Commodities Look Red Hot in 2021, How to Invest in Them

Commodities offer good diversification for your portfolio. They look hot in 2021. There are six ways to invest in commodities.

Feb. 22 2021, Published 11:21 a.m. ET

Investing in commodities is a good way to diversify your portfolio. However, commodities aren't a homogenous asset class. They can be divided into energy, metals, and agri commodities. Most commodities have been red hot amid the strengthening global economy. How can you invest in commodities and benefit from the uptrend in commodity prices?

Commodities are real assets and you can own and store them. The trading in commodity markets globally is higher than what we see in stock markets. Along with investors, commodity buyers and sellers also participate in commodity markets to hedge their positions.

How to invest in commodities

There are six main ways to invest in commodities, including:

- Buying the commodity physically

- Trade in the futures market

- Trade in derivatives like CFD (Contract for Differentials) and binary options

- Buy ETFs that invest in commodities

- Buy stocks of commodity producers

- Invest in ETFs that invest in stocks of commodity producers

Buying commodities physically might not be the best strategy. Realistically speaking, you can also do so with only high-value commodities like precious metals. It isn't possible for investors to buy and store commodities like copper and crude oil since they would require a lot of storage space.

Trading in commodity futures is a good way to get leveraged exposure to commodities. You can also invest in ETFs that invest in commodity futures. Another way of investing in commodities is to invest in stocks of companies that produce them. The stock prices of commodity producers have a high correlation to the underlying commodity.

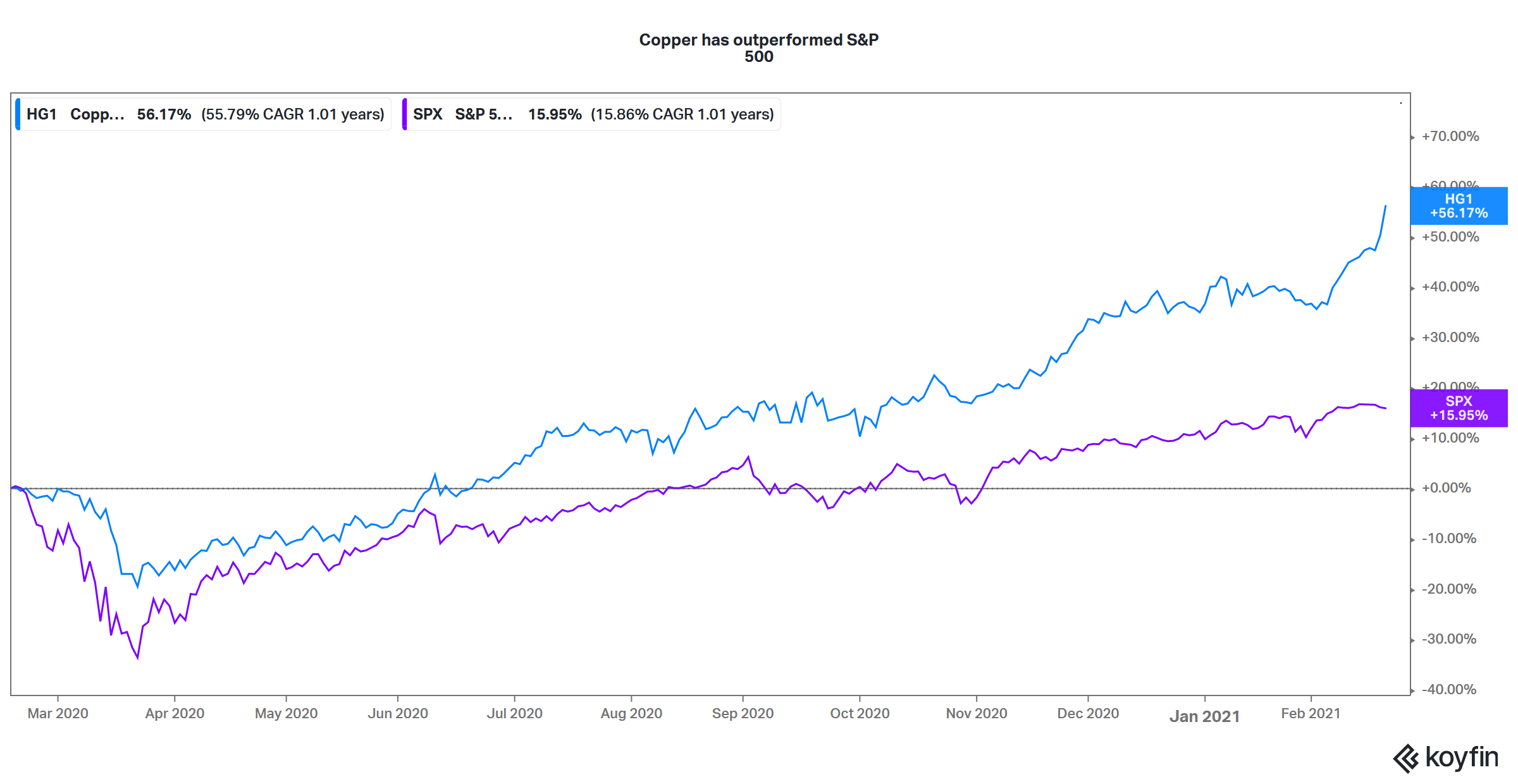

Copper futures versus S&P 500

Finally, you can invest in ETFs that invest in a basket of commodity stocks. Through these ETFs, you can also get diversification and get access to many commodity stocks. If you are comfortable taking higher risks, you can also trade in commodities through derivative instruments like binary options and CFDs. However, these are generally short-term trades and are speculative in nature.

