Are Deep Value ETFs Worth Your Money?

Value investing is back in 2021 after a decade of underperformance. What are the best deep value ETFs to invest in, and how do they compare?

March 22 2021, Updated 8:06 a.m. ET

Value and growth investing are growing in popularity, and some ETFs are dedicated to these investing styles. What are the top deep value ETFs in 2021, and how do they compare? Can these value ETFs take on Cathie Wood’s ARK ETFs?

Value stocks have consistently underperformed growth stocks over the last decade, and the gap widened in the last two years. Berkshire Hathaway, whose chairman Warren Buffett is the embodiment of value investing, underperformed the S&P 500 by double digits in 2019 and 2020.

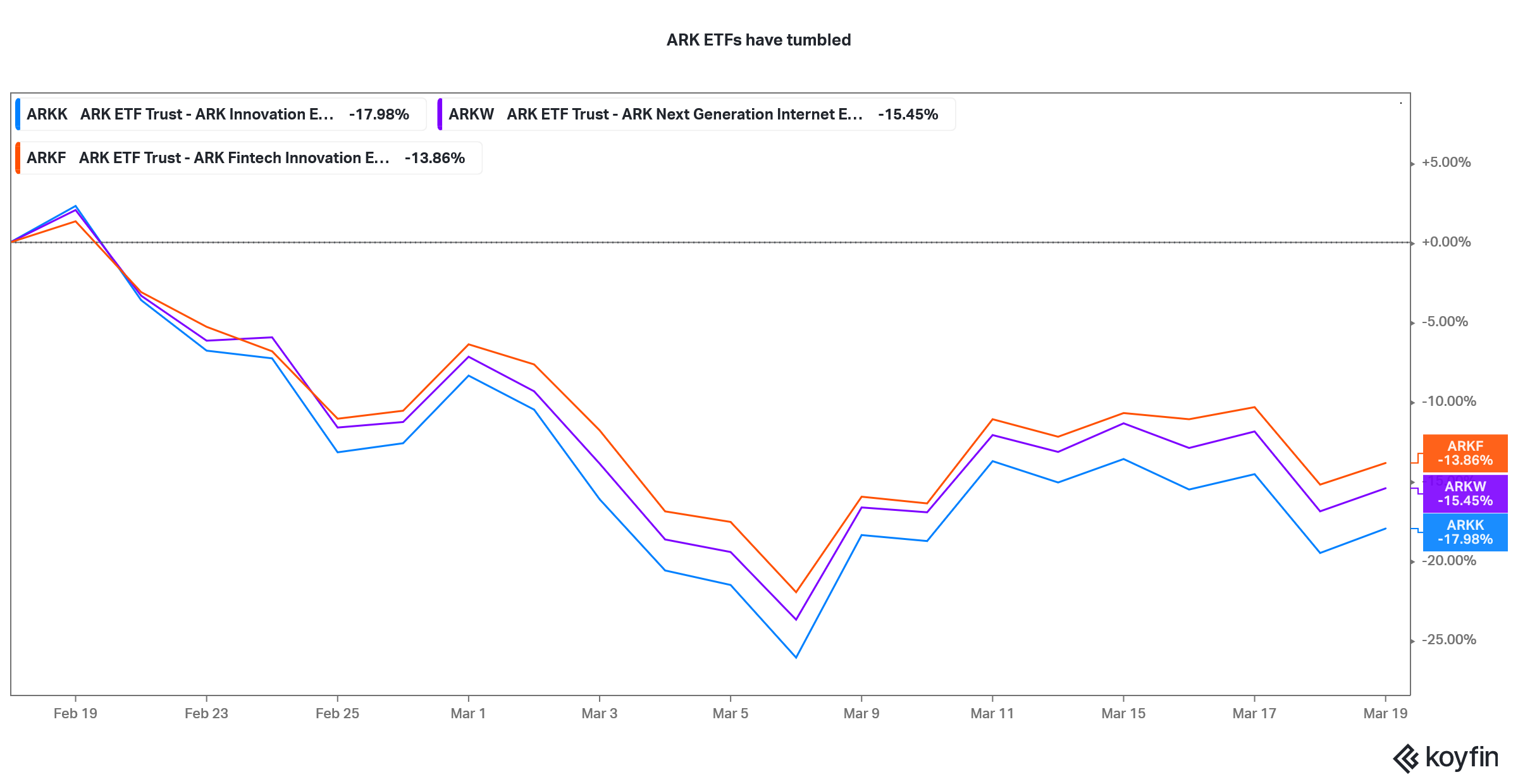

However, value stocks are strengthening this year amid the shift from growth to value stocks. Value ETFs could offer better returns than growth ETFs such as Cathie Wood’s ARK funds, which have come under pressure amid a sell-off in growth stocks.

Cathie Wood's Ark ETFs have tumbled

A list of deep value ETFs

Many ETFs adopt a value strategy. Some of them include:

- The Roundhill Acquirers Deep Value ETF (DEEP).

- The Invesco Pure Value ETF (RPV).

- The Invesco S&P SmallCap 600 Pure Value ETF (RZV).

- The Alpha Architect US Quant Value ETF (QVAL).

- The iShares Focused Value Factor ETF (FOVL).

The DEEP ETF tracks the returns of the Acquirers Deep Value Index after accounting for expenses. According to Roundhill Investments, “The Acquirers Deep Value Index seeks to find deeply undervalued small-and-micro cap stocks using the Acquirers Multiple, the measure used by activists and buyout firms to identify targets.”

DEEP has an expense ratio of 0.80 percent, and its market price fell almost 10 percent in 2020. The ETF is overweight on financials and industrials, which account for 37.8 and 32.4 percent of its portfolio, respectively. Information technology is the fund’s third-largest sector, comprising 23.1 percent of the portfolio, followed by consumer discretionary at 6.8 percent.

As of Dec. 31, 2020, the ETF had price-to-sales and price-to-book multiples of 1.0x and 1.2x, respectively, and a PE ratio of 12.2x. As the ETF leans toward small-cap companies, its median market capitalization is only $846 million. The ETF manages $59 million in assets.

