What’s Aswath Damodaran’s Net Worth and Is He Right on BABA Stock?

Damodaran said that he's ready to buy Alibaba (BABA) stock despite delisting fears. What’s his net worth and is he right on BABA stock?

Dec. 6 2021, Published 8:16 a.m. ET

Aswath Damodaran is a professor of Finance at the Stern School of Business at New York University. Also known as the “dean of valuation,” his views on corporate finance and valuations are widely followed by investors globally. Recently, Damodaran said that he's ready to buy Alibaba (BABA) stock despite delisting fears. What’s his net worth and is he right on BABA stock?

Aswath Damodaran

Professor of Finance at the Stern School of Business

Net worth: $283 million (estimated)

On his official page, Damodaran describes himself as “a teacher first, who also happens to love untangling the puzzles of corporate finance and valuation, and writing about my experiences.” He calls himself at the “intersection of three businesses” which include publishing, education, and financial services.

How did Damodaran make his money?

Damodaran made the money from three businesses. He has authored many books including on valuation. He also earns money through his association with NYU. He holds seminars and valuation classes globally. While not much is known publicly about his portfolio and other investments, he likely holds several stocks, considering his expertise in valuation.

Aswath Damodaran's net worth is substantial.

Unfortunately, we don’t have credible estimates of Damodaran’s net worth. VIP FAQ puts his net worth at around $283 million. However, the website arrived at the figure based on responses from the users, so it’s tough to vouch for its correctness.

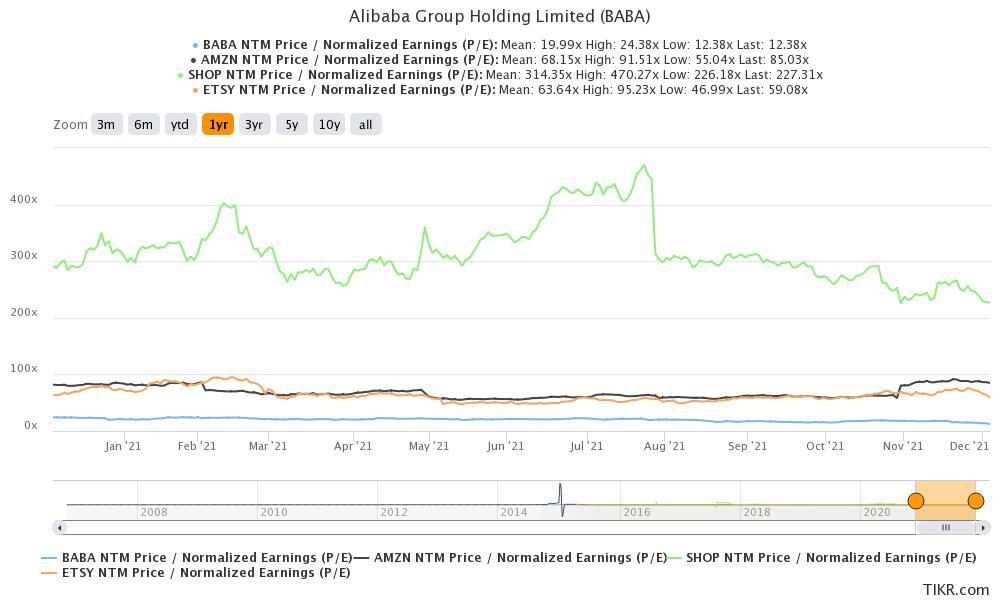

Damodaran finds BABA stock attractive.

Speaking with CNBC, Damodaran said that he’s ready to buy Alibaba stock. He said that it's a “solid company in terms of the businesses it’s in.” However, he cautioned that it isn't the kind of stock that one should buy from a three to six months perspective. He sees BABA stock as a good long-term investment.

BABA stock looks like a good but risky investment.

Chinese stocks have been under severe pressure this year. Alibaba deserves a special mention because it's a good example of what's wrong with U.S.-listed Chinese companies.

Alibaba was among the first companies to be targeted by China. Alibaba co-founder Jack Ma was perceived to be getting too big for his shoes. Then there was the wider tech crackdown in China. Recently, the slowing growth in the Chinese economy has taken a toll on Alibaba’s growth outlook and its stock price.

BABA stock faces delisting fears.

BABA stock in the U.S. is a VIE (variable interest entity). While China has denied reports that it plans to delist companies that have a VIE structure, one can’t rule out the possibility. Also, SEC Chairman Gary Gensler has been a critic of these VIEs where U.S. investors don’t own the Chinese companies directly but through a shell company, usually formed in a tax haven.

Overall, while BABA stock looks reasonably valued and its valuation is too cheap to ignore, it's also a risky bet considering the current geopolitical environment. As Damodaran put it, “At the prices at which it’s trading, I think not withstanding all the worries about corporate governance and the Chinese government, I think it’s well positioned to be a long-term investment.”

While Damodaran is known as the “dean of valuation,” some of his bets have been horrifically wrong. For instance, he values Tesla at a fraction of its current value. Despite his bearish views, Tesla stock has jumped multi-fold over the last two years.

Recently, Damodaran sounded bullish on Indian fintech company Paytm, where even Berkshire Hathaway invested. The stock fell sharply on listing day and became one of the worst IPOs of 2021.