Looking for Bargain Stocks? These Deep Value Stocks Are Good Buys Now

Many investors are looking for bargain stocks and some stocks look like good bargains after the crash. Here are some of the deep value stocks that look like good buys now.

March 14 2022, Published 8:20 a.m. ET

U.S. stock markets are looking weak amid the Russia-Ukraine war and are in a correction zone. A bear market looks like a real possibility and brokerages have been slashing their 2022 S&P 500 targets. The sell-off in growth names has been even more severe and many of them look like a bargain at the current stock prices.

While U.S. stocks have room to fall more from these levels as the dead cat bounce has lived its course, there's an opportunity in some of the deep value stocks. Here are some of the deep value stocks that look like good buys now.

What are deep value stocks?

Deep value stocks are trading well below their intrinsic value. These stocks are characterized by low valuation multiples, high cash flow and dividend yields, and a high margin of safety, a term popularized by the legendary Warren Buffett.

Some Chinese stocks look like bargains now.

Chinese stocks have fallen hard in 2022. U.S.-listed Chinese companies face the dual whammy of being targeted by regulators in the U.S. as well as back home. The slowing Chinese economy hasn’t been helping matters either for these companies. There's also the continued tech crackdown in China and fears of delisting in the U.S.

If you're a bargain hunter, Alibaba and DiDi look like two attractive deep-value stocks. DiDi stock cratered on reports that it has suspended the planned Hong Kong IPO.

While there are plenty of risks with DiDi, its market cap has fallen below $10 billion while the EV is a mere $3.3 billion. The company is the largest ride-hailing company in China — the world’s second-largest economy and the most populous country.

While DiDi is a loss-making company, it trades at around 0.1x its NTM EV-to-sales multiple, which is cheap compared to its peers. If you're willing to take the risk, DiDi looks like a good deep value stock at this price.

Alibaba is another deep value stock.

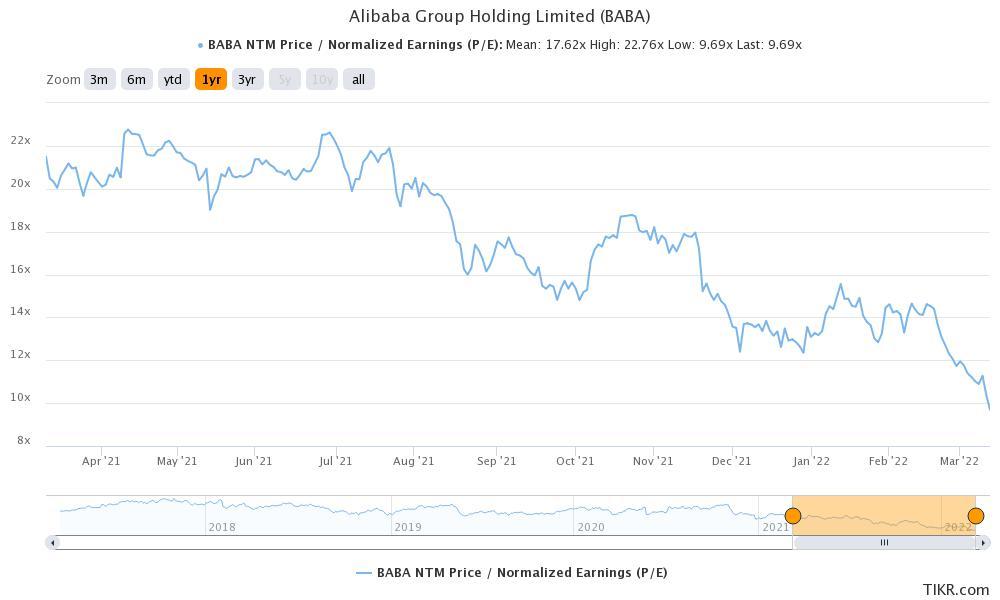

Alibaba also faces the risk of delisting in the U.S. However, it's already listed in Hong Kong and isn't in a “nowhere land” like DiDi. The stock now trades at a single-digit forward PE multiple. Even Ashwath Damodaran, popularly known as the “dean of valuation,” said in December 2021 that Alibaba stock looks attractive.

The stock has fallen even more from those levels. Charlie Munger has also been loading up on Alibaba shares. Daniel O’Keefe, a portfolio manager at Artisan Partners, thinks that the Chinese e-commerce giant is the cheapest stock outside Russia. Overall, if you're looking for a deep value stock, BABA would tick most of the boxes.

What are some deep value stocks in the U.S.?

In addition to Chinese stocks, some of the U.S. companies also look like a bargain at these prices. Facebook parent Meta Platform would top the list with an NTM PE multiple of 15x.

Famed investor Mohnish Pabrai thinks that the stock could easily double from these levels. He hasn’t even accounted for the metaverse in his projections and if the venture succeeds it could take the stock even higher.

PayPal looks like another deep value stock.

PayPal stock has also tumbled in 2022 amid the slowing growth. However, with an NTM PE multiple of just above 20x, the stock now falls in the deep value category. The long-term structural growth story for PayPal looks intact even though it's facing tougher YoY comps in the short term.

Wolfe Research made a list of deep value stocks.

Wolfe Research has picked its deep value stocks. The list has three energy companies — ExxonMobil, Chevron, and Valero. Incidentally, Buffett, who has been a net seller of stocks for the last four quarters, and lamented the lack of “exciting” investment opportunities in his recent annual letter, has also been buying Occidental Petroleum.

Chipmaker Intel made it on Wolfe’s list along with Ford. Ford deserves a special mention here as the company has announced a business restructuring and will separate the legacy ICE (internal combustion engine) business from the electric vehicle business. The stock has an attractive dividend yield and could see significant upside as it pivots towards electric cars.

Wolfe also listed furniture maker La-Z-Boy and VICI Properties, a REIT, as deep value stocks to buy.

Are bargain stocks a good investment now?

Deep value bargain stocks have started to look attractive now. That said, given the market volatility, it would be prudent to do staggered buying since markets might fall more from these levels. Also, a diversified portfolio of deep value stocks would be a better bet as it would lower the risk. You might also consider one of the deep value ETFs.