Where Is Crypto Not Taxed? Go to One of These Six Countries

As the IRS seeks to raise more money to fund the U.S. government’s expanding budget, where isn't crypto taxed?

Oct. 28 2021, Published 2:43 p.m. ET

People are getting rich with cryptocurrencies, but the IRS isn’t allowing them to keep all the profits. That might be a setback for many people at a time when jobless benefits have stopped, inflation is ratting households with soaring product prices, and there's student loans debt to tackle. It isn't a surprise that many investors want to move where crypto isn't taxed.

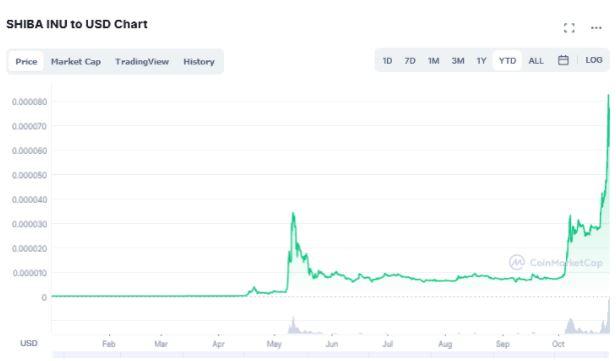

Crypto investing has proved to be a smart way for people to make quick money. For example, after Shiba Inu's price skyrocketed following its Coinbase listing and amid Robinhood listing hopes, an investment of only $100 in the meme crypto turned into more than $100 million in less than a year. With that kind of quick profit, it wouldn’t hurt to give the IRS its cut.

However, if you aren't making huge profits and struggling to get by, taxes might be a great inconvenience even though it’s your duty to contribute to funding government programs.

How to avoid crypto taxes

As government spending expands, the IRS might seek a greater cut of your investment gains. In the U.S., Bitcoin, Ethereum, Dogecoin, and other cryptocurrencies are regarded as capital assets for tax purposes. Therefore, profit from crypto investments is subject to capital gain tax just like stocks or real estate property. You can avoid the capital tax as long as you don’t sell the asset.

Also, you aren't liable for tax if you investment turned up a loss. You can avoid paying more in taxes if you wait a long time before booking a profit from your crypto investment.

If you made your profit in less than one year, the tax rate could be as high as 37 percent. But if you held your crypto investment for more than one year before taking a profit, the maximum tax rate is 20 percent.

The IRS requires crypto exchanges to report clients’ gains and losses. Therefore, the agency expects to see your crypto trading activities in your tax returns. And you have to file the returns before the deadline or face severe consequences. The IRS has been ramping up its crackdown on crypto tax cheats.

Where is crypto not taxed?

There are many examples of companies that shifted their corporate residence to low-tax countries. Some companies have used the tax maneuver to allow them to retain more money to expand their operations quickly or fund innovation. If you want to do more crypto investing but you're concerned about the IRS, there are crypto tax havens that you could move to if that makes sense. Below are some of the countries where crypto gains are tax-free.

El Salvador

Germany

Portugal

Belarus

Singapore

Malta

El Salvador made history as the first country to adopt Bitcoin as legal tender. It has only invested in the flagship crypto for its treasury and aims to become a crypto mining hub. The government is trying hard to attract foreign investors to the crypto sector. As part of the efforts to grow its crypto sector, El Salvador decided to make Bitcoin gains tax-free for foreign investors.

In Germany, individuals can pocket all of their crypto profits without worrying about taxes as long as the investment is held for longer than one year. But even for crypto gains realized in less than a year, taxes apply only on amounts that exceed 600 euros ($700).

Bitcoin profits from individual trades are tax-free in Portugal. In Belarus, individuals and businesses are enjoying crypto tax breaks until at least 2023.

Many countries have chosen not to burden crypto investors with taxes to see how the nascent industry develops and innovates. Perhaps the hope is that if left alone for now, the crypto sector could become a more lucrative tax base in the future. There is a lesson here. Light regulations allowed the tech sector to flourish for many years. Now, tech companies contribute huge amounts in taxes to governments in addition to offering many jobs.