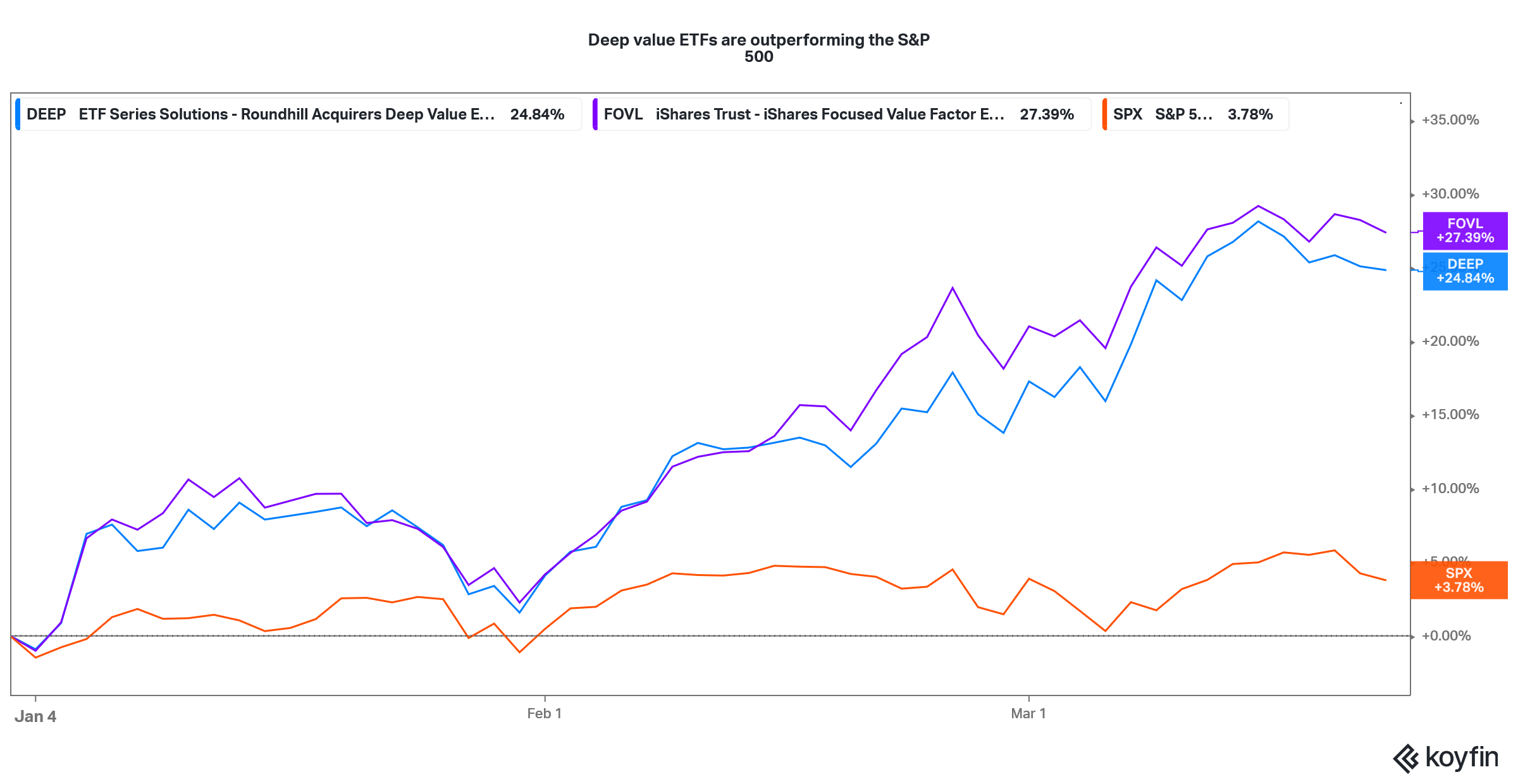

The DEEP ETF versus the FOVL ETF

FOVL has a large-cap bias and invests in the top 40 U.S. large- and mid-cap companies. The fund’s expense ratio of 25 basis points is less than a third of DEEP's. However, like DEEP, FOVL is overweight in financials, with the sector accounting for over 55 percent of its portfolio.

Deep value ETF versus S&P 500

FOVL's three other main sectors—materials, energy, and consumer discretionary—account for 20, 7.7, and 5.9 percent of its portfolio, respectively. The ETF's market price fell 13.3 percent in 2020, and the fund has price-to-book and PE multiples of 1.64x and 16.6x. Both multiples are higher than DEEP's because large-cap value stocks trade at a premium to small caps.

Vanguard's deep value ETF

The Vanguard U.S. Value Factor ETF (VFVA) is a diversified value ETF that aims to invest at least 80 percent of its assets in U.S. stocks. It has 879 stocks in its portfolio, whereas FOVL has only 40.

Financial stocks make up a little over a quarter of VFVA. Industrials and consumer discretionary are the other two top sectors, comprising 15.1 and 15.0 percent of the fund, respectively.

Emerging market deep value ETFs

Investing in emerging markets can help diversify your portfolio, and ETFs are among the best ways to access emerging market stocks. The iShares Edge MSCI EM Value Factor UCITS ETF (EMVL) invests in large- and mid-cap value stocks in emerging markets.

The EMVL ETF returned 7.57 percent in 2020 and 16.5 percent in 2019. It has an expense ratio of 40 basis points, 186 holdings, and price-to-book and PE multiples of 1.10x and 11.92x, respectively. Chinese stocks make up a third of EMVL's portfolio, followed by Taiwanese and South Korean stocks at 19.6 and 18.7 percent.