Matt Phillips

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Matt Phillips

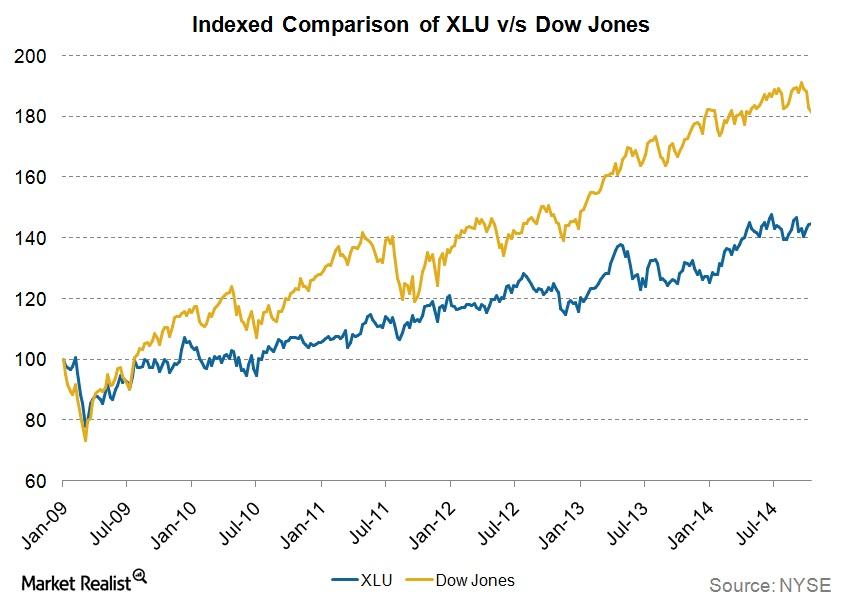

Must-know: US power sector and its indicators

The power sector is the backbone of any economy. All of the other industries depend on it. In the U.S., the power utilities business is characterized by steady dividends and stable earnings.Energy & Utilities Why did the market punish Exelon?

Exelon Corporation’s (EXC) stock has been hammered in the last six years. In 2008, the stock was trading at ~$90 per share. Early this year, the stock was available at less than $27 per share.Energy & Utilities Must-know: Understanding Duke’s strategy

In recent years, Duke Energy (DUK) made its intent very clear. It concentrates on its regulated utilities—its core business—instead of other areas. The regulated utilities business is Duke’s strength.

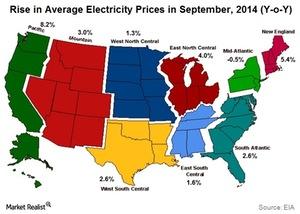

New England and the Pacific are great regions to produce power

The US is divided into nine divisions. The Pacific and New England divisions had the highest year-over-year, or YoY, growth in electricity prices in September 2014.

