Hall of Shame: These Are the Biggest IPO Fails of 2021

This year hasn’t been a very pleasant year for IPOs, and many stocks are now trading below their debut price. Here are the biggest IPO fails of 2021.

Dec. 1 2021, Published 10:54 a.m. ET

The IPO market has been strong in 2021 and looks on track to beat the record set in 2020. However, this year hasn't been great for new listings, with many newly listed companies trading below their IPO price. Here are the biggest IPO fails of 2021.

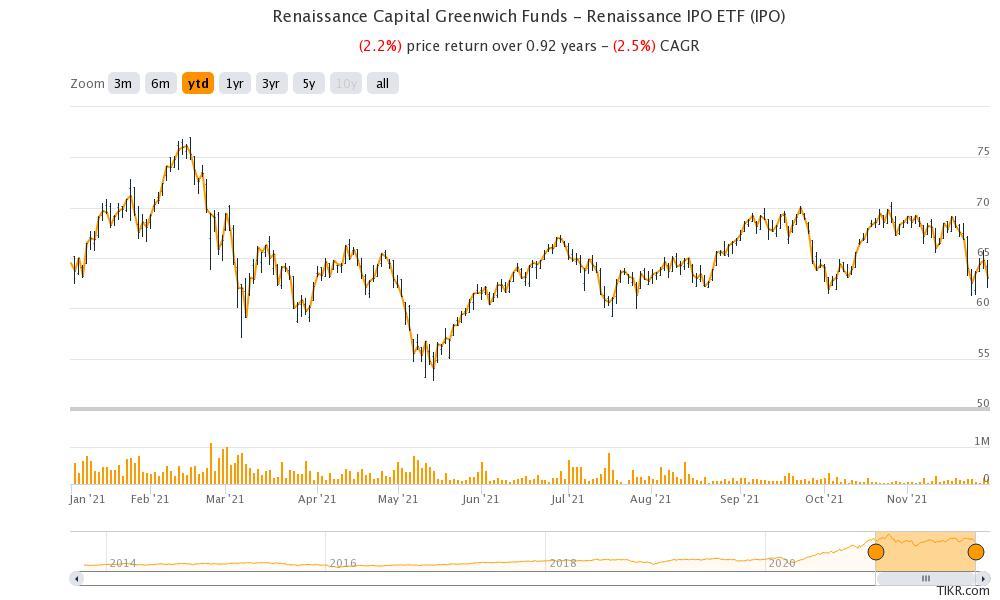

To get a sense of how the IPOs have performed in 2021, we can look at the Renaissance IPO ETF. It's down 2.2 percent this year but outperformed the S&P 500 in 2020.

The biggest IPO fails in U.S. markets in 2021

In 2021, Oscar Health has been among the worst IPOs. The stock fell 11 percent below its IPO price on its debut and has continued to slide. Currently, it trades at less than a quarter of its IPO price of $39.

Robinhood was among the high-profile IPO fails of 2021

Robinhood was probably the most high-profile IPO fail of 2021. It fell below its IPO price on its listing day despite having slashed pricing. While the stock then rose amid buying interest from retail and institutional investors, it has again fallen below its IPO price.

DiDi and RLX Technology also flopped

Chinese companies' IPOs have also fared poorly in 2021 amid the country's tech crackdown. Chinese ride-hailing app DiDi failed to gain on its listing and has since tumbled amid uncertainty over its future in China. And although RLX Technology did well on its listing, it now trades at a third of its IPO price of $12.

Paytm has been one of the worst Indian IPOs of 2021

Indian fintech company Paytm has been among the worst high-profile IPO fails of 2021. The company, backed by Berkshire Hathaway and Alibaba, saw massive selling pressure in its first couple of trading days. While the stock has since recovered slightly, it's still below its IPO price.

In London, Deliveroo stock plummeted on its listing and became the worst IPO ever in the country. Its shares still trade below their IPO price.

Some high-profile SPAC mergers flopped, too

Whereas many companies that went public through a SPAC reverse merger are now trading below their IPO price, some deserve special mention.

Clover Health, which merged with a SPAC sponsored by Chamath Palihapitiya, is now trading at 50 percent below its IPO price, and Paysafe, which merged with a Bill Foley–backed SPAC, is 60 percent below. Carlotz and Katapult Holdings are 70 and 60 percent below their SPAC IPO price, respectively.

Furthermore, companies with a high valuation have had to lower their IPO asking price. Berkshire Hathaway-backed Nu Holdings had to lower its IPO price amid unfavorable market conditions, as did Krispy Kreme. Allvue Systems and Cingulate had to withdraw their IPOs altogether due to a tepid market response.

In contrast, several companies hiked their IPO price before listing in 2020. The IPO market has definitely changed in 2021. On one hand, we're headed for a record year in terms of new listings, but on the other hand, even hyped IPOs have flopped.