Investors May Want To Steer Clear of GESI Stock Amid the Market Sell-Off

General European Strategic Investments (GESI) is up almost 13 percent in 2022. What's the forecast for GESI? Is it a good penny stock to buy?

May 26 2022, Published 8:40 a.m. ET

The year is turning out to be a nightmare for investors, with the Dow Jones down for the last eight weeks. Amid a bear market, energy and some commodities have been some notable exceptions. Penny stocks have been hit particularly hard as investors pivot toward larger companies. However, penny stock General European Strategic Investments (GESI) is up almost 13 percent this year. What’s the forecast for GESI stock?

GESI gained 20 percent on May 25. The stock has become popular on social media groups.

GESI invests in the natural resources sector in Europe

GESI has interests in the natural resources sector in Europe. The company's main focuses right now are:

- The Laakso PGE-Nickel-Copper Project in Finland.

- Its 80 percent stake in the Gemerska Poloma Arbitration Case.

- Getting an exploration license for the Transcarpathian Gold Project and Pryniprovian Diamond Project in Ukraine.

- Its 49 percent stake in ColdPro, a U.K.-based, privately held waste management company.

The Gemerska Poloma Arbitration Case

GESI has a stake in the Gemerska Poloma Arbitration Case through its association with EuroGas, which is seeking $15 billion in damages from the Slovak Republic over what GESI calls the “alleged illegal expropriation of EuroGas Inc. previously owned mining rights in the world-renowned Gemerska Poloma talc-soapstone deposit.”

GESI's stock forecast and its preferred shares

GESI stock trades on OTC markets, and no major brokerages cover the company. Much of the company’s forecast depends on its projects.

General European Strategic Investments is seeking stockholder approval for converting 1.5 million of its 10 million preferred stocks as “Series C Preferred Stock.” These would have a par value of $0.0001 and be converted to common stock in a 1:100 ratio if the volume-weighted average price of GESI is over $5 for 20 consecutive days.

The company said, “Through the use of these authorized preferred shares, the company's management believes it will be able to better attract funding from various strategic sources."

GESI also announced that its CEO Wolfgang Rauball would take a yearly salary of only $1, which the company said demonstrates “his full commitment to creating value for all shareholders.”

Penny stocks are risky

Penny stocks are riskier, as OTC markets can have low volumes. GESI has an average daily traded volume of just over 260,000 shares, and its beta is quite high.

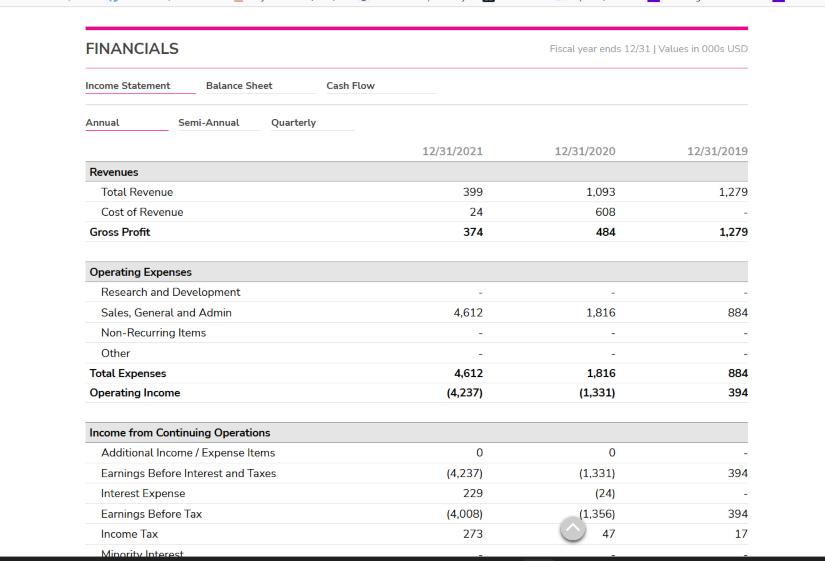

In 2021, GESI had revenue of just $400,000 and an operating loss of $4.23 million, and in 2020, it had an operating loss of $1.33 million. Overall, only investors with a high-risk appetite should consider the company.

How to buy GESI stock

To buy GESI, you'll need to do so through a broker that lets you trade OTC stocks. Popular retail trading app Robinhood doesn't support it.