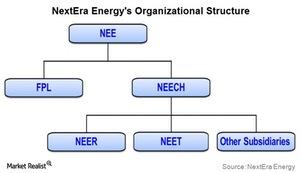

Utilities company overview: NextEra Energy

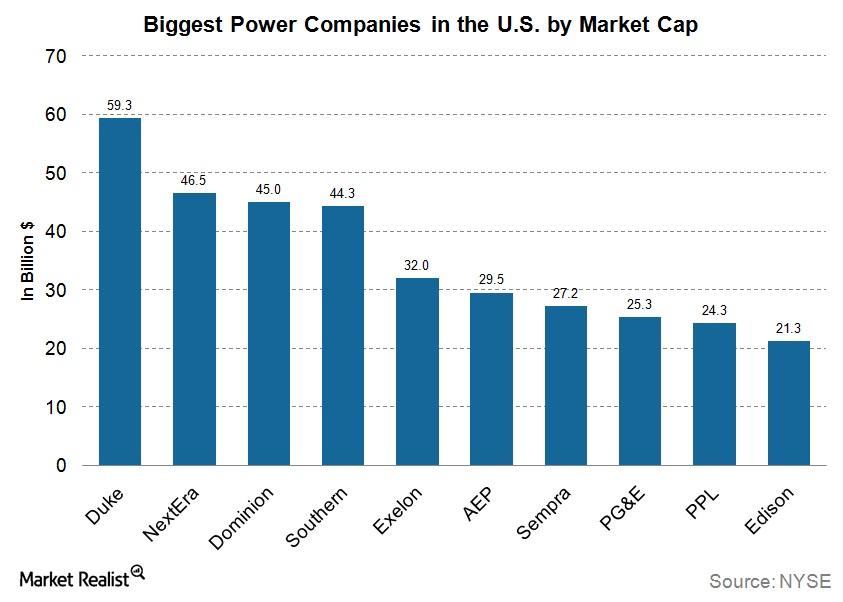

NextEra Energy (NEE) is the second-largest power company in the US after Duke Energy (DUK) in terms of market capitalization.

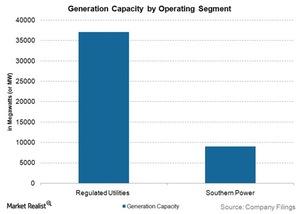

Regulated business is Southern Company’s strength

Southern Company manages its regulated utility business through the following four subsidiary companies: Alabama Power, Georgia Power, Gulf Power, and Mississippi Power. These subsidiaries have a combined power generation capacity of 37,000 megawatts (or MW).

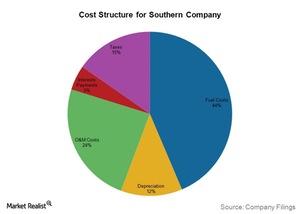

Cost structure sets Southern Company above its competitors

Fuel costs per kWh can be used to evaluate the efficiency of a power producer to produce electricity. Southern Company’s fuel cost per kWh is lower than its competitors’ in the regulated utility business.Energy & Utilities Must-know: Risks to AES Corporation’s business

Given the nature of its business, AES Corporation (AES) faces risks relating to currency fluctuations, fuel prices, interest rates, and a scattered business model.Energy & Utilities Must-know: Who owns Dominion?

Institutional investors hold most of Dominion Resources’ (D) outstanding shares. As of June 30, 2014, a total of 351.2 million shares were held by 1,069 institutions.Energy & Utilities Why electricity demand is linked to GDP

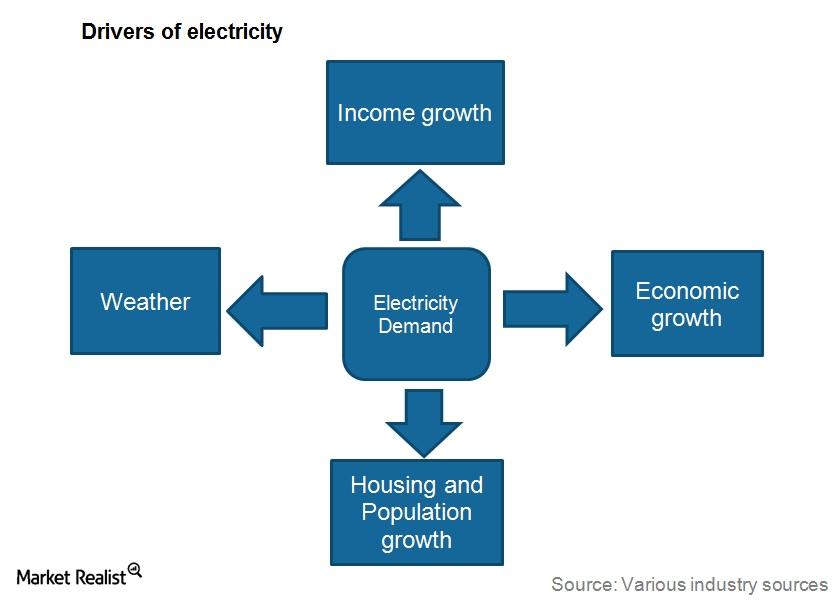

Electricity is the backbone of a nation’s progress. All of the industries need electricity to operate—directly or indirectly. When a business flourishes, the electricity consumption increases.Energy & Utilities Why net capacity additions are important

Capacity is defined as the potential power output that power plants can generate. Each power plant has a shelf life. After the shelf life, they’re replaced with new power plants.

