What Are Recession-Proof Stocks and Should You Buy Them in 2022?

Some analysts advise buying “recession-proof” stocks. What are recession-proof stocks and should buy them in 2022? Here's what investors can expect.

June 24 2022, Published 8:19 a.m. ET

Many brokerages including Wells Fargo, Goldman Sachs, Deutsche Bank, and Citigroup have raised their odds of a recession in the U.S. Slowing consumer demand and rising rates are making many analysts bearish on the outlook for U.S. stocks, and many advise buying “recession-proof” stocks. What are recession-proof stocks and should buy them in 2022 amid deteriorating economic conditions?

U.S. stock markets have been volatile in 2022. Earlier in June, the stocks hit their lowest level for the year. The stocks have since recovered somewhat but are still down by double digits. The sell-off in growth, cyclical, and consumer discretionary stocks has been even more severe.

What are recession-proof stocks?

At the first glance, the term "recession-proof stock" might sound like an oxymoron. The word "recession" has negative connotations for most people and stock markets invariably plunge during a recession. As people cut down on spending, both voluntarily and due to a loss of income, most sectors of the economy witnessed a downturn. Also, stocks see a derating of their valuation multiples during a recession.

Buying recession-proof stocks might make sense in 2022.

That said, during a recession, while the economy shrinks, it doesn't come to a standstill. People still spend on essential goods. While defensive stocks might not deliver super high returns during boom times, they tend to outperform in a recession, both on a relative as well as an absolute basis.

To be sure, a recession isn't imminent and JPMorgan Chase believes that recession fears are overblown and expects U.S. stock to rebound in the second half of the year. However, the overall economic environment looks uncertain, and especially if you're a risk-averse investor, it might make sense to shift some money into recession-proof stocks.

Wells Fargo listed its recession portfolio.

Ahead of the Federal Reserve’s June meeting where the U.S. central bank raised rates by 75 basis points, Wells Fargo outlined its “Recession Portfolio.” The portfolio has some of the usual names like Coca-Cola, McDonald’s, PepsiCo, Verizon, and Johnson & Johnson.

Wells Fargo also listed Berkshire Hathaway along with stocks like Chevron, Duke Products, IBM, and Realty Income in its recession portfolio.

Morgan Stanley released its recession-proof stock list.

Morgan Stanley listed Coca-Cola, Eli Lilly, Marathon Petroleum, Delta Air Lines, Endeavour, and Liberty Formula One as recession-proof stocks. The list has some surprise names like Delta Air Lines. The stock is in the red this year and airline stocks generally see a fall in business during a recession as people cut back on air travel.

Here are six recession-proof stocks to buy in 2022.

In the consumer space, Coca-Cola and PepsiCo look like good bets. The demand for their products isn't impacted much by a recession. Both of these stocks also have a good dividend yield and trade at reasonable valuations.

Healthcare and pharma companies can also be a good bet. Eli Lilly, Johnson & Johnson, and GlaxoSmithKline look like good bets. Johnson & Johnson and GlaxoSmithKline are splitting their consumer products from the pharma business, which will help unlock value.

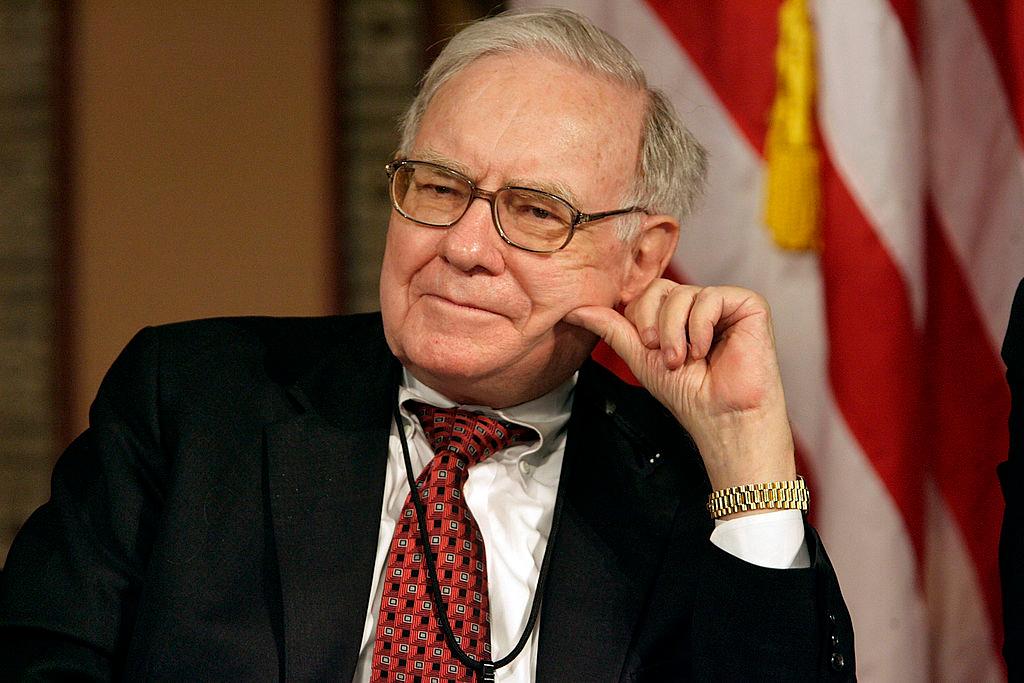

Berkshire Hathaway is another stock worth considering for a recession portfolio. While the company’s business is far from recession-proof as it has stakes in cyclical industries like railroads and energy, and holds a significant stake in Apple, a recession would help Warren Buffett profitably deploy the conglomerate’s cash.

Buffett is anyways back at dealmaking in 2022 and has invested billions in stocks like HP, Chevron, Occidental Petroleum, and Activision Blizzard. Berkshire has also announced the acquisition of Alleghany Corporation, its biggest deal since 2015. As the Fed continues to plug easy money and recession fears rise, Buffett should be able to negotiate better deals with prospective companies.

Investors should prepare for a recession.

Readjusting your portfolio is among the first steps you can take to prepare for a recession. For risk-averse investors, lowering your overall exposure to stocks can also be a good idea. Also, being mentally prepared for a recession also helps as recessions are normal for any economy.