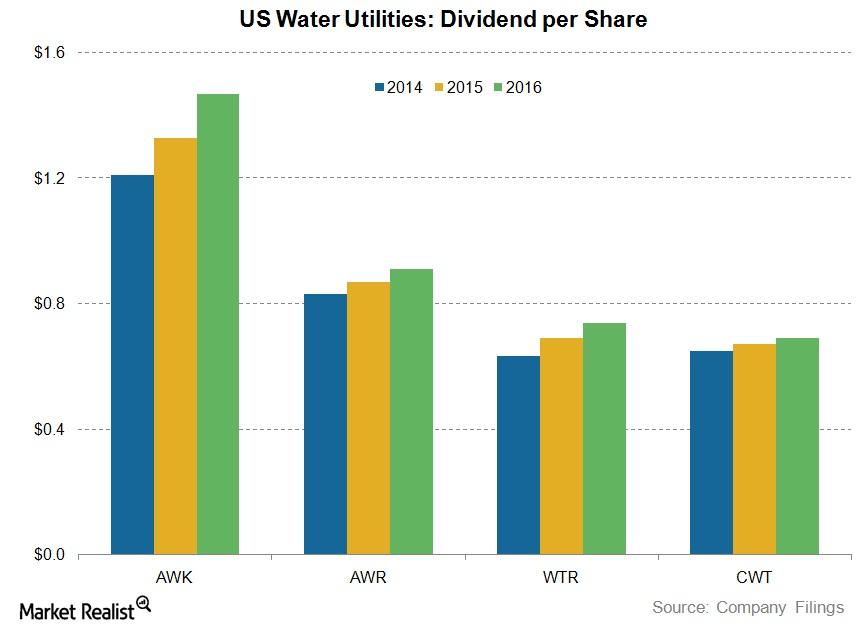

Inside Water Utilities’ Historical Dividends and Growth

US water utilities have distributed fair dividends for the past few years American Water Works’ dividend growth during the past five years stands at 10%.

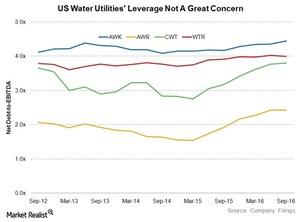

How Is American Water Works’ Leverage Compared to Peers?

Water utilities depend heavily on debt financing due to their capital projects for the longer term, and so company leverages can be useful for investors.

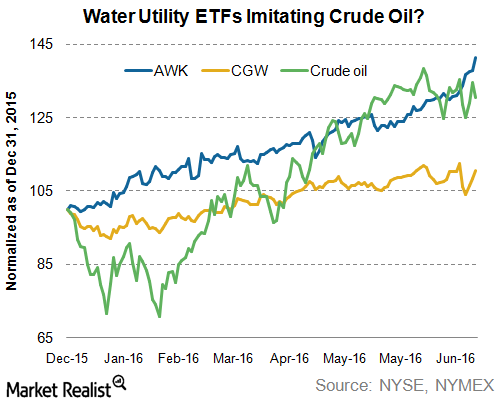

What Does the Correlation between Water Utilities and Crude Oil Mean?

Investors may find water utilities attractive due to their yields and stable earnings growth. However, they may not be as safe as they seem.

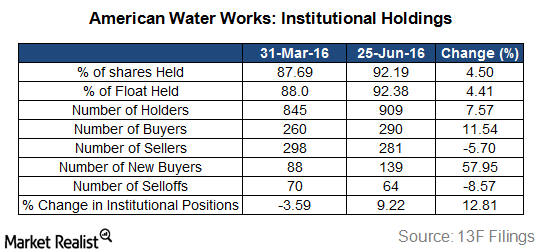

What Do Institutional Investors Think about American Water Works?

Institutional investors increased their positions in American Water Works (AWK) in 2Q16 as compared to where they stood on March 31, 2016.

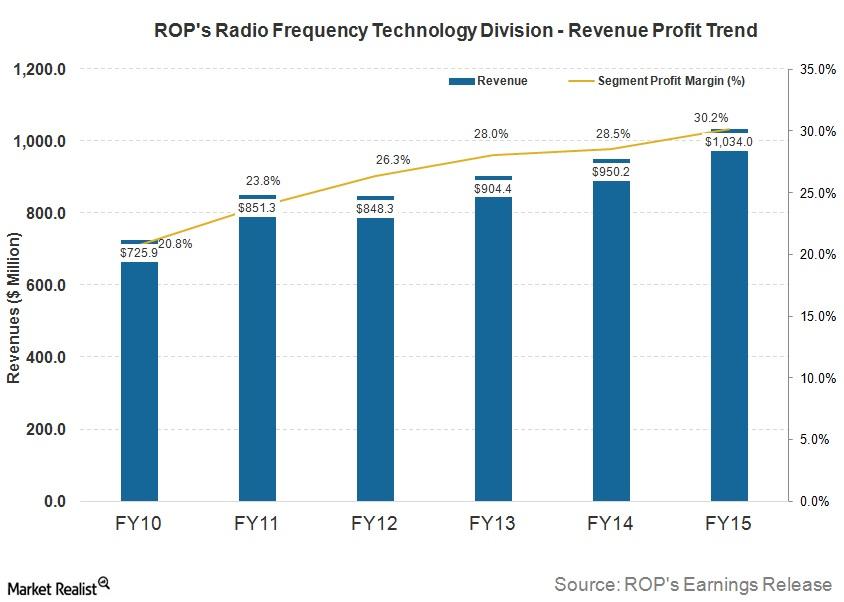

ROP’s Second-Largest Segment: Radio Frequency Technology

In 2015, ROP’s Radio Frequency Technology segment contributed ~28.9% to its total consolidated revenue and ~30.4% to its consolidated operating profit

Are US Water Utilities Fairly Valued?

It seems that US water utilities are trading at a premium compared electric utilities.

What Does Falling Water Usage Mean for Water Utilities?

According to data released by the United States Geological Survey (or USGS), national water usage experienced a sharp drop between 2005 and 2010.

Roper Technologies: Recent Acquisitions That Count

Since its inception, Roper Technologies (ROP) has followed an acquisition-based growth strategy. The company has acquired over 50 companies since 1981.

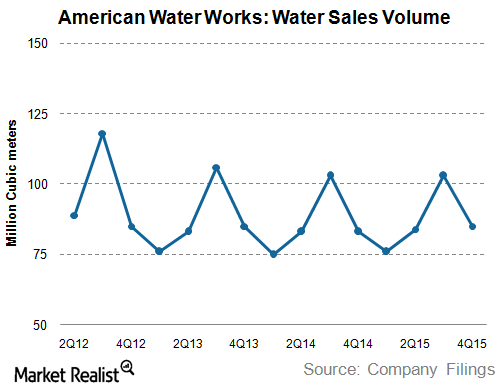

How Are American Water Works’ Sales Volumes Trending?

American Water Works (AWK) witnessed a sharp decline in its water sales volumes after 2010 despite a population increase and economic growth.