A brief overview of Exelon’s power operations

Power generation is a significant segment for Exelon, generating more than 60% of its total revenue. The energy delivery business provides the other 40% of the company’s revenues.

NextEra Energy plays in regulated and unregulated utility markets

NextEra Energy is a Florida-based power company. Its subsidiaries are Florida Light & Power and NextEra Energy Resources.

Must-know: Factors that impact electricity demand

The most important factor that affects electricity demand is household income. According to the U.S. Energy Information Administration (or EIA), between 1981 and 2001, household real disposable income increased by 49%—from $17,217 to $25,698.

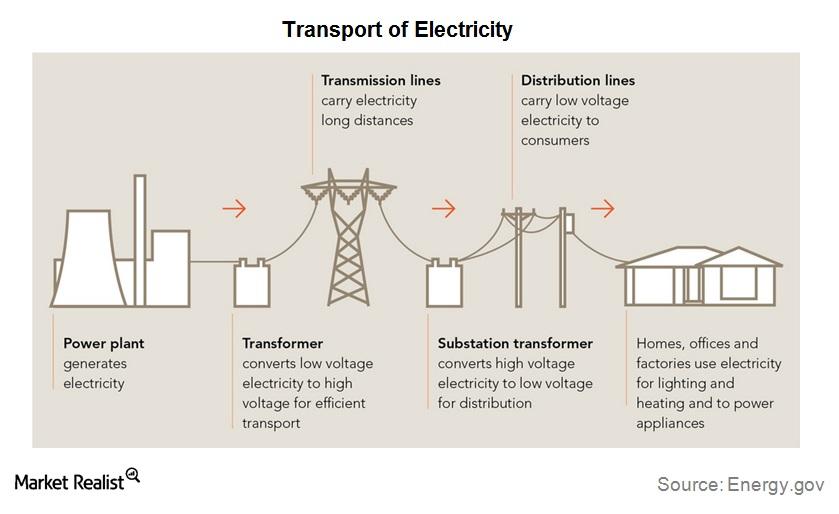

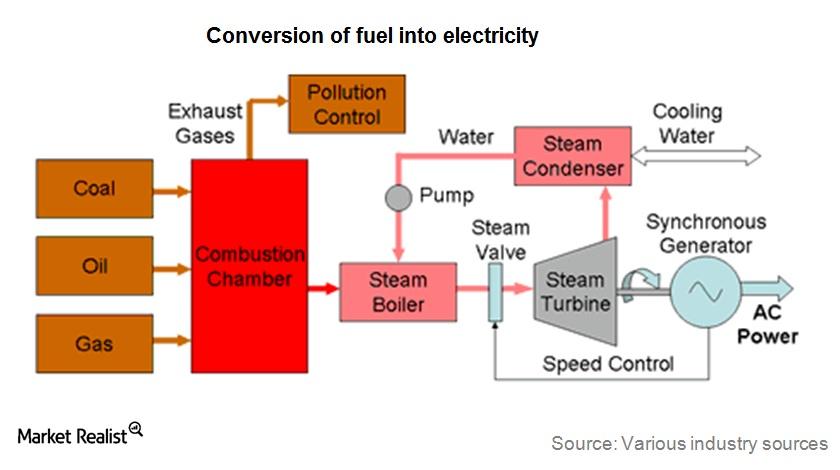

Must-know: The supply chain delivers electricity

The industry’s supply chain consists of three broad categories—generation, transmission, and distribution. Power generation requires a fuel source—for example, coal, nuclear, natural gas, or wind—and a power plant to convert the fuel source into electricity.Energy & Utilities Must-know: The top US electric utility companies

The top electric utility companies in the U.S. include Duke Energy, Exelon Corporation, Southern Company, NextEra Energy, and Dominion Resources. These companies are largest in terms of market cap.

Must-know: Terminology used in the electric utilities industry

Electricity comes from energy sources that are found in nature. These sources are called primary energy sources. They’re the first form of energy. Primary energy sources include coal, gas, oil, wind, and water.