Pharma Stocks to Buy in 2022 Even Though Warren Buffett Ditched the Industry

Defensive stocks like pharma can be a good bet in volatile markets. Pfizer, GlaxoSmithKline, and Eli Lilly look among the best pharma stocks to buy now

June 8 2022, Published 1:21 p.m. ET

While U.S. stock markets have been weak in 2022 and the tech sector has especially underperformed, pharma stocks have been a relative outperformer. The SPDR S&P Pharmaceuticals ETF (NYSE: XPH) is down 7.3 percent in 2022 based on June 7 closing prices, which is better than the S&P 500’s over 12 percent YTD losses. What are the best pharma stocks that you can buy in 2022?

Berkshire Hathaway chairman Warren Buffett, who had invested billions in buying pharma majors like Pfizer, Merck, AbbVie, and Bristol Myers Squib in 2020, has gradually exited these companies. Berkshire Hathaway has also sold its stake in Royalty Pharma which the company only recently took.

Berkshire Hathaway has been selling pharma stocks.

Over the last two years, Berkshire Hathaway has sold several stocks within a few quarters of buying. Apart from the above-listed pharma stocks, the conglomerate exited Oracle and Barrick Gold quickly.

In 2022, Buffett has spent billions buying shares of energy companies. He has also added to the already huge Apple position and bought several new stocks like HP to the portfolio. While Buffett might have turned negative on the pharma sector, the industry looks like an attractive investment opportunity especially considering the current market sentiments.

Why do pharma stocks look attractive in 2022?

Pharma stocks are defensive in nature. As concerns over a recession as well as stagflation rise in the U.S., investors have been pivoting towards pharma stocks. Pharma companies don’t see much impact on sales in an economic downturn even as consumer discretionary and cyclical companies see a slide in their revenues and profitability.

Also, most pharma companies pay hefty dividends. Pharma stocks are a good investment option for investors looking for companies with a high dividend yield.

Three pharma stocks to buy in 2022.

Pfizer, GlaxoSmithKline, and Eli Lilly look like three pharma stocks worth buying in 2022. Pfizer (NYSE: PFE) has been generating loads of cash with its COVID-19 vaccine, which was the first vaccine to receive full FDA approval. The company’s COVID-19 pill Paxlovid also has conditional approval in 60 countries.

Pfizer has announced a $120 million investment to increase Paxlovid production in the U.S. While the severity of coronavirus has come down, the need for booster doses would keep the company’s cash registers ringing for the coming years. It has a dividend yield of almost 3 percent, which looks quite good.

GlaxoSmithKline is a pharma stock worth watching.

GlaxoSmithKline’s (NYSE: GSK) price action has disappointed and the stock barely appreciated over the last five years. The company is now splitting its consumer products business, which will help create value. GlaxoSmithKline will be able to focus on the core pharma business.

While the company has an encouraging product pipeline, its COVID-19 vaccine was disappointing even as rivals raced ahead. GlaxoSmithKline has been looking at acquisitions to boost its pipeline. It acquired Tesaro in 2019 whose dostarlimab has shown encouraging trial results.

In May, GlaxoSmithKline announced a deal to acquire privately-held pneumonia vaccine-maker Affinivax for a total consideration of $3.3 billion.

GSK has a dividend yield of 4.5 percent and trades at an NTM PE ratio of only around 14x. At these price levels, GSK looks like a pharma stock worth buying ahead of the demerger.

Eli Lilly's diabetes drug got FDA approval.

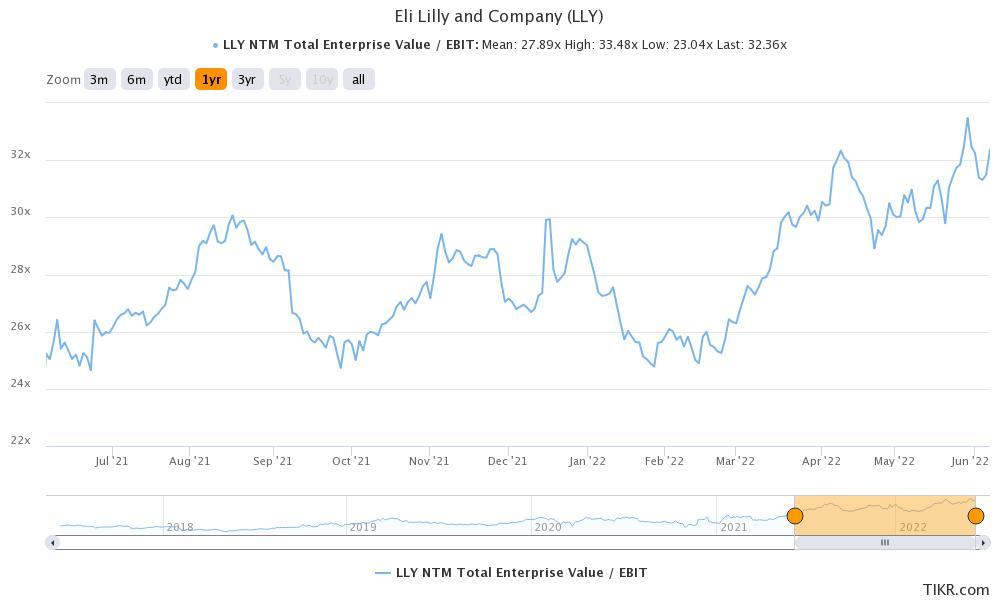

Eli Lilly (NYSE: LLY) stock is outperforming pharma peers in 2022. The company has been in the news after its diabetes drug Mounjaro received FDA approval. The drug is also showing good results in treating obesity. Lifestyle diseases like diabetes and obesity are rising globally and Eli Lilly stock is a good way to play the story.

The stock trades at an NTM PE ratio of 36.2x, which is higher than its peers. However, SVB Securities isn't too perturbed by the valuations and thinks that the company’s earnings estimates are conservative and its “ability to transform the treatment of obesity is underappreciated.”