What to Know if the Infrastructure Bill’s Crypto Tax Worries You

When the infrastructure bill’s crypto tax takes effect, the IRS will gain more insight into your trading activities.

Nov. 10 2021, Published 8:22 a.m. ET

The crypto community tried but failed to get Congress to amend certain tax rules in the infrastructure bill. The House went on to pass the bill and send it to Joe Biden for signing on Nov. 5, 2021, with all the worrying tax provisions. When does the infrastructure bill’s crypto tax take effect?

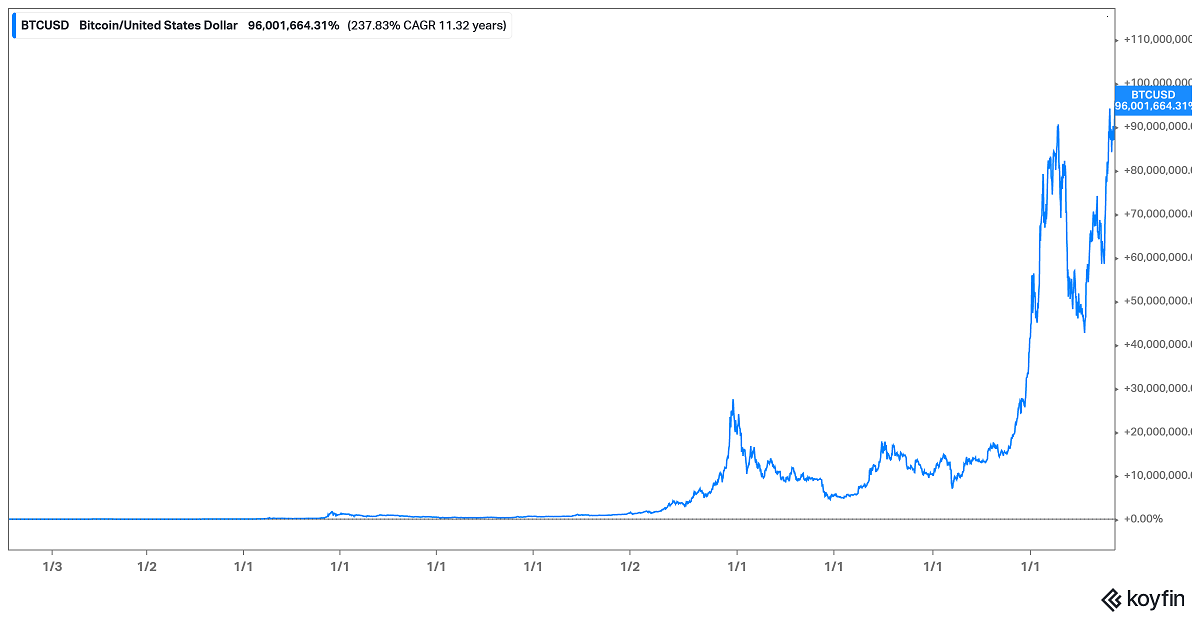

Bitcoin's, Ethereum's, Livepeer's, and Shiba Inu's surges to record highs have made people rich quickly. For many, crypto trading has become an important source of income after stimulus checks stopped and inflation is rattling households. Others hope crypto profits can help them tackle student loan debt.

Do you have to pay taxes on every crypto trade?

The IRS treats crypto as capital assets for tax purposes, just like stocks or real estate. It requires crypto exchanges to report their clients’ trading activities. If you made a profit from a Bitcoin trade, for example, the IRS requires that you pay a capital gain tax. The rate varies depending on the profit and the duration of the investment. The infrastructure bill, which proposes more tax reporting requirements for crypto transactions, could see the IRS capture more of people’s profits.

Can you avoid paying crypto taxes?

Breaking tax rules can have severe consequences. Even missing a tax filing deadline when a tax refund isn’t due can expose you to heavy fines. However, there are ways you can legally avoid paying crypto taxes or at least minimize your tax burden.

If you don’t sell your crypto assets, you don’t have to pay taxes on them, and you owe no taxes if your investment turns up a loss. You can reduce your crypto tax liability by holding the investment for a long time. For example, profits made from an investment held for less than one year can be taxed at a rate as high as 37 percent. But profits from investments held for more than one year are subject to a maximum tax of 20 percent.

What are the infrastructure bill’s crypto tax requirements?

Biden’s $1.2 trillion infrastructure spending plan targets transport, internet, and utility systems for upgrades. The White House expects to fund the infrastructure programs partly with money raised from taxing crypto investments. The estimate is that crypto tax could raise as much as $28 billion in 10 years.

To get that money, the bill proposes treating most participants in the crypto transaction chain as brokers. As a result, they will be required to report their clients’ activities to the IRS, and that could bring the agency more tax revenue opportunities. Additionally, the bill proposes a requirement that crypto transactions worth more than $10,000 are reported to the IRS. Breaking the proposed crypto tax rules could be treated as a felony.

The crypto community denounced the bill, with some seeing it as posing an existential threat to the nascent crypto sector. There are concerns the bill’s proposal will increase the tax burden for crypto miners, DeFi apps developers, and crypto wallet providers.

When does infrastructure bill’s crypto tax take effect?

The crypto tax rules in the infrastructure bill will take effect in 2024. Once the bill becomes law, the IRS will need time to outline the rules. The agency will need to define which crypto participants it will treat as brokers and subject to the reporting requirements. Concerns over the bill’s impact on traders’ profits have some investors considering moving to countries where crypto isn’t taxed.

The crypto community plans to continue fighting the provisions of the bill. In addition to lobbying the IRS to soften the reporting requirements when drafting the rules, they may move the battle to the courts. Additionally, the crypto community sees hope in Congress easing the crypto tax burden in the infrastructure bill through standalone legislation. A number of lawmakers understand that the crypto tax provisions in the bill need adjustments.