Will a WallStreetBets Short Squeeze Save RKT Stock?

What’s Rocket Companies (RKT) short interest telling us? Is RKT stock the next short squeeze target for WallStreetBets?

May 6 2021, Published 12:34 p.m. ET

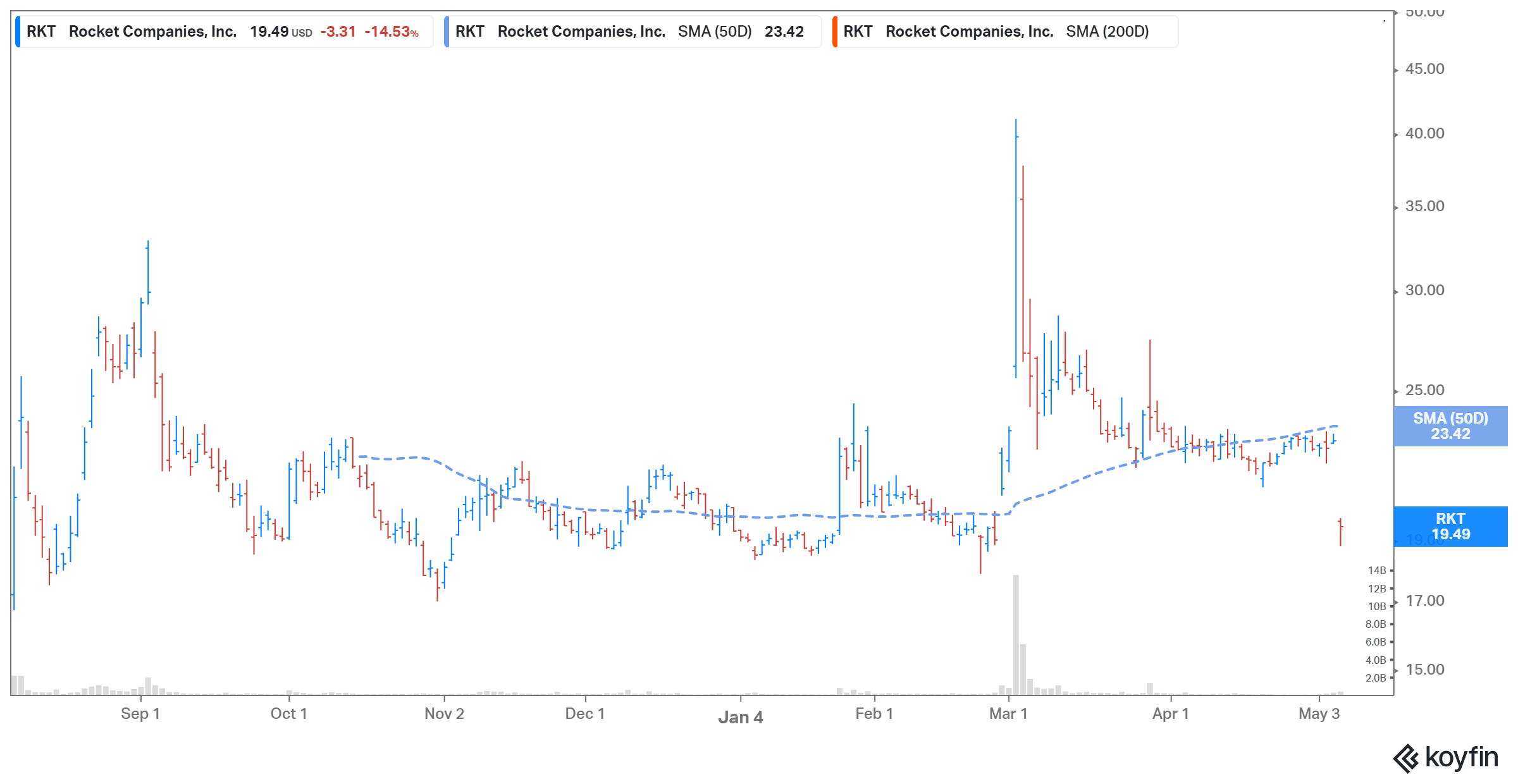

On May 6, Rocket Companies (RKT) stock fell more than 17 percent after the company reported its first-quarter earnings results. Investors were disappointed because the mortgage company reported larger-than-expected net losses in the quarter. RKT stock has pulled back 55.8 percent from its 52-week high. Is RKT stock the next short squeeze target for retail investors on WallStreetBets?

RKT stock has been very volatile in 2021. It hit a 52-week high of $43 in March amid the social media-driven pump. However, the stock has fallen since then and is down 6 percent YTD.

Rocket Companies' Q1 2021 earnings

Rocket Companies reported an adjusted EPS of $0.89, which missed analysts’ average estimate of $0.90. However, on the positive side, the company generated adjusted revenue of $4.0 billion in the first quarter, which marked a 91 percent rise YoY. The mortgage company beat analysts’ average sales estimate of $3.97 billion.

Rocket Companies reported strong loan origination volumes and wide margins. In the first quarter, the company's closed loan origination volumes grew 100 percent YoY to $103.5 billion, which beat its guidance of $98 billion–$103 billion. Its net rate lock volumes were also up by 70 percent YoY to $95.1 billion, which beat its guidance of $88 billion–$95 billion.

RKT Stock Price

RKT stock has low short interest

RKT’s short interest has decreased consistently over the last few weeks. According to Koyfin, RKT’s short interest as a percentage of outstanding shares fell to 7.4 percent on May 5 from 18.6 percent on April 5. The ratio surged to 37.4 percent on March 5.

On May 5, nearly 10.0 million RKT shares were shorted, compared to 21 million on April 5. Meanwhile, RKT’s short volume ratio increased to 18.3 percent on May 5 from 12.3 percent on April 30.

Will WallStreetBets target RKT stock again?

RKT has been a major topic of discussion on Reddit's WallStreetBets group, which initiated the GameStop and AMC Entertainment short squeezes. Most of the Reddit discussion insists that RKT stock is significantly undervalued and that the stock has strong support at $18.

RKT stock hit $43 on March 2, but it's worth noting that this surge was mostly driven by Reddit traders. The stock fell significantly after the burst of euphoria, which is normal in short squeezes.

A short squeeze isn’t possible in RKT stock.

With a low short interest ratio, RKT stock isn’t a likely short-squeeze candidate in the fintech sector. Usually, a short interest ratio of more than 10 percent is seen as high by traders.

RKT stock looks like a good buy.

RKT stock looks like a good buy based on the growth outlook and strong fundamentals. The stock is trading at a forward PE ratio of 8.47x, compared to the industry’s average forward PE ratio of 31.96x. This indicates that RKT stock is significantly undervalued. Analysts' average price forecast suggests RKT stock has a 30 percent upside potential.

Rocket Companies has guided for its second-quarter closed loan volume to come between $82.5 billion and $87.5 billion. The company also guided for a net rate lock volume in the range of $81.5 billion–$88.5 billion. Its ability to capture market share is expected to remain strong in 2021.