Is it hard to trade commodities?

It isn't hard to trade commodities, but you need to get accustomed to the nuances of futures markets. While trading in futures, you might face frequent margin calls and your losses might exceed the initial investment that you made. If you aren't comfortable with margin calls and are just looking at exposure to a commodity, an ETF that invests in commodities would fit the bill.

Certain commodities are the best investments

Looking at the strengthening global economy, energy commodities and industrial metals look like good investments in 2021. Also, metals like copper, lithium, and nickel, which are used in electric cars, could be a good way to bet on vehicle electrification. Copper is already trading at multi-year highs. Copper could see more gains amid strong demand and tepid supply growth.

Best commodities ETF

The SPDR S&P Metals and Mining ETF (XME) is a good diversified play on U.S.-based metal and mining companies. The ETF is overweight on steel but also invests in copper, aluminum, and gold. If you are looking at a copper ETF, the United States Copper Index Fund (CPER) and the iPath Series B Bloomberg Copper Subindex Total Return ETN (JJC) look like good options.

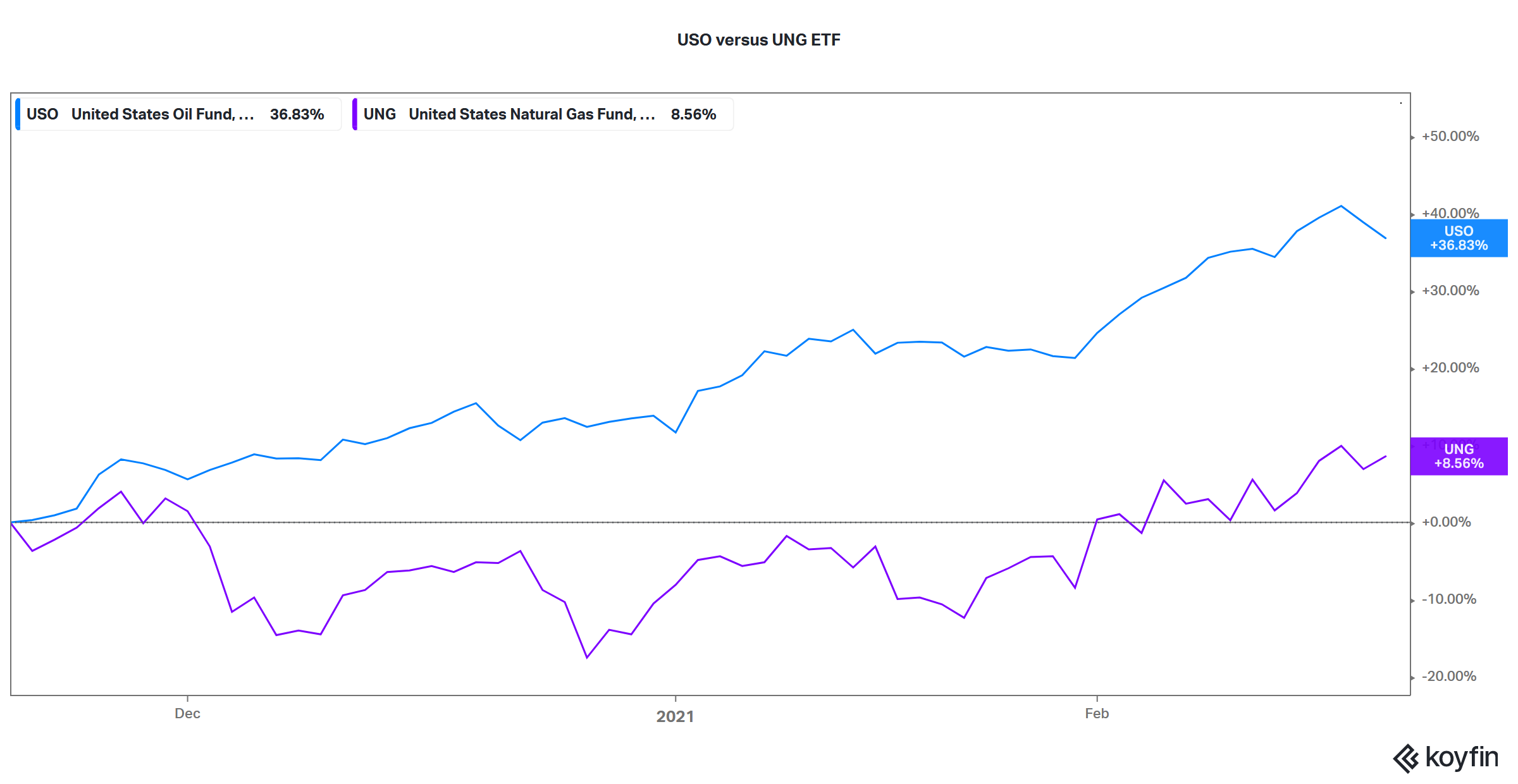

USO versus UNG three month returns

In the energy space, there are many ETFs that you can choose from. The United States Oil Fund (USO) tracks the price movement of WTI. The United States Natural Gas Fund (UNG) invests in natural gas futures contracts.

Uranium is another commodity that has a positive outlook as the world transitions from fossil fuels to alternative sources of energy. The Global X Uranium ETF (URA) is a good way to invest in a basket of uranium mining companies.