President Biden’s Saudi Arabia Visit Might Help Lower Oil and Gas Prices

President Joe Biden is visiting Saudi Arabia. Will Biden’s visit to the region help lower oil and by their extension gasoline prices for U.S. consumers?

July 11 2022, Published 8:16 a.m. ET

President Joe Biden is heading to the Middle East this week in what will be his maiden visit as the U.S. president to the region. He will start the visit in Israel and conclude in Saudi Arabia. Apart from the strategic implications, Biden’s visit to Saudi Arabia is coming at a time when global crude oil prices are at elevated levels. Will Biden’s visit to the region help lower oil and by their extension gasoline prices for U.S. consumers?

Gas prices in the U.S. have already come off their all-time highs and the national average has dipped below $5 per gallon. Biden has also proposed a federal gas tax holiday, which if approved by Congress, would help lower gas prices more.

Why are gas prices dropping now?

Many analysts predicted that gas prices would rise more during the summer driving season. However, gas prices have instead dropped even if they are much higher than last year. Global recession fears have been rising, which is putting pressure on oil prices. Oil demand is correlated with the growth in the global economy and if global GDP growth tapers down, oil demand will also take a hit.

Saudi Arabia is the largest crude oil exporter.

Saudi Arabia is the world’s largest crude oil producer and home to Aramco, the world’s largest oil company. As crude oil prices surged, Aramco’s market cap surpassed that of Apple in May.

Saudi Arabia is increasing its oil production and in August the country is set to increase the production to 11 million barrels per day. In the past, the country put great emphasis on maintaining its market share in global oil markets. However, after the 2014 debacle where OPEC’s failure to reach a production cut triggered a rout in oil prices, OPEC members have largely given up their reluctance to lose market share.

In 2021, Saudi Arabia surprised markets with a unilateral production cut of 1 million barrels per day. The move helped trigger a rally in oil prices. As oil demand also rebounded amid the reopening of the economy, oil prices surged as the year progressed.

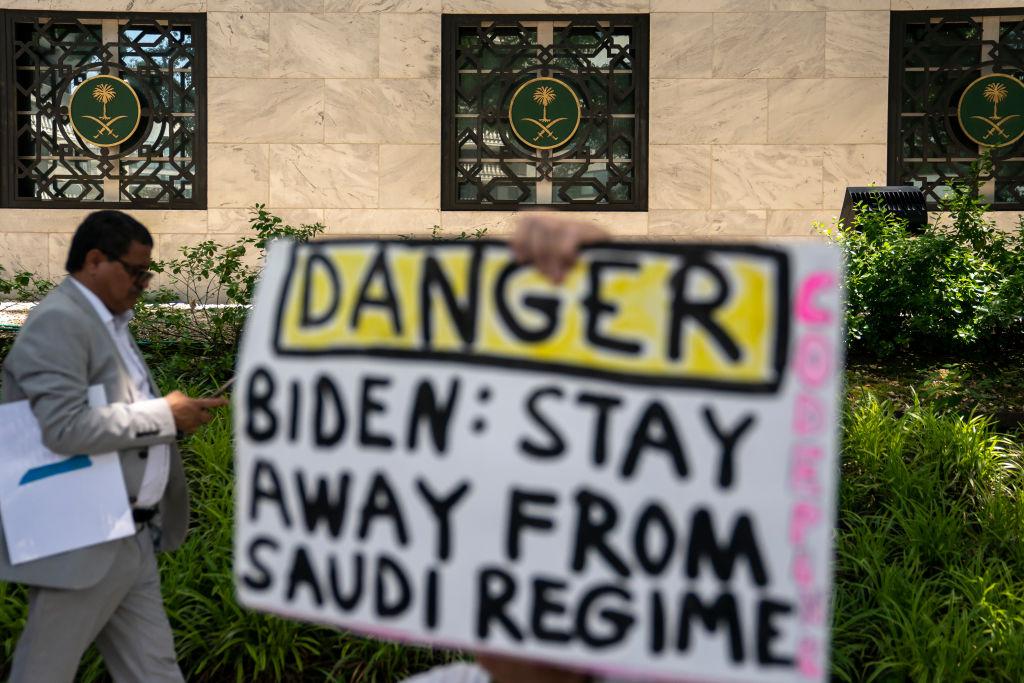

Biden has defended his visit to Saudi Arabia.

Many are criticizing Biden’s visit to Saudi Arabia given the administration’s emphasis on global human rights issues. Biden has defended his visit and said that human rights and fundamental freedom are “always on the agenda” when he travels to other countries. Nonetheless, the visit to Saudi Arabia is an about-turn for Biden who in 2019 vowed to make the country a “pariah.”

Biden’s visit to Saudi Arabia might help lower oil prices.

Nobody is expecting wonders from Biden’s visit to Saudi Arabia. Talking about oil markets, Saudi Arabia doesn't have much spare capacity to increase oil in the short term. However, the visit would still send a signal to markets that Biden is looking to reset ties with the Saudi leadership.

In the past, the efforts of U.S. leaders to reason with Saudi Arabia on production adjustments have yielded mixed returns. While Bill Clinton and George W. Bush failed to cajole the country to increase production in 2000 and 2008, respectively, Donald Trump got the OPEC block to cut production when prices plunged in 2020.

Biden’s oil policy has been mixed.

Many have been critical of Biden’s oil policy. Recently, he received criticism from oil and gas producers for calling upon gas station owners to lower gas prices. Biden has also been calling upon U.S. oil producers to pump more oil. However, he hasn’t been able to get past his image of being adversarial to the fossil fuel sector.

While the pivot towards green energy is a long-term necessity, for Biden, the timing couldn't have been worse. He's having a hard time asking oil majors to increase production and drilling new wells when the administration favors a fast pivot towards renewable energy.