Lucid Motors Goes Public, Might Be a Much-Awaited Tesla Killer

As Lucid Motors stock lists, there are bound to be comparisons with Tesla. Many investors wonder whether they should buy Tesla or Lucid Motors.

July 26 2021, Published 12:10 p.m. ET

The most awaited SPAC merger of 2021 has finally happened after Churchill Capital IV (CCIV) stockholders approved the business combination with Lucid Motors. Lucid will list on July 26 under the ticker symbol “LCID.” As the stock lists, there are bound to be comparisons with EV (electric vehicle) industry heavyweight Tesla. Many investors wonder whether they should buy the established Tesla or the startup LCID.

Lucid Motors generously compared itself to Tesla in its investor presentation. Lucid Motors CEO Peter Rawlinson sees the EV industry as a two-horse race between Lucid and Tesla. While there are several similarities between the two companies, they are very different.

How Lucid Motors compares with Tesla

Rawlinson is a former Tesla executive. He worked on the company’s luxury Sedan Model S. Tesla has now launched the Plaid version of the Model S, even as the company withdrew the Plaid+ model at the last moment.

Apart from Lucid being led by a former Tesla executive and the company targeting the premium EV segment, there are several other similarities between the two companies.

The similarities include:

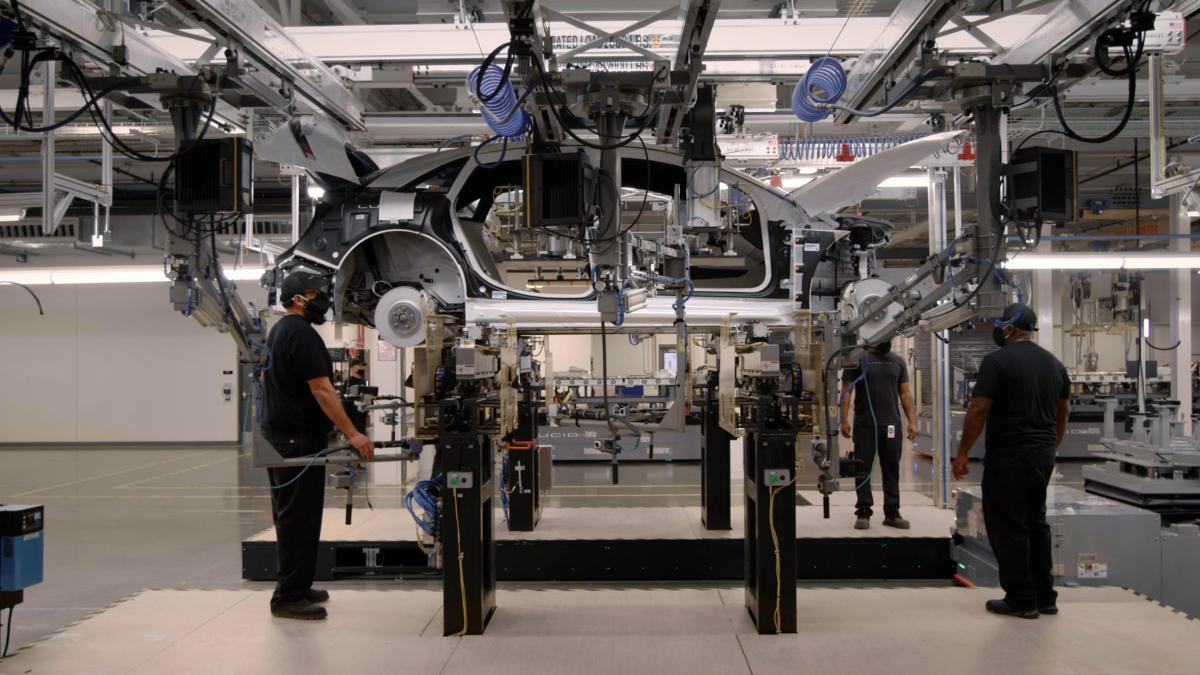

- Own manufacturing facilities rather than relying on third parties

- Plans to target the budget segment

- Both companies are targeting the direct-to-consumer strategy in sales and service

- Both companies see themselves as green and renewable energy champions and not mere EV companies

While most EV startups like Fisker and NIO have gone for third-party tie-ups to produce their cars, Lucid—like Tesla—is building its own plant. In my view, this gives the company much more control over the production process even though there could be “production hells” like Tesla faced according to Musk.

Where Lucid Motors differs from Tesla

There are a few notable differences between Tesla and Lucid Motors. First, while Tesla has built its own charging network named Superchargers, Lucid has entered into an agreement with Electrify America. The company doesn't think that it's wise to allocate capital towards the charging network.

Also, while Tesla doesn't do advertising and relies on word of mouth and Musk’s tweets, Lucid has been advertising its cars on traditional media. But that isn't surprising given the fact that the EV market is getting crowded, unlike the previous years when Tesla was the only major company to focus on electric cars.

Tesla doesn’t really need to do advertising since the brand is synonymous with electric cars. Also, Elon Musk’s celebrity status and over 58 million Twitter followers are good enough for promoting the company’s cars.

Another notable difference between the two companies is Lidar technology. While Musk has mocked Lidar technology, Lucid is using it for its autonomous technology. Finally, while Tesla has reached scale and delivered almost half a million cars in 2020, Lucid Motors expects to reach that run rate by 2030.

Could Lucid Motors be the "Tesla-killer"

We don’t have an apples-to-apples comparison between Lucid Motors and Tesla since they are in different stages of the lifecycle. While Tesla has proved its mettle and reached a critical mass, Lucid Motors will only start delivering its cars later in 2021.

Currently, Tesla has a market cap of over $630 billion and is valued at an NTM price-to-sales multiple of 11.5x. Lucid Motors has a market cap of around $38 billion. It won’t be prudent to value the company based on NTM revenues, so we’ll look at 2025 numbers.

Lucid Motors expect to post revenues of almost $14 billion in 2025, which would mean a 2025 price-to-sales of 2.7x. The stock trades at around 7x its projected 2023 revenues. TSLA and LCID don't really look cheap. However, from product specifications to hype, Lucid will bring some real competition for Tesla and many would fancy it as the "Tesla-killer." As for Tesla bulls, there's no such thing as a "Tesla-killer."